Lien release letter template

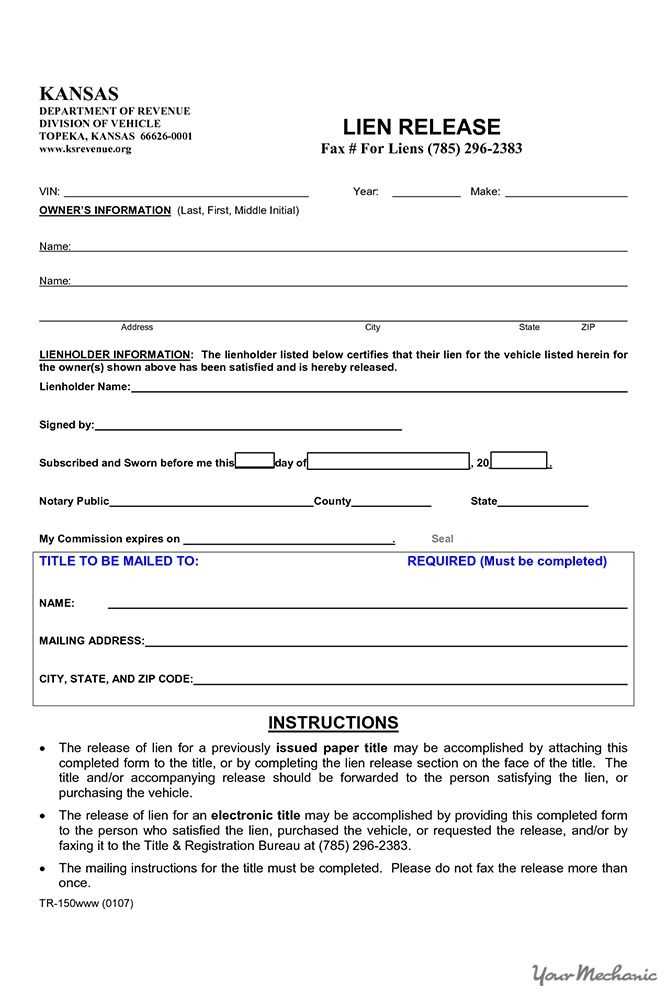

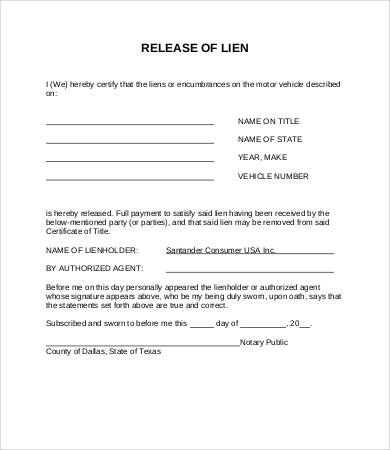

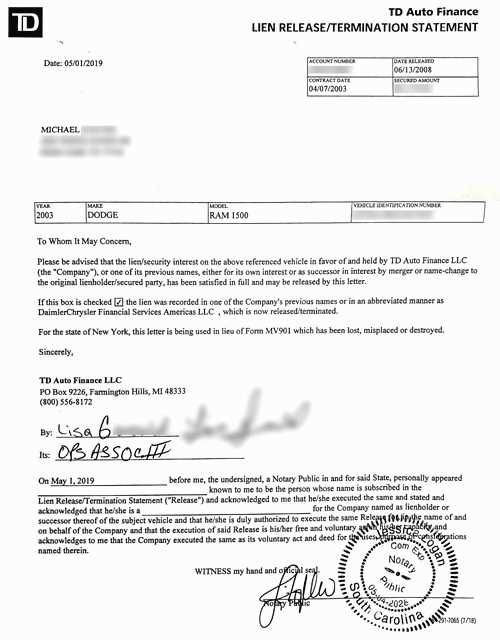

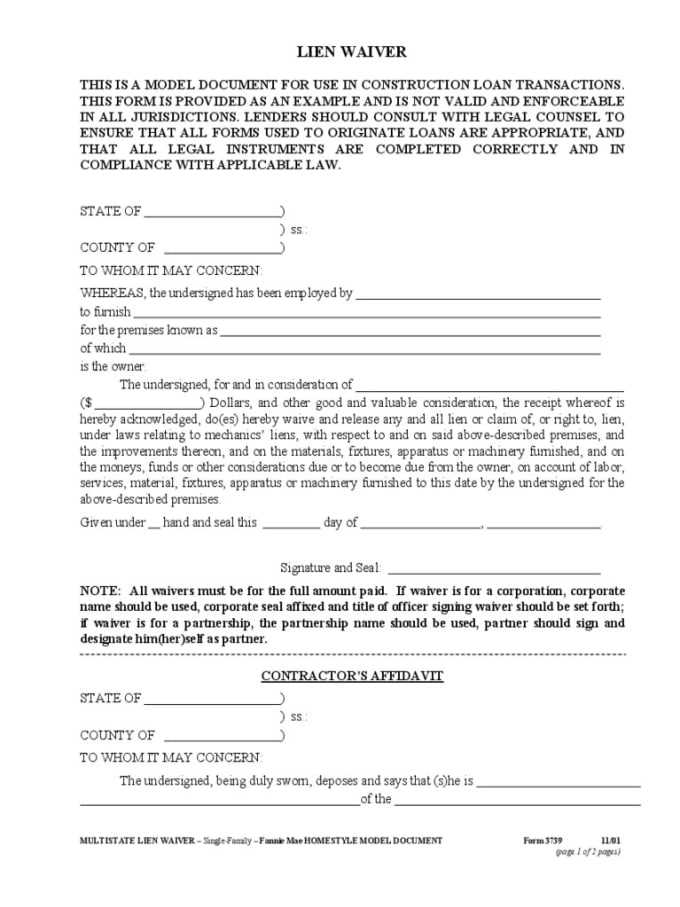

If you’re in need of a lien release letter template, it’s important to get it right. A lien release is a legal document that confirms a debt has been paid, and the lien holder no longer has a claim to the property. Using a clear and accurate template ensures that all necessary information is included, and it can help avoid delays or complications in the process.

The lien release letter should contain specific details: the name of the lienholder, the debtor’s name, a description of the property involved, and the amount of debt that has been paid. It’s crucial to state that the lien is fully released and that no further claims are being made. This letter acts as proof of the completion of the debt settlement, so precision is key.

For your template, make sure to include a space for both the date of release and the signatures of the involved parties. These signatures signify the agreement and acknowledgment of the lien release. In some cases, notarization may be required to add an extra layer of validation to the document.

Here’s the corrected text without repetitions:

When preparing a lien release letter, ensure it includes the necessary information such as the lienholder’s details, property description, and the lien amount. The letter should clearly state that the lien is being released, the date of the release, and confirm that all obligations have been met. Make sure the document is signed and dated by the appropriate parties. The letter should be concise, focusing on the key facts without unnecessary details. Keep the tone professional and straightforward, ensuring clarity in the terms and conditions outlined in the release.

- Lien Release Letter Template

A lien release letter serves as a confirmation that a lien holder has removed their claim on a property or asset. It is a crucial document when a debt has been settled or paid off, proving that the lien has been lifted. Below is a clear and simple template for a lien release letter. You can adapt it based on your needs.

Template for Lien Release Letter

Letter Title: Lien Release

To whom it may concern,

This letter confirms the release of the lien on [property or asset description] held by [Lien Holder’s Name] on [Date]. The lien was placed due to an outstanding debt. As of [Date], the full amount owed has been satisfied, and the lien is now considered null and void.

The lien was formally recorded on [Date of Lien Record], and this letter serves to notify all relevant parties that the lien has been officially released as of [Release Date].

Should you need further verification or documentation, please do not hesitate to contact me at [Your Contact Information].

Thank you for your attention to this matter.

Sincerely,

[Lien Holder’s Full Name]

[Title/Position, if applicable]

[Company Name, if applicable]

[Address]

[Phone Number]

[Email Address]

Begin by including the property details such as the address, legal description, and any other identifiers. Clearly state the lien holder’s name, the borrower or property owner’s name, and any relevant account or case number associated with the lien.

Next, confirm that the lien has been satisfied. Include the exact date of the payment or action that led to the lien release. Mention the amount paid, if applicable, and refer to any payment method or reference number that connects to the satisfaction of the lien.

In the body of the letter, express the intent to release the lien. Use clear language like “This letter serves as formal notice that the lien placed on the property located at [address] has been fully satisfied and is hereby released.” Avoid ambiguity.

Ensure the letter includes a section stating that the lien holder will notify the relevant parties or entities about the release, if needed. This could include notifying local governments or title companies.

End with a statement where the lien holder affirms they have no further claim on the property, and the lien is fully removed from the public record. Finally, provide space for signatures, including the lien holder’s, and any necessary witnesses or notarizations.

By providing specific, clear details and an official tone, your release letter will effectively confirm that the lien has been cleared and the property title is unencumbered.

A Property Lien Release Letter must clearly identify the lien being released, provide the correct property details, and ensure both parties are in agreement regarding the resolution. Key elements to include are as follows:

1. Lien Information

Clearly state the lien’s original filing details. Include the lienholder’s name, the property address, and any relevant reference number or document IDs that identify the lien in public records. This ensures the lien release is associated with the correct property.

2. Full Payment Acknowledgment

The letter must confirm that the debt tied to the lien has been fully satisfied. Include a specific statement that the outstanding amount has been paid or settled in full. Provide the exact payment date, the amount, and method of payment to avoid any future disputes.

3. Release of Claim

Include a clear statement that the lienholder releases any claim or interest in the property once the debt is resolved. This legally frees the property from any further claims related to the lien.

4. Signature and Date

Ensure both parties sign the letter. The lienholder should sign to confirm the release, and the property owner may also sign for acknowledgment. Both signatures should be dated to confirm when the release occurred.

Writing a release letter involves a clear and straightforward approach. Follow these steps to craft a well-structured and effective letter.

1. Start with the Header

- Include the name of the issuing party (your company or organization) at the top of the letter.

- Provide the date the letter is being written.

- Include the recipient’s name and contact information for clarity.

2. Begin with a Clear Subject Line

- The subject line should briefly state the purpose of the letter, such as “Release of Lien for [Property Address].”

3. Include a Formal Salutation

- Use the recipient’s full name or a respectful title (e.g., “Dear [Name]”).

4. State the Release of Lien

- Directly mention that the lien is being released. Use clear language such as “This letter confirms the release of the lien placed on [property address].”

- Specify the type of lien, whether it’s a mortgage lien, mechanic’s lien, or another type.

5. Provide Relevant Details

- Include important details such as the lien’s original date, the amount involved, and any references that relate to the lien (e.g., loan number, case number).

- Reference any legal documents that pertain to the release, such as the settlement agreement or payment receipt.

6. Confirm the Lien Release

- State that the lien has been fully released or satisfied.

- If applicable, specify any final payments that were made to clear the lien.

7. Closing Remarks

- Thank the recipient for their cooperation or attention.

- Offer to provide any further documentation or clarification if needed.

8. End with a Professional Closing

- Use a formal closing phrase like “Sincerely” or “Best regards.”

- Sign the letter and include your job title, company name, and contact information.

Accuracy in the details is key. One common mistake is failing to match the lien release information with the original lien document. Always ensure that the property details, lien amount, and involved parties are consistent between the two documents.

Not Including Necessary Signatures

A lien release must have signatures from all relevant parties. Missing a signature can cause delays or even invalidate the document. Check that all involved parties, including the lienholder and property owner, have signed the release.

Incorrect Dates

Incorrect or missing dates can cause confusion. Always double-check the release date and ensure it aligns with the actual completion of payment or satisfaction of the debt. The date is vital to avoid disputes over when the lien is officially released.

Don’t forget to properly file the lien release. In some cases, simply signing and providing the document isn’t enough. It’s important to submit it to the appropriate authorities or land registry to ensure the release is officially recorded and visible in public records.

Lastly, using vague or general language can lead to misinterpretations. Make sure to state clearly that the lien is fully satisfied and released, with no remaining obligations, using precise legal terminology.

To customize a release letter for different types of liens, focus on addressing the specifics of each lien type and the required legal language. Tailor the content to reflect the exact nature of the lien, the agreement made, and the parties involved.

1. Mortgage Lien

For a mortgage lien release, include the following details:

- The mortgage’s account number or property address.

- Confirmation that the full payment has been made or the debt has been settled.

- A statement indicating the release of the lien from the property title.

2. Tax Lien

For a tax lien release, be clear that the taxes owed have been paid in full, and provide:

- The taxpayer’s identification number.

- The tax period or assessment year.

- Proof of payment or a reference to the official tax agency’s acknowledgment of payment.

3. Mechanic’s Lien

When drafting a release for a mechanic’s lien, include the project details, such as:

- The contractor’s name and the project’s address.

- The specific work completed or materials provided.

- A statement that all payment obligations have been fulfilled and the lien is fully discharged.

4. Judgment Lien

For a judgment lien, make sure to specify:

- The court case number and jurisdiction.

- Confirmation of the settlement or full payment of the judgment amount.

- The full release of the lien from the affected property or assets.

Each lien release letter should reference the original lien agreement, any settlement or payment confirmation, and include an official statement confirming the release of the lien. Make sure the letter complies with state and local laws where applicable.

Releasing a lien marks the formal acknowledgment that the debt or obligation secured by the lien has been satisfied. This process carries significant legal implications that should be understood before proceeding.

Effect on Property Ownership

Once a lien is released, it clears the legal claim on the property, allowing the rightful owner to transfer or sell the property without restrictions from that specific lien. However, the release does not eliminate other potential claims or liens that may exist against the property. Always verify that all related liens have been addressed before finalizing a property transaction.

Potential Risks of Improper Release

Failing to properly execute a lien release can lead to legal disputes, including claims for unpaid debts or challenges from creditors. A lien release document must be clear, accurately worded, and properly filed with relevant authorities to ensure the lien is fully discharged and does not resurface in future property transactions.

| Step | Action | Legal Consequence |

|---|---|---|

| 1 | Obtain a signed lien release from the lienholder | Confirms that the debt has been paid or settled |

| 2 | File the release with the county or relevant government office | Ensures public records reflect the lien is removed |

| 3 | Confirm no additional claims are pending | Prevents future legal challenges to property title |

Before signing a lien release, ensure that all the terms and conditions tied to the debt are met and that the release document complies with state or local regulations. Consult a legal professional if there is any uncertainty about the procedure or language used in the lien release document. Proper execution provides peace of mind and avoids future complications.

When drafting a lien release letter, be clear and direct in stating that the lien has been removed. Begin with a statement acknowledging the release of the lien, followed by specifics of the property and the original lienholder’s information.

Ensure that the letter includes details like the date the lien was placed, the amount owed, and the final payment that satisfied the debt. These details clarify that all obligations have been met, leading to the lien’s removal.

Next, confirm the legal binding of the document. State that the letter serves as formal confirmation of lien release, and specify any conditions that might apply to this release. This reduces ambiguity and secures both parties’ interests.

Finally, conclude with the signatory’s details, including their position or relationship to the lienholder, to affirm the authenticity of the release. Don’t forget to have the letter notarized if required by local regulations.