Letter to investors template

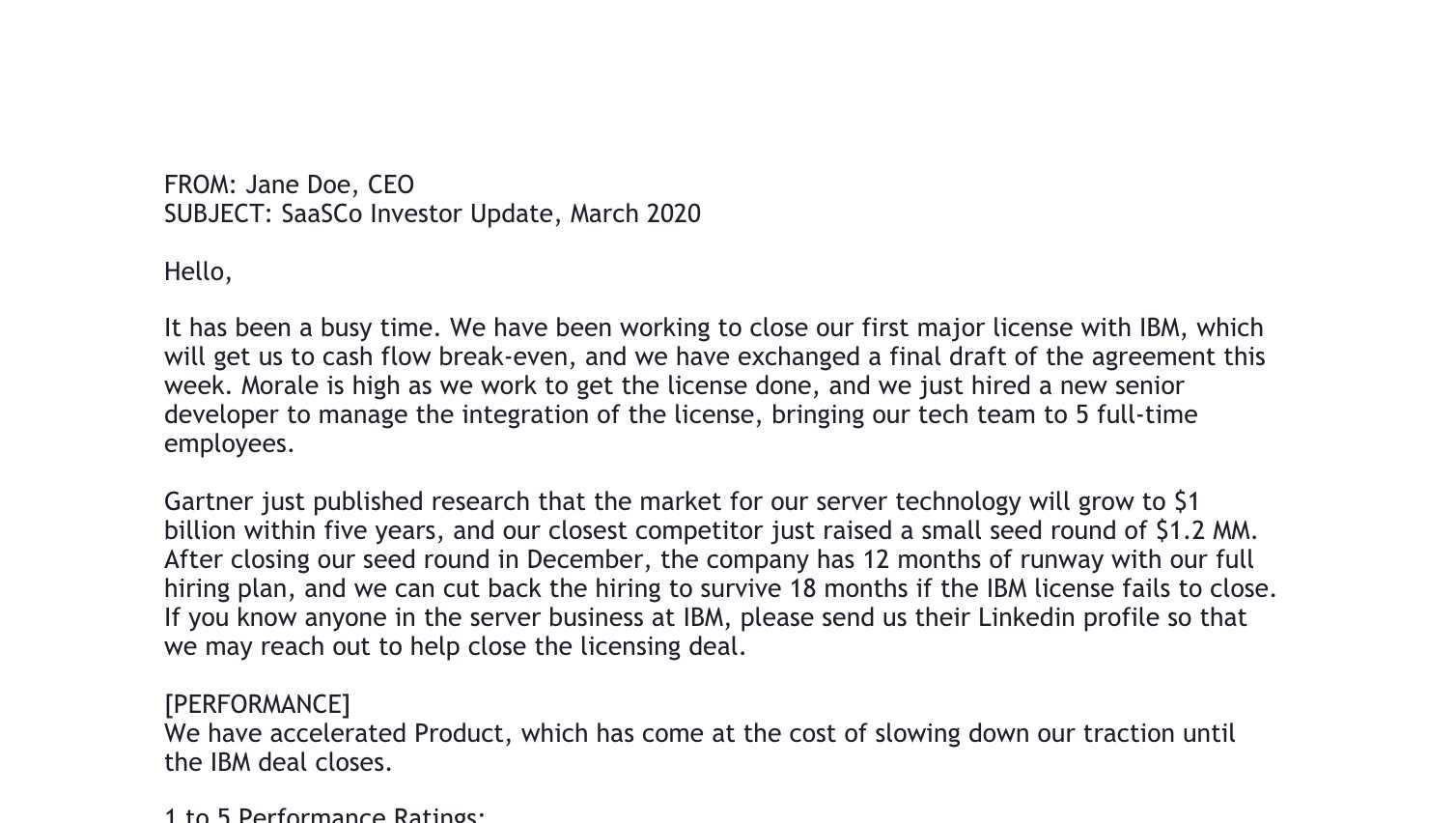

Creating a clear and concise letter to investors is key to establishing trust and transparency. Use this template to craft a message that communicates your goals, progress, and upcoming opportunities. Highlight the financial status of your business, key milestones, and projections for future growth. Tailor your letter to the specific interests and concerns of your investors.

Start with a direct introduction to acknowledge the investors and express appreciation for their continued support. Be transparent about the current state of your business–whether it’s growth, a transition phase, or tackling challenges. Provide an honest and straightforward view to keep them informed.

Highlight key financials in a clear and digestible format. Include revenue growth, profit margins, and any major financial shifts. Investors want to see the numbers behind your business decisions. Keep your language simple, and avoid overwhelming them with unnecessary details.

Discuss future plans in a focused and actionable manner. Provide insights into your strategic direction, upcoming product launches, or expansion into new markets. Be specific about what you’re working on and how it impacts the investors’ returns. Keep your focus on outcomes rather than abstract goals.

Conclude with a call to action that invites further engagement. Whether it’s scheduling a follow-up meeting, asking for feedback, or requesting additional support, make it clear what steps you’d like the investors to take next. Keep the tone confident yet respectful, showing you value their partnership.

Letter to Investors Template: A Practical Guide

Begin your letter with a clear and concise subject line that outlines the purpose of the communication. For example, “Quarterly Update: Growth and Future Strategy.” This provides context right away.

Address your investors directly. Use a formal but approachable tone to establish a connection. A simple greeting like, “Dear [Investor’s Name],” or “Dear Valued Investor,” works well.

Introduction

In the first paragraph, provide a quick overview of your company’s current status. Highlight the most important updates and financial metrics. Avoid overly technical jargon, but ensure the information is informative. For example:

| Key Metric | Q3 Performance |

|---|---|

| Revenue Growth | 12% increase year-over-year |

| Customer Acquisition | 20% higher than target |

| Operating Margin | 15% improvement |

Key Developments and Future Outlook

In the next section, discuss any major developments or changes in the business. This could include new partnerships, product launches, or strategic shifts. Make sure to outline the potential impact of these changes on future performance. For example:

- Partnership with [Company X] to expand into [new market].

- Launch of [Product Y], expected to drive [specific revenue target].

Wrap up the letter with a direct call to action. Encourage investors to reach out if they have any questions or need further information. Close by reiterating your appreciation for their continued support.

End the letter with a professional closing, such as “Sincerely,” followed by your name and position. This simple but respectful gesture strengthens the tone of the message.

How to Structure the Opening of Your Letter to Investors

Begin with a clear and direct statement of purpose. Address your audience specifically–use “Dear [Investor Name]” or “To Our Esteemed Investors” to make the tone personal and respectful. Establish the context of the letter right away, whether you’re seeking funding, updating on progress, or presenting a new opportunity.

Set the Tone with Confidence

The opening paragraph should reflect your vision and commitment. Show you are confident about the value your business offers without overselling. Be transparent and straightforward, stating what you hope to achieve with this communication and why it matters.

Highlight Key Points Early

Investors have limited time. Use the first few sentences to highlight the most critical information–whether it’s a new funding round, a significant achievement, or a strategic shift. Give them a reason to read on by pointing out the value proposition clearly and quickly.

What Information Should You Include in the Investment Opportunity Section?

Be clear about the opportunity’s specifics. Investors need a precise understanding of what they are funding and how it will benefit them.

Key Details to Include:

- Investment Amount: Specify how much capital you seek. Clearly outline the minimum and maximum investment thresholds, if applicable.

- Use of Funds: Describe exactly how the funds will be used. Whether it’s for product development, marketing, or operational scaling, transparency builds trust.

- Equity or Debt: State whether investors will receive equity, convertible notes, or debt. Outline terms such as interest rates, equity percentages, and payment schedules.

- Valuation: Include your company’s valuation and how it was determined. Provide supporting data and metrics to back up your figures.

- Exit Strategy: Offer potential exit routes for investors, such as acquisitions, IPOs, or buybacks. Be clear about the timeline and scenarios in which these options could become viable.

Key Metrics and Projections:

- Revenue Projections: Provide detailed forecasts for the next 3-5 years. Break down expected revenue growth by product line or market segment.

- Profit Margins: Outline the expected profit margins over time. Show how the business plans to become more profitable.

- Market Opportunity: Explain the size of the target market and the company’s potential to capture market share. Present data-driven insights into industry trends and demand.

- Risk Assessment: Acknowledge potential risks. Present strategies to mitigate them, whether related to competition, regulatory challenges, or operational hurdles.

Provide as much specific data and real-world evidence as possible to back up these claims. Investors will appreciate your transparency and thorough approach to the investment opportunity.

How to Present Your Financial Data Clearly for Investors

Organize your financial data into simple, digestible sections. Begin with your key metrics–revenue, profit margins, and cash flow. Present these in a table with comparative data for the past few years. Include a percentage change to give investors immediate insight into growth or decline.

Use charts and graphs to make trends more visible. Bar or line charts are effective for showing revenue growth or expenses over time. Avoid cluttering the presentation with too many data points–highlight the most relevant ones.

Offer context for your numbers. Investors need to understand the “why” behind the figures. Explain the reasons for any spikes or drops in revenue or costs, such as new market entry or unexpected expenses. Transparency builds trust.

Break down the key financial statements–income statement, balance sheet, and cash flow statement. Simplify the language, avoiding jargon or complex accounting terms. If necessary, include an appendix with more detailed data for those who want it.

Focus on your forecasts for the upcoming year. Show how you plan to grow, manage costs, or improve margins. Back these forecasts with realistic assumptions and data-driven insights.

Be honest about risks. Acknowledge potential challenges in your financial projections, such as industry shifts or economic downturns. Investors appreciate a balanced view that doesn’t ignore possible pitfalls.

Lastly, keep your financial summary short but impactful. Investors typically skim through documents, so make sure the most crucial data stands out. Avoid lengthy explanations and keep the focus on what matters most.

Key Points to Highlight in the Risks and Mitigation Strategy Section

Clearly identify potential risks that could impact your business or project. Be specific about the nature of the risks, whether financial, operational, legal, or market-related. A general statement about “market volatility” won’t suffice; instead, explain how fluctuations in demand or regulatory changes could affect your revenue streams or production capabilities.

Risk Categories

Break down risks into distinct categories, such as financial, operational, or environmental. This helps investors quickly assess which areas pose the highest threat. For example, an operational risk could involve supply chain disruptions, while a financial risk might focus on interest rate changes that could increase borrowing costs. By categorizing risks, you provide a structured approach that makes it easier to understand how each risk is being managed.

Mitigation Measures

For every risk identified, offer concrete mitigation strategies. Be clear about how you plan to reduce the impact of each risk. For example, if you’re concerned about currency fluctuations, outline hedging strategies or plans to diversify revenue sources across regions. Showing investors that you’ve already considered and planned for potential challenges builds confidence in your ability to handle unforeseen issues.

Proactive monitoring and contingency plans are critical. Explain how you will track these risks over time and adjust your strategies accordingly. Investors want to know you have a system in place for early detection and swift response to any emerging threats. Regular risk reviews should be part of your ongoing operational strategy.

Transparency and specificity are key. Avoid vague references like “we’ll address risks as they arise.” Instead, provide tangible steps you’re taking to manage each risk. For example, if a new competitor enters the market, explain how you plan to respond, whether through increased marketing, product differentiation, or cost optimization.

Best Practices for Crafting a Persuasive Call to Action

Focus on clarity. A good call to action (CTA) should be direct and easy to understand. Use simple verbs that prompt immediate action like “Get,” “Start,” “Claim,” or “Buy.” Avoid vague or generic terms that don’t give a sense of urgency or value.

- Be specific: Tell your audience exactly what they will get. Instead of “Click here,” try “Download your free eBook now” or “Start your 7-day free trial.”

- Highlight the benefit: Make it clear how the action will help the user. People are more likely to act when they see a clear benefit. For example, “Get your free consultation today” or “Save 20% on your first order.”

- Create urgency: Use time-sensitive language like “Limited time offer,” “Act now,” or “Hurry–spots filling fast” to motivate immediate responses.

Make your CTA stand out. Position it where it’s easy to find, preferably above the fold or near key content. Use contrasting colors or buttons that draw attention without being overwhelming.

- Use active language: Opt for action-oriented words that prompt users to act immediately, such as “Grab,” “Join,” or “Order.”

- Make it visible: Avoid burying the CTA. It should be prominent without being intrusive, allowing users to take action without searching for it.

Keep it short. Brevity is key. Stick to a few words that clearly state the next step. The goal is to make the CTA easy to grasp without overwhelming your audience.

- Avoid jargon: Use straightforward language that anyone can understand. A CTA like “Start your journey” may sound nice but doesn’t tell the user what exactly to do.

Test and iterate. Continually assess your CTAs. A/B testing different versions can help identify what resonates best with your audience, allowing you to optimize your messaging and placement.

How to Conclude Your Letter with a Strong Investor Follow-Up Strategy

Close your letter by clearly defining the next steps and setting expectations. Mention a specific date or time frame when you will follow up, ensuring it aligns with the investor’s schedule and interests. For example, you can say, “I will reach out on Friday to discuss the next phase of our partnership,” or propose a meeting within the next two weeks. This sets the tone for a prompt follow-up.

Provide multiple ways to get in touch, whether by phone, email, or a video call. Reaffirm your availability and flexibility to meet the investor’s preferences. Acknowledge any potential barriers by offering solutions, such as scheduling around their existing commitments.

Reiterate the value of the opportunity, but focus on specific points that align with the investor’s goals. This final touch reinforces why your proposal is a smart fit for them. Avoid overloading them with information. A simple reminder of the key benefits is enough.

Express genuine interest in hearing their thoughts and invite feedback. This shows that you value their perspective and are committed to maintaining an open dialogue. If possible, provide a link to your calendar or suggest a couple of times for a quick follow-up call.

Finish with a thank-you note that acknowledges their time and consideration. This polite closing leaves a positive impression and keeps the conversation open for future engagement. A phrase like “Thank you for your time and consideration, I look forward to our next conversation” works well to close on a respectful, professional note.