Mortgage Loan Approval Letter Template Guide

When securing a property purchase, one crucial step involves formalizing the decision to extend financial support. This process often requires a written statement that outlines the conditions of the agreement and provides assurance to the recipient. Creating a clear and professional document is essential for both the issuer and the recipient to understand the terms and commitments involved.

Clarity and precision in the content of such a document are key to ensuring that the recipient fully comprehends the approval and its conditions. Without a proper format, misunderstandings could arise, leading to confusion or delays in the process. A well-structured written endorsement also helps maintain legal integrity and avoid potential issues down the line.

In this article, we will explore how to craft an effective document for confirming financial support. We’ll look at what information to include, common mistakes to avoid, and tips for tailoring the statement to specific situations. By the end, you’ll have a comprehensive understanding of how to write a clear and professional document that serves its intended purpose effectively.

What is a Financial Endorsement Document

In the world of property financing, a formal document is often issued to confirm that a person is eligible for financial assistance based on specific criteria. This communication is essential as it outlines the key details of the support being offered and reassures the recipient that their request has been reviewed and is moving forward. It serves as an official acknowledgment of the decision to provide resources for purchasing a property.

This document typically includes vital information, such as the approved amount, repayment terms, and any conditions attached to the agreement. It acts as a crucial step in the process of securing a property, helping both parties understand their responsibilities and expectations. The clarity of this document ensures that all parties are aligned before proceeding further with the transaction.

Essential Information to Include in Documents

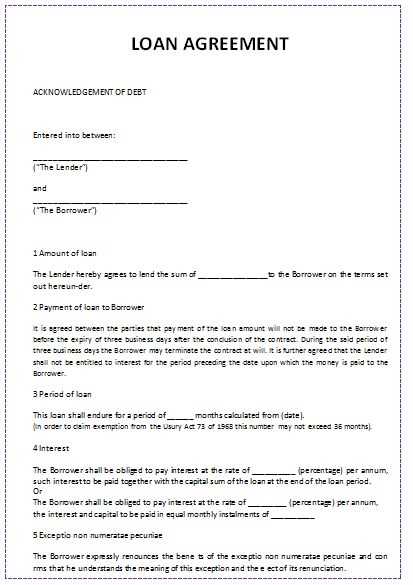

When drafting a formal document to confirm financial support for a property purchase, certain key details are essential for clarity and transparency. These details ensure that both parties understand the terms of the agreement and provide a reference for future discussions. Including the right information is crucial to avoid confusion or legal issues down the line.

At a minimum, the document should clearly state the amount of support offered, the terms of repayment, and the duration of the agreement. Additionally, any conditions that must be met, such as property appraisals or insurance requirements, should be included. It is also important to specify the responsibilities of both parties to ensure that expectations are aligned before proceeding with the transaction.

Steps to Create a Financial Confirmation Document

Crafting a formal document to confirm financial assistance involves several important steps. Each phase ensures that the message is clear, precise, and legally sound. The process requires attention to detail to make sure both parties understand the terms of the agreement and their obligations moving forward.

1. Gather Necessary Information

Before drafting the document, gather all relevant details, including the amount of funding, repayment conditions, and any special requirements tied to the agreement. Ensure that all information is accurate and up-to-date, as errors can lead to confusion or delays in the process.

2. Format the Document Properly

Once the necessary information is collected, start formatting the document. Use a professional tone and clear language, making sure that each section is easy to read. Proper organization of the content helps prevent misunderstandings and ensures that the important details stand out.

Key Considerations Before Sending Documents

Before dispatching any formal communication that confirms financial support, it’s crucial to carefully review the content and ensure that everything is in order. This step is necessary to avoid errors, misunderstandings, or delays that could complicate the process. Ensuring the document is accurate and properly formatted reflects professionalism and can prevent potential legal issues.

Double-check the details to ensure that the amount of funding, repayment terms, and any other conditions are clearly stated and correct. Clarity is vital in preventing confusion and ensuring that all parties involved are aligned. Make sure to verify that the recipient’s information is accurate and complete, and review the terms to confirm they meet all required criteria.

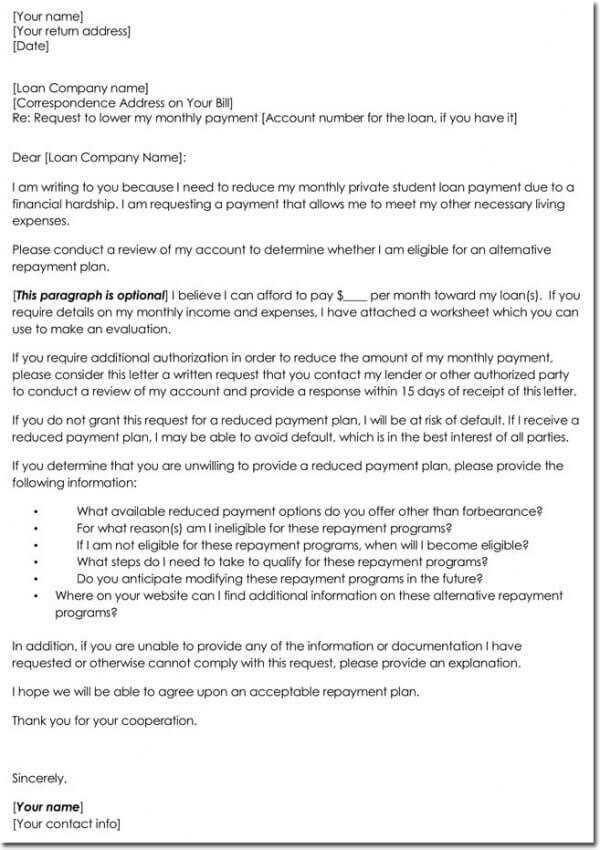

How to Personalize Your Confirmation Document

Customizing a formal document can make a significant difference in the recipient’s understanding and perception of the offer. Personalization ensures that the document feels more tailored and relevant to the recipient, which can help build trust and clarity. By adjusting the content to reflect specific details of the transaction, you make the document more engaging and professional.

1. Address the Recipient Directly

- Start the document by using the recipient’s full name.

- Include a personalized greeting to establish rapport.

2. Include Relevant Details

- Specify the exact amount of support being provided and any unique conditions tied to it.

- Adjust repayment terms or other aspects based on the recipient’s specific situation.

Personalizing the document demonstrates attention to detail and enhances the professionalism of the communication. By making these adjustments, you help ensure that the document resonates with the recipient and sets a positive tone for the next steps in the process.

Sample Templates for Financial Confirmation Documents

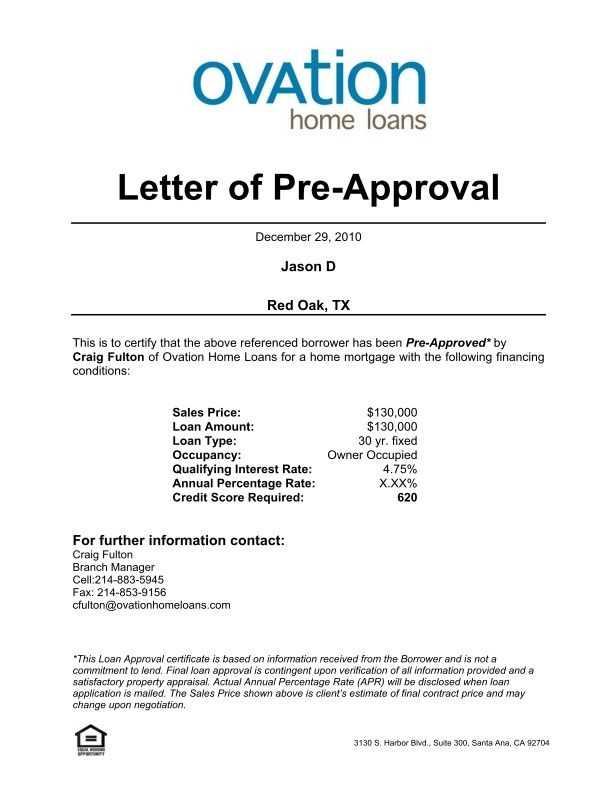

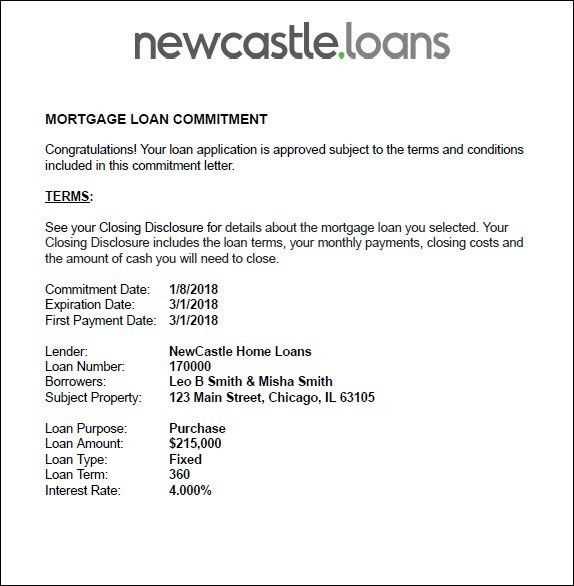

Having a ready-to-use sample can make the process of drafting a formal document much easier and more efficient. These samples serve as a useful guide, ensuring that all the essential elements are included and properly formatted. By following a well-organized template, you can tailor the document to fit the specific circumstances of each situation while maintaining a professional tone.

1. Basic Confirmation Sample

This sample is straightforward and includes all necessary details such as the funding amount, repayment terms, and any conditions for the agreement. It is ideal for situations where the terms are standard, and there is no need for complex conditions or additional clauses.

2. Detailed Financial Support Sample

For more complex cases, a detailed sample may be required. This type of sample includes sections for various conditions, such as property evaluations, insurance requirements, and any contingencies that may need to be met before the transaction is finalized. It’s designed for situations where additional information is necessary to outline the full scope of the arrangement.