No Income Letter Template for Financial Support

There are times when individuals need to provide a formal explanation of their current financial situation. Whether for assistance, rent relief, or other purposes, presenting this information clearly is essential for receiving the necessary support.

Such documents are used to communicate the lack of steady financial resources and can help recipients understand the individual’s situation. Knowing how to draft such a document properly is crucial to ensure it conveys the right message and is accepted by the relevant parties.

Understanding the structure of this important communication can save time and avoid unnecessary complications. By following a few simple guidelines, anyone can create a professional and effective document to meet their specific needs.

Why You Might Need a No Income Letter

There are various situations where it becomes necessary to provide a written statement explaining your financial situation. This type of document is often requested by organizations, landlords, or government bodies when assessing eligibility for assistance or benefits. By clearly outlining your current circumstances, you help ensure that you are evaluated fairly and accurately.

Here are some common scenarios where such a statement may be required:

- Applying for public assistance or welfare programs.

- Requesting rent relief or deferral of payments.

- Negotiating with creditors or lenders for temporary hardship accommodations.

- Seeking tax exemptions or reductions due to financial difficulty.

- Providing evidence of financial hardship when applying for loans or other financial support.

In each of these cases, the document serves as a formal way to explain why you may not be able to meet financial obligations at the moment, helping to facilitate the process of requesting support or adjustment. Understanding when and how to present this information can help you navigate these situations with confidence.

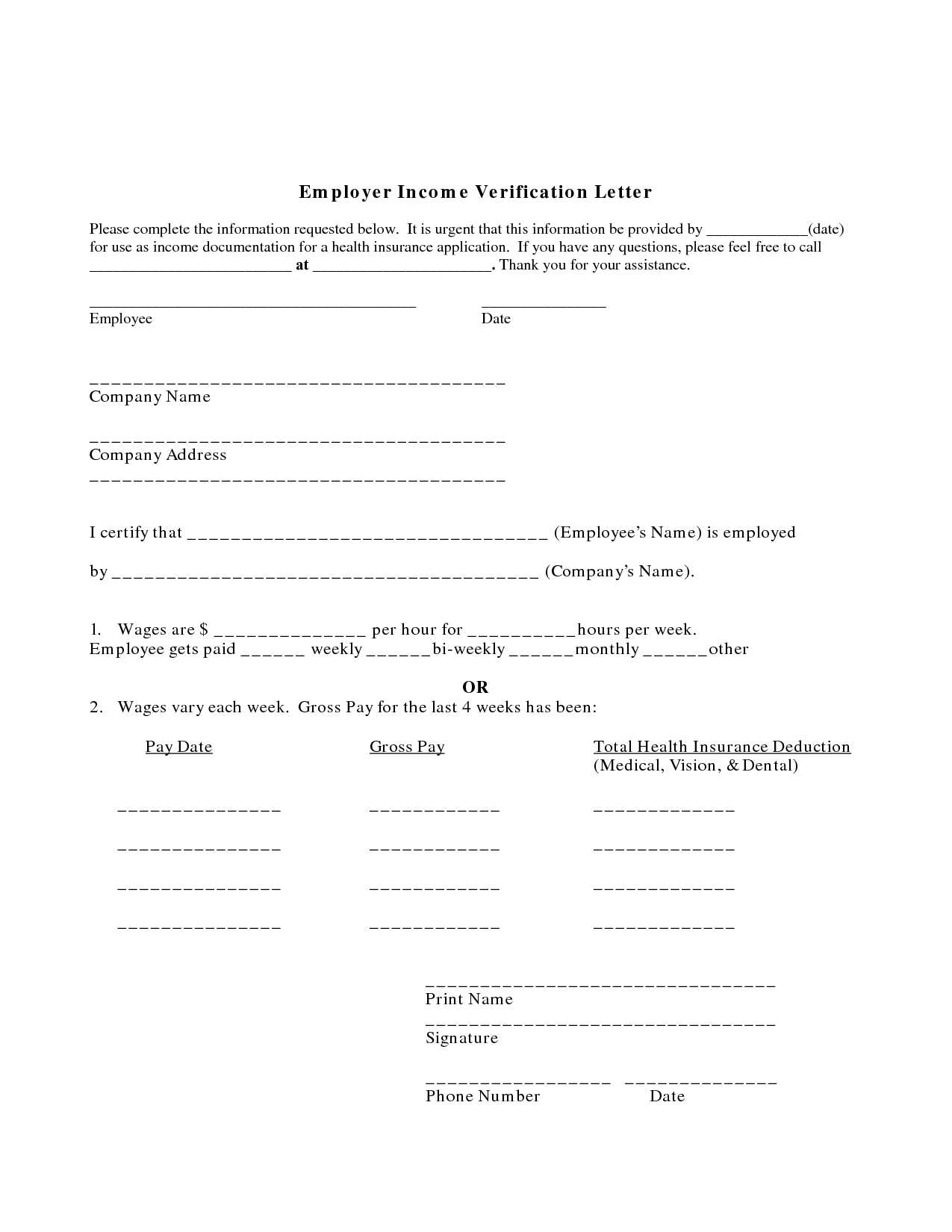

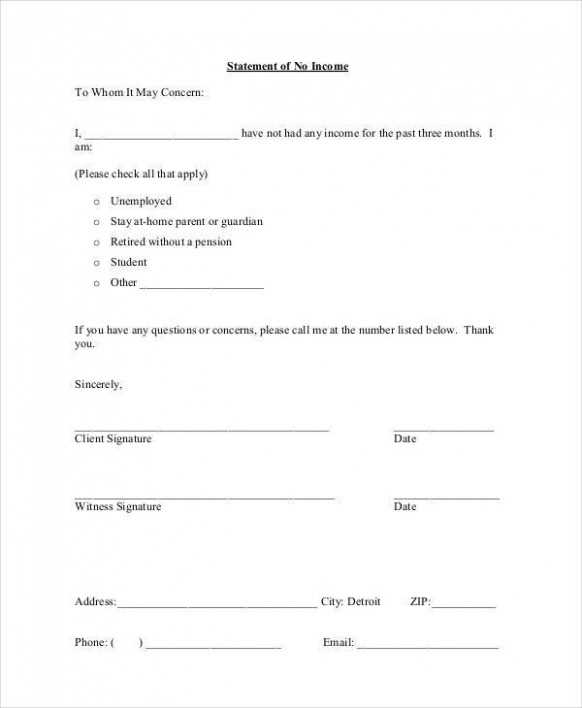

Key Elements of an Effective Letter

To create a well-crafted document explaining your financial situation, it is essential to include specific details that provide a clear and honest picture of your current status. A strong communication will address all the necessary points while maintaining a professional tone.

Here are the main elements to include for an effective statement:

- Introduction: Start by briefly explaining who you are and why you are writing the document.

- Personal Details: Include your full name, contact information, and any reference number if applicable.

- Explanation of Financial Situation: Clearly describe the circumstances that have led to the lack of steady funds. Be truthful and provide any supporting facts.

- Timeframe: Mention the period during which you have been without regular income or funds, if applicable.

- Request for Assistance: Specify what kind of support or relief you are seeking, whether it’s rent reduction, financial aid, or other services.

- Contact Information: Provide details on how the recipient can contact you for further clarification or follow-up.

By including these elements, you ensure that the recipient has all the information they need to make an informed decision regarding your request.

Step-by-Step Guide to Writing It

Creating a well-structured document to explain your financial situation is essential for a clear and effective communication. By following a step-by-step approach, you can ensure that all relevant information is included in a professional and concise manner.

Step 1: Start with a Clear Introduction

Begin by introducing yourself and explaining the purpose of the document. Keep it brief but informative, stating the reason for your request and giving context to your situation.

Step 2: Provide Your Personal Details

Include your full name, address, and any necessary identification or reference numbers that will help the recipient easily identify your case.

Step 3: Explain Your Current Situation

Describe your financial condition honestly and clearly. Focus on key factors that have led to your present circumstances, whether it’s job loss, medical issues, or other factors that have impacted your financial stability.

Step 4: Specify the Assistance You Need

State what type of help or relief you are seeking, whether it’s deferral of payments, financial assistance, or other forms of support. Be specific to avoid confusion.

Step 5: Include Supporting Documents if Needed

If possible, attach any documents that validate your claims, such as unemployment benefits, medical records, or other relevant paperwork that supports your explanation.

Step 6: End with Contact Information

Conclude the document by providing your contact details, so the recipient can reach out for further clarification or follow-up.

By following these steps, you create a clear and professional document that is likely to receive a positive response. Make sure to check for any required documents or specific formats requested by the recipient before submitting it.

When to Submit a No Income Statement

There are specific situations in which submitting a statement detailing your financial hardship is necessary. Understanding when it is appropriate to provide such a document can help streamline the process and ensure that your request for assistance is processed smoothly.

Government Assistance and Welfare Programs

One of the most common times to submit this type of statement is when applying for government aid, such as unemployment benefits, food assistance, or other welfare programs. Agencies may require proof of your financial status to assess eligibility for these services.

Negotiating with Creditors and Landlords

If you are struggling to meet financial obligations, creditors or landlords may ask for a statement to understand your situation better. This document helps to negotiate payment plans, deferments, or possible reductions in your payments.

Submitting this statement at the right time is essential to ensure that your request for relief is considered seriously and processed without delays. Always check for specific requirements from the relevant parties before submitting the document.

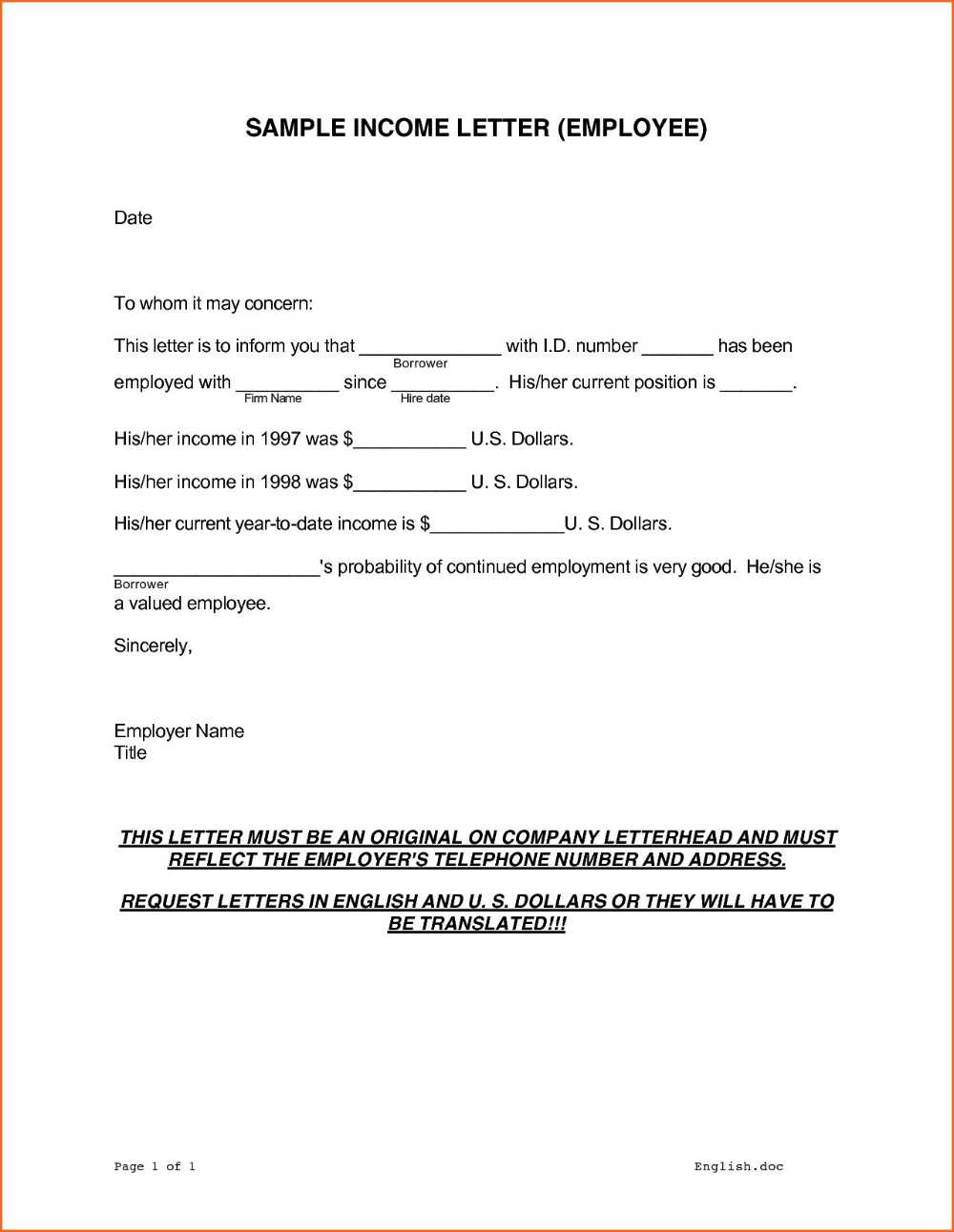

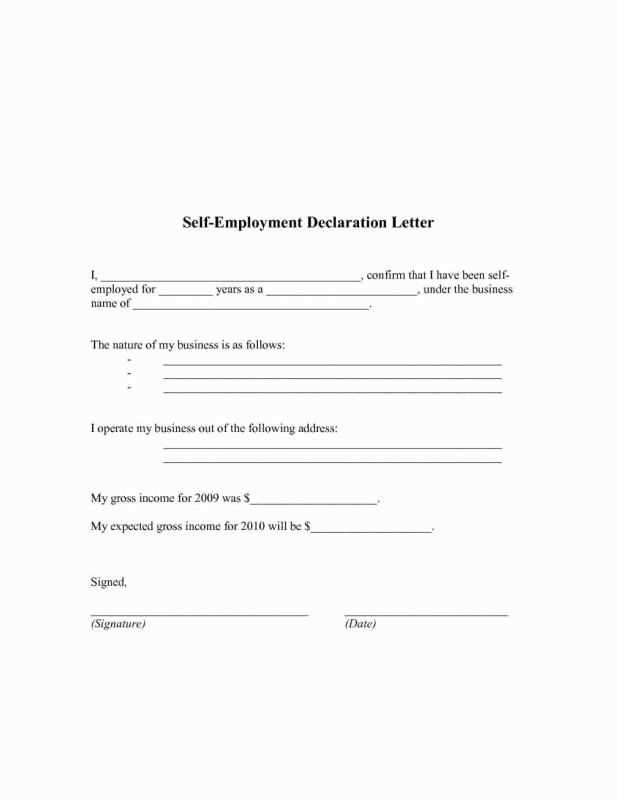

Examples of Different Letter Formats

Depending on the purpose of your communication, the structure of your statement may vary. It’s important to choose the right format to ensure that the recipient clearly understands your situation and request. Here are a few examples of different ways to present your information.

Formal Format for Government Agencies

This format is typically used when submitting your statement to a government agency for assistance. It is concise, professional, and includes all required personal and financial details.

Example:

Dear Sir/Madam,

I am writing to inform you of my current financial situation, which has been impacted by [reason]. I am requesting [type of assistance] for the period from [date] to [date].

Enclosed are supporting documents that verify my circumstances.

Sincerely,

[Your Name]

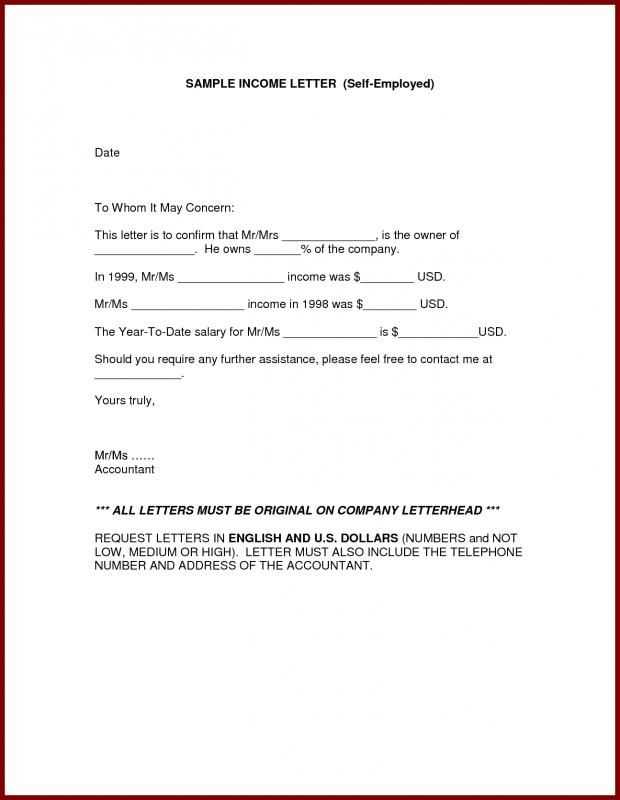

Informal Format for Creditors or Landlords

This format can be used when addressing creditors or landlords. It maintains a polite tone but may be less formal in structure compared to a government submission.

Example:

Dear [Creditor/Landlord],

I am currently facing financial hardship due to [reason], and as such, I am unable to meet my financial obligations at this time. I kindly ask for your understanding and request [reduced payment/deferred payment/other assistance].

Thank you for your consideration, and I look forward to hearing from you.

Best regards,

[Your Name]

Each of these formats serves a different purpose but follows the same principle: clarity, professionalism, and a clear explanation of the request. Tailoring your communication to the specific audience can help ensure a more favorable response.

Common Mistakes to Avoid in Writing

When drafting a document to explain your financial situation, it’s important to avoid common errors that could hinder the effectiveness of your communication. A clear and well-organized submission is key to ensuring that your message is properly understood and processed.

Unclear or Incomplete Information

One of the most frequent mistakes is providing vague or incomplete details. Failing to include essential personal and financial information can cause delays or even rejection of your request.

Overly Emotional or Unprofessional Tone

While it is understandable to feel stressed or frustrated, maintaining a professional and neutral tone is crucial. An overly emotional or accusatory tone may undermine your credibility and lessen the likelihood of a positive response.

Here’s a comparison of the right and wrong ways to present your situation:

| Incorrect Approach | Correct Approach |

|---|---|

| “I have no job and no money, I’m begging for help.” | “Due to recent job loss, I am unable to meet my financial obligations at this time and am seeking assistance.” |

| “I will not be able to pay you at all unless you help me right away!” | “I kindly request a temporary deferment or reduced payment plan due to my current financial hardship.” |

By avoiding these common mistakes and ensuring that your message is clear and respectful, you improve your chances of receiving the necessary support or understanding. Always review your document before submitting it to make sure it effectively communicates your request in a professional manner.

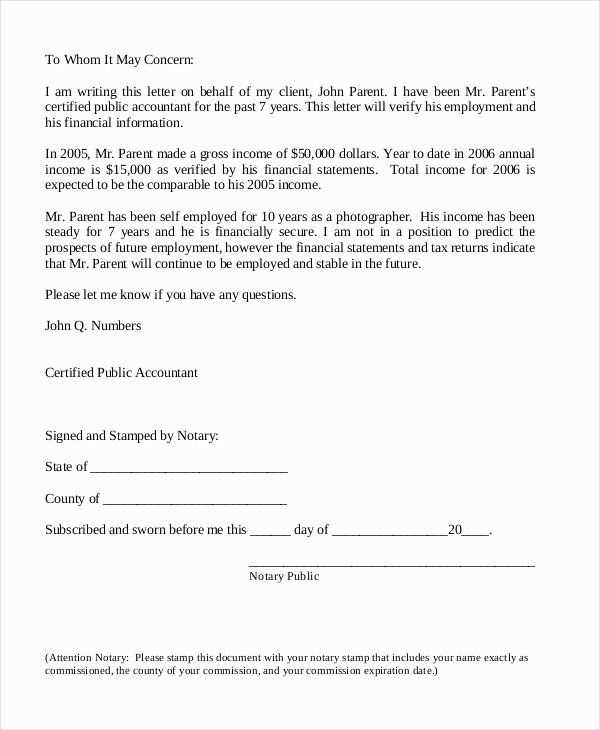

How to Tailor It for Specific Situations

Adapting your document to fit the specific needs of different audiences is essential for ensuring that your message is received clearly and effectively. Whether you’re communicating with a creditor, landlord, or government agency, the way you present your financial situation may need to change depending on the context.

For Government Assistance Requests

When reaching out to government organizations for financial help, it is important to use formal language and be specific about your current financial challenges. Focus on your need for assistance and provide all relevant supporting documents to strengthen your case.

For Communicating with Creditors

In this situation, you may want to request a payment plan or temporary forbearance. Be polite but firm, providing details about your financial hardships and offering a realistic plan for repaying the debt. Clarity and respect are key.

For Landlord or Rent Assistance

Here, it’s crucial to highlight your need for temporary rent relief or a payment deferral. Politely explain the situation, express your commitment to paying once circumstances improve, and suggest a mutually beneficial arrangement, such as a revised payment schedule.

By tailoring your message to the specific audience, you ensure that your request is heard and understood, increasing the likelihood of a positive response.