Money Transfer Letter Template for Simple Transactions

When dealing with financial exchanges, clear communication is essential to ensure all parties involved understand the terms and expectations. A well-structured document can simplify the process and provide a professional approach to outlining payment details, responsibilities, and agreements. This type of document helps avoid misunderstandings and serves as a record for future reference.

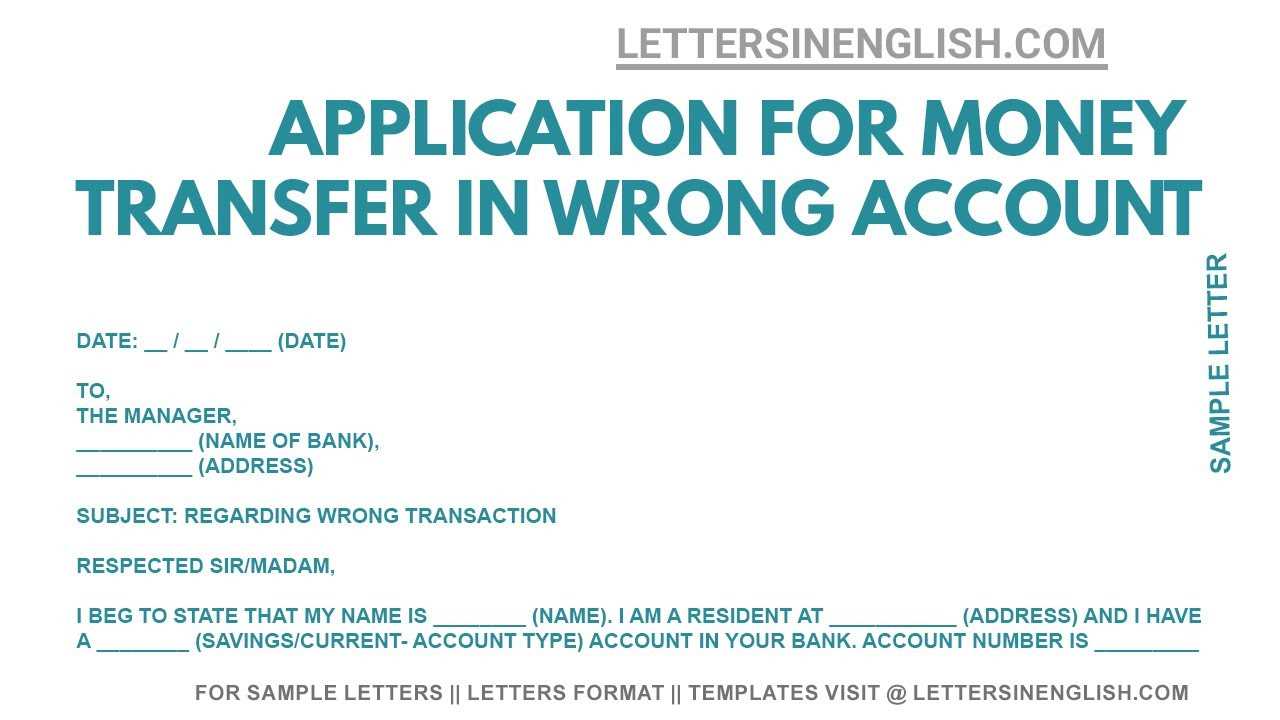

Essential Components of a Payment Communication

Every effective communication for a financial exchange should include several key pieces of information to ensure clarity and precision. These components help structure the document in a way that makes it easy for all parties to follow.

- Sender and Recipient Information: Clearly stating the names, addresses, and contact details of both parties.

- Purpose of the Payment: A brief description of the transaction, whether it’s for services, goods, or another arrangement.

- Amount and Currency: Explicitly stating the amount involved and the currency used to avoid confusion.

- Payment Terms: The conditions under which the payment is to be made, including deadlines and method of transfer.

- Signatures: Ensuring the document is signed by both parties to acknowledge the agreement.

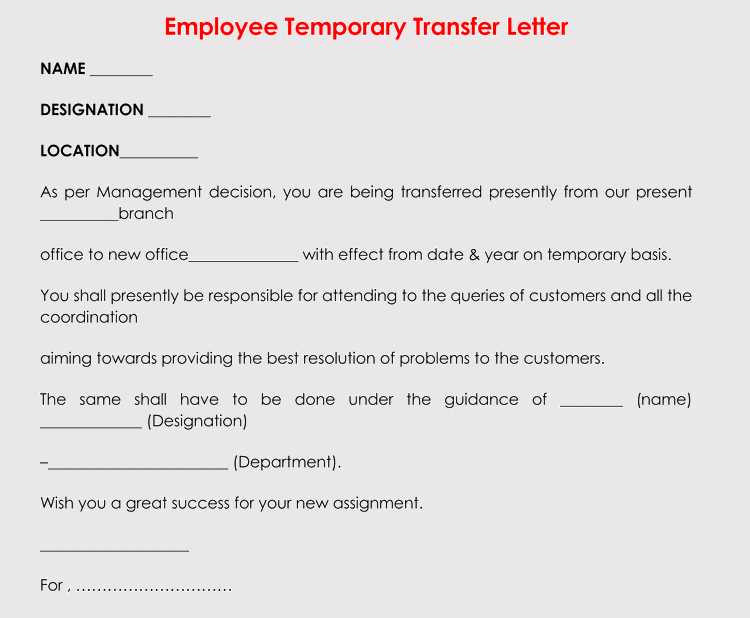

How to Personalize the Document

Each communication should be tailored to the specific exchange it relates to. Personalization ensures that all necessary details are covered and that the document remains relevant to the current transaction.

- Adjust the Language: Use formal or informal language depending on the relationship with the recipient.

- Include Specifics: Detail the items or services involved in the transaction to provide a clear reference.

- Custom Terms: If applicable, include any unique terms that apply only to the current situation.

Legal Considerations

While drafting this document, it’s important to ensure it complies with relevant laws and regulations, especially in cases involving large sums or international transactions. Always consider the legal framework governing financial dealings in your jurisdiction.

- Understand Local Laws: Familiarize yourself with any legal requirements that may apply to your communication.

- Clarity on Payment Disputes: Include clauses that specify how disputes will be resolved, ensuring legal protection for both parties.

- Review for Compliance: Before sending, ensure that all the terms of the agreement align with applicable laws.

When to Use This Type of Document

This document is most useful when clear written communication is needed for any form of financial exchange. Whether you’re settling a debt, paying for services, or finalizing a sale, having a structured communication helps keep things transparent and organized.

Using such a document ensures that the terms are mutually agreed upon and provides a formal record should any issues arise in the future.

Understanding Financial Transaction Documents

Clear and precise written communication plays a crucial role in documenting the terms of financial exchanges. Such documents are essential in ensuring all parties are on the same page regarding the details, responsibilities, and deadlines associated with a monetary agreement. Proper structure and content are necessary for avoiding confusion and guaranteeing that both sides understand their commitments.

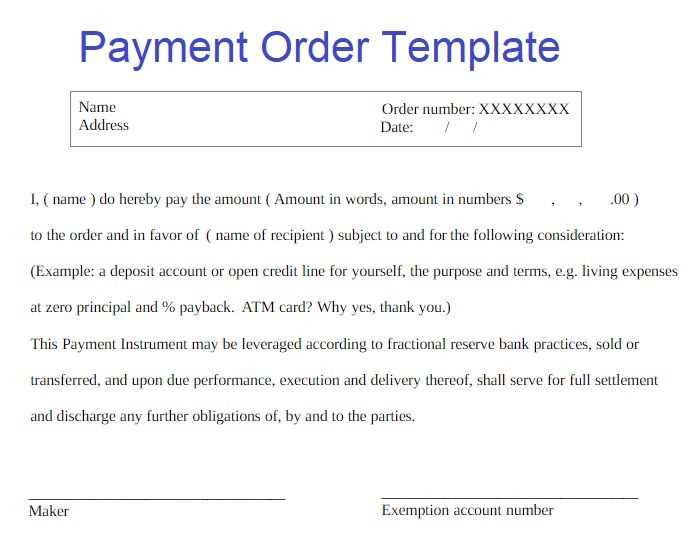

Components of an Effective Financial Document

An effective document should cover the basic details that make the agreement comprehensible and actionable. Key elements include:

- Identification of Participants: Names and contact information of both the sender and recipient.

- Transaction Purpose: A description outlining the reason behind the exchange.

- Amount and Terms: The exact value of the exchange and any conditions attached to the payment.

- Payment Method: The way in which the exchange will be processed.

- Signatures: Both parties should sign to confirm understanding and agreement.

How to Personalize Your Document

Customization is essential for ensuring the document reflects the specific details of each transaction. Tailor the content based on the type of deal or relationship between the parties involved. Use clear references to the transaction, adapt the tone, and include terms unique to the current agreement.

Personalizing ensures that the document addresses all the needs of both parties and highlights any specific conditions that may apply to this particular situation.

Avoiding Common Writing Errors

Accuracy is vital when drafting financial documents. Common errors can lead to misunderstandings or legal complications. To avoid mistakes:

- Check for Typos: Errors in names, amounts, or dates can cause confusion.

- Be Specific: Avoid vague language; ensure the purpose and terms are clearly defined.

- Avoid Ambiguity: Use straightforward, concise language to prevent misinterpretation.

Legal Requirements for Financial Documents

While drafting the document, consider the legal landscape of your jurisdiction. Certain rules and regulations may govern how such agreements should be written and executed. Ensure that the document complies with any applicable laws regarding contracts, financial exchanges, and dispute resolution.

Ensuring Clarity and Precision in Communication

Effective communication is key to ensuring all parties fully understand the terms of the agreement. Use direct language, avoid jargon, and ensure that each part of the document is easily interpretable. The clearer the terms, the less likely there will be misunderstandings in the future.

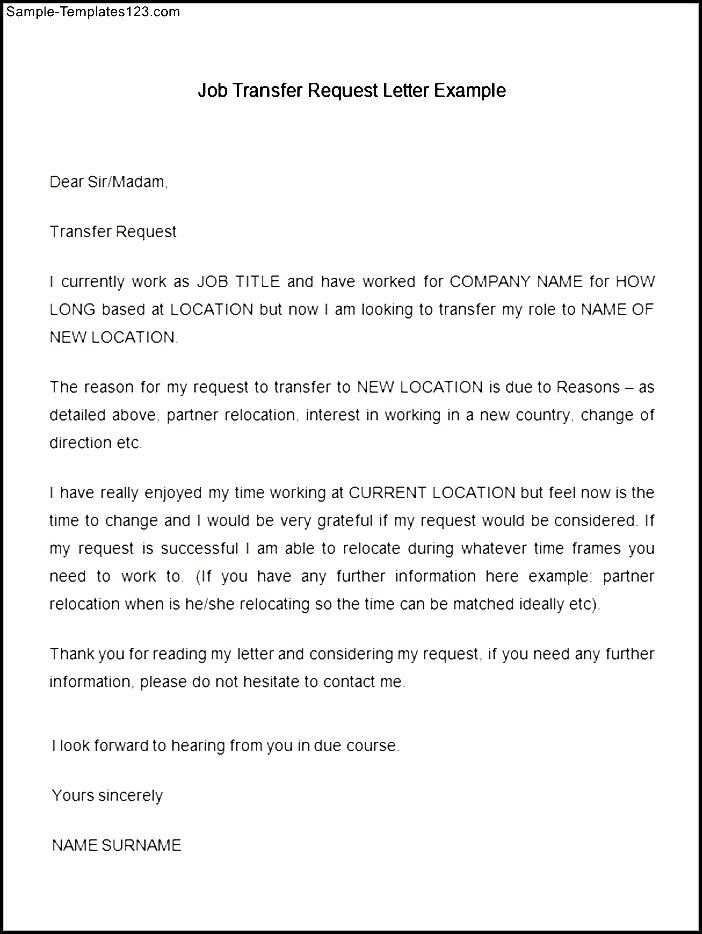

When to Use a Financial Document

This type of document is most useful when formalizing agreements related to financial exchanges. Whether for personal or business transactions, having a written record ensures transparency and protection for both parties involved. It provides a clear reference point and can help resolve any disputes should they arise.