Mortgage gift letter template uk

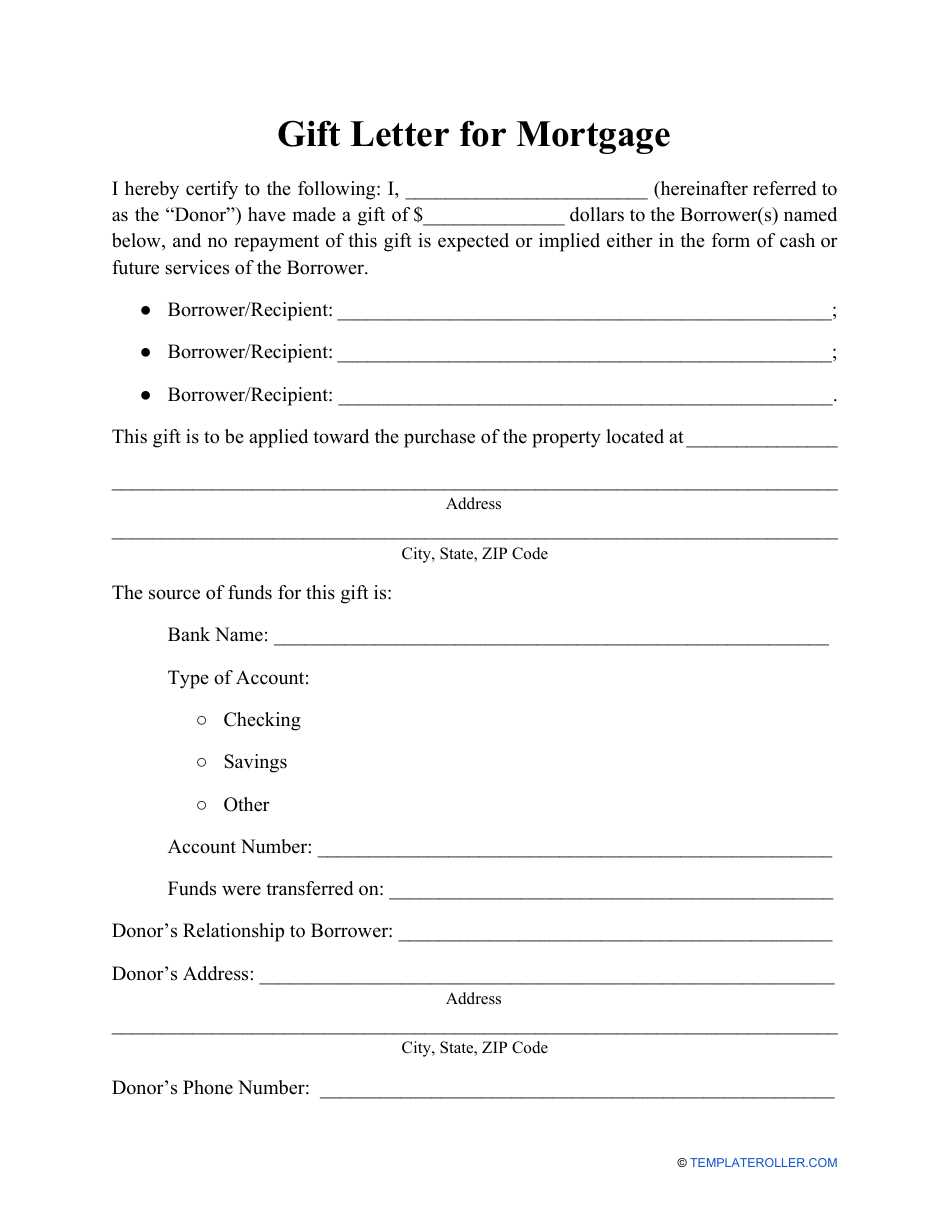

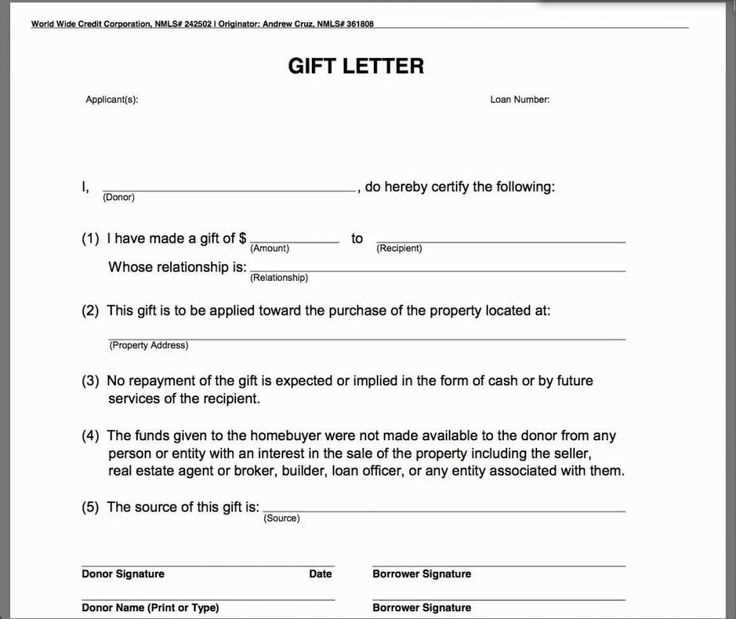

If you’re planning to help someone with a house deposit, a mortgage gift letter is a necessary part of the process. This letter outlines that the funds given are a gift, not a loan, which assures lenders that the borrower won’t have to repay the money. It’s a straightforward document, but it must include specific details to ensure it’s accepted by the lender.

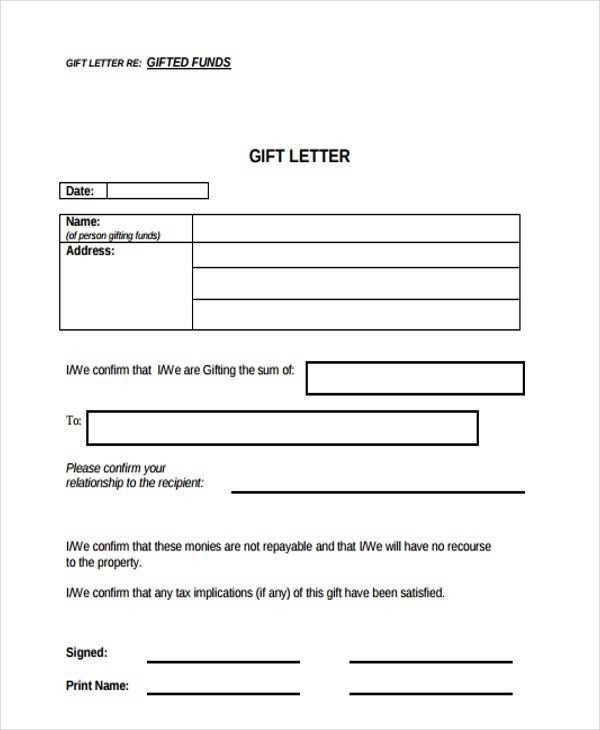

A well-structured gift letter should state the donor’s relationship to the borrower, the amount of the gift, and confirm that the money will not be repaid. It’s also crucial to include the donor’s contact information and a statement that the gift is given freely and with no expectation of repayment. This helps the lender assess the gift as non-repayable, which impacts the borrower’s eligibility for the mortgage.

Be sure to include your full name, address, and the exact date the gift is given. Some lenders may request further documentation, such as proof of the donor’s ability to give the gift, so having this information on hand can prevent delays. Using a mortgage gift letter template can simplify the process, ensuring you don’t miss any key details that could slow down the approval process.

Once the letter is completed, both the donor and the recipient should sign it. Keep in mind that some mortgage providers may have specific requirements or formats, so always check with your lender for any extra details they might need. Following these simple steps ensures a smooth transaction and keeps everything transparent for all parties involved.

Here’s the revised text, where repeated words appear no more than 2-3 times:

When drafting a mortgage gift letter, be clear about the relationship with the donor and specify the amount given. The letter should confirm that the gift is not a loan and that the funds are provided without any expectation of repayment. Mention any conditions that apply, such as whether the gift is conditional on the mortgage approval. It’s important to state that the gift won’t create a financial obligation for the borrower. Keep the tone professional but straightforward, avoiding unnecessary jargon or complex terms. Ensure all relevant details, including the donor’s address and contact information, are included for clarity.

The letter should be signed by both parties involved–the donor and the borrower. Always verify that the donor’s statement is accurate and matches the information provided in the mortgage application. Providing clear documentation will help prevent any delays in the approval process.

- Mortgage Gift Letter Template UK

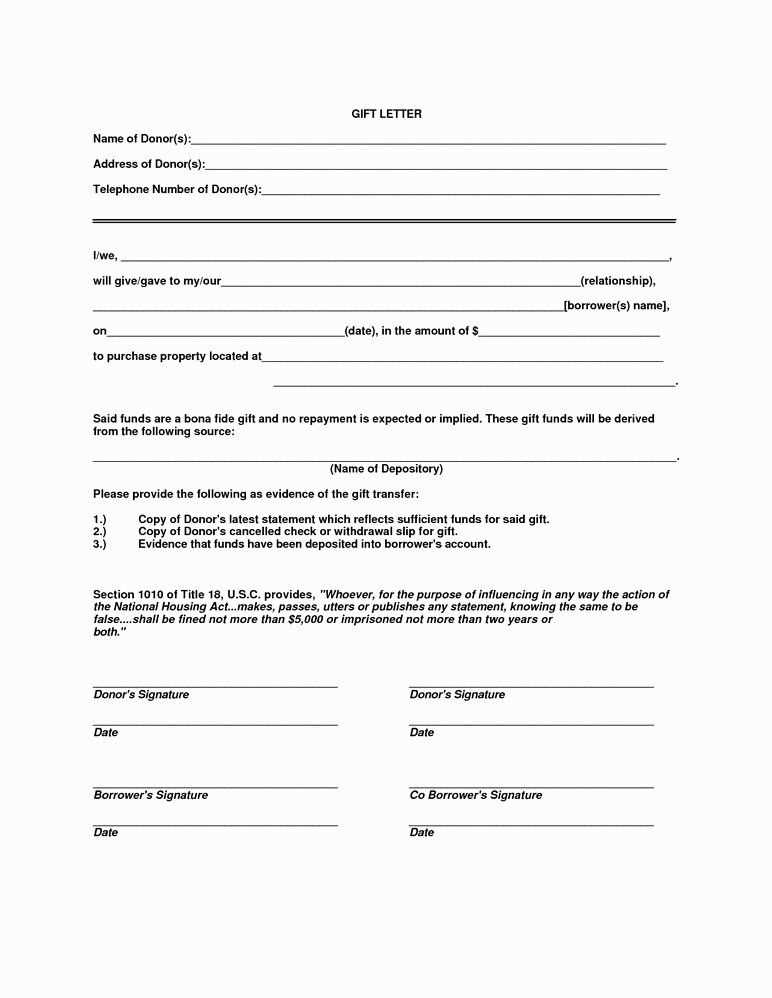

To create a mortgage gift letter in the UK, follow this structure to ensure clarity and legality:

- Donor’s Information: Begin with the full name, address, and relationship to the recipient. Include the donor’s contact details for verification purposes.

- Recipient’s Information: Include the full name and address of the borrower receiving the gift.

- Gift Amount: Clearly state the amount of money being gifted for the property purchase. This figure should match the sum mentioned in the agreement.

- Gift Declaration: Confirm that the gift is given with no expectation of repayment. State that the donor is not expecting any future financial returns from the recipient.

- Gift Purpose: Specify that the gift is intended solely for the purchase of the property and not for any other purpose.

- Donor’s Signature: The letter should end with the donor’s signature, dated appropriately.

- Witness or Notary (optional): If required, have the letter signed by a witness or notarized for additional legal standing.

Example Template:

Dear [Lender’s Name],

I, [Donor’s Full Name], residing at [Donor’s Address], confirm that I am gifting [Recipient’s Full Name], my [relationship to recipient], the amount of [gift amount in words] (£[gift amount in numbers]), which is intended for the purchase of the property located at [Property Address]. I understand that this gift is non-repayable, and there are no expectations of any future payments or financial return. I affirm that this gift will be used exclusively for the property purchase.

Sincerely,

[Donor’s Full Name]

[Donor’s Signature]

Date: [Date]

A Mortgage Gift Letter is a document used in the UK to confirm that a financial gift has been given to the homebuyer to assist with their property purchase. This letter is typically provided by the person offering the gift, often a family member, and it outlines that the funds are a gift, not a loan, and do not need to be repaid.

The letter should clearly state the amount of the gift, the relationship between the giver and the recipient, and include a declaration that the funds are given freely and without any expectation of repayment. It is a vital part of the mortgage application process, as it assures the lender that the buyer does not have additional financial obligations from a loan disguised as a gift.

Make sure to include the giver’s full name, address, and signature in the letter. Some lenders may request additional information, such as proof of the gift source, to ensure everything is in order.

Start the letter by clearly stating that the funds provided are a gift, not a loan. Mention the full amount of the gift and the specific purpose–helping with the mortgage. Ensure the lender understands the donor’s relationship to the borrower and their intent. Address the donor’s willingness to cover the entire gift amount, without any expectation of repayment.

Details to Include:

- The full name of the donor and the recipient.

- The exact amount of the gift.

- A statement confirming that the gift is not a loan and there is no obligation to repay.

- The relationship between the donor and recipient (e.g., family member, friend).

- Contact information for the donor in case the lender needs further clarification.

Additional Points:

- If possible, include a reference to any prior discussions with the lender regarding the gift.

- Consider providing proof of the donor’s ability to give the gift (e.g., bank statement or proof of assets).

- Clearly state that the donor will not have any interest or claim in the property or mortgage.

Mortgage gifts are typically offered by close family members, such as parents or grandparents. They must be financially able to provide the gift without expectation of repayment. The person offering the gift should not be a co-borrower on the mortgage, as this could complicate the loan process. If the gift is from a friend or extended family member, it may be subject to more scrutiny, and lenders might require additional documentation to confirm that the money is a genuine gift, not a loan. Always ensure that the donor provides a letter confirming that the gift is non-repayable to avoid any misunderstandings with the lender.

Begin the mortgage gift letter by clearly stating that the money being provided is a gift, not a loan. This removes any ambiguity for the lender. Mention the relationship between the giver and the recipient, ensuring the lender understands the context of the gift. Next, indicate the amount of money being gifted and the purpose of the gift, which in this case is to assist with a mortgage. Include the date the gift is being provided to establish the timing of the transaction.

| Section | Details |

|---|---|

| Introduction | State the amount of the gift and confirm it is a gift, not a loan. |

| Relationship | Describe the relationship between the giver and recipient (e.g., parent, friend). |

| Purpose | Specify that the gift is intended to assist with the mortgage. |

| Amount | Clearly state the exact amount of the gift being given. |

| Timing | Indicate the date the gift is being provided. |

| Signature | Ensure the giver signs the letter and includes their contact details. |

Lastly, the letter should be signed by the giver, along with their contact details, in case the lender requires further verification. This ensures transparency and prevents any confusion down the line.

Ensure the gift letter is signed by both the giver and the recipient. Missing signatures can create doubts about the authenticity of the gift and complicate the mortgage application process.

State the amount of the gift clearly. Avoid ambiguous phrasing like “approximately” or “around.” A precise figure is required to avoid misunderstandings with the lender.

Be specific about the relationship between the giver and the recipient. Avoid vague terms like “friend” or “acquaintance” without further details. A clear explanation ensures the lender knows the nature of the relationship.

Do not include any repayment clauses. The letter should state that the gift is not a loan and does not need to be repaid. Any mention of repayment can invalidate the gift and confuse the mortgage process.

Avoid using incorrect dates or making contradictory statements. Double-check the dates and amounts mentioned in the letter to ensure they align with the documentation provided to the lender.

Submit the gift letter as soon as possible, ideally during the mortgage application process. The lender will typically request it after you submit your initial application, but it’s best to provide it earlier to avoid delays. Ensure the letter is clear, signed by the gift giver, and includes their contact details.

The gift letter must be submitted before the mortgage offer is made. Lenders may require additional documentation, such as proof of the giver’s funds or a bank statement showing the transfer. Always double-check the lender’s specific requirements to avoid complications later in the process.

Submitting the letter early helps ensure that all aspects of the mortgage application are processed smoothly, with no last-minute hurdles. If the gift funds are transferred close to the closing date, make sure to inform the lender right away and provide any extra documents they might need.

Ensure your mortgage gift letter is clear and to the point. Start by confirming the donor’s full name, address, and relationship to the recipient. State the amount of the gift and that it is a non-repayable contribution. Specify the intended use of the gift, such as for the deposit on a property. Include the donor’s declaration that the gift is not a loan, and there are no repayment expectations. It’s helpful to provide proof of funds if available.

Key points to include:

- Full names and addresses of both the donor and the recipient.

- Gift amount and confirmation that it is non-repayable.

- Confirmation that the gift is not a loan.

- Intended purpose of the gift (e.g., house deposit).

- Signature and date of the donor.

This letter helps to clarify the terms of the gift for mortgage lenders, ensuring smooth approval processes. Be sure the document is signed and dated to avoid confusion or delays.