Overdue Account Letter Template for Effective Debt Management

When clients or customers delay payments, it can create financial stress for businesses of all sizes. Timely communication is key to resolving these issues while maintaining professional relationships. A well-crafted communication can remind debtors of their responsibility and encourage prompt settlement of balances.

Clear and respectful communication plays a vital role in minimizing disputes and fostering trust. By outlining payment expectations and providing clear instructions for settlement, businesses can ensure that financial matters are handled smoothly. The right approach helps ensure that outstanding balances are addressed promptly.

Using a formal written approach to address these situations ensures that all parties are on the same page regarding expectations. This method provides a solid foundation for resolving financial discrepancies while protecting the business’s interests. An effective message can be both polite and firm, striking the right balance to motivate swift action.

Understanding the Importance of Overdue Letters

In business, addressing payment delays is essential to maintaining healthy cash flow. A written communication designed to remind clients about their financial obligations plays a crucial role in ensuring timely payments. These messages provide a formal way to address issues without escalating tensions, maintaining professionalism throughout the process.

Why Timely Communication Matters

Promptly reaching out to customers about missed payments prevents issues from growing into bigger problems. Early intervention can:

- Minimize financial disruptions for the business.

- Encourage a swift response from the debtor.

- Demonstrate a professional approach to debt management.

Maintaining Positive Business Relationships

While it is important to follow up on outstanding payments, it is equally vital to maintain a cordial relationship with customers. By using clear and respectful language, businesses can:

- Protect customer loyalty while addressing payment issues.

- Reduce the likelihood of misunderstandings or disputes.

- Reinforce the importance of maintaining professional conduct in business transactions.

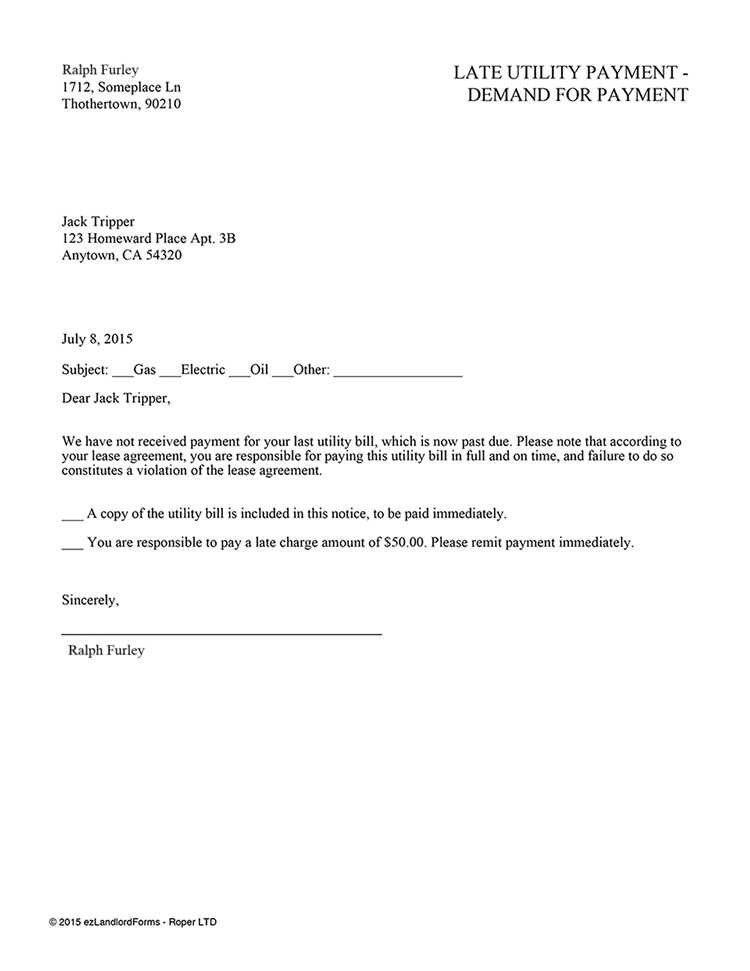

How to Write an Effective Payment Reminder

When a customer fails to make a payment on time, it’s essential to send a reminder that is both professional and clear. The purpose of such a message is to prompt action without causing tension or conflict. Crafting a well-written reminder involves striking the right balance between politeness and firmness, ensuring the debtor understands the urgency while maintaining a positive relationship.

Key Components of a Payment Reminder

An effective reminder includes several important elements that help convey the message clearly and professionally:

- Clear subject line: Ensure the subject clearly indicates the purpose of the message, such as “Payment Due” or “Action Required.”

- Respectful tone: Use courteous language that shows professionalism and respect.

- Details of the transaction: Include the amount due, due date, and any other relevant information to avoid confusion.

- Next steps: Clearly state what actions the recipient needs to take and provide payment methods if necessary.

Tips for Writing a Polite Yet Firm Reminder

To ensure your reminder is effective and encourages prompt payment, consider these tips:

- Keep the message concise and to the point.

- Avoid being overly harsh or accusatory; instead, frame the message as a gentle nudge.

- Provide a specific timeframe for payment to create urgency.

- Consider offering assistance in case the debtor has questions or concerns regarding the payment process.

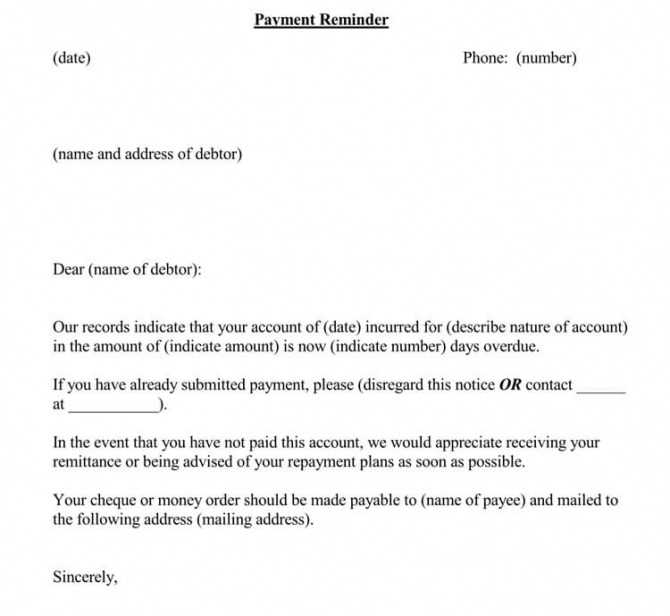

Key Elements of an Overdue Account Letter

When following up on missed payments, it is essential to include specific components that ensure clarity and professionalism. A well-structured reminder should convey the message effectively, outlining expectations while maintaining a respectful tone. Each section of the message should be carefully crafted to provide the necessary details and encourage prompt action.

Essential Components to Include

To maximize the effectiveness of a payment reminder, be sure to incorporate these key elements:

| Element | Description |

|---|---|

| Introduction | A polite and formal greeting, addressing the recipient directly. |

| Payment Details | Clear information about the outstanding balance, including the amount due and the original due date. |

| Call to Action | Clear instructions on how to make the payment, including payment methods and deadlines. |

| Polite Closing | End the message on a courteous note, offering assistance if necessary and expressing gratitude for their attention. |

Tips for Clear Communication

Clarity and professionalism are essential when requesting payment. Ensure that the message is direct, yet polite, and easy to understand. Avoid ambiguity by being specific with dates, amounts, and payment methods. A well-organized structure helps ensure the recipient knows exactly what is expected of them and the timeframe in which action should be taken.

Best Practices for Debt Collection Letters

When addressing outstanding payments, it’s crucial to follow a strategic approach that balances professionalism with firmness. The goal is to resolve the situation efficiently while maintaining good customer relations. By applying proven methods and structuring your communication effectively, you can increase the likelihood of receiving payment without escalating the issue.

Effective Communication Strategies

Here are some best practices to follow when drafting a reminder for unpaid bills:

- Be Clear and Direct: Clearly state the amount due, the due date, and any consequences of non-payment to avoid confusion.

- Maintain a Professional Tone: Use respectful and neutral language. Avoid being overly aggressive, as this can lead to frustration and disputes.

- Provide Multiple Payment Options: Offering different methods to settle the debt increases the likelihood of timely payment.

- Set a Firm Deadline: Encourage prompt action by including a clear deadline for payment.

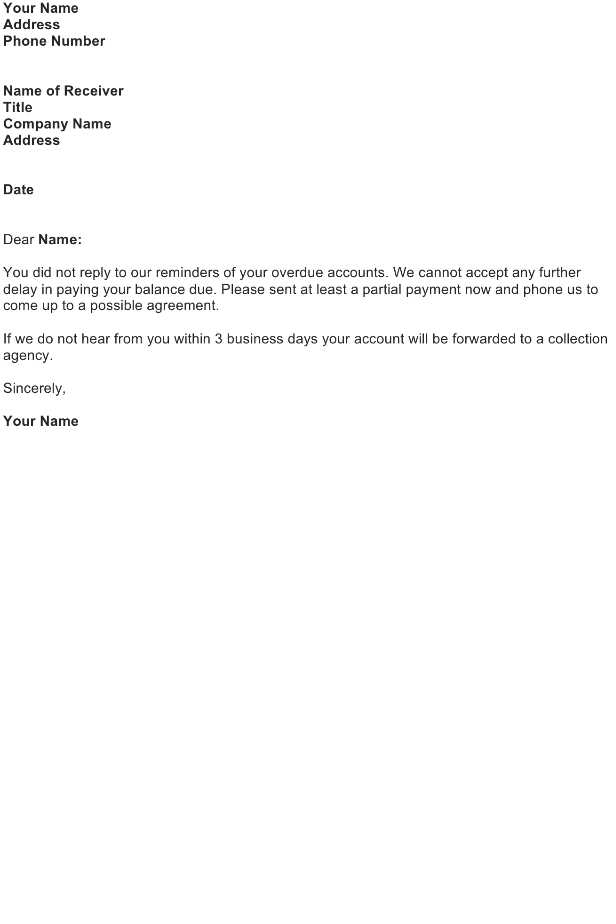

Follow-Up Procedures

If payment is not received within the specified time frame, it’s essential to have a follow-up strategy in place. Sending additional reminders or offering assistance with payment arrangements can help resolve the issue without damaging the relationship with the client. Document each step of the process to ensure compliance with any legal requirements and maintain a record of communications.

Common Mistakes to Avoid in Overdue Letters

When addressing unpaid invoices, certain missteps can hinder the process of getting payments on time. It’s crucial to maintain a balance between professionalism and assertiveness, ensuring that the message is both clear and polite. Avoiding common mistakes can help facilitate smoother communication and encourage prompt payment without damaging relationships with clients.

1. Using an Aggressive Tone

One of the most significant mistakes is using harsh or confrontational language. A demanding or threatening tone may escalate the situation unnecessarily and damage your professional relationship with the client. Instead, focus on being firm yet respectful, offering solutions and reminding them of the payment terms.

2. Lack of Specific Information

Ambiguity can create confusion and delay payment. Make sure the message includes clear details such as the amount due, the original due date, and any applicable late fees. Providing this information allows the recipient to understand exactly what is expected and reduces the chances of miscommunication.

3. Failing to Set a Deadline

Not specifying a deadline for payment can lead to unnecessary delays. Without a clear timeline, the recipient might not feel the urgency to act. Always include a specific date by which the payment should be made to ensure clarity and to prompt immediate action.

4. Not Offering Payment Options

It’s important to offer the recipient a variety of payment methods to make it as easy as possible for them to fulfill their obligation. Failing to do so might hinder their ability to pay promptly, especially if they have limitations with certain payment methods. Providing different options encourages faster resolution of the issue.

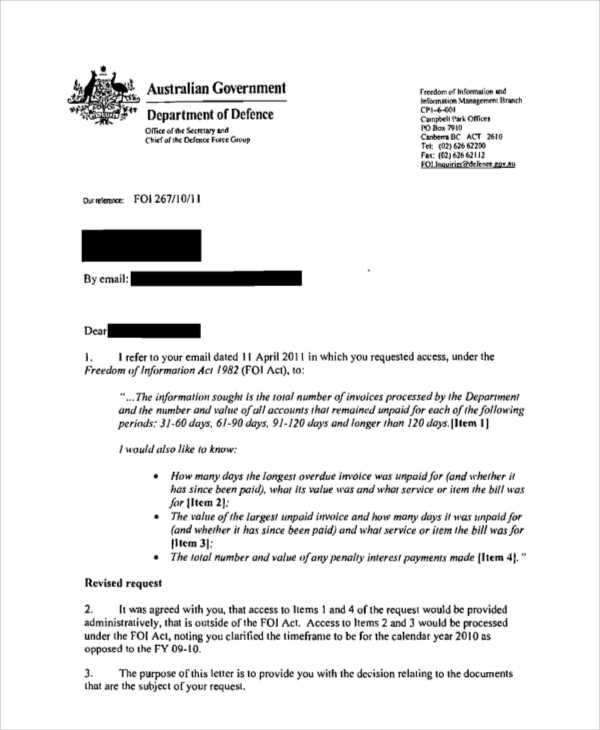

Legal Considerations for Debt Collection Letters

When pursuing payments for unpaid invoices, it’s important to be aware of the legal implications involved in the process. Communications related to debt recovery must comply with laws and regulations that protect both businesses and consumers. Understanding these legal requirements helps avoid potential lawsuits or fines and ensures that the collection process remains professional and fair.

1. Compliance with Debt Collection Laws

Various laws, such as the Fair Debt Collection Practices Act (FDCPA) in the U.S., regulate how businesses can approach debtors. These laws prohibit abusive practices, including harassment, threats, and false statements. It’s essential to understand these regulations to ensure that all communications are respectful and within the legal framework.

2. Avoiding Defamation

Publicly disclosing someone’s debt or making disparaging remarks can lead to legal consequences for defamation. Be careful to only communicate with the debtor and any other relevant parties about the debt, and avoid any public or unnecessary exposure of financial matters.

3. Providing Proper Documentation

To avoid disputes and legal issues, ensure that all communications related to payment requests are documented. Keep a record of the message sent, any responses received, and any agreements made. Proper documentation can protect you in the event of legal action and helps establish clear communication between both parties.