Loan denial letter template

When informing an applicant about the denial of their loan application, clear and respectful communication is crucial. A well-structured loan denial letter helps maintain professionalism while offering transparency. Use the following template to ensure the message is conveyed with sensitivity and clarity.

Start by clearly stating the decision to deny the loan application. Avoid using vague language that could cause confusion. Be direct but courteous in your wording, as it helps manage the applicant’s expectations right from the start.

Be transparent about the reason for the denial. Providing a brief, specific explanation will help the applicant understand the factors that contributed to the decision. Ensure the reason complies with legal requirements, such as the Equal Credit Opportunity Act (ECOA), which mandates that you provide a valid reason for denial.

If applicable, suggest ways the applicant could improve their chances in the future. For example, you might recommend steps like improving their credit score or reducing existing debt. This gives the applicant a clear path to possibly securing a loan with you or another financial institution later on.

Lastly, maintain a tone that leaves the door open for future applications. While it’s important to be firm in your decision, you can express your willingness to consider a future application once the applicant’s situation improves.

Here are improved lines with minimal repetition:

Ensure your tone is clear and firm, while maintaining respect. If a loan application is declined, it’s vital to offer specific reasons without overloading the recipient with unnecessary information. Acknowledge their effort, then explain the decision straightforwardly.

Clear, Direct Language

Use phrases like: “Unfortunately, after careful review, we cannot approve your loan application at this time due to [reason].” Avoid vague terms like “at this moment” or “currently,” which may confuse the reader.

Offer a Path Forward

Provide information on potential next steps. For example, “You may reapply after [time period] or consider other financing options that suit your needs.” Avoid overwhelming the applicant with too many suggestions, just one actionable step is enough.

Keep it simple, direct, and free of jargon. Always ensure the recipient understands why their request was declined and what they can do next.

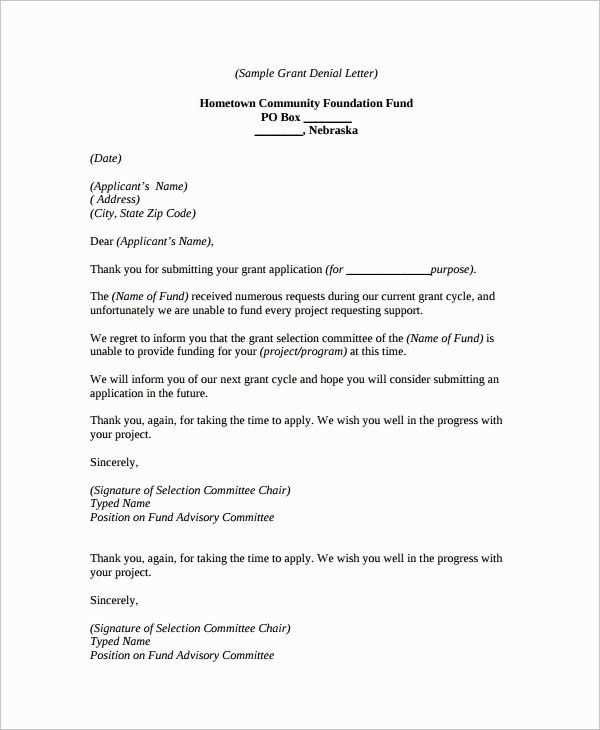

- Loan Denial Letter Template

When denying a loan application, it’s important to communicate clearly and respectfully. Below is a simple and professional template for a loan denial letter.

- Header: Begin with your company’s name and address at the top of the letter. Follow this with the date and the applicant’s details (name, address, etc.).

- Greeting: Use a polite greeting, such as “Dear [Applicant’s Name],”

- Reason for Denial: Be specific about the reason for the denial. Include any relevant details from the applicant’s credit report, financial history, or other factors. For example: “After careful consideration, we regret to inform you that your loan application has been denied due to insufficient credit history.” Avoid vagueness.

- Additional Information: Offer any next steps or additional information, such as ways the applicant can improve their eligibility in the future. For example: “You may wish to work on reducing existing debt or increasing your credit score to be considered for a future loan.” Be concise, but helpful.

- Closing: Use a courteous closing, such as “Thank you for your application. If you have any questions, feel free to contact us at [phone number or email address].”

- Signature: End the letter with your name and position, followed by your company’s contact details.

Here’s a sample template:

[Your Company Name] [Your Company Address] [Date] [Applicant's Name] [Applicant's Address] Dear [Applicant's Name], Thank you for applying for a loan with [Your Company Name]. After reviewing your application, we regret to inform you that we are unable to approve your loan request at this time. The reason for the denial is [reason, e.g., insufficient credit score]. We recommend [suggestion, e.g., improving your credit score or paying down existing debt] to better position yourself for future loan opportunities. If you have any questions or would like to discuss this further, please don’t hesitate to reach out to us at [contact information]. Sincerely, [Your Name] [Your Job Title] [Your Company Name]

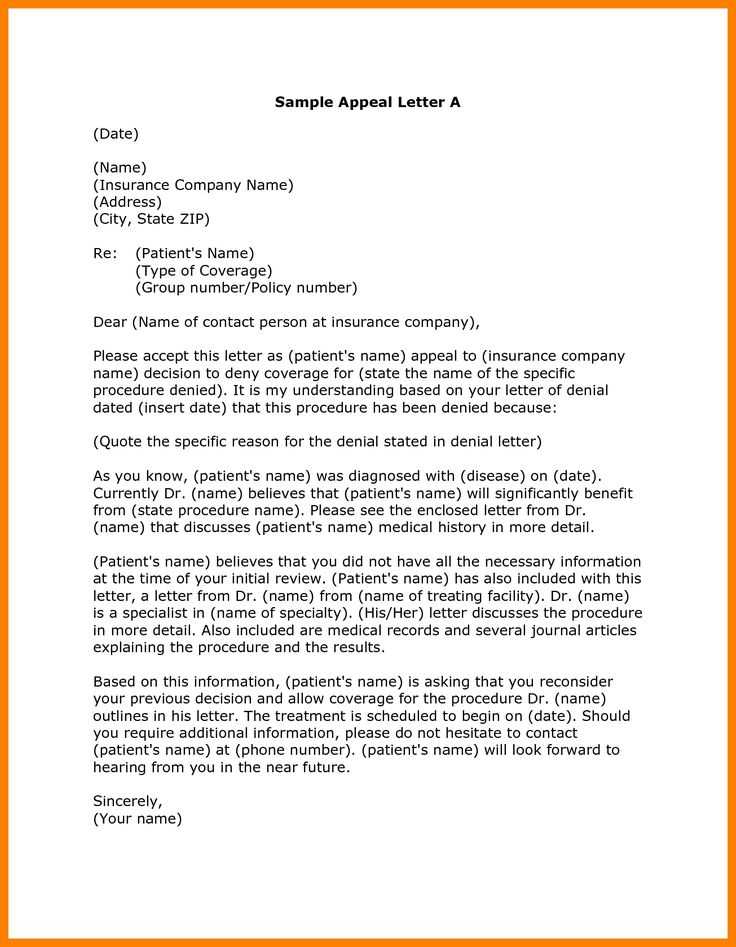

Begin with a clear, polite opening. Address the applicant by their full name and express appreciation for their interest in your loan services. This sets a respectful tone for the message.

1. Inform About the Decision

After your greeting, directly inform the applicant that their loan request has been denied. Be concise and avoid unnecessary explanations right away. For example: “We regret to inform you that your loan application has been declined.”

2. Provide a Reason for Rejection

Offer a brief explanation for the denial. If possible, reference specific criteria such as credit score, income level, or outstanding debt. Avoid overwhelming the recipient with too many details. Keep it clear: “Unfortunately, your application did not meet our required credit score criteria.”

Make sure this section is straightforward, without blaming the applicant. Instead of pointing out faults, focus on the conditions that led to the decision.

3. Offer Next Steps or Alternatives

Encourage the applicant to review their financial situation or seek advice. If appropriate, suggest alternative options such as applying for a smaller loan, improving their credit score, or reapplying after a certain period.

Conclude with an offer of support, such as providing further clarification or guidance on future applications. This can help maintain goodwill and leave the door open for future interactions.

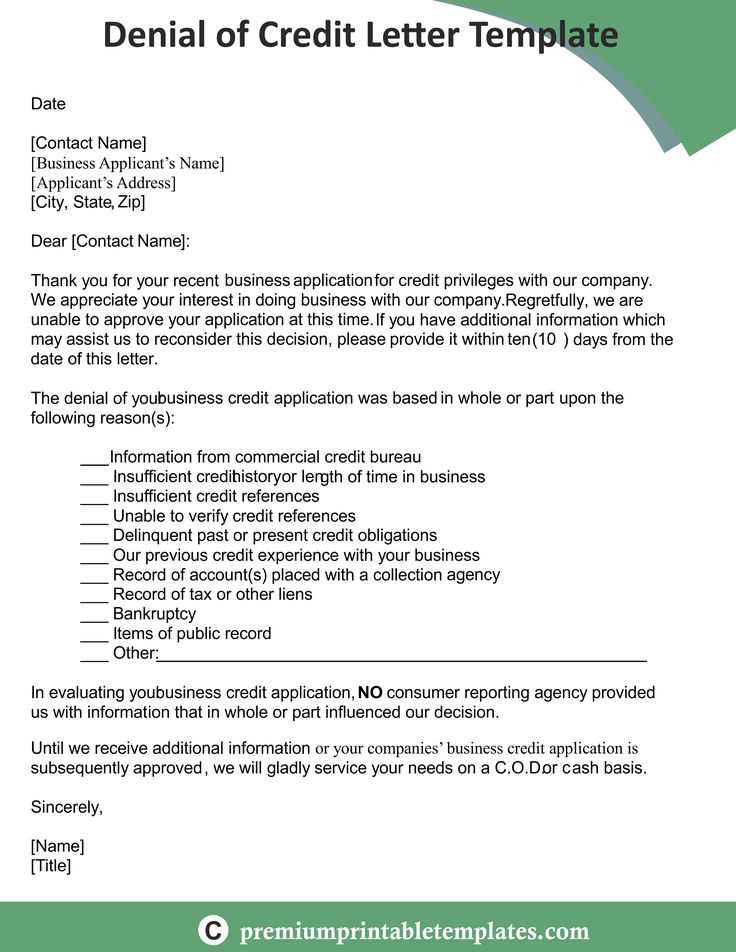

A rejection letter should be clear, concise, and informative. Including key details helps the recipient understand the reason for the decision and ensures transparency. Here’s what to include:

1. Loan Application Reference Number

Start by including the application reference number. This will help the recipient identify their specific loan request quickly.

2. Clear Rejection Statement

State clearly that the loan application has been declined. Avoid ambiguity and ensure the recipient knows the outcome of their request.

3. Reason for Denial

Provide a brief but specific explanation for the denial. Whether it’s credit score issues, insufficient income, or other factors, this gives the applicant insight into the decision-making process.

4. Information on Improving Future Applications

Offer guidance on how the applicant can improve their chances in the future. This could include tips on improving credit scores, increasing income, or providing additional documentation.

5. Option for Further Clarification

Encourage the recipient to contact your office for further details. This shows willingness to assist and can provide additional clarification on the decision.

6. Contact Information

Include the appropriate contact details, such as phone numbers or email addresses, for inquiries. This allows the recipient to follow up directly with any questions they might have.

7. Closing Remarks

End the letter politely and professionally. Acknowledge the applicant’s effort in applying and express appreciation for their interest in your financial services.

| Section | Details |

|---|---|

| Loan Application Reference | Include the unique identifier for the application. |

| Rejection Statement | Clearly state the application is denied. |

| Reason for Denial | Provide specifics about the reason for rejection. |

| Improvement Tips | Offer guidance on how to improve for future applications. |

| Contact Information | Provide phone number or email for follow-up questions. |

Common Reasons for Denial Explained in Detail

Financial institutions often deny loan applications due to specific factors that affect your eligibility. Understanding these reasons can help you address issues and improve your chances of approval in the future.

Low Credit Score – Lenders typically rely on your credit score to gauge your ability to repay a loan. A score that is too low can result in automatic denial. Improving your score by paying off debts and making payments on time can increase your chances of loan approval.

High Debt-to-Income Ratio – Lenders assess your debt-to-income (DTI) ratio to determine if you can afford additional debt. A high DTI ratio suggests you might struggle with repayment. Reducing existing debt or increasing income can help lower your DTI ratio.

Insufficient Income – Lenders need to see that you have a reliable and adequate income to make loan repayments. If your income is too low or inconsistent, they may deny your application. Consider providing proof of steady income or additional sources of income to strengthen your application.

Unstable Employment History – If you have frequent job changes or long periods of unemployment, lenders may view you as a higher risk. Maintaining stable employment for an extended period can improve your chances of approval.

Incomplete or Inaccurate Information – Providing incomplete or inaccurate information on your application can result in an automatic denial. Double-check all your details, including your income, employment status, and debts, before submitting the loan application.

Recent Bankruptcies – If you’ve recently filed for bankruptcy, it may affect your ability to secure a loan. Lenders often require a waiting period before considering you for a loan after a bankruptcy discharge. In the meantime, focus on rebuilding your credit history.

Too Many Recent Loan Applications – Applying for multiple loans in a short period can raise red flags for lenders. It may signal financial distress or desperation. Limiting loan applications and focusing on one at a time can help improve your chances of success.

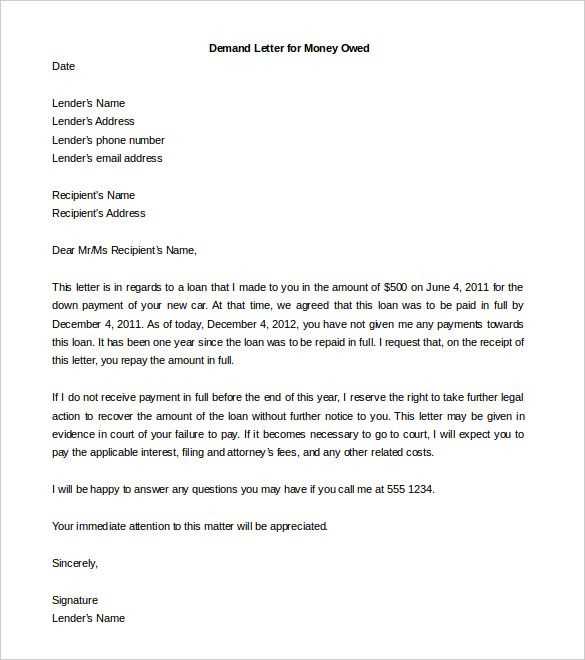

Start by being clear and direct. State the decision without ambiguity, avoiding unnecessary details about the reasoning unless it directly impacts the recipient’s understanding.

Be respectful and empathetic. Acknowledge the time and effort the applicant invested, showing appreciation for their interest in your company or offer.

Keep the tone neutral and formal. Avoid using overly casual language or expressions that might appear dismissive. Maintain a balance between warmth and professionalism.

Offer an opportunity for future engagement, if possible. You can express openness to future applications or collaborations, ensuring that the recipient feels valued even if the current decision is negative.

Finally, close on a positive note. Wish the recipient well in their future endeavors, reinforcing that their rejection is not a reflection of their abilities but rather a matter of fit or timing.

Offer clear, constructive suggestions to maintain a positive relationship with the applicant. If they don’t meet the criteria for approval, suggest options that can help them improve their situation. For instance, advise them to work on improving their credit score or reducing outstanding debt. You might also recommend applying for a smaller loan or a loan with different terms, which may have a better chance of approval.

If your institution offers products other than the one they applied for, inform the applicant about those options. Some alternatives may better suit their financial situation or have more lenient requirements. Always make sure to highlight the next steps they can take to improve their eligibility for future applications.

Let them know you’re available for further assistance. This approach shows empathy and provides a pathway for potential future success, encouraging the applicant to come back when they’re ready. Offer tools like budgeting resources or debt consolidation advice that could help in the long run.

Be clear and specific when explaining the reason for the loan rejection. Stating the exact cause will help avoid any confusion or potential legal issues. For example, if the rejection is based on credit score, mention the score and the specific threshold it failed to meet.

Ensure that the language in the letter is non-discriminatory. Avoid any language that could be interpreted as biased based on race, gender, age, or other protected categories. Stay focused on the financial criteria or specific actions that led to the decision.

Under the Equal Credit Opportunity Act (ECOA), a lender must notify the applicant of the decision within a reasonable timeframe, typically within 30 days. Failure to comply could result in legal ramifications. Always include the date of the decision and make sure the letter is sent in a timely manner.

If the applicant requests a reason for the rejection, you are required by law to provide it in writing. However, make sure that the explanation aligns with the specific reasons for denial that were considered during the loan evaluation process. Offering a vague or incorrect explanation could expose the lender to potential legal challenges.

Consider including information on how the applicant can obtain a copy of their credit report, if applicable. Providing this information promotes transparency and ensures compliance with credit reporting regulations.

Loan Denial Letter Template

Start by clearly stating the reason for the denial in simple terms to avoid confusion. Ensure that the language used is direct and specific to the applicant’s situation.

- Reason for Denial: Mention the specific criteria that led to the denial, such as low credit score, insufficient income, or high debt-to-income ratio.

- Alternative Options: Suggest other options, like improving credit or reapplying in the future after certain conditions are met.

- Respectful Tone: Even though the news is negative, maintain a professional yet empathetic tone. Express understanding of the applicant’s disappointment.

- Clear Instructions: Provide clear steps on how the applicant can improve their financial situation or eligibility for a future loan application.

Always personalize the letter with the applicant’s name and reference the loan application number for clarity. This ensures the recipient knows exactly which application is being addressed.