Loan default letter template

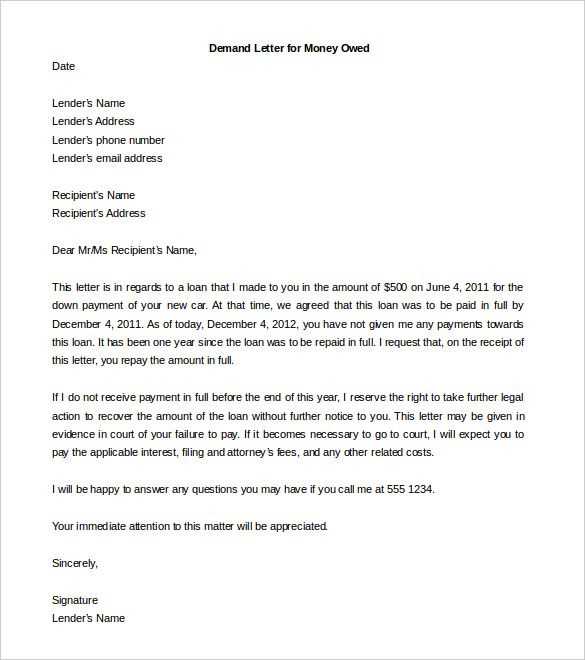

If you’re facing a situation where a borrower has defaulted on their loan, sending a formal default letter is one of the first necessary steps. This letter serves as an official notification to the borrower, outlining the overdue payment and the next steps. The tone of the letter should be firm yet respectful, ensuring clear communication without escalating tensions unnecessarily. By taking the time to draft a professional letter, you can set the stage for resolving the situation amicably or proceeding with further legal action if needed.

A well-crafted loan default letter should contain specific details, such as the amount due, the loan agreement terms, and the consequences of continued non-payment. Make sure to highlight any penalties or fees associated with the default, as well as the deadline for resolving the matter. It’s crucial to remain precise, as this letter may be referenced in future negotiations or legal proceedings.

Ensure that the letter is concise and to the point, without unnecessary embellishments. Address the borrower by name and include all relevant account details. An important part of the letter is providing a clear path for the borrower to make the payment or contact you to discuss possible arrangements. Offer them a reasonable time frame to rectify the situation while clearly outlining the legal ramifications if the debt remains unpaid.

Here’s the improved version with minimal repetition:

Focus on clarity and brevity. Structure your letter with a direct introduction that outlines the reason for writing. Use simple, clear sentences to explain the situation and provide any necessary details, such as the loan terms, payment history, and current status.

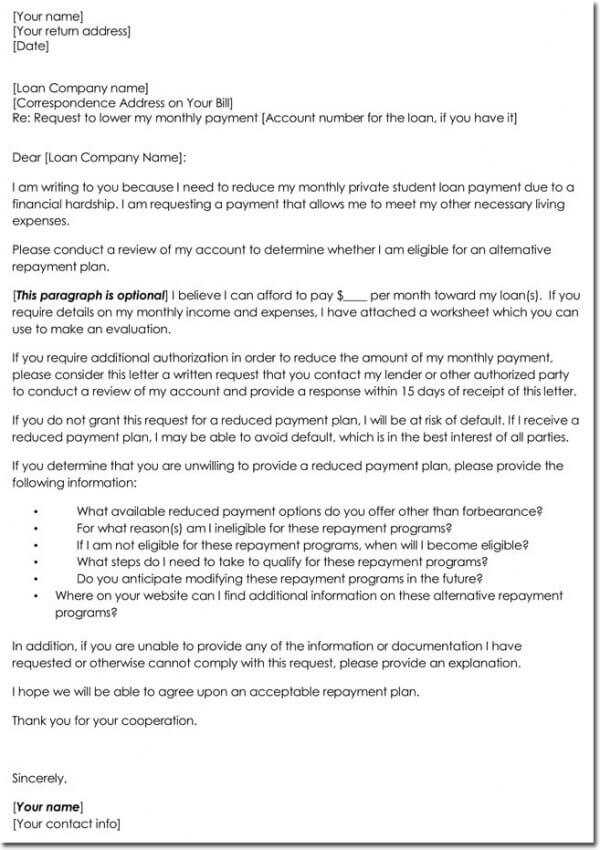

Provide a solution or request for action. Instead of just stating the problem, suggest a specific course of action or request that the lender can take. This could be a revised payment schedule or an alternative arrangement to resolve the default.

Stay polite but firm. Maintain a respectful tone throughout the letter, even while expressing dissatisfaction or concern. This shows professionalism and keeps the lines of communication open.

Proofread carefully. Double-check for any errors or unclear language. A well-written letter with no mistakes ensures your message is taken seriously and avoids confusion.

Loan Default Letter Template

How to Begin Your Default Letter

What to Include in the Default Notification

How to Address the Creditor Properly in the Letter

How to Clearly Explain the Reasons for Default

What Steps to Offer for Resolving the Issue

How to End the Letter Professionally with a Call to Action

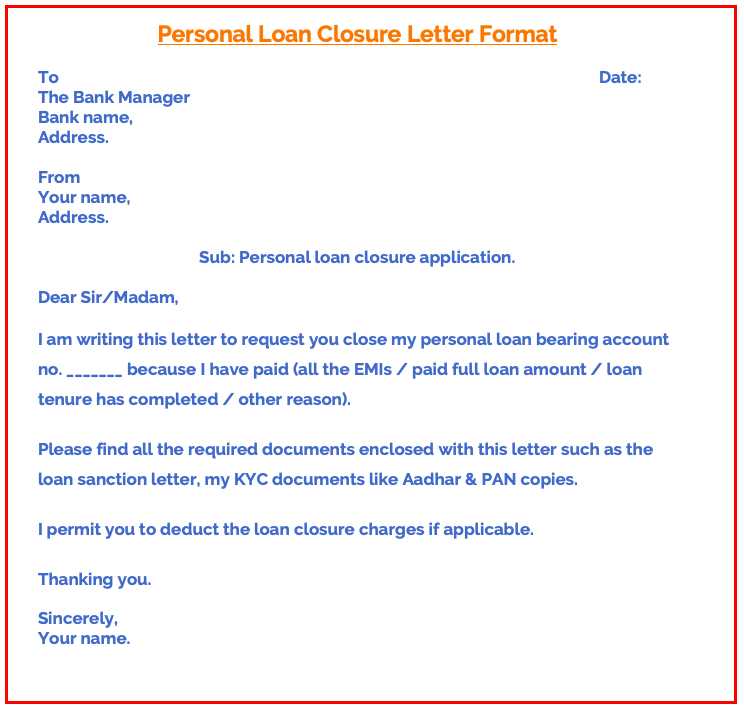

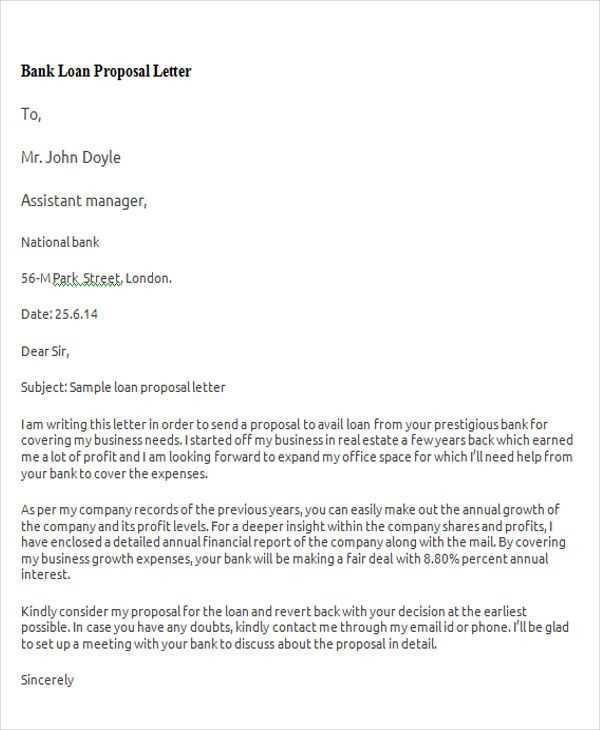

Start by addressing the creditor with their full name and title, followed by a formal salutation. Ensure your language is polite yet direct to convey the seriousness of the matter. Begin the letter by stating your purpose clearly: inform them of your loan default and explain why you are writing. For example, “I am writing to inform you of my current inability to meet the repayment terms for the loan I have with your company.”

In the body of the letter, include the essential details such as your account number, the amount owed, and any previous communications or agreements regarding payment terms. Be transparent and concise about the nature of your default, whether it is due to personal hardship, job loss, medical emergencies, or other financial difficulties. Make sure to be truthful to avoid any future misunderstandings.

Address the creditor properly by using their official name or title, such as “Dear Mr. Smith” or “To the Loan Department.” Using the correct formality and title helps maintain professionalism throughout the communication.

Clearly explain the circumstances surrounding the default. Keep your explanation straightforward and factual. For example, “Due to an unexpected medical emergency, I was unable to continue working, leading to a temporary loss of income, which affected my ability to meet the agreed-upon payments.”

Offer a solution or propose steps for resolving the issue. You might suggest restructuring the loan, requesting an extension, or negotiating a lower payment amount. Propose a reasonable and actionable plan, like “I am proposing a revised payment schedule that I believe would better align with my current financial situation.”

Conclude the letter by expressing your commitment to resolving the situation and requesting feedback. End with a polite but firm call to action, such as “I would appreciate your consideration of my proposal and look forward to your response within 10 business days.” Sign the letter with your name and contact details for further communication.