Management letter audit template

Begin by ensuring that your audit management letter template is structured to clearly communicate findings and recommendations. Tailor the template to highlight key issues and provide actionable steps for improvement. Organize the content logically, starting with a summary of major findings and followed by specific suggestions for addressing each identified concern.

Use concise language to describe areas of concern and potential risks, allowing the recipient to understand the issue without unnecessary details. Include specific quantifiable metrics where possible to support your recommendations and give clarity on how the issues can be resolved effectively.

Consider integrating a follow-up schedule to ensure that the actions recommended are addressed within a reasonable timeframe. This helps maintain accountability and shows your commitment to resolving the concerns raised in the audit.

Conclude with a clear call to action that encourages engagement and sets the next steps for addressing the issues outlined in the letter. Ensure your template is both professional and approachable, making it easy for stakeholders to digest the information and take the necessary actions without ambiguity.

Here is the revised text, minimizing word repetition:

Ensure all audit findings are clearly addressed with precise actions. Begin with specifying the key areas that require attention and the risks associated with each. Provide actionable steps to improve processes, citing any necessary changes in policies or procedures. Each recommendation should be directly linked to an identified issue, and the timeline for addressing the matter should be specified.

Recommendations for Immediate Action

Begin implementing controls over identified weaknesses. Ensure that these actions are measurable and assigned to responsible parties. Set a realistic deadline for completion and monitor the progress regularly. Make adjustments to plans as needed, especially when new risks are detected.

Long-term Improvements

Focus on sustainable improvements to governance structures. Regularly review internal controls and refine them to stay ahead of emerging risks. Encourage a culture of continuous improvement where employees at all levels contribute to risk mitigation strategies.

| Recommendation | Action Steps | Responsible Party | Completion Date |

|---|---|---|---|

| Strengthen financial reporting | Implement new reporting procedures and tools | Finance Manager | End of Q2 |

| Enhance employee training | Launch a training program for compliance | HR Department | Start of Q3 |

| Update risk management procedures | Revise the risk management framework | Risk Manager | End of Q4 |

By taking swift action on these points, you will address the most critical issues while setting a foundation for long-term stability. Keep communication clear and consistent to ensure all stakeholders are aligned on the necessary steps.

- Management Letter Audit Template

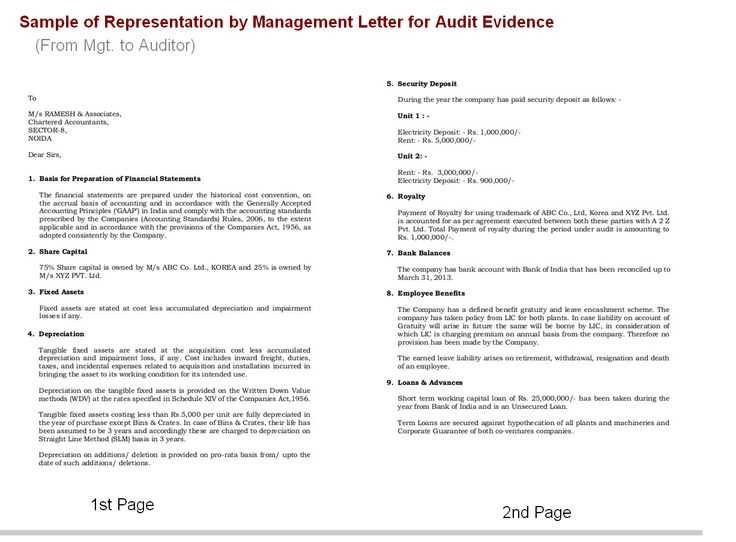

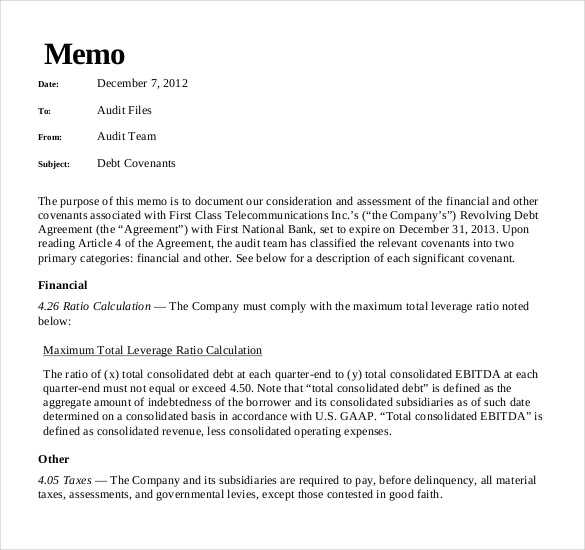

Use clear headings and structured bullet points to organize the content. Begin with an introduction that summarizes the purpose of the letter. This should include an overview of the audit scope, the period under review, and the key objectives. The template should start with a brief statement of the auditor’s responsibility, clarifying the type of audit performed.

Next, outline the significant findings in a concise manner, addressing areas such as internal controls, compliance, and financial statements. Categorize the findings into sections, each with a title to improve readability. Be specific with each issue, listing facts and evidence where applicable. For example, if internal control weaknesses are found, provide a detailed explanation of the issue, along with the potential risk it poses to the organization.

After each finding, include recommendations. Keep the language direct and actionable. Recommendations should focus on practical improvements or changes that can be implemented easily. Ensure these suggestions are measurable and realistic, such as “Revise the policy for reconciliations to ensure monthly checks are completed on time.”

In the next section, provide a summary of any unresolved issues from previous audits and the progress made. This helps track improvements and shows continued commitment to addressing ongoing concerns. It’s important to acknowledge improvements where they have occurred, as this will foster a collaborative relationship with the management team.

End with a conclusion that reaffirms the auditor’s independence and the importance of implementing the recommendations for better financial health and compliance. This should be followed by a clear call to action, urging management to address the points raised in the letter in a timely manner.

The executive summary is the first part of the letter that captures attention. Focus on delivering key findings clearly and concisely. Highlight any major issues, risks, or recommendations that the audit uncovered, giving executives an immediate understanding of the most pressing matters. Avoid unnecessary details and keep the language direct and to the point.

Key Components

The summary should include an overview of the audit scope, objectives, and timeframe. Briefly mention the methods used for assessment. Follow this with a clear presentation of critical audit findings and their implications. For example, note areas where the organization could improve internal controls or operational efficiency. Focus on issues that could impact financial reporting or compliance.

Tone and Clarity

Maintain a professional yet accessible tone. Avoid technical jargon that might confuse non-experts. Provide actionable recommendations with a direct call to action. Be transparent, but concise–executives need to know what steps to take next without being overwhelmed by the details.

Focus on pinpointing areas with the highest potential for financial inaccuracies or control weaknesses. Examine discrepancies in accounting entries, misclassifications of expenses, or ineffective internal controls. These are typically the first indicators of underlying issues that could affect the company’s financial stability or regulatory compliance.

Areas to Watch

Concentrate on significant transactions that may not follow standard procedures or lack sufficient documentation. Pay special attention to the timing of revenue recognition, particularly in industries with complex sales cycles or multiple performance obligations. Variations in these areas often lead to material misstatements or tax liabilities.

Risk Assessment Approach

Assess the effectiveness of internal controls and management’s ability to identify and mitigate risks. Weaknesses in controls, such as inadequate segregation of duties or lack of timely reconciliations, can expose the organization to fraud or errors. Look for areas where management may not be fully aware of the implications of their control environment or accounting practices.

Lastly, address any potential legal or regulatory risks that might arise from mismanagement or non-compliance. This includes scrutinizing adherence to accounting standards and industry-specific regulations that could lead to fines or other penalties if neglected.

Link each recommendation to a specific observation to ensure clarity and actionability. For example, if an audit reveals inconsistencies in the inventory process, recommend implementing a more structured tracking system. Avoid vague terms; specify the exact improvements needed, such as “install barcode scanners” or “conduct monthly inventory audits.” Provide clear steps for implementation to make it easy for the client to follow through.

Use simple, actionable language. Instead of suggesting a “review” of policies, recommend a “quarterly review” with specific guidelines for improvement. Break down each recommendation into clear, measurable objectives. This helps avoid ambiguity and ensures the client understands the scope and intent of each suggestion.

Anticipate challenges the client might face during implementation and offer solutions. If a recommendation involves software updates, clarify the expected timeline and resources required to complete the task. If training is necessary, suggest a timeline for staff training and outline key areas to focus on.

Prioritize recommendations based on their impact and feasibility. Address high-priority issues first, especially those that directly affect compliance or financial performance. For less urgent matters, suggest a timeline for gradual implementation.

Identify specific control weaknesses and outline clear, actionable steps for remediation. Start by assigning responsibility for each task to a designated individual or team. This ensures accountability and a structured approach to resolving issues. Ensure that corrective actions are realistic, achievable, and aligned with overall business goals.

Define Key Areas of Focus

Pinpoint critical processes where control issues are most prominent. For instance, if financial controls are weak, prioritize actions that improve reconciliation processes or enhance approval workflows. Break down each control weakness into smaller components to prevent overlooking any detail.

Establish Timelines for Implementation

Set realistic deadlines for each corrective action. These deadlines should be feasible and provide enough time for proper implementation, while also encouraging prompt resolution. Regularly track progress against these deadlines to maintain momentum.

Ensure that all involved parties are trained or informed about the new procedures. Regular feedback and updates will help refine the approach and ensure that changes are effectively integrated into daily operations. Regular reviews and adjustments will prevent control weaknesses from reoccurring.

To meet regulatory and reporting standards, ensure that your internal processes and controls align with the latest legal requirements. Review applicable laws regularly and update your procedures accordingly. Implement a system that tracks compliance deadlines and creates alerts for key milestones, so nothing is overlooked. Regular training for your team on these regulations is crucial, as changes in laws or guidelines can often go unnoticed without a proactive approach.

Implement Internal Audits and Reviews

Schedule frequent internal audits to verify that your company is adhering to regulatory standards. These audits should assess all aspects of your operations, from financial reporting to data privacy. Using checklists based on the latest legal requirements can help ensure thoroughness. Once completed, take immediate corrective action for any non-compliance issues and document these actions to demonstrate your commitment to maintaining standards.

Maintain Accurate Reporting and Documentation

Accurate and up-to-date reporting is necessary to prove compliance. Regularly review your financial and operational reports to confirm that they reflect current regulations. Secure and properly store all documentation related to audits and compliance activities, making it easily accessible for any external audits or reviews. This practice not only prevents fines but also enhances your company’s credibility with stakeholders.

Begin the closing section by providing a concise summary of key findings and recommendations. Focus on presenting the most relevant issues, ensuring clarity without overwhelming the client with unnecessary details.

Highlight Critical Points

Identify the areas that require immediate attention or action. Use bullet points for easy readability, ensuring each item is clear and actionable. Be direct and precise in your language to avoid confusion.

- Focus on high-priority issues that could impact financial performance or compliance.

- Emphasize areas where improvements or corrective actions are necessary.

Provide Clear Actionable Recommendations

Each point should be accompanied by practical recommendations. Specify the steps the client should take and provide an estimated timeline for implementation.

- Recommend specific actions with deadlines for addressing issues.

- Offer guidance on how to monitor the progress of recommended actions.

End the section with a reaffirmation of your willingness to assist the client in implementing the suggested improvements. Maintain a collaborative and solution-oriented tone to foster positive engagement.

Management letter audit template

Ensure clear, concise communication in the audit management letter by following this structure:

- Introduction: Summarize the purpose and scope of the audit in one or two sentences. Highlight any major changes or areas of focus during the audit.

- Findings: List key observations with a clear, brief description of each. Include facts without unnecessary elaboration.

- Recommendations: Provide actionable suggestions for improvements. Use a direct tone, ensuring the recommendations are practical and specific to the findings.

- Conclusion: Recap the overall audit result, addressing any significant concerns raised and steps taken for resolution.

Keep the tone professional but approachable. Avoid jargon that could obscure the message. Focus on clarity and precision to ensure the reader can act on the recommendations without confusion.