Mortgage access letter template

To request mortgage access, use a formal letter that provides the necessary details and is clear and direct. A mortgage access letter typically serves as a formal request to your lender or another financial institution, allowing you to access the funds or terms needed to secure your mortgage loan.

Your letter should start with the date and your personal contact information. Next, include the name of the lender and any relevant loan numbers. Be sure to outline the purpose of the letter, such as asking for access to specific documents, inquiring about the status of your application, or requesting adjustments to the terms.

In the body of the letter, state your request concisely. For example, if you’re asking for mortgage access, explain exactly what information or action you require. If you’re submitting documentation for approval, mention the documents included. Keep the tone polite but firm, and be specific about deadlines or expectations where necessary.

Finish the letter with a formal closing, expressing gratitude for their attention to your request. Always proofread to ensure accuracy and professionalism in the tone and content.

Here’s the revised version:

To request mortgage access or support from a financial institution, your letter should be clear and concise. Begin by addressing the lender or institution directly. Clearly state the purpose of your request, providing essential details such as the property address, your mortgage account number, and your full name as registered. Include any necessary supporting information or documents that could help speed up the process.

Ensure that your tone remains polite yet firm, focusing on the specific assistance you require. For example, if you’re requesting an extension, detail why it’s necessary, but avoid overly personal details. Mention any previous correspondence or applications if relevant. End the letter with a request for a response, and provide your contact details for follow-up.

Example:

Dear [Lender’s Name],

I am writing to formally request access to my mortgage records for the property located at [Property Address]. My mortgage account number is [Account Number], and I would like to review the payment history and terms of my loan agreement. Please provide these documents at your earliest convenience.

If you require any further information or clarification, please don’t hesitate to contact me at [Phone Number] or [Email Address]. I look forward to your prompt response.

Thank you for your assistance.

Sincerely,

[Your Full Name]

Mortgage Access Letter Template: A Practical Guide

When you need to provide access to a property for mortgage purposes, crafting a clear and precise letter is key. This letter is often used to grant permission for appraisers, surveyors, or other professionals to enter a property to conduct necessary evaluations. Here’s how to structure a straightforward mortgage access letter:

Key Components of a Mortgage Access Letter

- Subject line: Specify the purpose of the letter, such as “Grant of Access for Property Evaluation”.

- Introduction: Begin by stating your intention to allow access to the property. Mention your name and the property address clearly.

- Details of Access: Specify the date(s) and time(s) for access. Include any guidelines or restrictions, such as areas not to be accessed or specific times when access is available.

- Contact Information: Provide contact details for coordination and any queries.

- Signature: Sign and date the letter. Ensure that it’s signed by the property owner or authorized representative.

Sample Template

Subject: Grant of Access for Property Evaluation

Dear [Name of Appraiser/Surveyor/Inspector],

I, [Your Full Name], the legal owner of the property located at [Property Address], hereby grant permission for you to access the property on [Date(s)] between [Time] for the purpose of conducting a property evaluation, inspection, or appraisal related to the mortgage process.

Please note that the following guidelines must be followed during your visit:

- Access is only allowed to the areas listed in the evaluation request.

- No alterations or damage should occur during the visit.

- If any issues arise, please contact me immediately at [Your Contact Information].

Thank you for your cooperation.

Sincerely,

[Your Full Name]

[Your Contact Information]

Date: [Date]

Providing clear and concise instructions in your mortgage access letter helps avoid misunderstandings and ensures smooth coordination for any evaluations or inspections that are required.

- What is a Mortgage Access Letter and When Is It Needed?

A Mortgage Access Letter is a formal document issued by a lender, confirming that a borrower has been approved for a mortgage or is eligible for mortgage financing. It is a crucial piece of information used in property transactions, specifically when buyers are applying for mortgages. This letter serves as proof that a lender has assessed the borrower’s financial situation and is willing to extend a loan based on certain conditions.

This letter is typically needed when applying for a mortgage to buy a home or property, but it can also be necessary when refinancing an existing mortgage. The letter outlines the loan amount, terms, and the conditions under which the lender is willing to approve the mortgage. It can be used to demonstrate a buyer’s ability to secure financing, which is often required when making offers on properties or negotiating with sellers.

It’s a helpful tool for buyers to showcase their financial readiness to both sellers and agents, providing a clear indication that they can proceed with a purchase. Without a Mortgage Access Letter, potential buyers may struggle to prove their qualifications, which could delay or even prevent the closing of a deal.

| When is it Needed? | Why is it Important? |

|---|---|

| When buying a home | Proves to the seller that the buyer can secure financing for the property |

| When refinancing | Shows that the borrower qualifies for a new loan on favorable terms |

| During the pre-approval process | Helps buyers gauge their financial capacity before making offers |

Clearly state the purpose of the letter at the beginning, specifying that it’s a request for mortgage access. Include the full name of the applicant, address, and contact information. This provides a clear identification of the individual requesting access to the mortgage details.

Applicant’s Mortgage Information

Provide detailed mortgage information, such as the loan number, type of mortgage, and lender’s name. This helps the recipient easily locate the mortgage file and ensures no confusion about which mortgage is being referenced.

Authorization and Access Request

Specify the scope of access being requested. Clarify whether the letter is seeking full access to mortgage records, payment history, or just specific details. Include any relevant dates or periods to avoid any misunderstanding about the time frame involved.

Finish the letter with a polite but clear request for the required documents or information, along with the preferred method of receiving it, whether by mail or email.

Begin by researching each lender’s specific requirements. Some may need additional information, such as income verification or property details, while others focus more on credit history or loan-to-value ratios. Customizing your letter to reflect these preferences will show your attention to detail and streamline the process.

1. Adjust the Financial Information

Each lender has different criteria for loan approval, so ensure that the financial information in the letter aligns with the lender’s requirements. If a lender prioritizes a higher credit score, emphasize that detail. Include precise numbers for your credit score, debt-to-income ratio, and any other metrics the lender values. Avoid generalizations–be specific with the data to improve your chances of approval.

2. Personalize the Tone and Language

Different lenders may appreciate different tones in communication. Some might prefer a more formal approach, while others may be comfortable with a conversational style. Pay attention to the lender’s communication style and adjust your letter accordingly. For example, for more traditional lenders, stick to a formal tone with clear, concise language. For more modern, tech-forward lenders, you might adopt a more approachable style, while still maintaining professionalism.

Lastly, always include all relevant contact details and be sure to specify any deadlines or time frames in your letter. Tailoring your mortgage access letter to each lender’s specific requirements not only increases the likelihood of approval but also demonstrates your preparedness and commitment to securing the best possible deal.

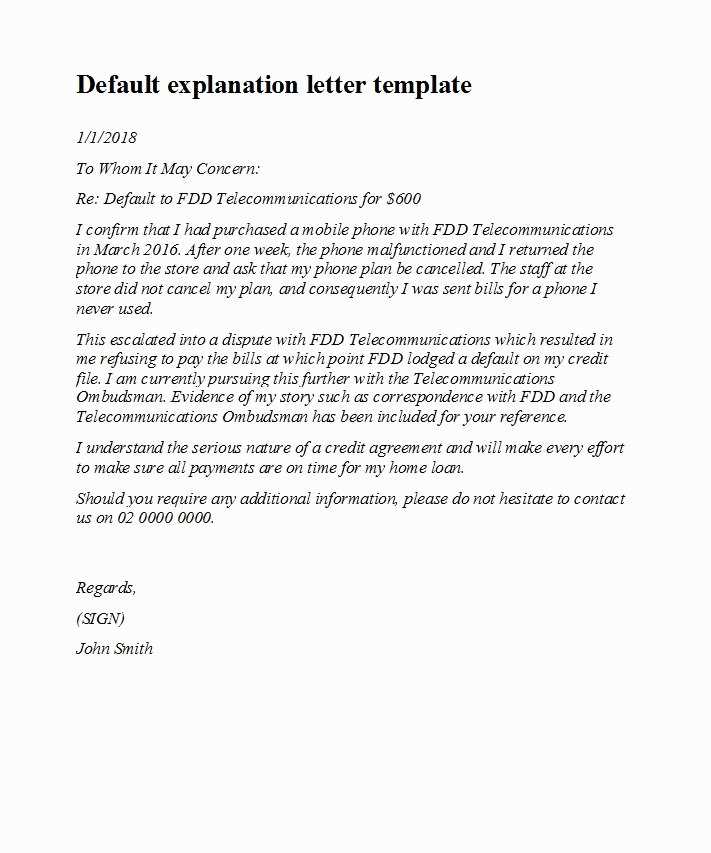

One common mistake is failing to include key property details. Be specific about the address, unit number (if applicable), and any relevant features of the property. Leaving these out can create confusion and delay the process.

Another mistake is not clearly stating the purpose of the letter. Clearly indicate that the letter is a request for mortgage access, outlining exactly what access is needed, whether it’s for an appraisal, inspection, or another purpose.

Avoid using overly complex language. Keep your sentences simple and to the point. Unnecessary jargon or complicated phrasing can make the letter hard to understand, potentially leading to miscommunication.

Do not forget to specify dates. If the access needs to happen on a particular date, mention it clearly. Omitting this detail can lead to scheduling conflicts or misunderstandings.

Always double-check for accuracy. Incorrect information, such as wrong property details or inaccurate contact information, can slow down or even derail the process. Proofread the letter carefully before submission.

Another error is not addressing the right recipient. Ensure the letter is directed to the correct person or department that can handle the request. This saves time and prevents it from being lost in the wrong hands.

Finally, avoid being too vague about access conditions. Clearly define what is expected, such as specific times for entry and any special instructions regarding the property or security measures. This helps the other party plan accordingly and ensures no misunderstandings.

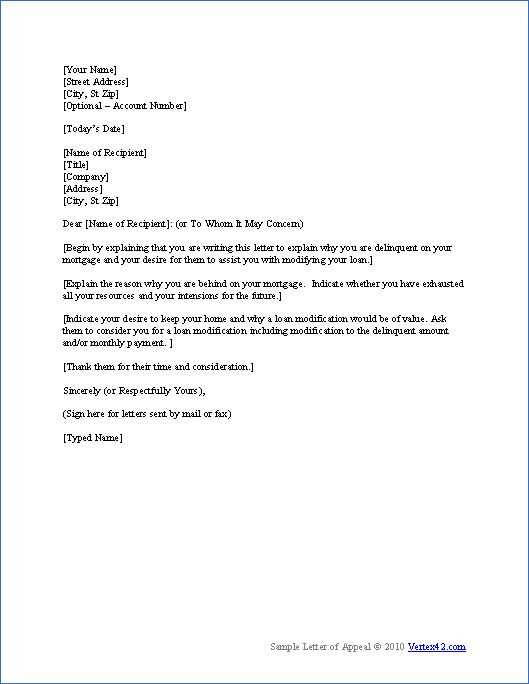

Begin by clearly stating the purpose of your letter in the opening sentence. Include the full name of the applicant and specify the type of mortgage or property access requested. Use a formal tone and avoid unnecessary embellishments.

Next, break the letter into organized sections for easy reading. Start with an introduction, followed by a detailed request or explanation of the situation. Ensure each paragraph serves a distinct purpose: the first addresses the request, the second provides any supporting details, and the last concludes with a call to action or expectation.

Be sure to include any necessary references like account numbers or property addresses to avoid confusion. If applicable, provide background information, such as previous correspondence or meetings related to the request. Use bullet points or numbered lists for clarity when presenting multiple points or conditions.

Conclude the letter with a polite but clear statement, reiterating your request. Offer to provide further documentation if needed, and include a professional closing, such as “Sincerely” or “Kind regards.”

Proofread the letter carefully for grammar and accuracy. A clean, error-free letter strengthens your professionalism and ensures your request is taken seriously.

Once you have submitted your mortgage access letter, track the response timeline provided by the lender. Keep an eye on the processing time, as delays can happen, and stay prepared to address any additional requests promptly. You may receive a follow-up email or phone call for clarification or to provide further documentation. Stay organized and make sure you can access all your submitted documents easily for quick reference.

If the lender requests more information or documents, provide them without hesitation. This may include updated financial statements, proof of income, or even further identification details. The quicker you respond, the smoother the process will be.

During the waiting period, review your financial situation again. Ensure your credit score and other relevant factors are in good standing, as they may impact the outcome. Also, it’s a good time to start researching other financial options or mortgage products, in case you need alternatives.

Once you hear back from the lender, whether it’s approval or denial, be ready to move forward with the next steps. If approved, review the terms and conditions carefully before signing the agreement. If denied, ask for feedback, and consider improving your financial standing for future applications.

I’ve reduced the number of repetitions while preserving the core meaning.

To write a concise mortgage access letter, focus on clarity. Address the key points: your financial status, employment details, and loan specifics. Avoid unnecessary details and maintain a straightforward tone.

Key Sections to Include

Start with a brief introduction of yourself, highlighting your current financial situation and why you’re seeking mortgage access. Include income verification, employment status, and any relevant property details. Ensure that all numbers and facts are accurate to prevent delays in the process.

Final Touches

End with a clear request for the mortgage, specifying any particular terms you are seeking, such as loan amount and repayment duration. Sign off professionally, ensuring your contact information is included for further communication.