No estate letter template

If you’re looking to create a no estate letter, start by addressing the core purpose of the document: to confirm that no estate exists under the name of the deceased. This letter is commonly used when the decedent did not leave behind a will or any substantial assets that would require probate proceedings.

Begin by clearly stating the deceased’s full name, date of birth, and date of death. Then, mention that after a thorough review of their affairs, it has been determined that no assets or liabilities remain under their name. Include any necessary legal declarations to support your claim, such as references to property searches or financial assessments, if applicable.

Keep the tone respectful and professional, ensuring that all facts are accurate and well-supported. Conclude with a statement of confirmation, and if necessary, provide contact details for further inquiries or clarification. This ensures the recipient has all the necessary information to understand the situation fully.

Here’s a detailed article plan in HTML format for the topic “No Estate Letter Template,” with six specific and practical subheadings, formatted with

Introduction to the No Estate Letter

A “No Estate” letter is often needed when someone passes away without leaving any assets or property. It serves as confirmation that there is no estate to be administered. This document is essential for notifying financial institutions, government agencies, and other relevant parties that no estate exists. The letter can prevent confusion and expedite the process of closing accounts and resolving any remaining issues.

Key Elements of a No Estate Letter

The letter should be clear and concise. Include the deceased’s full name, date of birth, and date of death. State explicitly that the deceased left no assets, and provide supporting details if applicable, such as the absence of a will or any outstanding debts. Make sure to include contact information for the executor or representative handling the matter.

Step-by-Step Guide for Writing a No Estate Letter

Begin by addressing the relevant recipient, such as a bank or legal institution. Start with a brief statement confirming the deceased’s details and the absence of an estate. Then, offer any necessary information that proves there is no property or assets left to manage. Close by providing your contact information in case further clarification is needed.

When to Use a No Estate Letter

Use this letter when you need to inform any organization, such as banks, insurance companies, or the IRS, that the deceased left no assets or estate. This is especially useful for settling financial obligations and ensuring that there are no further claims or paperwork tied to the deceased’s estate.

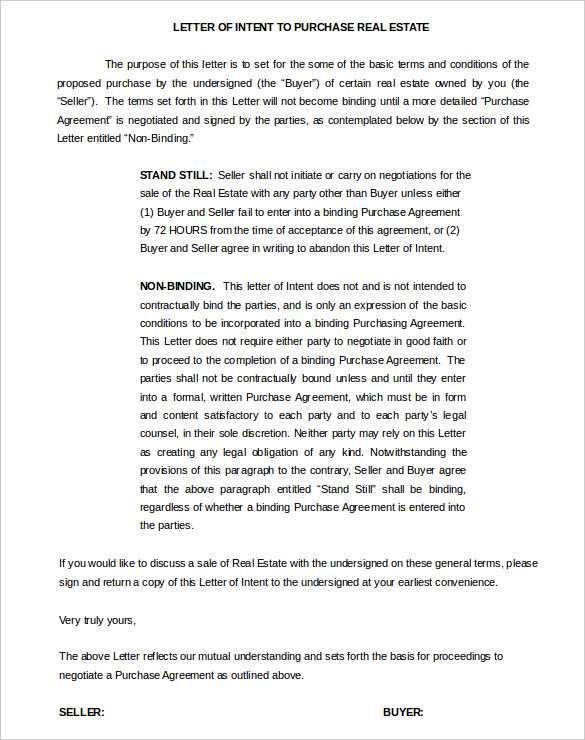

Sample No Estate Letter Template

Below is a simple template for a No Estate Letter:

[Your Name] [Your Address] [City, State, ZIP Code] [Phone Number] [Email Address] [Date] [Recipient Name] [Recipient Title] [Company Name] [Address] [City, State, ZIP Code] Dear [Recipient Name], Subject: No Estate Letter for [Deceased's Name] I am writing to inform you that, unfortunately, [Deceased's Name], who passed away on [Date of Death], left no estate. There were no assets or properties involved, and there is no will. Please consider this letter as official notice of the absence of an estate. Should you require any further documentation or have any questions, feel free to contact me at [Your Contact Information]. Thank you for your attention to this matter. Sincerely, [Your Name] [Your Relationship to Deceased]

Legal Considerations

Before sending the No Estate Letter, it’s important to ensure that the letter complies with local laws and requirements. In some jurisdictions, a death certificate may need to be attached, or you might be required to notify certain agencies. Always check with legal counsel if you are uncertain about any legal implications.

Conclusion

A No Estate Letter is a practical tool for settling the affairs of a deceased individual who left no assets. It serves to clear up any confusion, and following the steps outlined above ensures that the process is straightforward and efficient.

Understanding the Purpose of a No Estate Letter

A No Estate Letter serves as an official declaration that a deceased person did not leave behind an estate or assets that require formal distribution. This letter clarifies the situation for financial institutions, government agencies, and other parties involved in processing the deceased’s affairs. It is typically used when there are no significant assets to probate or distribute, and it helps close the individual’s financial accounts without the need for a full probate process.

This letter is often necessary to prevent confusion or miscommunication regarding the deceased’s financial status. It formally states that there are no debts or estate assets, ensuring that organizations do not mistakenly pursue unnecessary actions such as debt recovery or probate procedures. Without it, there could be delays or complications in the administration of the deceased’s matters.

For those handling the affairs of someone who has passed, providing a No Estate Letter simplifies the process and offers clarity to relevant parties, confirming that no further legal steps are required. It is particularly useful when the deceased’s estate is small or non-existent, saving time and resources for everyone involved.

Key Elements to Include in a No Estate Letter

Begin by clearly stating that no estate exists. Directly address the situation and specify that the deceased left no assets or estate behind. Be concise but factual in this opening statement.

Identification of the Deceased

Include the full legal name, date of birth, and date of death of the individual. This helps clarify who the letter pertains to and serves as a formal record.

Explanation of the Situation

Provide a brief but precise explanation of why there is no estate. Mention that the deceased had no property, savings, or liabilities left behind, if applicable. This section should reassure recipients about the clarity of the situation.

Finally, close by offering contact information for further inquiries, ensuring that the letter remains transparent and open for any necessary follow-up.

How to Write a No Estate Letter: A Step-by-Step Guide

Start by clearly stating that no estate exists. This will set the tone and provide clarity to the recipient.

- Step 1: Begin with the header. Include your name, address, phone number, and the date of the letter. This gives a professional appearance.

- Step 2: Address the recipient appropriately. Use the recipient’s name and title if available, such as “To Whom It May Concern” or a specific name if known.

- Step 3: In the opening sentence, state explicitly that you are writing to inform them that no estate is left. For example: “I am writing to inform you that there are no assets or estate left for distribution.”

- Step 4: Provide a brief explanation of the situation. For example, if you are an executor or involved with the estate, explain your position and clarify that no estate remains to be administered.

- Step 5: State any additional important facts. If necessary, mention any actions taken or steps already completed that led to the conclusion of no estate. This may include probate proceedings or settlement of debts.

- Step 6: Close the letter with a polite, formal statement. Offer to answer any questions if needed, such as: “Should you require further clarification, please feel free to contact me.”

- Step 7: Sign the letter, and provide your contact details again if necessary for any follow-up.

This approach ensures that your message is clear, professional, and concise. Avoid unnecessary details and keep the focus on the primary point: no estate exists.

Common Mistakes to Avoid When Drafting This Type of Letter

Be clear and concise. Avoid using overly complex language or unnecessary details. Keep your sentences simple and straight to the point. Your goal is to convey the message clearly without confusion. Avoid ambiguous statements or leaving room for misinterpretation.

Ensure proper formatting. Using incorrect or inconsistent formatting can make your letter appear unprofessional. Stick to a clear structure with proper paragraphs, dates, and addresses. This gives the letter a polished look and makes it easier to read.

Verify the accuracy of the information. Any incorrect details, especially regarding legal matters, can cause serious issues. Double-check names, dates, addresses, and other factual information. Incorrect data can invalidate the letter or delay the process.

Avoid overly emotional language. Stick to neutral and factual language. Strong emotional expressions may undermine the professionalism of the letter and distract from the main message. Be direct and to the point.

Don’t forget to include all necessary details. Ensure that you provide all relevant information required for the specific purpose of the letter. Leaving out crucial points can lead to confusion or delays. Always double-check the requirements before submitting the letter.

When to Use a No Estate Letter: Practical Scenarios

A No Estate Letter is useful when someone passes away without leaving a formal estate, or if their estate is small enough to avoid legal probate. If you are a relative or representative of the deceased, you may need to provide a No Estate Letter to various institutions to confirm that no formal estate exists. This document informs banks, creditors, or any other interested parties that there are no assets or liabilities to manage under an estate. It’s especially common when the deceased had no significant property or when all assets were jointly held or accounted for outside of an estate.

Common Use Cases

If you are settling minor financial matters or closing accounts, a No Estate Letter may be required to verify there is no estate to administer. This letter can be presented to financial institutions, insurance companies, or even government offices to assure them that no formal estate exists and no further actions are necessary. Another scenario might involve handling a deceased person’s debts, where a No Estate Letter helps clarify that no estate is available to settle outstanding obligations.

When to Consider a No Estate Letter

If the deceased’s assets are minimal or non-existent, a No Estate Letter will help avoid unnecessary proceedings. It is particularly relevant in cases where the deceased’s assets are jointly owned, passed outside of probate, or directly inherited, and no further administrative steps are required. In some regions, even a small estate may need to go through probate, but a No Estate Letter can demonstrate that it does not apply in cases where it is unnecessary.

Legal Considerations When Sending a No Estate Letter

Ensure you have all relevant documentation before sending a no estate letter. Verify that the deceased had no property or financial assets that require distribution. This information can typically be gathered through estate records or by contacting the deceased’s bank or financial institutions.

Verify the Deceased’s Status

Before proceeding, confirm the individual’s legal status. Check with local authorities or the probate court to ensure that no estate proceedings have been initiated. If probate has been started, the letter should not be sent as it may interfere with the legal process.

Provide Clear Information

Be precise and clear when stating that the deceased has no estate. Avoid vague statements, and make sure to list any documents or inquiries you used to come to this conclusion. This adds credibility to the letter and helps avoid any confusion or future disputes.

| Document/Action | Purpose |

|---|---|

| Estate Records | Confirm that no assets exist that need distribution. |

| Probate Court Inquiry | Verify that no legal proceedings have been started. |

| Financial Institution Contact | Check if any assets are held by the deceased. |

It is recommended to consult with a legal expert before sending the letter. This ensures you adhere to the correct protocol and avoids future complications.