Paid in Full Letter from Debt Collector Template

When an individual or business successfully resolves an outstanding financial obligation, a formal acknowledgment of this settlement becomes essential. This document serves as an official confirmation, providing clarity and peace of mind to both parties involved. Properly crafted, it ensures transparency and avoids any future misunderstandings regarding the payment status of the account.

The document not only signifies the conclusion of the financial agreement but also serves as a protective measure for both the payee and payer. It is a critical part of ensuring that all records are up to date and free of discrepancies. By having such an acknowledgment, both sides can confidently move forward without lingering concerns about previous obligations.

Creating a reliable version of this document requires specific details and structure to ensure its legal validity and usefulness. By following a well-organized approach, one can ensure that all necessary elements are included, facilitating smooth communication and recordkeeping.

Understanding Debt Settlement Confirmation

A formal acknowledgment of a settled financial obligation serves as a vital document for both parties involved. It confirms that the agreed amount has been satisfied in full and no further payments are required. This statement is crucial for maintaining accurate records and preventing any future disputes or confusion regarding the settlement status.

Such documentation holds significance not only for the individual making the payment but also for the receiving party. It establishes a clear conclusion to the transaction, ensuring that both sides can proceed with certainty, free from concerns about unresolved balances.

Key features of this type of confirmation include:

- Clarity: Clearly outlining the amount settled and the terms of the agreement.

- Legality: Ensuring compliance with relevant laws and regulations.

- Protection: Safeguarding the interests of both parties by preventing future claims or misunderstandings.

It is essential to draft this document carefully, ensuring that all required information is included and correctly presented. A well-written confirmation can offer legal protection and provide peace of mind to both the payor and the recipient.

What is a Settlement Confirmation?

This document serves as an official statement acknowledging that a financial obligation has been completely resolved. It confirms that the outstanding balance has been paid in full, and no further payments are required. This recognition is essential for both parties to have a clear understanding of the transaction’s conclusion.

The confirmation provides legal assurance to the payer, ensuring that no further claims can be made. It also protects the recipient by documenting that all terms of the agreement have been met, closing the account with no remaining obligations.

Typically, this form includes key details such as the date of settlement, the total amount paid, and the specifics of the original agreement. By offering a clear, formal acknowledgment, it ensures that both sides can move forward without any ambiguity surrounding the resolution of the financial matter.

Importance of Debt Settlement Confirmation

When a financial obligation is cleared, having official documentation that confirms this resolution is essential for both parties. This acknowledgment provides clarity, eliminating any confusion about whether the account has been fully settled. It ensures that both the payer and the recipient have a clear, written record of the agreement’s conclusion.

Legal Protection for Both Parties

Such confirmation offers legal protection, preventing the possibility of future claims or disputes. By having written proof of settlement, both the payee and the payer can confidently move forward, knowing the matter is officially closed.

Ensuring Accurate Recordkeeping

This document also helps in maintaining accurate records for both parties. It can be crucial for future reference, particularly if the payer needs to show proof of settlement for credit purposes or other legal matters. Having a formal statement ensures that the transaction is documented properly and remains accessible if needed later.

Why a Settlement Confirmation Matters

Having an official document that acknowledges the completion of a financial arrangement is crucial for both parties involved. It serves as a final recognition that the agreed-upon amount has been settled, ensuring there are no lingering questions or disputes. This confirmation provides peace of mind and a clear closure to the transaction.

For the payer, this confirmation is vital to prove that all obligations have been met. Without such documentation, there may be room for future misunderstandings or attempts to claim additional payments. For the recipient, the document serves as a record that the terms of the agreement were fulfilled in accordance with the arrangement.

Furthermore, it plays a significant role in legal contexts, offering protection against potential claims or negative financial consequences. Having a properly written confirmation guarantees that both parties are on the same page, legally and financially.

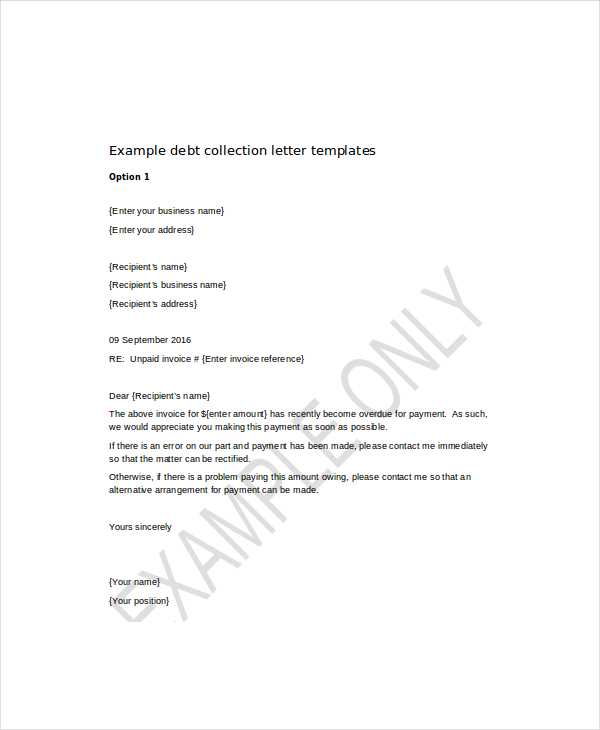

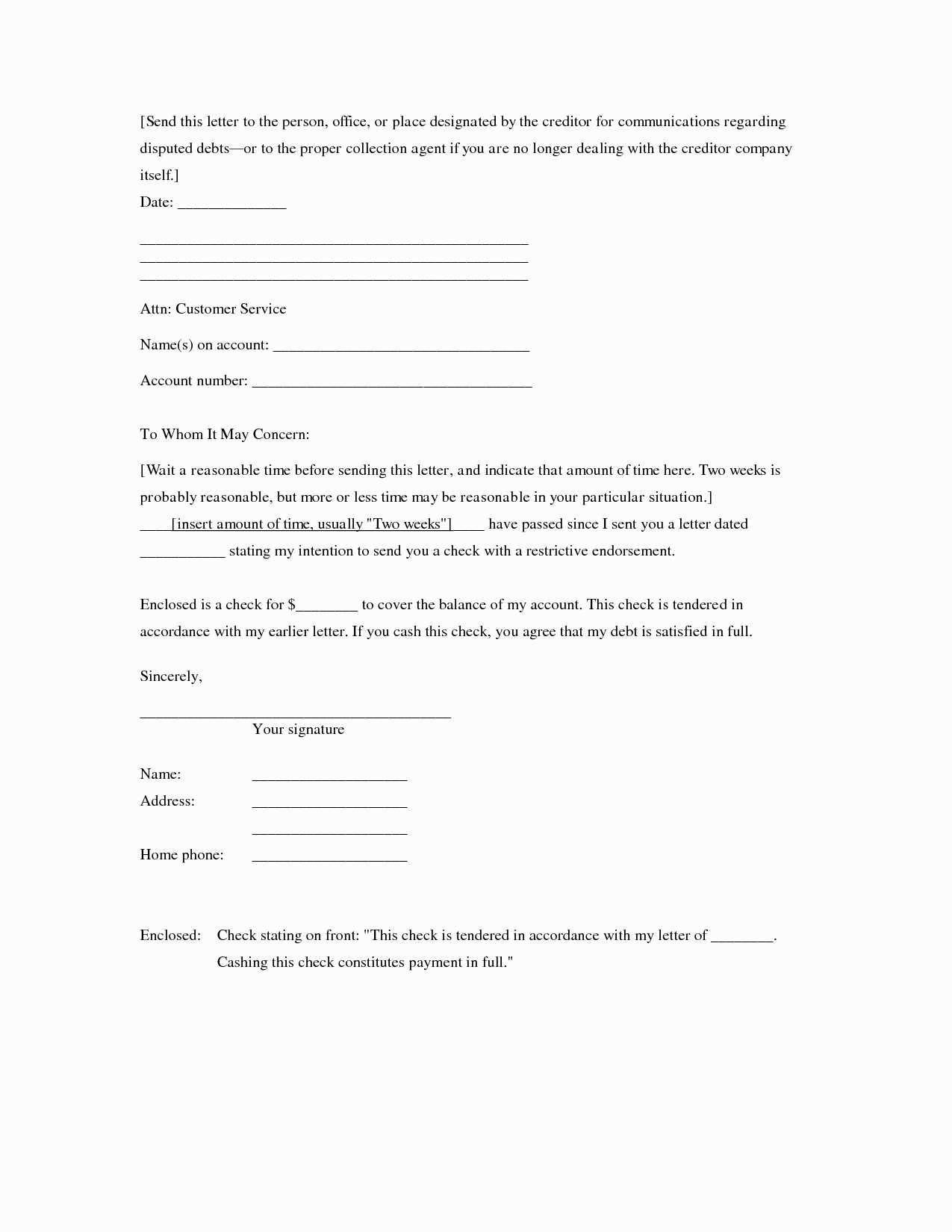

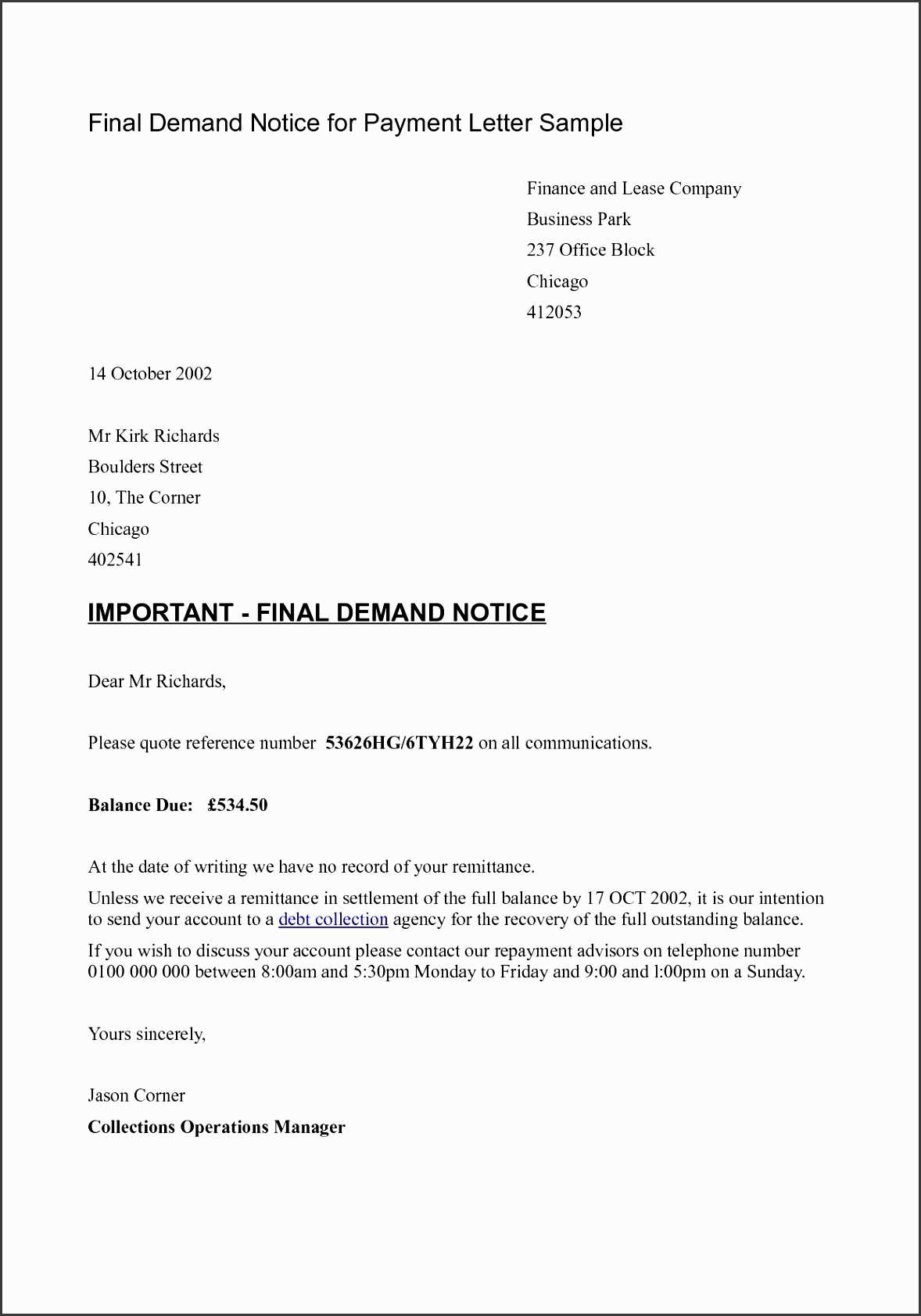

Creating a Financial Settlement Confirmation Document

When drafting an official statement confirming the resolution of a financial agreement, it is important to include essential details that ensure clarity and legality. A well-crafted document protects both parties and serves as an official record of the transaction. The process of creating this document involves organizing key information and presenting it in a clear, professional manner.

Key Elements to Include

There are specific pieces of information that should always be included to ensure the document is complete and legally valid. These elements provide both parties with the necessary confirmation of the agreement’s closure and help avoid future disputes.

| Section | Description |

|---|---|

| Confirmation Date | The date when the payment was received and the agreement was considered fulfilled. |

| Amount Paid | The exact sum paid to clear the outstanding obligation. |

| Payer Information | Details about the individual or entity who made the payment, including their contact information. |

| Recipient Information | Information about the party receiving the payment, ensuring the confirmation is correctly addressed. |

| Reference Number | A unique identifier for the agreement, if applicable, for easy reference in the future. |

Ensuring Accuracy and Professionalism

To ensure the document is both accurate and professional, all information must be carefully checked. Mistakes or omissions can cause confusion or legal issues later. By following a clear structure and including all required information, the document can serve as a strong and reliable piece of evidence should any questions arise in the future.

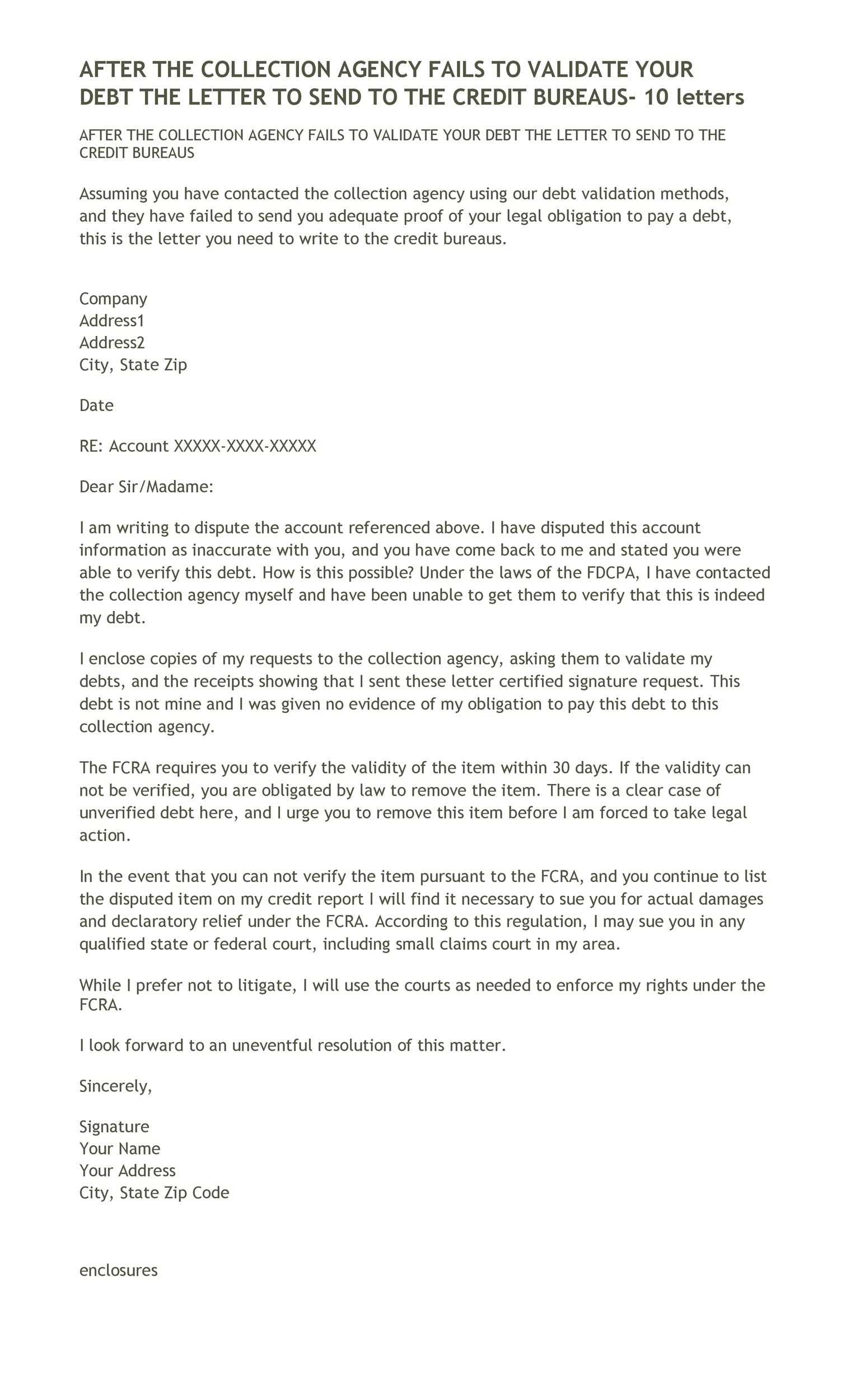

How to Draft the Perfect Confirmation Document

Creating an effective confirmation of a settled financial agreement involves following a clear structure and ensuring all essential information is included. A well-drafted document not only provides clarity but also protects both parties by serving as an official record. To achieve this, it’s important to focus on accuracy, professionalism, and completeness.

Steps for Creating the Document

To draft the perfect confirmation, follow these key steps:

- Begin with the header: Include the title or purpose of the document, ensuring it reflects the nature of the agreement’s completion.

- Include clear identification: Clearly identify both the payer and recipient, including full names and contact information.

- Provide details of the transaction: State the exact amount paid, the date it was received, and any reference number that links to the original agreement.

- Confirm the closure: Explicitly state that the payment has fully resolved the obligation, leaving no further balance due.

- Sign and date: Both parties should sign and date the document to indicate their agreement and the formal completion of the transaction.

Ensuring Accuracy and Legality

Double-check all the information for accuracy, especially the financial details. Mistakes or missing data could lead to confusion or legal complications. A legally sound document provides assurance that the agreement is completed and will help avoid any future disputes.

Legal Considerations for Debt Collectors

When handling the resolution of outstanding financial obligations, it’s essential for parties involved to understand their legal responsibilities. Proper documentation and adherence to relevant laws ensure that the process is carried out smoothly and without risk of future claims. Any misstep could lead to legal complications, so being aware of the legal requirements is vital.

One of the primary concerns is compliance with regulations governing financial agreements. Collectors must ensure that all actions taken are within the bounds of the law, including the creation of documents that confirm the completion of a transaction. Failure to do so may result in the document being contested or invalidated.

Additionally, it’s important to be mindful of privacy laws. Personal and financial information shared during the settlement process must be handled carefully and confidentially to avoid potential legal issues or breaches of trust. Ensuring that the document is legally binding requires a clear structure and compliance with all relevant statutes and regulations.

What You Need to Know About Compliance

Ensuring that all financial agreements are handled in accordance with relevant laws is crucial for avoiding legal issues and maintaining trust between all parties. Compliance involves adhering to specific regulations and guidelines that govern the creation and execution of documents related to settled obligations. Understanding these rules helps to protect both the payer and the recipient, ensuring that all actions are legally sound.

One of the key aspects of compliance is ensuring that the terms of the agreement are clearly stated and accurately represented. This includes verifying that the information provided is truthful, the settlement is properly documented, and both parties are fully informed of their rights and responsibilities.

Additionally, organizations must be mindful of federal and state laws that regulate financial transactions and document creation. This includes respecting privacy laws and consumer protection regulations, ensuring that sensitive information is safeguarded and that all actions taken are in line with legal requirements.