Paid in full collection letter template

If you’re looking to create a paid in full collection letter, clarity and professionalism are key. Begin by stating that the debt has been settled, ensuring the language reflects that the amount owed has been fully paid. Address the recipient courteously, confirming that their payment has been received and processed without confusion. Keep the tone neutral, focusing solely on confirming the completion of the financial transaction.

Next, provide relevant details such as the payment date, the amount settled, and any reference numbers tied to the transaction. This will help avoid any misunderstandings or disputes regarding the payment. It’s important to include a statement that assures the recipient that their account balance is now zero and there are no further obligations on their part.

Conclude the letter by thanking the recipient for their payment and encouraging them to contact you should they have any questions or need further clarification. It’s helpful to provide your contact information in case they need assistance in the future, ensuring a clear and direct way to reach you.

Here’s the improved version with repetition removal:

When drafting a “Paid in Full” collection letter, clarity and professionalism are key. Keep the language simple, direct, and courteous. Begin by confirming the payment has been received and the balance is now zero. Acknowledge the debtor’s prompt resolution of the matter.

Clear Acknowledgment

State clearly that the debt has been settled in full. For example: “This letter confirms that the balance due on your account has been paid in full as of [Date].” Avoid using complex wording that could confuse the recipient.

Polite Closure

Conclude the letter by thanking the debtor for resolving the issue. You might say: “We appreciate your prompt attention to this matter.” Be sure to provide contact information in case any further questions arise.

- Paid in Full Collection Letter Template Overview

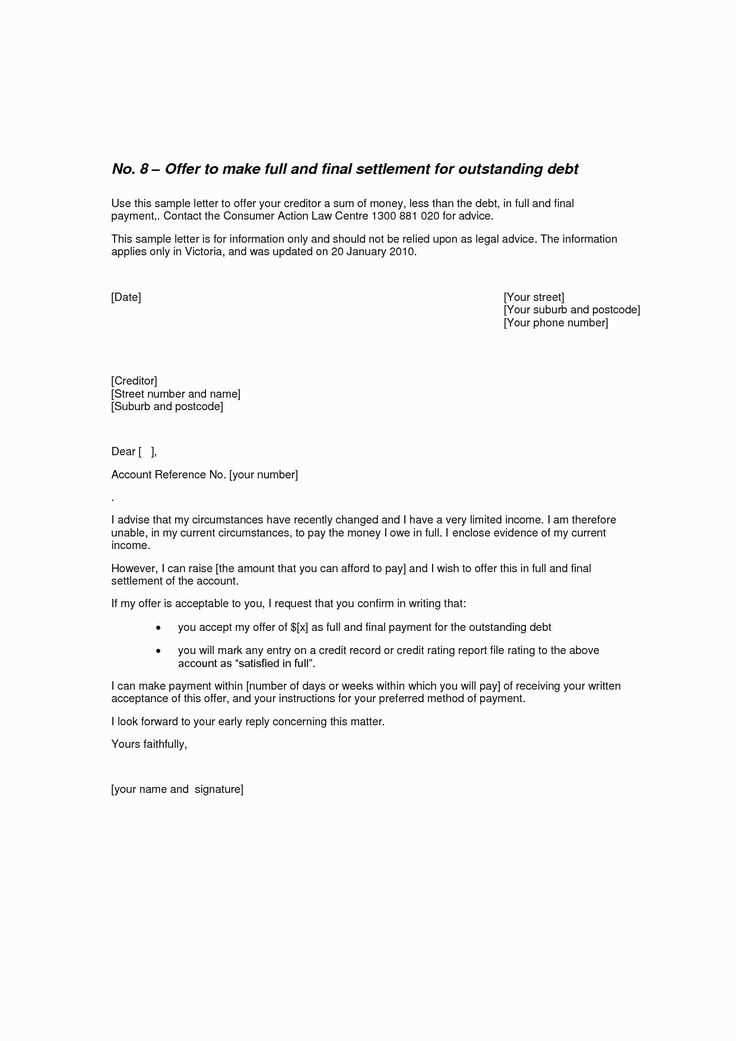

A “Paid in Full” collection letter is a formal document confirming that a debt has been completely paid and settled. This type of letter is typically sent by creditors or collection agencies to acknowledge the closure of a financial obligation. It ensures that the debtor receives written confirmation, which can be used to clear any remaining doubts regarding the debt status.

When drafting a “Paid in Full” letter, make sure to include the following key details:

| Key Element | Description |

|---|---|

| Creditor Information | Include the name, address, and contact details of the creditor or collection agency. |

| Debtor Information | Provide the full name, address, and any relevant account details of the debtor. |

| Payment Confirmation | State the exact amount paid, the payment method, and the date the final payment was made. |

| Account Status | Clearly indicate that the debt is “paid in full” and the account is now closed. |

| Legal Disclaimers | If necessary, include any relevant disclaimers regarding further actions or potential fees in case of future discrepancies. |

| Signature | Ensure the letter is signed by an authorized representative of the creditor or agency. |

To avoid confusion or legal complications, always double-check the details before sending the letter. This template helps both parties understand that the matter is resolved and prevents any future disputes regarding the debt.

Begin by confirming the full payment amount, stating the date of the transaction and the method of payment. Be precise with details to avoid any confusion.

- Include the invoice or reference number to link the payment to the specific transaction.

- Clearly mention the recipient’s name and the sender’s details for easy verification.

- State that the account or debt has been settled in full, without any remaining balance.

- If applicable, note any adjustments, discounts, or credits applied to the payment.

Conclude the letter by thanking the recipient for their payment, expressing appreciation for the timely settlement, and providing contact information for any follow-up questions.

Clearly state the payment amount and confirm that the debt is fully paid off. Include the date of payment and the payment method, whether it was a bank transfer, check, or cash. Be specific about any reference numbers or transaction IDs to avoid confusion.

Debtor Information

Provide the full name, address, and account number (if applicable) of the debtor to ensure there’s no ambiguity about who the letter pertains to. This will also help the creditor cross-check and confirm the details in their records.

Creditor Information

Clearly identify the creditor or collection agency handling the debt. Include their full name, business address, and contact details so the recipient can reach out if needed.

Request a confirmation of the debt being cleared. This can be in the form of a statement or written acknowledgment. Always ask for this confirmation to avoid future disputes or misunderstandings.

Start by carefully reviewing your records and identifying specific discrepancies. Ensure that all payments have been recorded correctly and match the amounts due according to the agreement. When discrepancies arise, follow these steps:

- Compare invoices and payment receipts: Cross-check your payment records with invoices to confirm whether the payments were applied to the correct accounts.

- Verify transaction dates: Ensure that payments made within the agreed period are not overlooked due to date errors or clerical mistakes.

- Double-check payment methods: If payment was made via an alternate method (e.g., bank transfer or credit card), ensure the transaction was accurately recorded in your system.

- Contact the payer: If any inconsistencies remain, reach out to the payer for clarification. This could be an error on their part or a misunderstanding.

- Update records promptly: Once discrepancies are resolved, immediately update your records and notify all relevant parties of the correction.

- Document communication: Keep a record of all communications regarding discrepancies, including emails or phone calls, for future reference.

By following these steps, you can effectively resolve discrepancies and ensure accurate payment records moving forward.

Maintain a courteous and clear tone. Address the recipient respectfully, using formal language and avoiding slang or overly casual phrasing. Choose words that reflect professionalism, such as “outstanding balance” instead of “due debt.” Keep sentences concise to avoid ambiguity.

Use direct and straightforward language. Avoid unnecessary fluff or filler words. For example, instead of saying “We kindly ask that you settle the remaining balance as soon as possible,” use “Please remit payment immediately to clear the balance.”

Always remain neutral and non-accusatory. Phrasing like “failure to pay” or “you ignored our previous requests” may sound confrontational. Instead, opt for “We have not yet received your payment” or “Your account shows an outstanding balance.”

Avoid any language that could be interpreted as threatening or coercive. Ensure that the letter reflects a tone of cooperation, aiming for a positive resolution. Phrases like “legal action” should be reserved for later stages, if necessary, and only in a factual, neutral context.

Finally, ensure clarity by maintaining proper structure and formatting. Short paragraphs and bullet points help improve readability, while clear headings guide the recipient through the letter. This professional presentation supports the message’s seriousness and urgency.

The best time to send a Paid in Full collection letter is immediately after receiving the final payment. This ensures the debtor is reminded of their cleared balance while the transaction is fresh in their mind. Aim to send the letter within a few days of payment confirmation to maintain clarity.

Waiting too long can create confusion. If too much time passes, the debtor may assume the issue has already been settled, potentially leading to delays or disputes. Sending the letter shortly after payment also prevents your records from being incomplete or outdated.

Timing matters for clarity and legal protection. Sending the letter promptly ensures that both parties are on the same page, reducing the likelihood of misunderstandings. If there are any issues with payment verification, this gives you a chance to address them before moving forward with further communication.

Ensure your settlement offer is clear and concise. Avoid vague language that could lead to confusion or misinterpretation. Specify the exact amount to be paid and the deadline for payment. Ambiguity in this area can delay resolution and complicate negotiations.

Do not include unrealistic terms. Offering a settlement amount that is too low or impossible for the creditor to accept may result in the letter being ignored or rejected. Keep the amount reasonable based on your financial situation.

Avoid using threatening or overly formal language. Be respectful and polite in your tone. Aggressive language can damage your relationship with the creditor and hinder future negotiations.

Do not neglect to mention any prior communications. Failing to reference previous discussions or agreements can lead to misunderstandings. Make sure to acknowledge any past correspondence to show that you are informed and serious about settling the debt.

Double-check that all details are accurate. Mistakes in the debtor’s name, account number, or settlement amount can cause delays and frustrate the creditor. Always verify that the information is correct before sending the letter.

Begin by structuring your paid-in-full collection letter in a clear and direct way. This ensures the recipient knows the purpose of your message immediately. In the first section, specify the payment received, referencing any invoice numbers, dates, and amounts paid. This helps prevent any confusion and confirms the accuracy of the transaction.

Follow with a summary of the payment terms. Clarify that the account is now closed and no further action is needed. This provides the recipient with reassurance that their financial obligation has been met.

Ensure you include a statement about how you appreciate the timely payment and encourage continued business relations. Keeping the tone positive helps maintain a professional connection.

| Invoice Number | Payment Amount | Payment Date |

|---|---|---|

| 123456 | $500.00 | January 25, 2025 |

| 789101 | $250.00 | January 26, 2025 |

Lastly, remind them that if there are any questions or if they need further assistance, they should feel free to contact you. This shows that you’re open to communication and willing to resolve any issues that may arise.