Loan modification hardship letter template

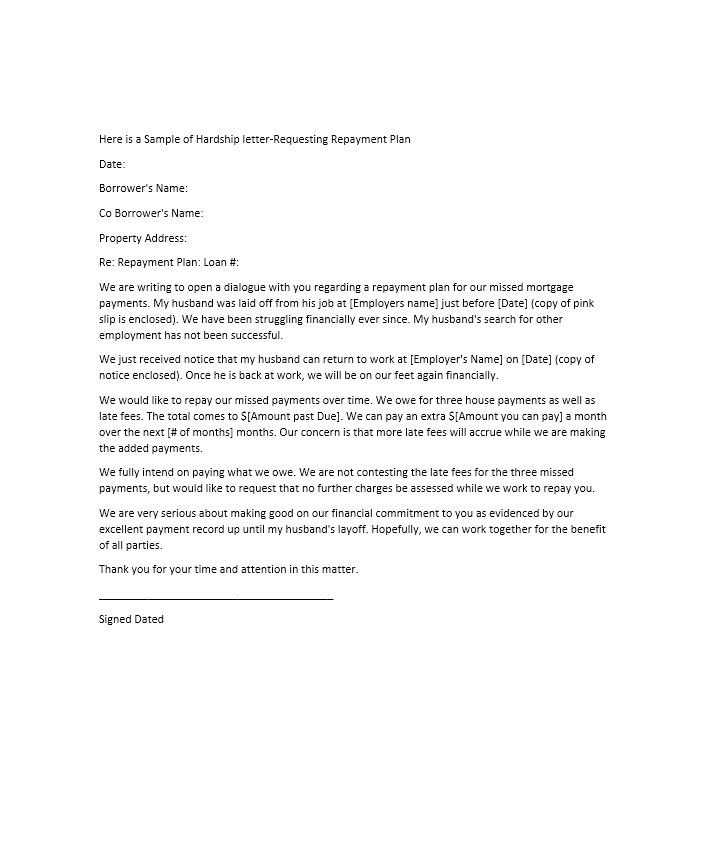

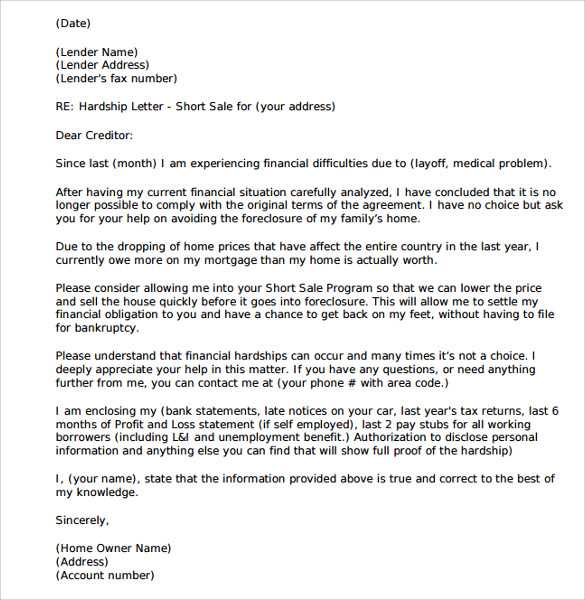

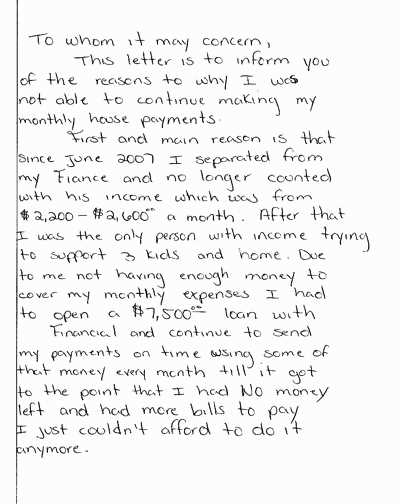

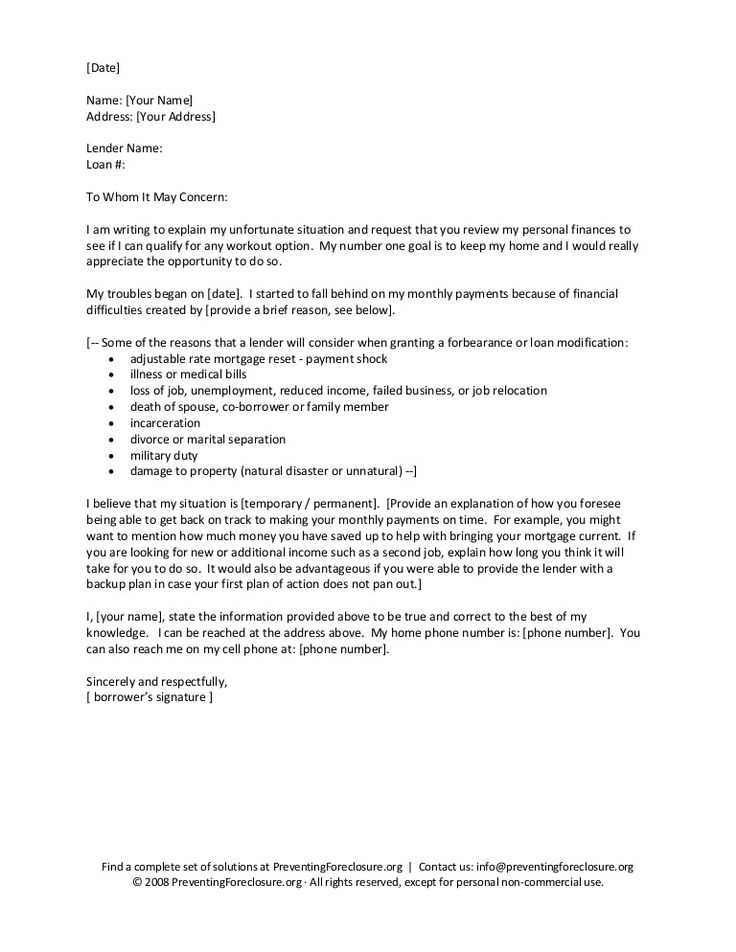

Write a clear and concise hardship letter to explain your financial difficulties when requesting a loan modification. Begin by directly addressing the lender, providing your full name, account number, and the reason for your request. Be honest and detailed about the circumstances that led to your financial hardship. Whether it’s a job loss, medical emergency, or other significant life events, explaining the situation thoroughly helps the lender understand your current financial standing.

Describe your current financial situation, including your income, monthly expenses, and any significant changes. This allows the lender to assess your ability to repay the loan and determine a feasible modification. Be transparent about what you can afford and what you are asking from the lender, whether it’s a lower monthly payment, an interest rate reduction, or an extension of the loan term.

Finally, express your willingness to cooperate with the lender and work towards a mutually beneficial solution. Ensure that the letter is respectful and professional. Keep the tone positive and emphasize your commitment to resolving the issue. A well-written hardship letter can significantly improve your chances of receiving a loan modification, so take the time to craft it carefully.

Loan Modification Hardship Letter Template

Begin your hardship letter by clearly stating the reason for your financial difficulty. Mention specifics, such as job loss, medical emergencies, or reduced income, and provide concrete examples that highlight your situation. Be honest and straightforward about the circumstances that are making it difficult to keep up with your loan payments.

Details to Include in Your Letter

Provide a clear overview of your current financial situation. Include details such as your income, monthly expenses, and any changes to your financial obligations. It’s helpful to provide supporting documentation, such as medical bills, termination letters, or bank statements, that show the severity of your hardship.

Explain Your Request

Clearly state what kind of loan modification you are seeking, whether it’s a reduction in interest rate, extension of loan term, or a temporary forbearance. Be specific about what changes would help you manage your payments and avoid foreclosure. Make sure to express your commitment to fulfilling your financial responsibilities as soon as your situation improves.

Conclude by thanking the lender for their time and consideration. Be polite and express hope for a positive outcome, while acknowledging their understanding of your challenges.

Key Details to Include About Your Financial Situation

Clearly outline your current income and any other sources of financial support, including government benefits, alimony, or child support. Provide exact figures to give a complete picture of your financial situation.

Income Breakdown

- List your monthly income from all sources (salary, freelance work, etc.).

- Include any irregular income, such as bonuses, commissions, or side jobs, if applicable.

- If applicable, mention any reductions in income (e.g., hours cut, pay cuts) and explain the reason.

Expenses and Debts

- Detail your monthly expenses (housing, utilities, groceries, insurance, etc.).

- List all outstanding debts, including credit cards, medical bills, personal loans, or car payments.

- Be honest about your ability to cover these expenses, especially if you’re experiencing difficulty making ends meet.

By providing this information, you help the lender understand your ability to repay the loan and your current financial challenges. This transparency is key to securing a loan modification that aligns with your situation.

Explaining the Circumstances Behind Your Hardship

Be clear and honest about the events that led to your financial difficulties. Outline specific situations such as job loss, medical issues, or unexpected life changes. Include any relevant dates or details to help the reader understand the timeline of your hardship.

Describe your current financial status with exact figures. Provide income, monthly expenses, and any other debts or obligations that might impact your ability to make payments. Be transparent about how the hardship affects your day-to-day life.

Provide evidence of your efforts to overcome the situation. If you have applied for new employment, reduced your expenses, or sought financial counseling, mention these steps. This shows that you are proactive in managing the situation.

Avoid exaggerating or leaving out key details. Stick to the facts and be honest about your situation. Transparency will build trust and increase the likelihood of a favorable outcome for your loan modification request.

How to Show Your Efforts to Overcome Financial Challenges

Provide detailed evidence of the actions you’ve taken to manage your financial situation. Document steps such as cutting non-essential expenses, seeking additional income sources, or negotiating with creditors for reduced payments. Include specific examples, like a part-time job you’ve taken or payment arrangements with other creditors.

List any financial counseling or debt management services you’ve engaged with. Mention meetings with financial advisors or consultations with nonprofit organizations that offer financial assistance. Demonstrating that you’re actively working with professionals shows commitment to resolving your financial difficulties.

If you’ve sold personal property to cover expenses, include receipts or proof of sales. This illustrates your willingness to make sacrifices to improve your financial situation. Include a summary of any emergency savings you’ve used and explain how you plan to rebuild them once your circumstances improve.

Show any positive changes in your budgeting habits. If you’ve switched to a stricter budget or have implemented new tools like budgeting apps, provide details of these steps. Showing consistent effort in managing your finances can reinforce your commitment to overcoming hardships.

What to Request in Terms of Loan Modification

Request a reduction in your monthly payment amount. Propose a payment plan that fits within your current budget. If necessary, suggest a temporary forbearance period where payments are lowered or paused.

Ask for an interest rate reduction. Lower rates can significantly reduce your payments over time. This can be particularly helpful if you’re struggling with high interest rates that make it difficult to keep up with payments.

Request an extension of the loan term. A longer repayment period will spread the payments out, making them more manageable on a monthly basis. This can be helpful if your current term is too short to meet your financial situation.

Propose a principal reduction if you’re facing severe financial hardship. If you’ve experienced a significant loss in income or a major financial setback, this may be a reasonable option to help bring your loan balance down to a more manageable level.

Consider requesting a loan modification that incorporates a combination of these options. Each individual’s financial situation is unique, and blending various modifications might offer the best solution to ease your burden.

Tips for Finalizing Your Letter and Improving Its Impact

Ensure your hardship letter is clear, direct, and free of unnecessary information. Focus on the most relevant details that explain your financial situation and why you are requesting a loan modification.

Be Concise and Specific

Avoid over-explaining your situation. Include only the details that matter to the lender. Specify the type of hardship you’re facing–whether it’s job loss, medical issues, or another reason. The more specific you are about your circumstances, the easier it is for the lender to understand your need for a modification.

Show Willingness to Cooperate

Express your commitment to working with the lender. Offer a plan for how you intend to resolve your situation, showing that you are proactive and ready to continue meeting your obligations in the future.

| Recommendation | Benefit |

|---|---|

| Keep your tone respectful and professional | Helps build a positive relationship with the lender |

| Provide accurate financial information | Increases the credibility of your request |

| Attach supporting documents (income, medical bills, etc.) | Strengthens your case by providing evidence |

Always review your letter for errors before sending it. A well-crafted letter can improve your chances of receiving a favorable response.