Non payment of invoice letter template

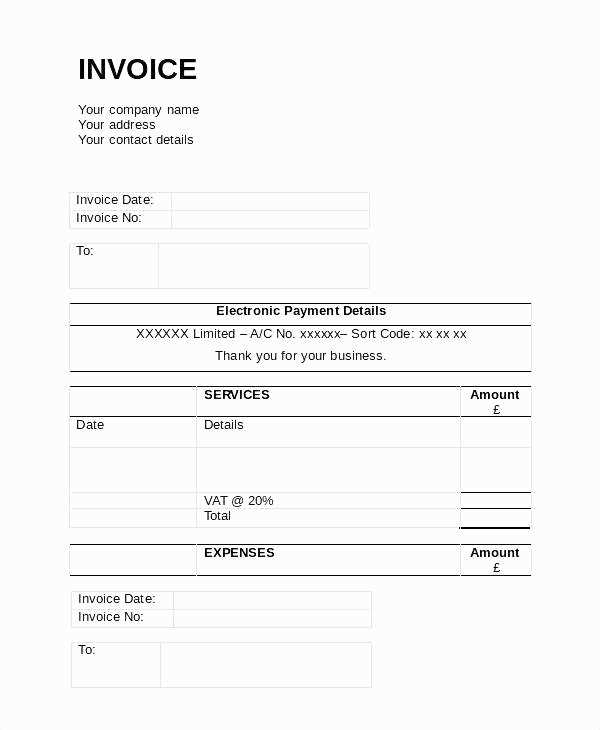

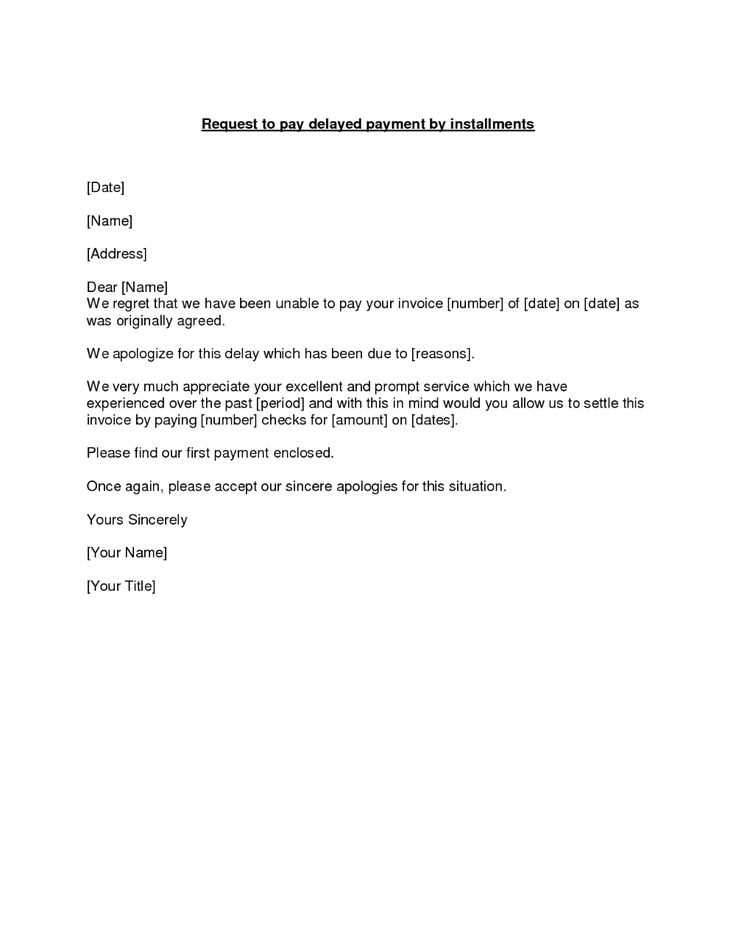

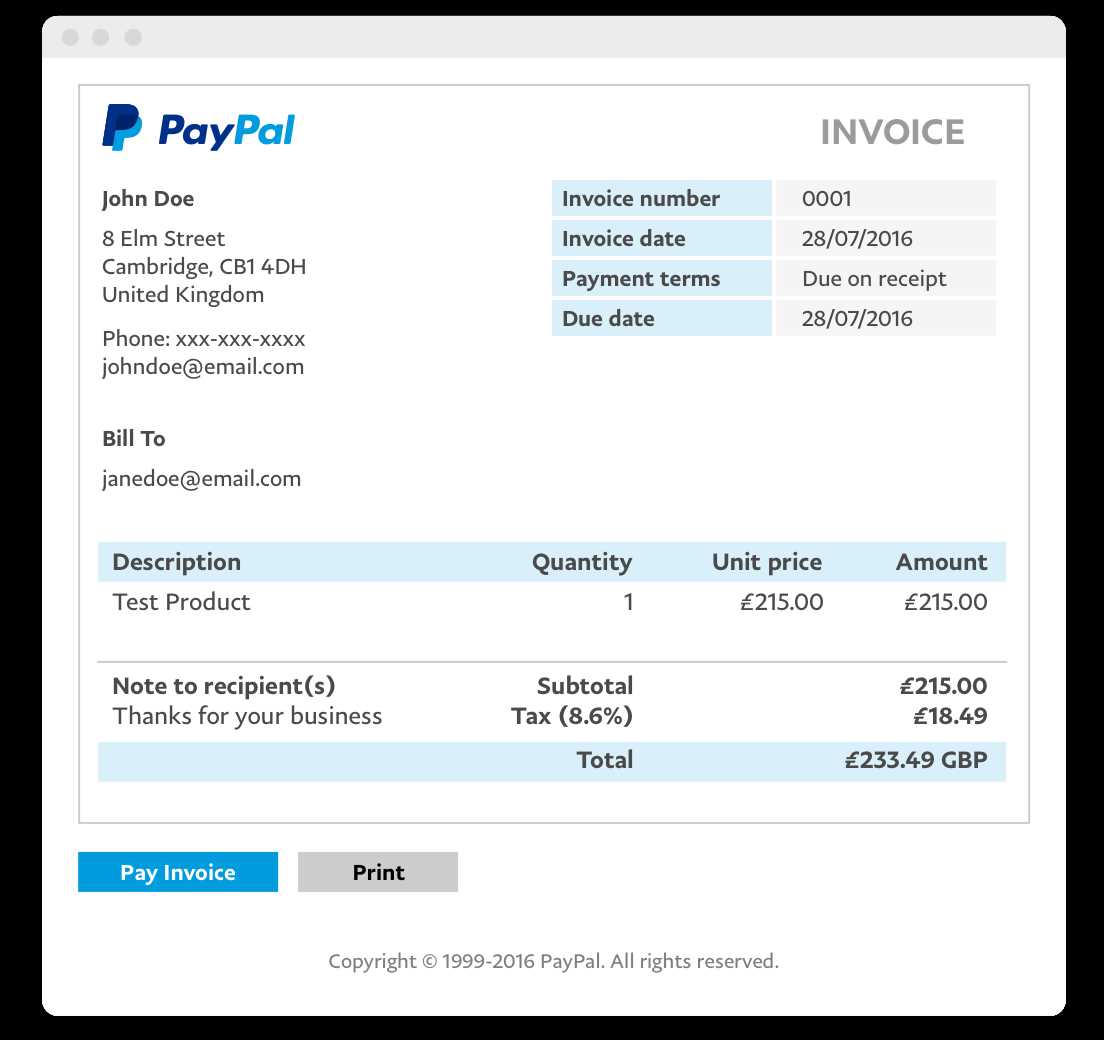

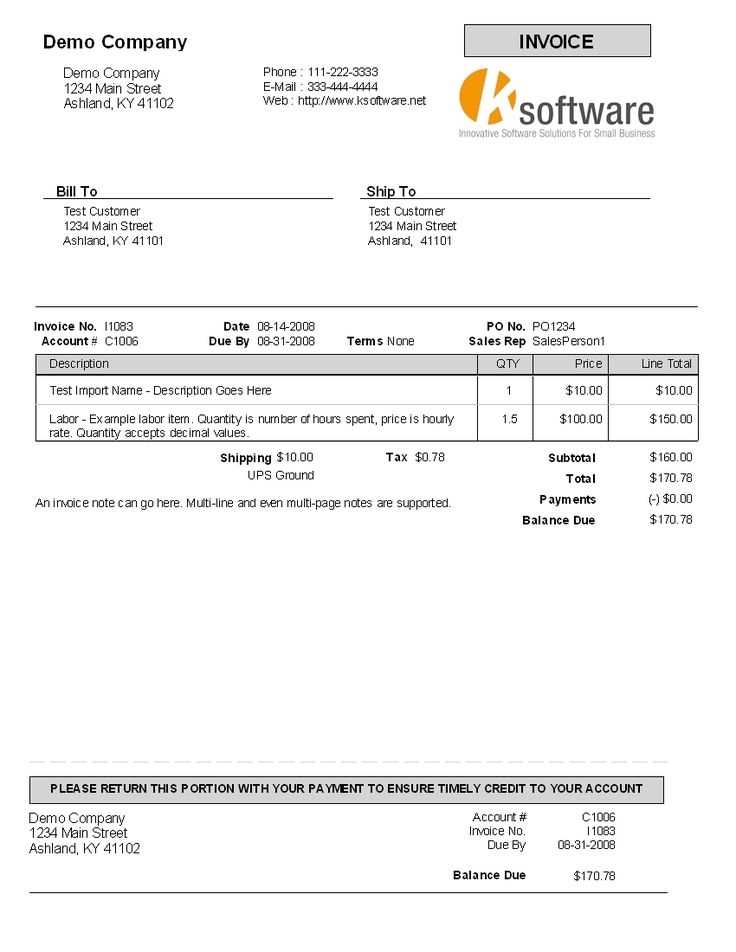

If a customer has not paid an invoice by the due date, sending a well-crafted letter can help resolve the situation swiftly. This template is designed to convey your message clearly while maintaining professionalism. It’s critical to include all necessary details, such as the invoice number, due date, and amount owed.

First, begin the letter with a polite reminder of the outstanding payment. Mention the specific invoice number and its due date. Clearly state the amount that is still due and any applicable late fees. Keep the tone firm but respectful, as this can encourage timely payment while preserving your business relationship.

Second, provide a clear call to action. Outline the next steps the customer should take to settle the invoice, including how they can make the payment and any payment options available. Indicate a deadline by which you expect to receive the payment. Mention potential consequences if the invoice remains unpaid, such as suspension of services or further legal actions, but avoid sounding threatening.

Lastly, offer assistance if there are any issues with the payment process. This shows flexibility and willingness to work with the customer, which can help maintain goodwill. Ensure the letter ends on a positive note, encouraging prompt resolution without causing frustration for the recipient.

Here’s an improved version of the text:

Use a clear and polite tone when drafting a non-payment reminder. Focus on being direct and courteous to avoid any misunderstandings. Ensure your wording encourages resolution while maintaining professionalism.

Invoice Reference

Start by referencing the specific invoice number and the due date. This helps your client quickly locate the relevant information. For example:

Invoice #12345, due on January 15, 2025.

State the Payment Status

Clearly mention the outstanding payment and the amount owed. Keep this part factual without sounding accusatory. Example:

Our records show that this invoice remains unpaid, with a balance of $500.00 still due.

Conclude the message with a call to action, asking for immediate payment or to discuss any issues regarding the invoice. Maintain a solution-oriented approach:

If there are any questions regarding this payment or if there’s an issue we should address, please don’t hesitate to reach out. We look forward to your prompt response and settlement.

Non-Payment of Invoice Letter Template

Begin with a clear statement of the overdue payment and reference the invoice number. For example: “This letter is to inform you that invoice #12345, due on January 15, 2025, remains unpaid.” Make sure to include the exact amount owed and the payment terms. A direct and straightforward approach works best here.

Set a clear deadline for the payment. Specify the date by which you expect to receive the full payment. For example: “Please arrange for payment by February 10, 2025, to avoid further action.” Having a clear, firm deadline helps prevent ambiguity and gives the client a clear target for action.

The tone should be professional but firm. Avoid sounding too lenient or too harsh. You are requesting payment, not continuing a conversation about the reasons for the delay. Keep the focus on the necessity of receiving the payment promptly. A friendly yet firm tone often works best.

If your payment terms include late fees or penalties, outline them clearly in the letter. For example: “Please note that a late fee of 2% per month will be added to the total amount if payment is not received by February 10, 2025.” Clearly state how the penalty will be applied to avoid misunderstandings.

After sending the letter, follow up with a concise email. Remind the client of the invoice details and the payment deadline. You can write: “I am following up on invoice #12345, which remains unpaid. As mentioned in our previous communication, please ensure payment by February 10, 2025, to avoid late fees.” Keep the tone polite and professional while reinforcing the deadline.

If the payment still hasn’t been made after the deadline, mention possible legal actions. A line like: “If payment is not received by February 10, 2025, I will have no choice but to consider legal action to recover the amount owed” makes it clear that you are serious about enforcing payment.