Overdue invoice letter template

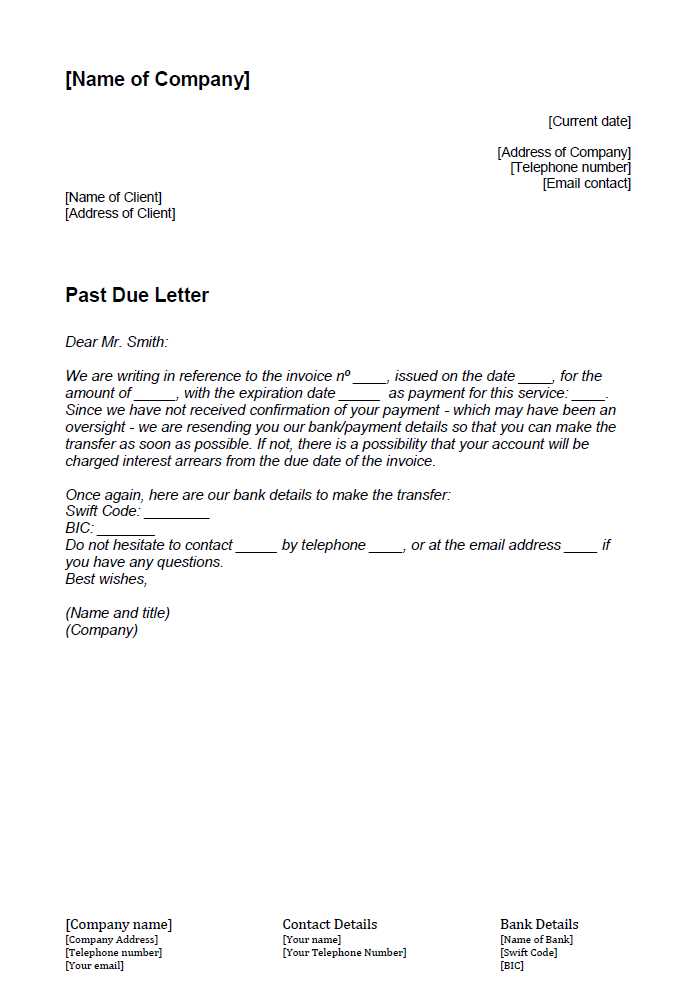

Start with a clear and concise subject line. Address the recipient by name and state the purpose of the letter immediately. Keep the tone polite, while expressing the urgency of the payment. Mention the invoice number and the original due date. Reference the specific amount owed and provide a breakdown if needed.

Politely remind the recipient that the payment is past due, emphasizing the agreed terms. Offer multiple payment options if applicable and include any late fees that might have accrued. Suggest a deadline for when payment should be received to avoid further action.

Finally, express willingness to assist with any questions or concerns. Provide contact details for easy communication. Close with a polite thank you and request a prompt resolution to the matter.

Overdue Invoice Letter Template

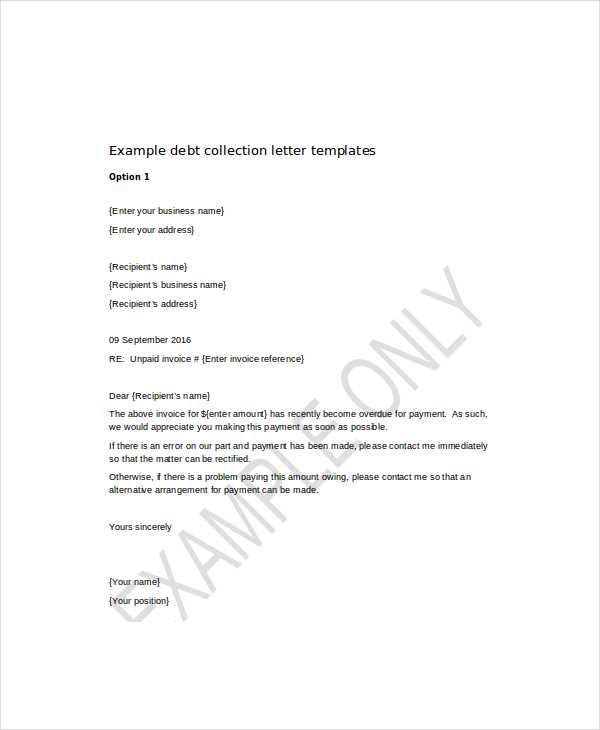

To address overdue payments professionally, use clear and polite language. Keep your tone friendly but firm. Here’s an example template you can adjust for your needs:

Sample Template

Dear [Client’s Name],

We are writing to inform you that the payment of invoice [Invoice Number] was due on [Due Date], but we have yet to receive it. The total amount outstanding is [Amount]. Please refer to the invoice attached for further details.

We kindly request that you settle this payment within [Number of Days] days to avoid any further actions. If you have already made the payment, please disregard this notice and provide us with the payment details for our records.

If you have any questions or concerns regarding the invoice, feel free to reach out to us at [Your Contact Information]. We are happy to assist you in resolving any issues promptly.

We appreciate your immediate attention to this matter and look forward to receiving your payment soon.

Sincerely,

[Your Name]

[Your Job Title]

[Your Company Name]

Key Elements of an Overdue Invoice Letter

- Polite reminder: Always begin with a courteous tone to maintain a positive relationship.

- Clear details: Specify the invoice number, due date, and outstanding amount for easy reference.

- Payment instructions: Be clear about the payment deadline and preferred methods of payment.

- Contact offer: Provide an open line for communication in case there are any issues with the payment.

Adopting a clear, respectful approach ensures the matter is handled smoothly without damaging business relationships.

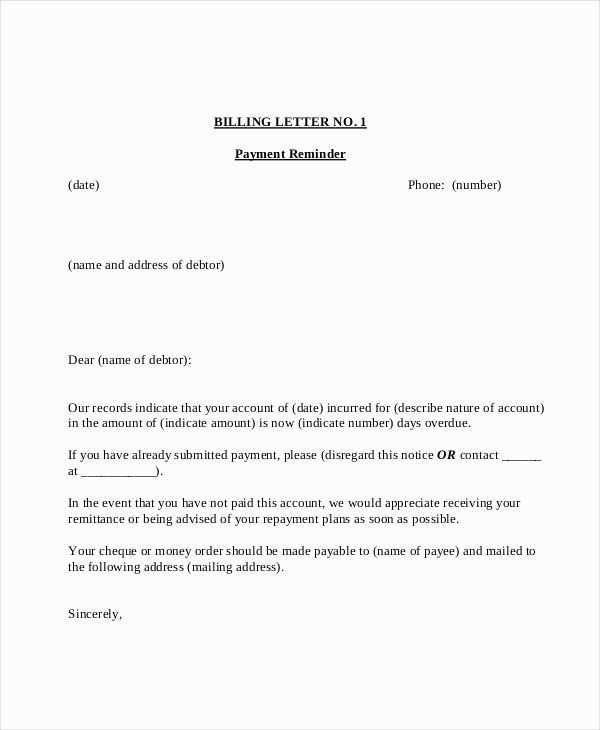

How to Start an Overdue Invoice Letter

Begin by clearly stating the purpose of your letter. Refer to the outstanding invoice and mention the due date. This sets the context immediately and helps the recipient understand the situation without confusion.

Address the recipient politely, acknowledging any possible delays or circumstances that may have led to the overdue payment. Show understanding but make it clear that the payment is still due.

Use a friendly yet firm tone when stating the amount owed and the original due date. Keep the language professional and precise to avoid ambiguity. If applicable, include any late fees or additional charges that may have accrued.

Key Information to Include in the Letter

Be clear and direct when composing an overdue invoice letter. The following details are crucial:

- Invoice number and date – Always include the invoice number and its issue date for easy reference.

- Amount due – Specify the total amount that is overdue. If partial payments have been made, list the remaining balance.

- Due date – State the original due date to highlight the delay.

- Payment terms – Clarify the agreed-upon payment terms and any late fees that may apply. Be specific about the additional charges or interest accrued.

- Recipient’s details – Include the name of the person or business that is responsible for the payment.

- Call to action – Politely ask for immediate payment or a prompt response. Provide clear instructions on how the recipient can settle the balance.

Always keep the tone professional but firm. Ensure your letter is easy to read and free of ambiguity.

Choosing the Right Tone for Payment Requests

Set a positive tone from the beginning. A polite yet firm approach works best to ensure the recipient feels respected but understands the seriousness of the situation.

Balance Professionalism and Friendliness

Acknowledge the customer’s previous commitment to payment while gently reminding them of the overdue balance. Use phrasing like, “We’d appreciate your attention to this matter” instead of sounding confrontational. Be clear but not harsh.

Stay Clear and Direct

Avoid overly formal language or vague statements. Clearly state the amount due, the original due date, and any potential consequences of non-payment. This provides transparency while maintaining professionalism.

| Do’s | Don’ts |

|---|---|

| Be courteous and straightforward. | Use threatening language. |

| Show appreciation for prompt payment. | Apologize excessively for the delay. |

| Offer clear next steps for payment. | Leave payment options unclear. |

Common Mistakes to Avoid in Collection Letters

Focus on clear, polite language. Avoid aggressive or threatening wording, as it can harm your relationship with the client and may even violate legal standards. Always maintain a respectful tone to encourage cooperation.

Vague Payment Terms

Be specific about the amount due and the payment date. Including unclear terms or vague deadlines can confuse the recipient, leading to delays. Always provide a precise date for payment and a detailed breakdown of the outstanding amount.

Failure to Offer Payment Options

Offer flexible payment options if possible. Not doing so can reduce the chances of receiving payment. Make sure your letter includes clear instructions on how the client can pay, whether through bank transfer, credit card, or online platforms.

How to Follow Up on Non-Response

Reach out promptly but respectfully. After sending your initial invoice reminder, wait a few days before following up. Give the recipient time to address the issue, but avoid letting too much time pass. Aim for a balance between being understanding and assertive.

Keep your tone polite and professional. Acknowledge that mistakes happen and offer assistance if needed. Include relevant details, such as invoice number, date, and amount due, to make it easier for the recipient to locate the payment.

If there is still no response after the second follow-up, try a more direct approach. Politely state the consequences of continued non-payment, such as late fees or potential suspension of services, while maintaining a respectful tone.

Consider adding a sense of urgency to encourage prompt action. Clearly state a new deadline for payment, offering a specific timeframe for resolution. This will help prompt the recipient to act swiftly without feeling pressured.

Maintain professionalism throughout, even if you’re frustrated. Keeping communication courteous increases the likelihood of a positive outcome. If payment is still not received, you may need to explore other options, such as involving a collection agency.

Legal Considerations When Sending Overdue Invoices

Ensure that your overdue invoice letters are clear, professional, and comply with legal requirements. Always reference the original agreement or contract to remind the recipient of the terms agreed upon. Be sure to clearly state the overdue amount, the invoice number, and the original payment due date.

Know Your Rights

Before taking any further action, familiarize yourself with local laws regarding overdue payments. Some regions have regulations on how long you must wait before sending a final notice or taking legal action. Check if you are entitled to charge interest or late fees and include these details in your communication if applicable. Always consult with a legal expert before applying these charges.

Avoid Harassment or Threats

It’s essential to maintain a respectful tone in your communication. While you have the right to request payment, avoid using aggressive language or threats of legal action unless you are ready to pursue it. Harassment or threats can result in legal issues for your business. Stick to facts and be clear about the next steps if the payment is not made promptly.