Loan settlement letter template

When settling a loan, you need a formal document that clearly outlines the agreement and confirms that all obligations have been met. A well-crafted loan settlement letter serves as proof of the transaction, offering both the lender and borrower peace of mind. This document should include the loan details, the payment made, and the fact that the borrower has fulfilled their responsibility.

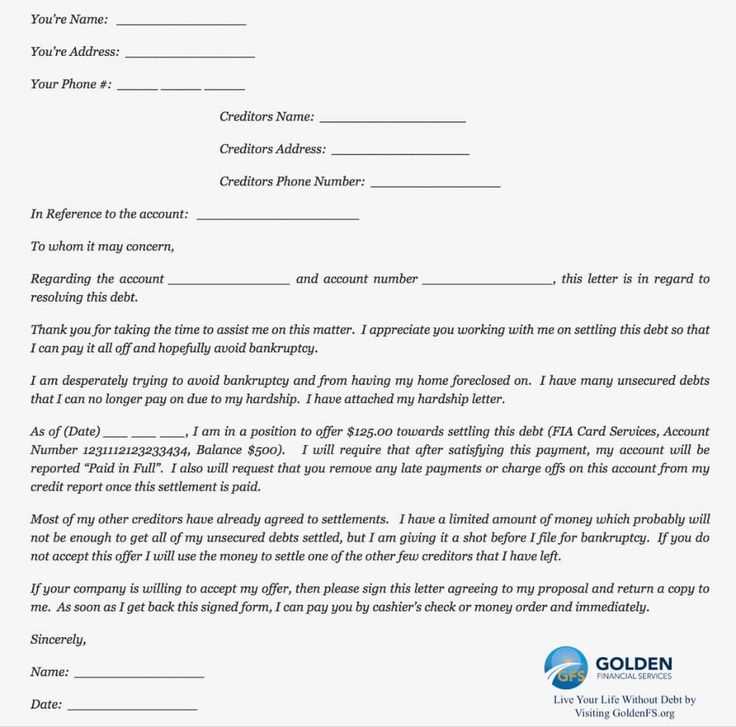

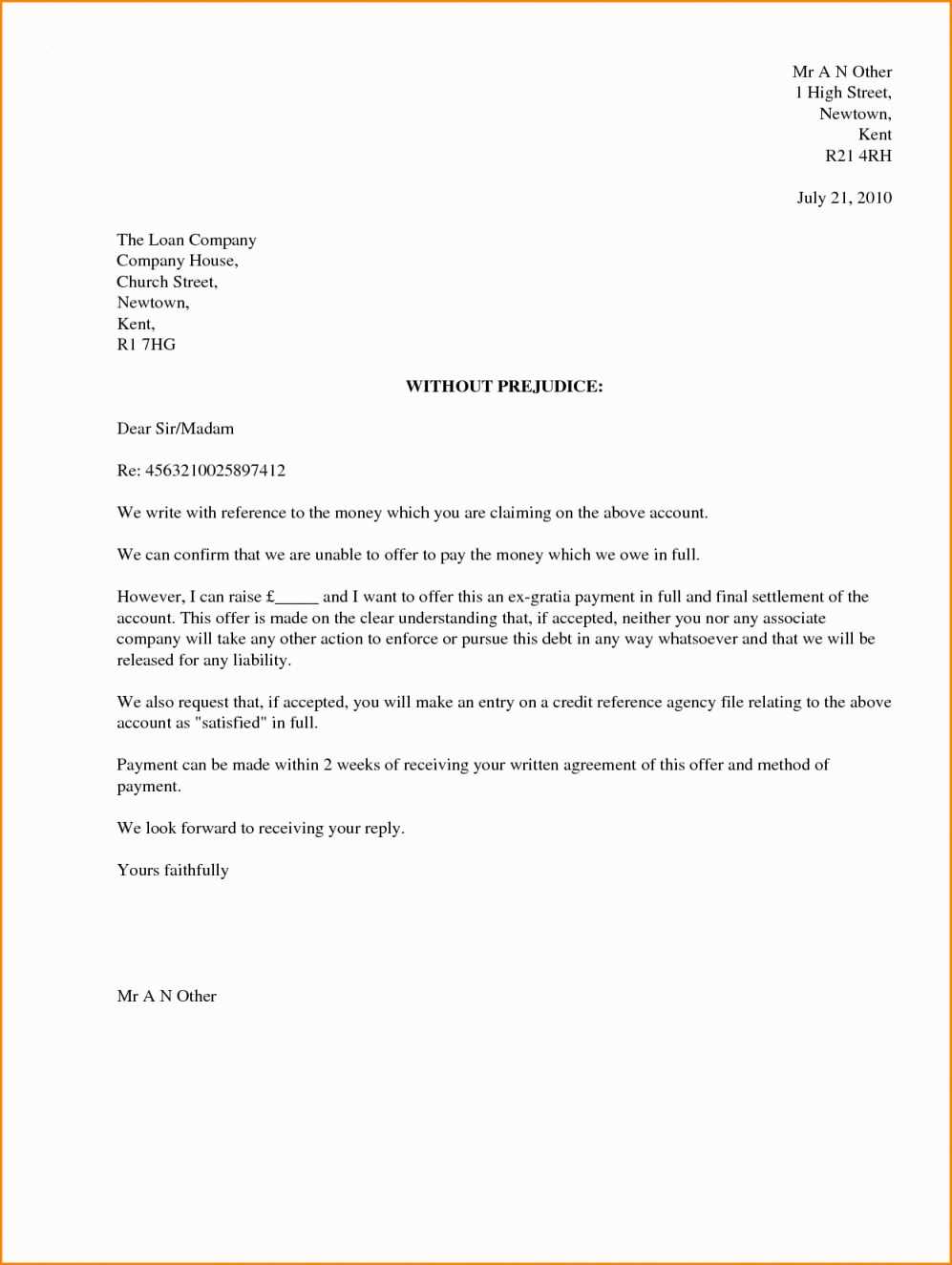

Start by including the full names and addresses of both the lender and borrower. Specify the loan number and the total amount owed. Then, state the date on which the loan was fully settled and any conditions that applied to the settlement. Be precise with the language to avoid any misunderstandings in the future.

Clearly mention that the loan balance is paid in full and that there are no remaining obligations. Include a statement that releases the borrower from any further claims related to the loan. If applicable, add any conditions for the return of collateral or property. This step helps ensure both parties have a clear record of the transaction.

Wrap up with a thank you note, showing appreciation for the cooperation between both sides throughout the loan period. This simple gesture adds a polite touch while confirming the official conclusion of the matter.

Sure! Here’s the revised version:

When drafting a loan settlement letter, it’s important to be clear and precise. Include the following details for a strong, professional approach:

Loan Information

Start by identifying the loan specifics, including the loan amount, original loan date, and the total outstanding balance. This sets the context for the settlement agreement.

Settlement Terms

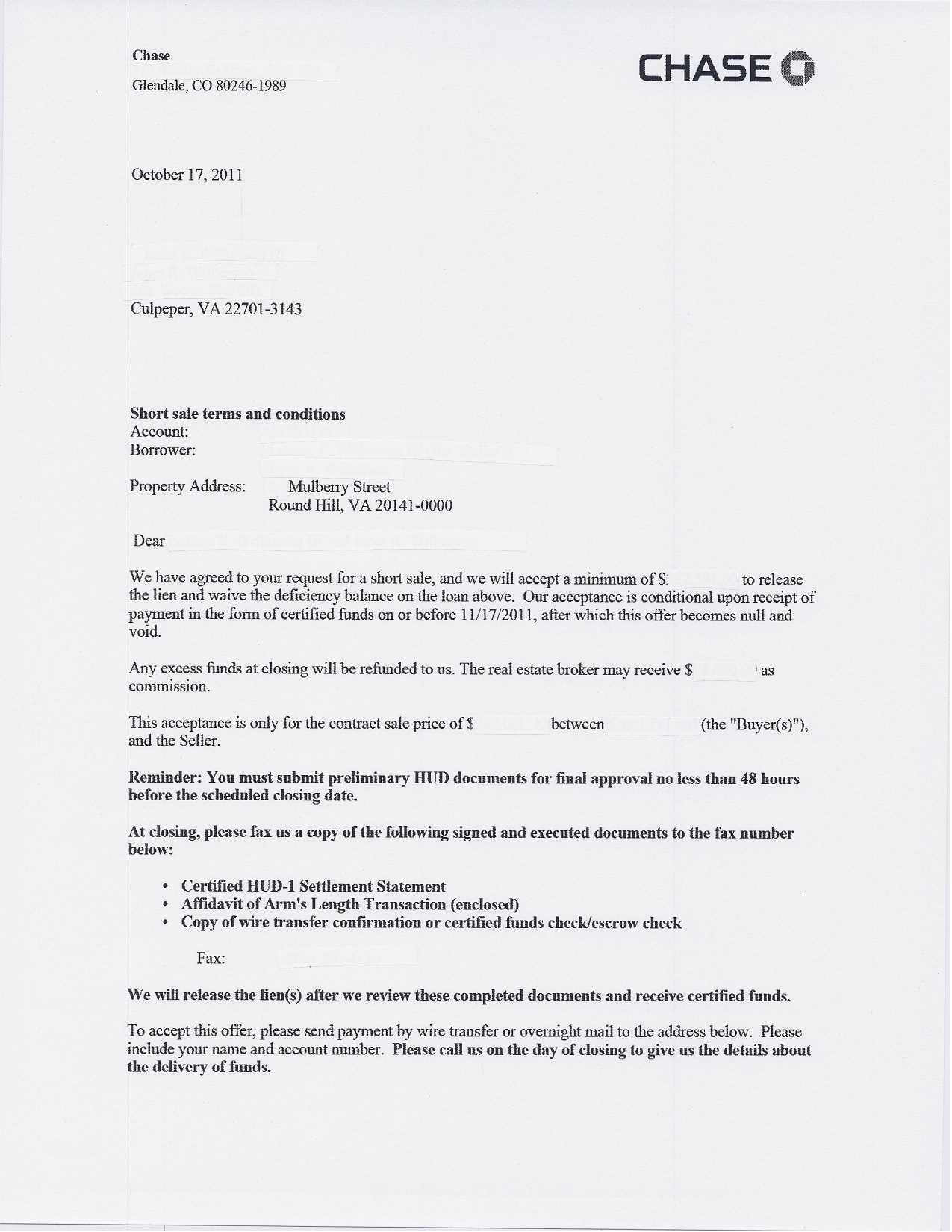

Clearly outline the terms of the settlement. State the agreed-upon amount for settlement, payment method, and timeline. If the settlement is a lump sum, note the date and amount. If installments are agreed upon, specify each payment’s amount and due dates.

Additional Notes: If there are any additional conditions, such as waiving certain fees or any required documentation, include them here.

Finish the letter with a polite closing, confirming that once the terms are met, the loan will be considered fully settled. Include a place for both parties to sign and date the agreement to finalize the process.

- Loan Settlement Letter Template

Begin the letter by stating your full name, address, and the date at the top of the page. Below that, include the lender’s information, such as their name, address, and title. Start with a formal greeting, addressing the lender by name.

Next, express your intent to settle the loan. Clearly state the loan number and any relevant details such as the date the loan was taken. Be specific about the amount being settled and whether the payment covers the full loan balance or just a partial settlement.

- Example: “I am writing to confirm the settlement of Loan Number [XXXXXXX] for the amount of [amount]. This payment will settle the entire balance of the loan.”

After this, outline the terms of the settlement. If the loan is being settled in full, mention that no further payments will be required. If only a partial settlement is made, explain the remaining balance and any future steps the borrower must take.

- Example: “This payment covers the full outstanding balance of the loan, and no further payments will be due.”

Ensure the lender acknowledges the settlement by requesting a formal confirmation. You may also want to include a request for the removal of any negative marks on your credit report if applicable.

- Example: “Please send written confirmation that the loan has been fully settled and that the loan balance has been cleared from my account.”

End the letter with a polite closing, such as “Sincerely,” followed by your name and contact information. If sending the letter via email, include your email signature with contact details.

A loan settlement letter must be clear and direct. Begin with your contact details (name, address, phone number, and email) at the top of the letter, followed by the date. Then, provide the lender’s contact information.

In the opening paragraph, briefly state the purpose of the letter: your intent to settle the loan. Clearly mention the loan account number, the outstanding balance, and your proposed settlement amount. Keep it concise.

Details of Settlement Agreement

In the next section, outline the terms of the settlement. Specify the agreed-upon settlement amount, payment method, and payment date. Include any additional conditions, such as whether the lender agrees to mark the loan as “paid in full” upon receipt of the settlement amount. This section is critical as it establishes the expectations of both parties.

Closing Remarks

End the letter by expressing your desire for a swift and smooth resolution. Thank the lender for their cooperation and provide any necessary instructions for sending the payment. Include a polite closing statement, such as “I look forward to your prompt confirmation of this agreement.”

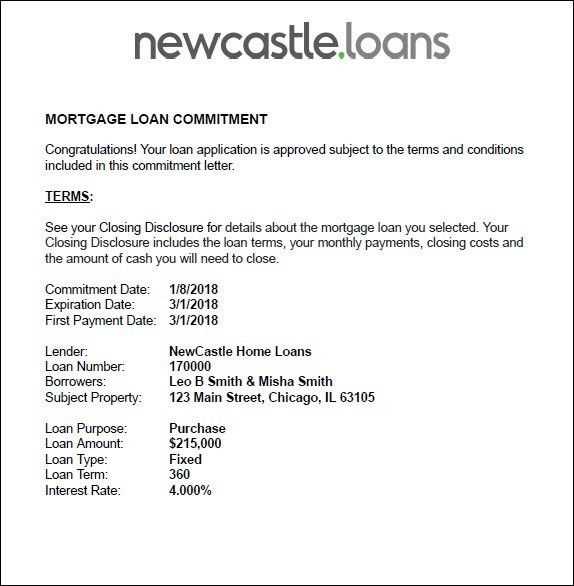

Include the loan amount, clearly stating how much money is being lent. Specify the interest rate and explain whether it is fixed or variable. Define the repayment terms, including the schedule, frequency of payments, and total duration. Outline any late fees or penalties for missed payments, and include any provisions for early repayment, if applicable.

List both parties’ full names, addresses, and contact information. Be specific about the collateral, if any, involved in securing the loan. Provide details on how disputes will be resolved, such as through mediation or arbitration. Lastly, add a section with the signatures of both parties, dated, to legally bind the agreement.

Common Pitfalls to Avoid in a Settlement Letter

Keep the language clear and specific. Avoid vague terms that could lead to misinterpretation. For example, terms like “reasonable” or “acceptable” are subjective and may create uncertainty. Instead, specify exact amounts, deadlines, and conditions to prevent misunderstandings.

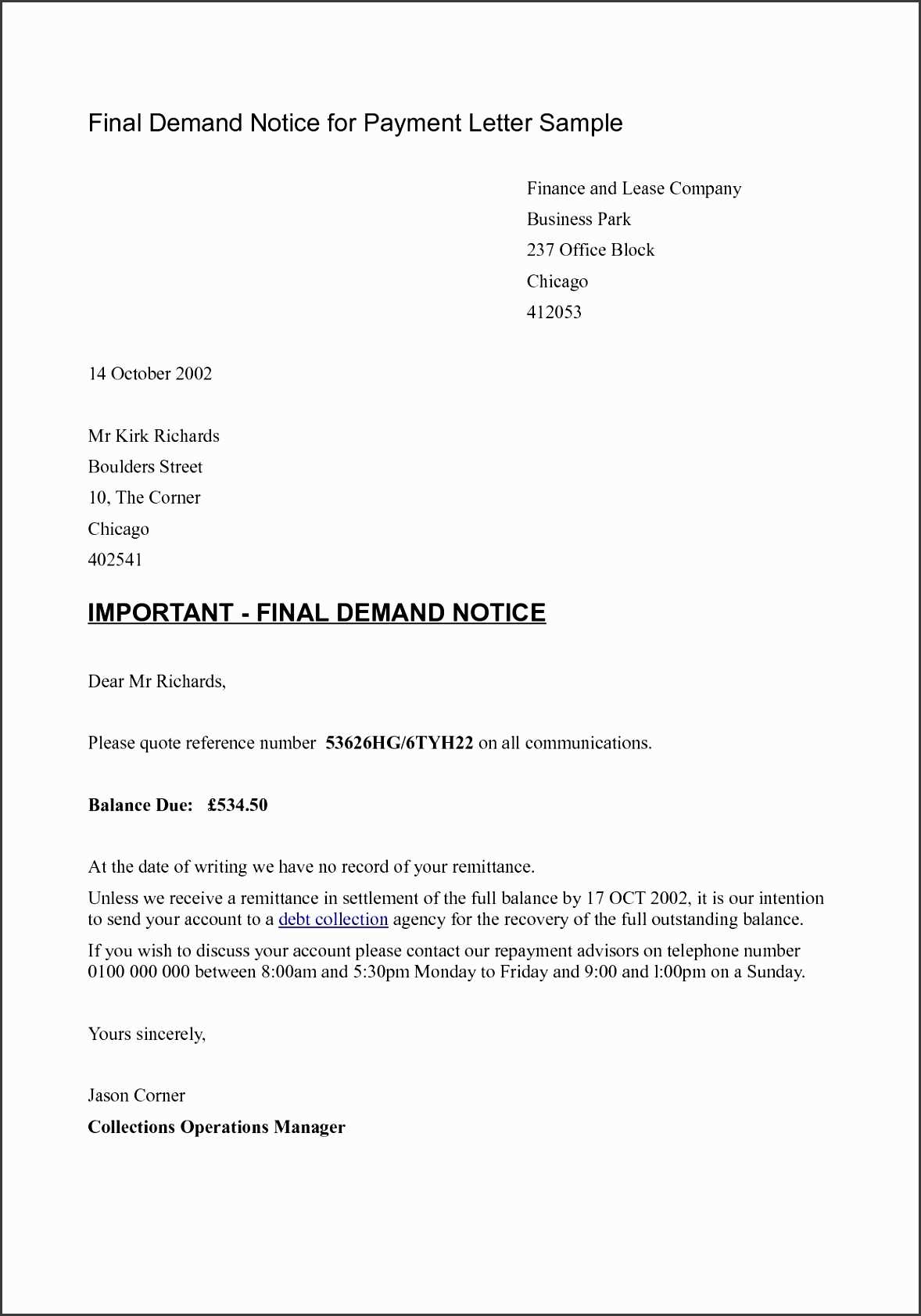

1. Ignoring Deadlines

Failing to include clear deadlines can lead to delays and confusion. Specify the time frame within which both parties must take action. Whether it’s a payment deadline or a response time, set firm dates and avoid leaving them open-ended.

2. Omitting Key Details

Don’t overlook important information. Ensure the settlement letter includes the specific terms of the agreement, the parties involved, and the exact amounts to be settled. Also, include any documentation or references that support the terms of the settlement.

3. Overcomplicating Terms

Avoid using legal jargon or overly complex language. The letter should be straightforward and understandable to all parties. If the letter becomes too difficult to comprehend, the risk of disputes increases.

4. Lack of Signatures

Ensure the settlement letter is signed by all involved parties. Without proper signatures, the agreement may not be legally binding. This step is critical to ensure that both sides are committed to the terms outlined.

5. Failure to Acknowledge Previous Agreements

Reference any previous communications or agreements. If the settlement is part of a larger negotiation or series of discussions, ensure those earlier terms are acknowledged and incorporated to avoid contradictions.

6. Not Addressing Future Disputes

Include a clause that outlines the steps to take in case of further disputes. This could involve specifying arbitration or mediation procedures, helping to prevent any future conflicts from escalating.

7. Making Assumptions

Do not assume both parties share the same understanding of terms. Explicitly state all conditions and avoid assuming that certain expectations are understood without being written down.

Steps for Negotiating a Settlement Before Drafting the Letter

Negotiating a loan settlement requires preparation and clear communication. These steps help achieve a fair and reasonable agreement with your lender:

- Assess Your Financial Situation

- Research the Lender’s Options

- Set Your Settlement Offer

- Prepare Your Case

- Open Negotiations

- Stay Flexible

- Get Everything in Writing

Evaluate your current financial standing, including income, expenses, and any outstanding debts. Understanding what you can realistically afford will guide your negotiation strategy.

Check your lender’s policies on loan settlements. Some may offer reduced payoffs or flexible terms. Knowing these options can shape your approach and expectations.

Determine a reasonable amount you can offer. A lump-sum payment often works best, but a payment plan might be acceptable depending on your situation. Make sure the offer aligns with your financial capabilities.

Gather supporting documents that show why a settlement is necessary, such as medical bills, job loss, or other financial hardships. A strong case increases your chances of approval.

Contact your lender to initiate the conversation. Present your offer and supporting documents. Be polite but firm in your approach, keeping your financial situation and goals in mind.

Expect counteroffers and be ready to adjust. While you may have a specific settlement amount in mind, some flexibility may help you secure a better deal in the long run.

Once an agreement is reached, ensure that all terms are documented. This includes the amount, payment schedule, and any other relevant conditions. A written agreement protects both parties.

After finalizing the negotiation, you’ll be ready to draft a formal settlement letter, outlining the terms of your agreement with the lender.

How to Verify the Accuracy of Your Settlement Details

Check each line item carefully. Compare the figures on your settlement statement with your records to ensure everything matches. Pay special attention to the following sections:

Loan Balance and Payments

Review the loan balance to confirm it reflects your remaining principal, including any fees or accrued interest. Cross-check this with your latest loan statement. Verify that payments made after your last statement are included and correctly applied to your balance.

Fees and Charges

Ensure all fees listed, such as prepayment penalties, administrative costs, or any other charges, align with the terms in your agreement. If you’re unsure about a particular fee, request clarification from the lender.

| Item | Amount | Confirmed? |

|---|---|---|

| Loan Balance | $XX,XXX | Yes |

| Prepayment Penalty | $X,XXX | Yes |

| Administrative Fees | $XXX | Yes |

Double-check any discrepancies between your expectations and the settlement details, especially if adjustments were made recently. If discrepancies exist, contact your lender to address them before finalizing the settlement.

Once you’ve sent your settlement letter, your next step is to monitor the response from the recipient. Be prepared to follow up if you don’t hear back within a reasonable time frame. Generally, waiting 7-10 days is a good rule of thumb before sending a polite reminder. Keep track of all communications in case you need to reference them later.

Confirm Receipt of the Letter

Contact the recipient to confirm they’ve received the settlement letter. This can be done through a quick phone call or email. If you sent the letter by mail, consider requesting a read receipt or delivery confirmation. This way, you ensure that the letter has reached the right person and is under consideration.

Stay Organized and Prepare for Negotiations

While waiting for a response, gather any additional documentation or evidence that may be required for negotiations. This could include receipts, contracts, or other correspondence that supports your position. It’s also helpful to prepare a follow-up response in case the recipient counteroffers or requests more information.

This keeps the meaning intact while reducing repetitive wording. Let me know if you need any other adjustments!

Focus on keeping your loan settlement letter clear and direct. Use simple, precise language to avoid redundancy. Instead of repeating phrases, convey the same message with variations. For example, replace “The loan has been settled and the balance is zero” with “The loan is fully paid off.” This makes the letter more concise without changing its meaning.

Keep the tone respectful but firm, and ensure that all required details–such as the loan amount, the date of settlement, and any remaining balance–are accurately stated. If the letter serves as confirmation, phrase it to emphasize that the settlement has been finalized and no further payments are required.

Avoid using too many qualifiers like “I believe” or “I think,” which can weaken the statement. Instead, opt for declarative sentences to make the message stronger. Clear, direct statements help the recipient understand their position without confusion.