Missed Payment Letter Template for Effective Communication

When clients or customers fail to meet their financial commitments, it is essential to address the situation promptly and professionally. Effective communication is key to maintaining positive business relationships while ensuring timely resolution of overdue balances. Sending a carefully crafted reminder can help encourage timely payments without causing unnecessary tension.

Clear and polite reminders can significantly improve the likelihood of recovering funds. By outlining the necessary details and offering solutions, you can create an atmosphere of cooperation. It is important to balance firmness with professionalism to avoid alienating customers who may be experiencing temporary challenges.

In this section, we will explore how to structure such communications effectively, providing examples and key elements that will help businesses address outstanding financial matters in a way that promotes continued partnerships and smooth operations.

Understanding the Importance of Payment Letters

Communicating with clients about overdue amounts is an essential part of business operations. When payments are delayed, it becomes crucial to address the issue in a professional and clear manner. Taking a proactive approach ensures that both the business and the customer understand the situation and expectations moving forward.

Effective communication can help maintain healthy client relationships while ensuring that finances are properly managed. A well-structured notice serves multiple purposes:

- Reminder: Gently reminds the client of their obligation without creating unnecessary tension.

- Documentation: Provides a record of attempts to resolve the matter, which can be useful for legal or accounting purposes.

- Professionalism: Demonstrates the business’s commitment to managing finances in an orderly manner, reinforcing trust.

By addressing late payments promptly, businesses can minimize disruptions and avoid the need for more aggressive measures later. A carefully worded reminder shows respect for both the client and the business, maintaining a cooperative atmosphere for resolving financial issues.

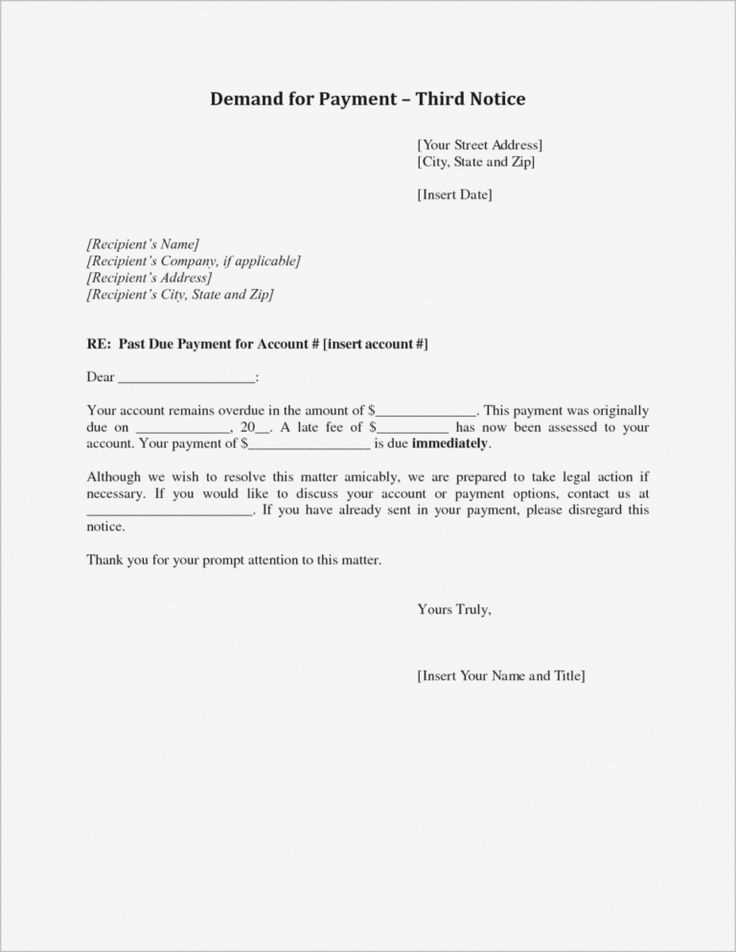

Key Components of an Effective Template

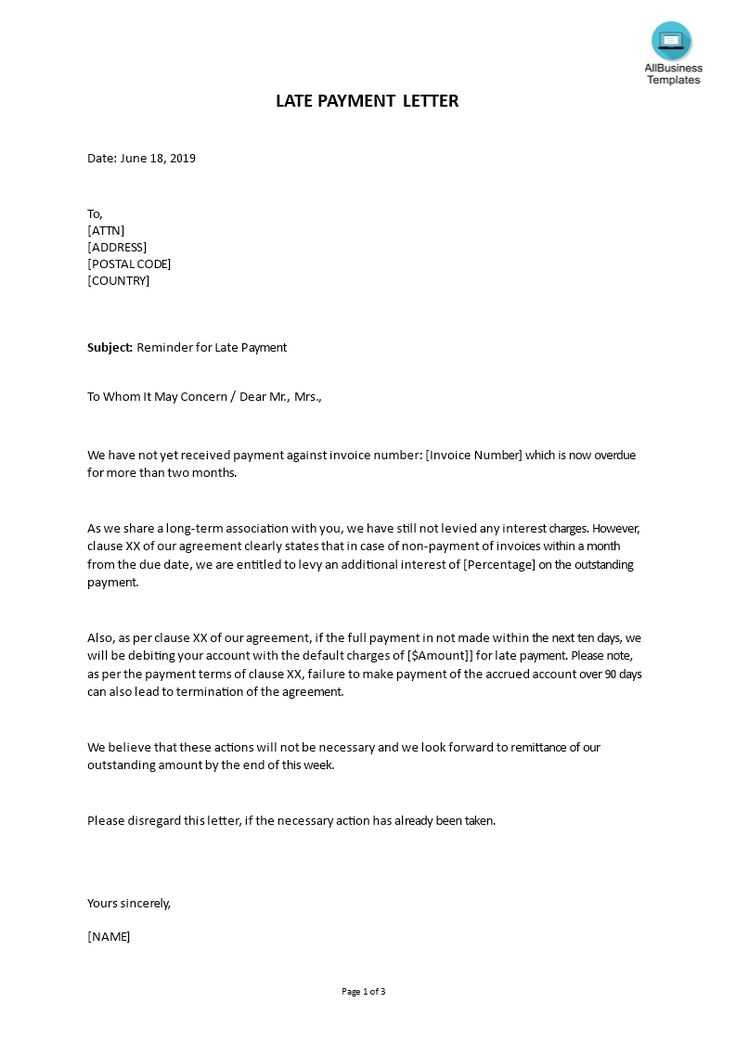

When creating a formal reminder for overdue obligations, certain elements are essential to ensure clarity and professionalism. A well-constructed document helps convey the necessary information while maintaining a positive tone. The goal is to encourage resolution without escalating tensions.

To create a successful reminder, consider the following key components:

- Clear Subject Line: Begin with a direct but polite subject line to grab attention and indicate the purpose of the message.

- Professional Salutation: Use a courteous greeting that sets a respectful tone for the communication.

- Details of the Transaction: Include specifics such as the amount due, the original due date, and any previous communication regarding the matter.

- Polite Request for Action: Politely remind the recipient of their obligation and request prompt resolution without sounding confrontational.

- Contact Information: Offer ways for the recipient to get in touch for any clarification or assistance, showing willingness to work together.

- Professional Closing: End with a courteous statement that reinforces the importance of resolving the issue, while leaving the door open for future cooperation.

Including these components ensures that the reminder is effective and respectful, helping both parties come to a resolution quickly and amicably.

How to Write a Polite Reminder

Crafting a courteous reminder requires striking the right balance between professionalism and empathy. The key is to communicate the need for action while maintaining a positive relationship with the recipient. A well-written note can help preserve goodwill and encourage a swift resolution of the issue.

Start with a Friendly Greeting

Always begin with a warm and respectful salutation. Address the recipient by name to personalize the message, and ensure the tone remains positive from the outset. This helps set a cooperative mood and makes the message feel less transactional.

Clearly State the Request

Clearly explain the purpose of the communication, providing details about the outstanding matter. Be specific but concise, and avoid sounding accusatory. Focus on the facts, and express your desire for a quick resolution. Offer assistance if necessary, showing that you’re open to discussing solutions.

By following these steps, you can create a polite and effective reminder that promotes a productive outcome while preserving a respectful business relationship.

Common Mistakes to Avoid in Letters

When drafting formal notices for overdue obligations, it’s essential to avoid certain errors that can diminish the effectiveness of the communication. A poorly constructed message can cause misunderstandings, damage relationships, or even prolong the resolution process. Recognizing common pitfalls can help ensure the message is professional and clear.

Below are some common mistakes to avoid when composing these types of communications:

| Mistake | Why It Should Be Avoided | Better Approach |

|---|---|---|

| Using an Aggressive Tone | An overly harsh or demanding tone can alienate the recipient and hinder the resolution. | Use a polite and respectful tone to maintain a cooperative relationship. |

| Failing to Include Specific Details | Vague or incomplete information may cause confusion and delay the process. | Provide clear details, such as amounts, due dates, and any previous communication. |

| Overcomplicating the Message | Too much detail or complex language can make the notice harder to understand. | Keep the message concise and straightforward, focusing on key points. |

| Neglecting to Offer Solutions | Simply pointing out the problem without offering a resolution can lead to frustration. | Suggest possible ways to resolve the situation or offer assistance in addressing the issue. |

By avoiding these common mistakes, you can craft more effective, professional reminders that help foster timely action and maintain positive relationships.

Best Practices for Payment Requests

To ensure that overdue financial matters are resolved efficiently, it’s important to follow best practices when requesting funds. A well-thought-out approach increases the chances of a swift resolution while maintaining a positive business relationship with clients. Professionalism and clarity are essential in crafting effective requests for outstanding amounts.

Here are some key best practices to keep in mind when drafting these requests:

- Send a Timely Reminder: Don’t wait too long before sending a follow-up. The sooner the issue is addressed, the easier it is to resolve.

- Keep It Professional: Maintain a polite, respectful tone throughout the communication. Avoid any language that could be perceived as accusatory or confrontational.

- Be Specific: Include essential details such as the amount due, the original due date, and any relevant invoice numbers to avoid confusion.

- Provide Clear Instructions: Clearly state the preferred method of payment and any deadlines. This helps avoid further misunderstandings.

- Offer Solutions: If appropriate, offer flexible solutions such as payment plans or extensions. This can foster cooperation and speed up the resolution process.

By adhering to these best practices, you can enhance the effectiveness of your requests while maintaining a positive, cooperative relationship with your clients.

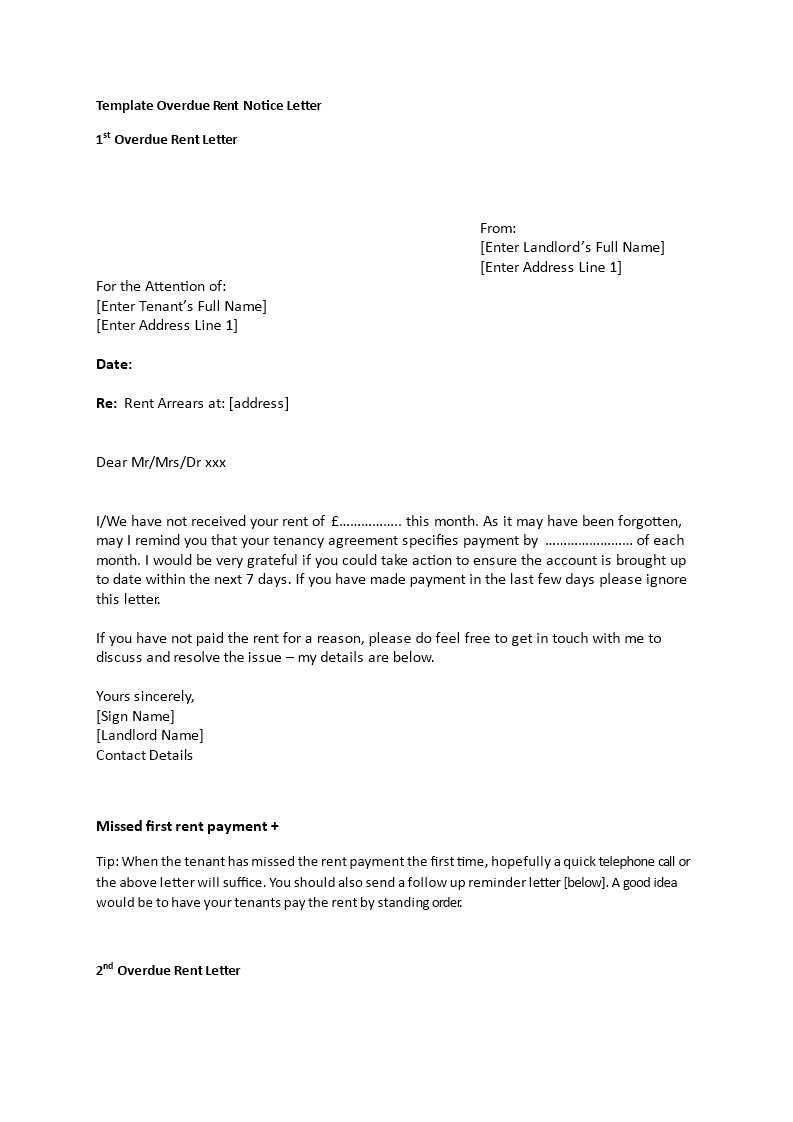

When and How to Send the Letter

Timing and method are crucial when addressing overdue financial obligations. A well-timed reminder can prevent the situation from escalating, while the appropriate communication channel ensures the message reaches the recipient effectively. Understanding when and how to send such notices can make a significant difference in achieving a timely resolution.

When to Send a Reminder

The ideal time to send a formal notice is after the payment deadline has passed, but not too long afterward. Typically, it’s recommended to wait a few days to allow for any delays, but not more than a week. If the due date is nearing, you may choose to send a preliminary reminder to avoid the need for further follow-up.

How to Send the Notice

Choose the most appropriate method based on your relationship with the recipient and the urgency of the situation. Common methods include:

- Email: Fast and efficient, especially for business-related matters. Ensure the subject line is clear and the message is professional.

- Postal Mail: Suitable for more formal situations or when previous attempts have not been successful.

- Phone Call: A direct approach that can help clarify any misunderstandings quickly, followed by a written confirmation.

By selecting the right time and method, you can increase the likelihood of a prompt and positive response, facilitating the resolution of overdue amounts.