Letter to debt collector template

Sending a well-structured letter to a debt collector is an effective way to address any outstanding debts. Begin by clearly stating your intent, including details about the debt in question. Ensure that all information provided is accurate and specific, such as account numbers, dates, and amounts owed. Be direct but respectful, maintaining a professional tone throughout.

In your letter, it’s important to request specific actions from the debt collector, such as verification of the debt or an updated payment plan. Clearly outline your expectations for how you wish to resolve the issue, whether through negotiation or other means. Avoid vague statements, and instead provide concrete details for easier resolution.

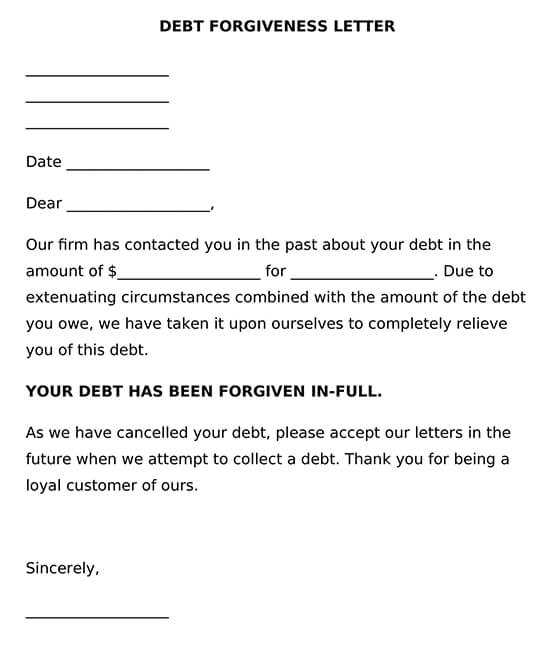

If applicable, you can offer a payment arrangement or request that the collection process cease until the dispute is resolved. Keep your letter concise, but ensure that all necessary information is included to avoid delays. Taking this step shows a proactive approach to managing your finances and can help you gain control over the situation while protecting your rights.

Here’s a detailed plan for an informational article on “Letter to Debt Collector Template” with practical, specific headings:

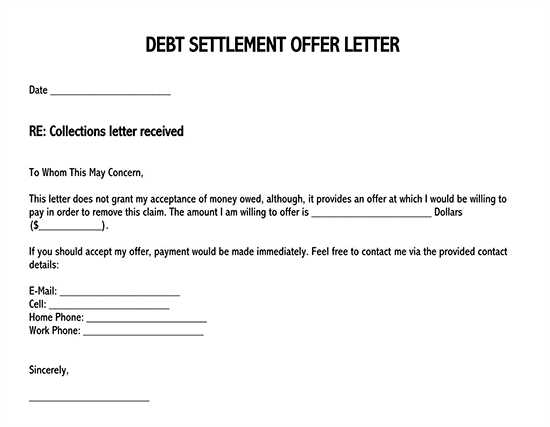

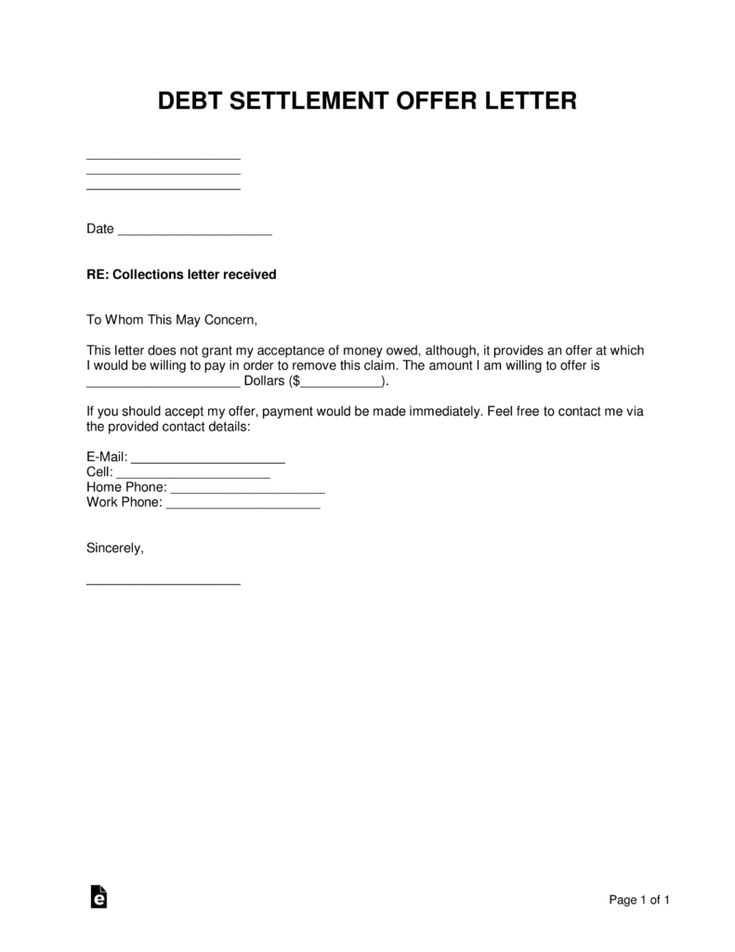

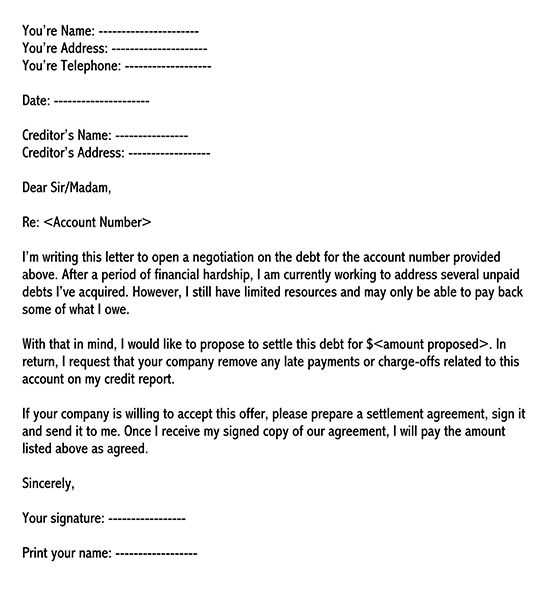

First, provide clear contact information. Include your full name, address, and the date on the top of the letter. Make sure the recipient knows exactly who they are communicating with. Include the debt collector’s details, such as their name, company, and address, as well.

State the Purpose of the Letter

Be direct and brief. State the purpose of the letter, for example, “This letter is regarding the debt you are attempting to collect on behalf of [Creditor Name].” Avoid unnecessary details. Confirm the exact amount you owe and, if applicable, the original creditor’s information.

Request for Debt Verification

Request verification of the debt. Ask the debt collector to provide specific information, such as the amount owed, the original creditor’s name, and any supporting documentation. For example: “Please provide proof that this debt is yours and that I owe the amount stated.” This will help ensure you’re addressing the correct issue.

Use polite but firm language. Acknowledge the collector’s efforts, but set clear expectations. Keep the tone respectful and non-confrontational to ensure positive communication.

Letter to Debt Collector Template

How to Begin Your Letter with Clear Identification

Including Essential Information to Dispute the Debt

Requesting Legal Validation of the Debt

Formulating a Payment Proposal or Arrangement

How to Maintain a Professional and Polite Tone

Steps to Follow After Sending the Collection Letter

Start with Clear Identification

Open your letter by clearly identifying yourself. Include your full name, address, and account number associated with the debt. This will ensure the collector knows exactly which account you are referring to. Make sure your contact information is up-to-date, allowing the collector to reach you without any confusion.

Dispute the Debt with Relevant Information

Provide clear reasons or evidence for disputing the debt. If you believe the amount is incorrect or if you never owed the debt, explain your reasons in a direct and concise manner. Attach any supporting documents such as statements or receipts to strengthen your claim.

Request Legal Validation of the Debt

Ask the collector to provide legal proof of the debt. State that, by law, you are entitled to verification of the debt, including the original creditor’s name and the amount owed. Request that the debt collector send you this documentation before continuing any collection efforts.

Propose a Payment Plan or Arrangement

If you are willing to resolve the debt, outline your proposal for a payment plan. Specify the amount you can pay monthly, or suggest a one-time settlement. Be clear about your expectations and make sure the offer is realistic based on your financial situation.

Keep a Professional and Polite Tone

Always maintain a respectful tone, even if you are upset or frustrated. A polite letter increases your chances of a favorable response and helps avoid escalation. Avoid using threats or emotional language, as this may work against you.

Next Steps After Sending the Letter

After sending the letter, keep a copy for your records. Monitor any responses from the debt collector, and track any legal actions. If you do not receive the requested validation, follow up in writing or seek legal advice on your next steps. It’s important to stay organized and respond promptly to any further correspondence.