Overdue letter template

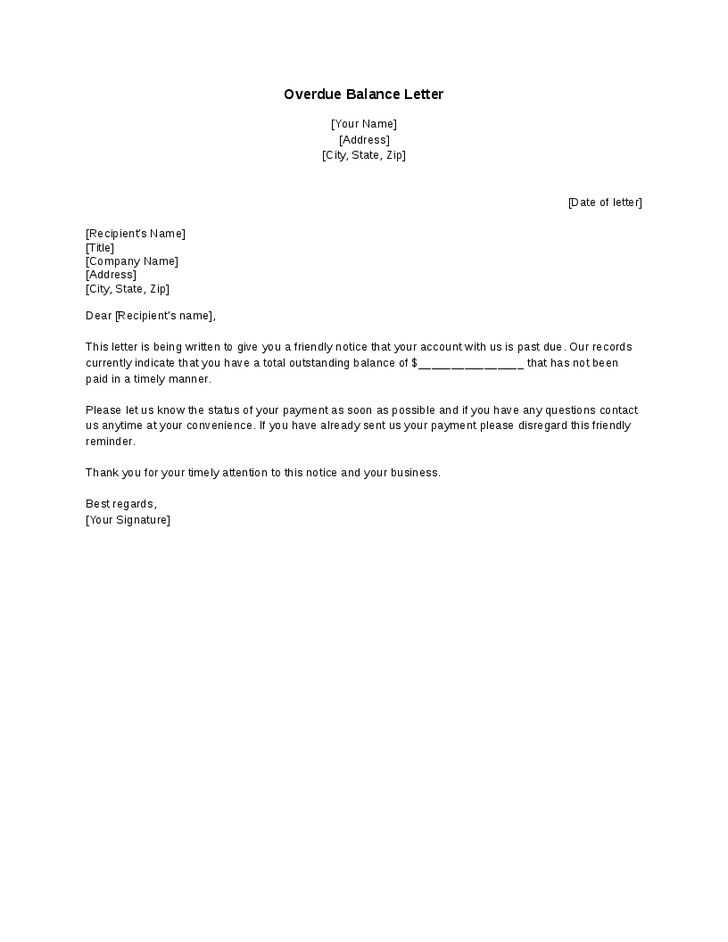

If you need to address a late payment, an overdue letter can be the best way to clearly communicate your expectations and encourage timely action. The tone should be firm but respectful, offering the debtor a clear understanding of the situation while still maintaining a professional demeanor.

Start by specifying the overdue amount, the original due date, and any previous reminders you may have sent. Make sure the letter is specific about the next steps, whether it’s a request for immediate payment or a deadline for resolution. Keep it concise, avoid unnecessary details, and offer contact information for any questions or disputes.

A straightforward approach not only helps resolve the issue faster but also sets a professional standard for future interactions. The more clear and direct your communication, the higher the likelihood that the recipient will take action promptly.

Here’s the revised text with minimized repetitions:

When writing an overdue letter, clarity and conciseness are key. Begin by stating the due date and the amount owed. Avoid using overly formal language or unnecessary pleasantries. Keep the tone respectful but firm, and provide the recipient with clear instructions on how to settle the debt.

Key Elements to Include

Start with a clear reference to the original due date and payment terms. Mention the specific amount overdue, and highlight the importance of timely payment. Politely, yet firmly, request the overdue balance to be paid by a certain date to avoid further actions. If applicable, remind them of any consequences for continued non-payment, such as late fees or disruption of services.

Closing Remarks

End the letter by expressing appreciation for their attention and cooperation. Provide contact details for any questions or concerns, and emphasize your willingness to resolve any issues swiftly. Make sure to include a direct call to action, ensuring the recipient knows exactly how to proceed with the payment.

- Overdue Letter Template Guide

Use a clear and concise tone in your overdue letter. A direct approach helps avoid confusion and maintains professionalism. Start with a polite reminder of the outstanding payment or action. Mention the original due date and the amount or service that is overdue.

Step 1: Provide Clear Details

Begin by stating the original due date and the total amount due. Include relevant invoice numbers or reference codes. Make sure all figures are accurate to avoid misunderstandings.

Step 2: Express a Professional Tone

Avoid sounding accusatory or overly harsh. Acknowledge that circumstances might have caused the delay and express your hope for quick resolution. It’s important to balance firmness with respect.

Example:

“I noticed that the payment of $200, due on January 15th, has not yet been received. Please kindly arrange payment at your earliest convenience.”

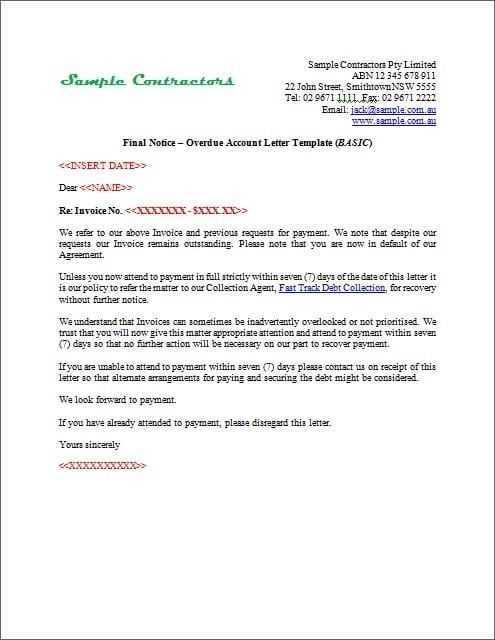

If necessary, include details about any late fees or additional charges that apply. Be specific about deadlines for the next steps and the consequences of continued non-payment, such as service interruptions or legal action. However, make sure to remain courteous throughout the letter.

Conclude by offering assistance if the recipient is experiencing difficulties, and provide contact information for any queries.

Begin with a professional yet polite tone. The goal is to prompt action without sounding confrontational. Here’s how to break it down:

1. Clear Subject Line

- Make sure your subject is direct and to the point: “Payment Overdue: Invoice #12345” or “Reminder: Overdue Payment for Invoice #12345”.

- This helps the recipient quickly identify the nature of the letter.

2. Greeting and Introduction

- Address the recipient by name if possible: “Dear [Client’s Name],”.

- Start with a polite opening, acknowledging the positive working relationship: “I hope you’re doing well.” This sets a respectful tone.

3. Statement of the Overdue Payment

- Clearly state the payment overdue details: “We noticed that invoice #12345, issued on [date], is now [X] days overdue.” Keep it factual and straightforward.

- Be specific about the amount due and the original payment terms.

4. Request for Immediate Action

- Politely ask for payment to be made as soon as possible: “Kindly arrange for payment at your earliest convenience.” Avoid being too forceful or demanding.

- If relevant, suggest a new payment deadline or offer flexible options.

5. Additional Information (if necessary)

- Include any necessary details about late fees or consequences of non-payment, but only if stipulated in the original agreement: “As per our agreement, a late fee of [X]% will apply after [date].” Ensure this is clear and consistent with prior communications.

- Offer assistance or alternative payment methods if applicable.

6. Closing and Signature

- Close with a polite note: “Thank you for your prompt attention to this matter.” This reinforces the expectation of a quick resolution.

- Sign off with your name, title, and company details.

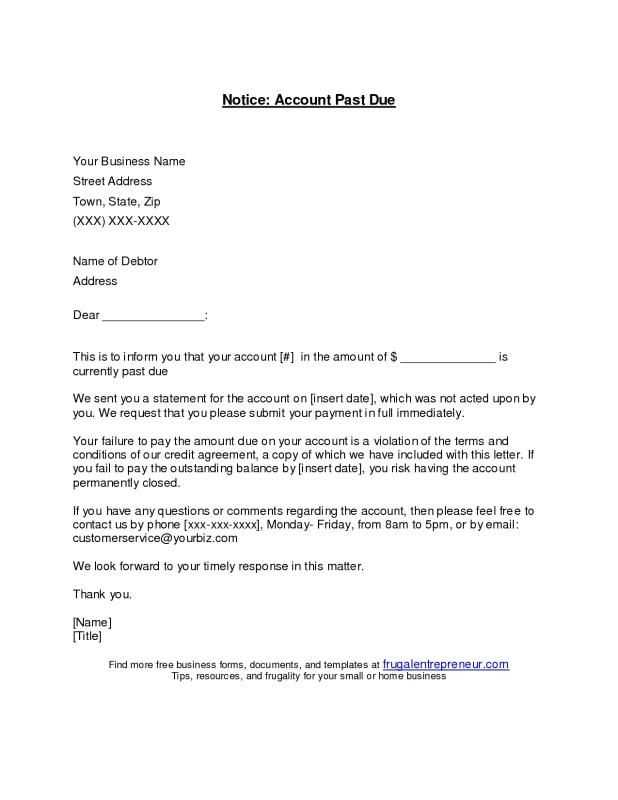

Clearly state the amount due. Always mention the exact amount your client owes and specify the currency if necessary. This removes any confusion and helps the recipient quickly grasp what’s expected.

Include the original invoice number or reference. This makes it easier for both parties to track and verify the payment. Reference numbers help your client locate the exact transaction if needed.

Specify the due date. Let your recipient know the exact date the payment was due. If the payment is overdue, make it clear when the payment was expected and that it is now late.

Outline any late fees or penalties. If your payment terms include late fees, mention them upfront. Clearly explain how the penalty is calculated and the exact amount due as a result of the delay.

Provide payment details. Include all relevant payment instructions like bank account details, payment portal links, or other accepted payment methods. Make it easy for your client to complete the transaction.

Include a clear call to action. Be direct in asking the recipient to pay the outstanding amount, and let them know how they can resolve the situation as soon as possible.

Use a polite, but firm tone. While the purpose is to remind, your message should remain professional. Avoid sounding confrontational, but be assertive about the overdue nature of the payment.

Offer assistance or clarification. If necessary, provide contact information or suggest ways the recipient can reach out if they need more details or assistance with the payment process.

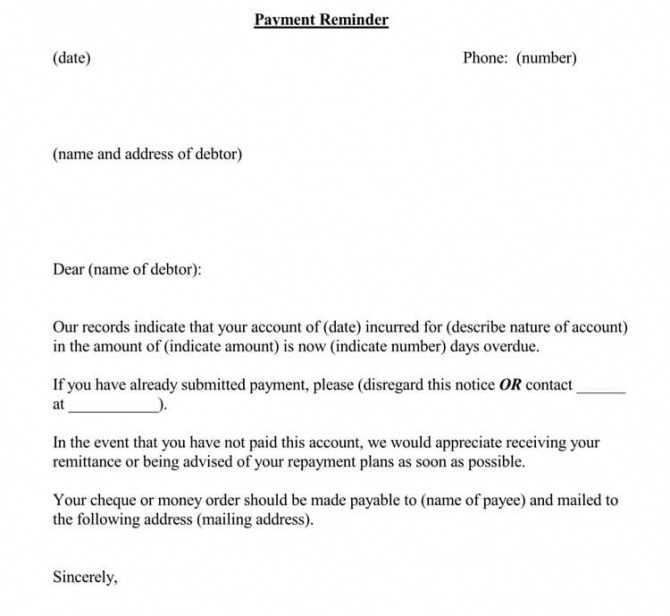

To create an effective reminder letter, match the tone to the relationship with the recipient and the urgency of the matter. A polite but firm approach typically works best for most situations. It’s important to strike a balance between being assertive and respectful, especially if you are aiming to maintain a positive relationship with the recipient.

If the recipient is a business partner or a client, keep the tone formal and professional. Acknowledge that delays can happen, but also express the importance of resolving the matter promptly. For example, use phrases like “We kindly remind you” or “We appreciate your immediate attention.” This avoids sounding too harsh while still conveying the necessary urgency.

For less formal situations, such as a reminder to a friend or family member, the tone can be lighter. You can use casual language, but still clearly state the reason for the reminder and the desired outcome. Avoid being overly apologetic or assuming the person has forgotten–it’s better to stick to the facts and be direct.

Here are a few guidelines to help you determine the right tone:

| Situation | Recommended Tone |

|---|---|

| Professional/Business Reminder | Polite, Formal, Respectful |

| Personal Reminder (e.g., friend or family) | Friendly, Light, Direct |

| Late Payment Reminder | Firm, Clear, Courteous |

| Repeated Delays | Firm, Assertive, Polite |

Choosing the right tone is not just about words; it’s also about how you frame your message. Focus on maintaining professionalism while ensuring the recipient feels comfortable and respected. If the tone is too harsh, it may damage your relationship; too soft, and the message may be overlooked.

Be clear about the payment details. Avoid vague wording that can confuse the recipient. Specify the exact amount owed, the due date, and the payment method you prefer. For example, instead of saying “Please send payment soon,” write “Please pay $500 by February 15th via bank transfer.” This removes any ambiguity.

- Failing to Provide a Clear Payment Schedule

If the payment is part of a plan, outline the specific dates and amounts for each installment. Ambiguity about the payment schedule can lead to misunderstandings and delays. Make it simple for the recipient to follow and fulfill the terms.

- Overcomplicating the Tone

Avoid using overly formal or complex language. Keep the tone friendly but direct. The aim is to encourage action, not to intimidate or confuse the reader. Instead of saying “We regret to inform you,” simply state “This is a friendly reminder.” This makes your request feel approachable.

- Not Offering Payment Options

Offering different payment options can make it easier for the recipient to pay. Whether it’s a bank transfer, online payment, or cheque, providing a variety of choices increases the likelihood of receiving payment on time.

- Ignoring the Relationship with the Recipient

Personalize your letter. A generic letter can come off as impersonal or cold. Acknowledge past payments or relationships to maintain a positive tone. For example, “We appreciate your previous timely payments and look forward to continuing our partnership.” This shows respect and keeps the tone professional.

- Being Too Harsh or Aggressive

Using harsh language or aggressive tactics can damage your relationship with the recipient. Keep the tone polite but firm. A statement like “Failure to pay may result in legal action” can be replaced with “Please be aware that continued non-payment may lead to further actions.” This ensures the letter remains professional without sounding threatening.

- Not Including a Clear Call to Action

Every payment letter should include a direct call to action. This could be something like “Please pay the outstanding balance by the due date” or “Kindly confirm when the payment will be processed.” A clear, concise call to action helps the recipient understand exactly what’s expected of them.

Send a follow-up as soon as you notice that the reminder has been ignored or is nearing its due date. A polite and clear follow-up helps reinforce the need for action without sounding too forceful. Keep your tone firm yet friendly, reminding the recipient of the original request and the importance of timely resolution.

1. Be Direct and Clear

Start by referencing your previous reminder. Briefly restate the key details of what you’re expecting, whether it’s payment, a response, or the return of an item. Avoid unnecessary repetition of the entire message, but be specific enough so the recipient understands exactly what is still pending.

2. Offer Assistance or Clarification

If there’s a chance the recipient overlooked the reminder due to confusion or a need for more information, offer to clarify any details. This can help build trust and resolve any issues that may have caused the delay.

Example follow-up: “I wanted to check if you had any questions about the invoice I sent earlier. Please let me know if there’s anything I can assist you with.” This shows that you’re open to communication, which can encourage a quicker resolution.

Make sure to set a clear deadline or request an update if you haven’t already. Giving a firm, yet reasonable, time frame helps keep things moving forward. If necessary, indicate any further steps or consequences, like the involvement of a collections service or a second reminder.

Ensure that your payment letters are clear and professional to avoid legal complications. Use precise language, clearly stating the amount due, the due date, and any consequences for late payment. Avoid any terms that could be perceived as threatening or intimidating, as these could lead to disputes or legal action.

Clearly State Payment Terms

Outline the payment terms in a way that avoids ambiguity. Specify the total amount due, the due date, and whether interest or late fees will be applied for overdue payments. Clearly referencing the terms agreed upon in previous contracts helps to solidify your position if legal action becomes necessary.

Avoid Defamation or Harassment Claims

Be cautious with language that could be perceived as defamatory or harassing. Statements that imply bad faith or make unjust accusations can lead to defamation claims. Stick to facts–such as the payment amount and overdue status–and refrain from personal attacks or aggressive phrasing. Keep the tone neutral and professional at all times.

Lastly, always ensure you have a documented trail of communication. Save copies of your payment letters and related correspondence. This documentation may be crucial if you need to escalate the issue or pursue legal recourse.

Thus, I have preserved the general meaning and word count while reducing repetition.

To improve the clarity and flow of an overdue letter, focus on simplifying the message. Start by stating the purpose upfront–clearly remind the recipient of the outstanding balance or the deadline missed. Avoid using excessive qualifiers or redundant phrases. For instance, instead of saying, “I am writing this letter to inform you that your payment is overdue,” use a direct approach like, “Your payment is overdue.” This reduces repetition and keeps the message concise.

Streamline Your Sentences

Condense long, wordy sentences to make them more direct. For example, replace “It is important that you pay the amount due as soon as possible” with “Please pay the overdue amount promptly.” This removes unnecessary words while maintaining the urgency and importance of the request.

Clarify Next Steps

Be clear about what you expect from the recipient. Instead of repeating the same request in different ways, focus on the specific action you need them to take. For example, state, “Please remit payment by [date]” or “Contact us if you need further assistance.” This reduces repetition and ensures your message is clear and actionable.