National Debtline Letter Templates for Debt Management

When facing financial challenges, clear and formal communication with creditors is crucial. Crafting well-structured documents can significantly aid in resolving debt issues, ensuring both sides understand expectations and obligations. Such tools provide a framework for individuals to express their situations, negotiate terms, and seek viable solutions without misunderstandings.

Structured documents help organize your thoughts and present your case effectively, whether you’re seeking a payment plan or requesting a reduction in your balance. These written communications can build a record of your efforts to resolve the situation, offering evidence should you need to refer to it later.

Knowing how to write the right kind of formal communication is key. It’s not just about the words, but the tone, format, and clarity that can influence the outcome of negotiations. With the right approach, individuals can take a proactive role in managing their finances and reaching mutually agreeable terms with creditors.

Understanding Debt Communication Tools

Effective written communication plays a vital role in managing financial difficulties. The right documents can guide individuals through the process of negotiating with creditors, seeking adjustments, or addressing payment issues. By providing a clear structure, these tools help ensure that the message is understood, reducing the risk of confusion and helping to maintain a positive relationship with those owed money.

Why Structured Documents Matter

Using organized communication formats ensures that all necessary information is included and presented in a professional manner. This not only increases the chances of a positive response but also provides a formal record that can be referenced in case of further disputes. By having a consistent approach, individuals can feel more confident in handling financial negotiations.

How These Documents Can Support Financial Solutions

Well-designed forms can assist individuals in outlining their financial situation, presenting offers, or requesting modifications to payment terms. This approach allows for a constructive discussion that is focused on resolving the issue. Properly crafted communications are key to exploring options like reduced payments, deferred deadlines, or even full settlements, offering a path to regain control over one’s finances.

Why Use Debt Communication Formats

Having access to pre-made communication formats for financial matters can simplify the process of managing debt. These ready-made documents offer a clear structure that ensures all necessary points are addressed, making it easier to communicate with creditors effectively. By following a consistent format, individuals can ensure they present their case in a professional and organized manner, which increases the chances of reaching a favorable resolution.

Additionally, these formats help reduce the risk of missing important details. They provide guidance on what information should be included, ensuring that nothing essential is overlooked. This can be especially useful for those who are unsure of the proper way to structure their communication or for individuals dealing with multiple creditors.

How Support Services Can Assist

Accessing professional help when managing financial difficulties can make a significant difference. Expert services provide individuals with the resources, advice, and tools necessary to navigate complex situations with creditors. These services can offer support through tailored strategies, guiding individuals toward effective debt resolution.

Providing Structured Guidance

One of the key benefits of these services is the structured guidance they provide. Individuals can receive step-by-step instructions on how to communicate with creditors, ensuring that every necessary point is covered. With the right support, individuals can feel more confident in their ability to manage their finances and work toward resolving their debts in a fair and efficient manner.

Offering Customized Solutions

Services can also provide customized solutions to meet unique financial needs. Whether it’s negotiating payment terms, seeking reductions, or creating manageable repayment plans, professional advice helps individuals explore all available options. Personalized assistance empowers individuals to take control of their financial future while working collaboratively with creditors.

Types of Debt Documents You Need

When dealing with financial obligations, it’s essential to know the different types of formal documents required to manage communication effectively. Each type serves a specific purpose, whether it’s to request adjustments, inform creditors of your situation, or seek an agreement on a repayment plan. Understanding these categories ensures you approach your creditors with the right tools at the right time, making the process more streamlined and effective.

Essential Communication for Debt Management

There are several key types of formal documents that individuals may need when negotiating or communicating with creditors. These documents can help outline requests, confirm agreements, or clarify situations. Each one is designed to address specific scenarios that may arise during the process of managing debt.

Common Debt Communication Categories

| Document Type | Purpose |

|---|---|

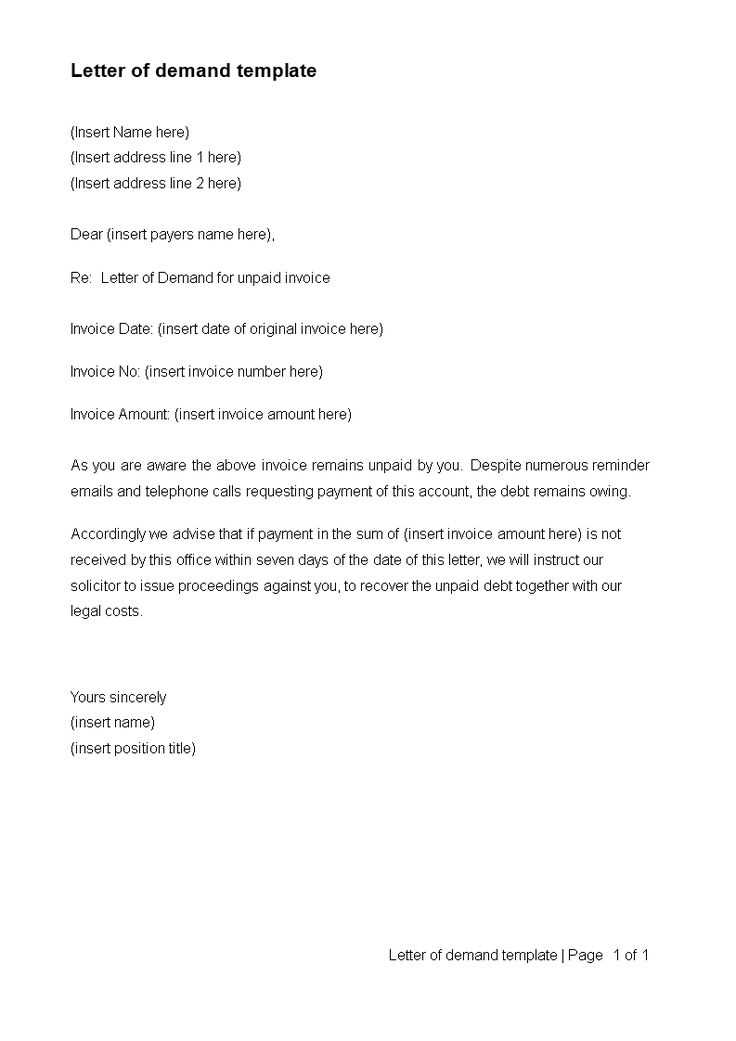

| Request for Payment Plan | To propose a structured repayment schedule to creditors. |

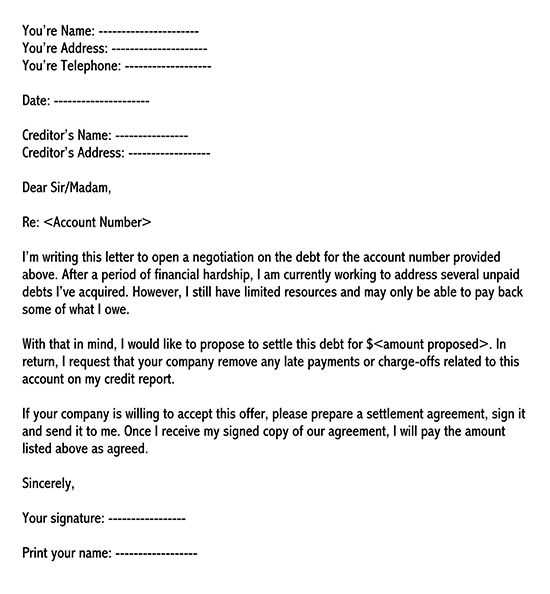

| Financial Hardship Letter | To explain financial difficulties and request leniency or adjustments in payment terms. |

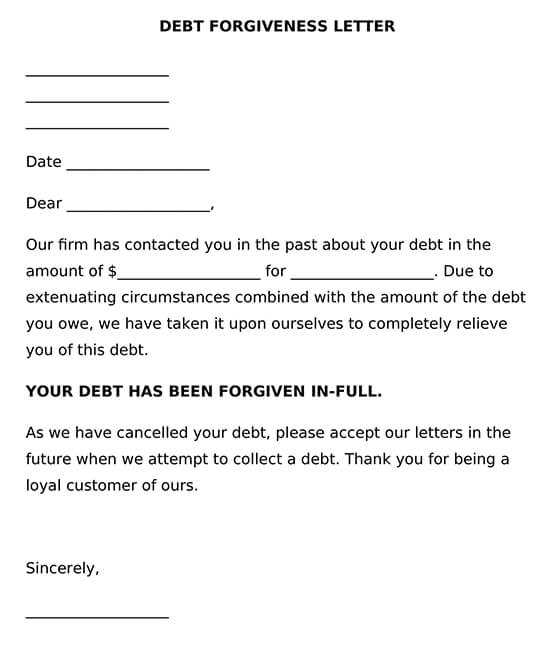

| Debt Settlement Offer | To negotiate a reduced amount to pay off the debt in full. |

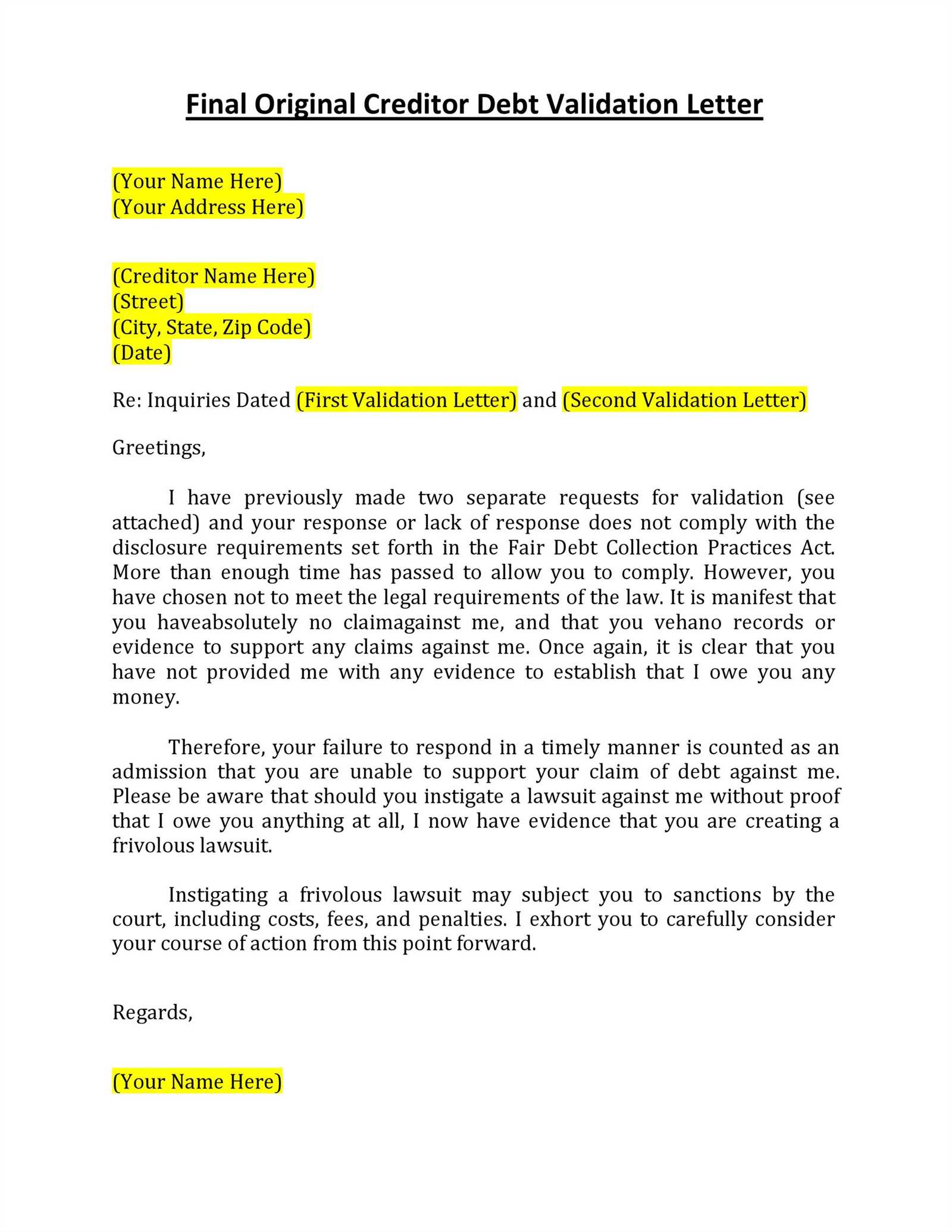

| Dispute Resolution Letter | To formally challenge the amount owed or the terms of the debt. |

Step-by-Step Guide to Writing Documents

Creating clear and effective written communications for financial matters requires a systematic approach. Each step is important to ensure that the message is both professional and thorough, addressing all necessary points while maintaining clarity. Following a structured process helps individuals communicate their financial situation effectively, increasing the likelihood of a positive response from creditors.

Here is a step-by-step guide to crafting formal documents that can help you manage your debts:

- Start with Your Personal Information: Include your name, address, and contact details at the top of the document, followed by the creditor’s information. This ensures both parties are clearly identified.

- State Your Purpose: Clearly explain why you are writing, whether it’s to request a payment plan, negotiate terms, or seek a reduction in your debt.

- Provide a Brief Overview of Your Situation: Explain any financial difficulties you are facing, providing enough context without going into excessive detail.

- Make Your Request or Proposal: Be specific about what you are asking for–whether it’s a delay in payments, a lower amount, or a more manageable payment schedule.

- Close Professionally: Thank the creditor for considering your request and provide a clear way for them to contact you if they need further information.

By following this structure, your communication will be organized, respectful, and more likely to be taken seriously by creditors.

Common Mistakes to Avoid in Debt Communications

When managing financial challenges, it’s crucial to approach communication with creditors carefully. Even small mistakes in the way you present your situation can negatively impact the outcome. Avoiding common errors in your documents ensures that your message is clear, professional, and likely to be taken seriously by the creditor.

Key Mistakes to Watch Out For

Here are some common mistakes individuals make when preparing formal communications for financial matters:

- Providing Incomplete Information: Always ensure you include all the relevant details, such as your account number, the amount owed, and your contact information.

- Being Too Vague: Avoid ambiguous language. Be clear about what you are asking for, whether it’s a payment extension, debt reduction, or a more manageable repayment schedule.

- Neglecting to Explain the Situation: While it’s important to be concise, provide enough context about your financial difficulties so the creditor understands your position.

- Using an Aggressive Tone: Keep your communication respectful and professional. An angry or demanding tone can make creditors less willing to work with you.

- Forgetting to Proofread: Ensure there are no errors in your communication. Mistakes can create confusion or make your message seem less credible.

How to Avoid These Pitfalls

By taking time to carefully structure your communication, you can avoid these common mistakes. Ensure your message is clear, professional, and respectful, and always review your document for accuracy before sending it. A well-prepared document can make a significant difference in resolving debt-related issues.

Tips for Effective Communication with Creditors

Communicating effectively with creditors is essential when working through financial difficulties. How you approach the situation can significantly influence the outcome. A respectful, clear, and solution-focused approach can help facilitate productive discussions and increase the likelihood of reaching an agreement that benefits both parties.

Key Strategies for Success

Follow these strategies to ensure your communication is both effective and respectful:

- Be Clear and Concise: State your purpose right away. Clearly explain your financial situation and what you are requesting, such as a payment plan or an extension.

- Maintain a Professional Tone: Use a respectful and polite tone throughout your communication. Even if you’re feeling frustrated, keeping things professional increases the chances of a positive response.

- Offer Solutions: Rather than simply asking for leniency, present reasonable proposals or payment terms that you can realistically meet. This shows you’re committed to resolving the situation.

- Stay Honest: Always be truthful about your financial situation. Lying or omitting details can hurt your credibility and hinder negotiations.

- Keep Records: Maintain a copy of all correspondence, including emails and letters, as proof of your efforts to resolve the issue.

How to Handle Difficult Situations

If negotiations become challenging or you’re unsure of your next steps, try to stay calm and patient. Consider requesting a meeting or phone call if necessary, and don’t be afraid to ask for more time to evaluate your options. The goal is to reach a mutually beneficial solution, so keep the conversation focused on finding a way forward.