Past Due Collections Letter Template for Debt Recovery

When payments are not received on time, it can disrupt cash flow and create financial challenges. Businesses and individuals often need a formal approach to request payment from those who have missed the agreed-upon deadlines. A well-crafted communication is essential to ensure professionalism and maintain good relationships while encouraging timely payment.

Creating an effective request for outstanding funds involves clear communication and a polite yet firm tone. The structure of such messages plays a crucial role in determining the outcome. By including essential details and following the right format, you can maximize the chances of receiving the funds promptly and without unnecessary delay.

In this article, we will explore the components of an effective payment request, tips for writing, and common pitfalls to avoid. With the right approach, you can confidently ask for overdue payments and maintain healthy financial practices.

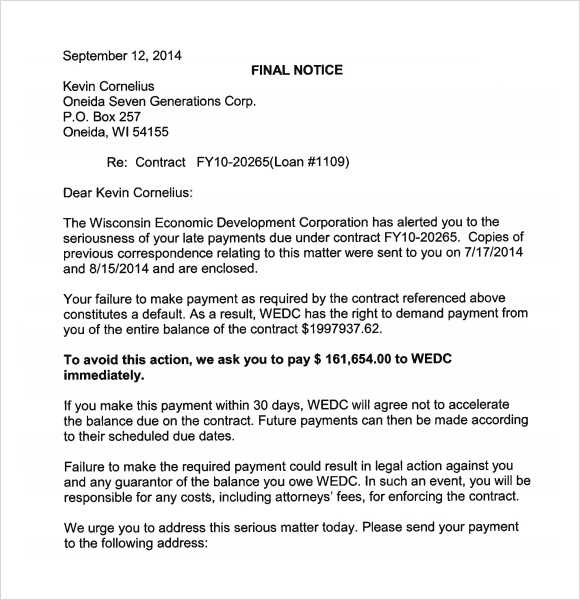

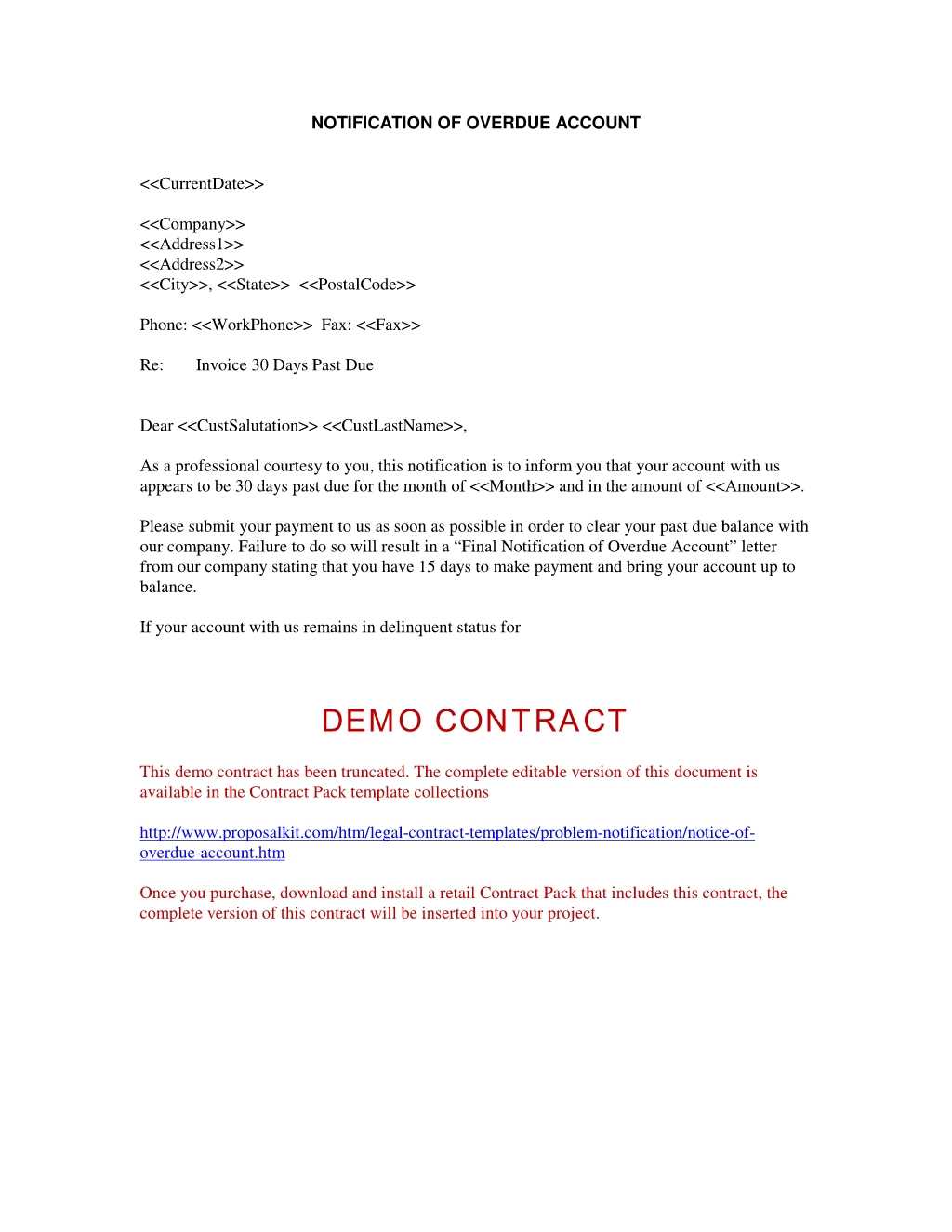

Effective Collections Letter Template Guide

When requesting payment for outstanding debts, having a clear and professional approach is essential. The message should be structured in a way that encourages prompt action while maintaining respect and professionalism. A well-organized document not only increases the chances of payment but also ensures that the communication is legally sound and tactfully worded.

Here are key elements to include in any request for overdue funds:

- Clear identification of the sender and recipient: Include the name, address, and contact details of both parties for easy reference.

- Account or invoice number: Make sure the specific invoice or transaction is referenced to avoid confusion.

- Outstanding amount: Clearly state the amount of money owed, including any applicable fees or interest.

- Due date: Specify the original deadline for payment, ensuring the recipient understands the timeline.

- Action required: Outline the steps the recipient should take to resolve the situation, such as how to make the payment.

- Consequence of non-payment: Mention any legal actions or penalties that may occur if payment is not received by the deadline.

- Closing statement: End with a polite, professional note encouraging timely action, and include your contact information for any questions or concerns.

By following this structure, your request will appear professional and well-organized, increasing the likelihood of a positive response.

Understanding the Importance of Collections Letters

When financial obligations are not met on time, it is crucial to address the issue promptly and professionally. Delaying action could lead to long-term financial instability for both parties involved. An effective approach to resolving overdue payments is through formal communication that serves to remind, request, and encourage the recipient to fulfill their financial responsibilities.

Why Timely Communication Matters

Sending a well-crafted request for overdue payments can help maintain a positive relationship with clients or customers while reinforcing the importance of adhering to financial agreements. It serves as a formal reminder, demonstrating professionalism and clarity. Properly written communication can often lead to quicker resolution and avoid more severe actions, such as legal involvement.

Building a Professional Image

Consistent and polite requests also reflect well on your business or personal reputation. By adhering to best practices in communication, you show that you value transparency and mutual respect, which can be beneficial in preserving ongoing relationships. A structured message instills trust and helps maintain a professional image, even in sensitive situations.

Key Components of a Past Due Letter

An effective request for overdue payments should include several essential elements to ensure clarity, professionalism, and legal soundness. These components help convey the necessary information in a clear and respectful manner, which increases the likelihood of a successful outcome. Each part of the communication plays a role in encouraging the recipient to act promptly while maintaining a positive relationship.

Important Elements to Include

Here are the key elements that should be present in any request for unpaid funds:

| Component | Description |

|---|---|

| Contact Information | Include the names, addresses, and phone numbers of both the sender and recipient for easy reference. |

| Invoice or Reference Number | Clearly state the specific invoice or transaction number for the amount owed. |

| Outstanding Amount | Specify the total amount due, including any interest or additional charges if applicable. |

| Payment Instructions | Provide clear details on how and where the payment can be made, including payment methods and deadlines. |

| Consequences of Non-Payment | Indicate any legal actions or further penalties that may occur if payment is not received on time. |

| Closing Remarks | Conclude with a professional and polite statement, encouraging prompt action and offering assistance if needed. |

Maintaining Professionalism and Clarity

Each section of your request should be crafted carefully to maintain a respectful tone while clearly communicating the urgency of the situation. A professional approach helps preserve the relationship and increases the likelihood of timely payment. By including all the necessary details, you ensure that there is no confusion and the recipient understands their obligations clearly.

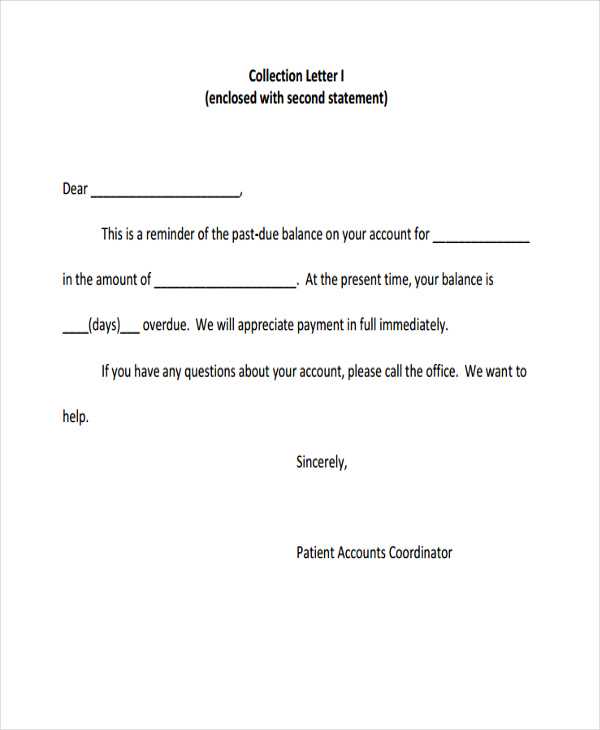

How to Write a Professional Reminder

When requesting payment for an outstanding balance, it is important to approach the situation with professionalism and tact. A well-crafted reminder should be polite yet firm, ensuring the recipient understands the urgency of the matter while maintaining a respectful tone. The message should also be clear and direct to avoid confusion and encourage prompt action.

Start by addressing the recipient respectfully and confirming the details of the transaction or agreement. Make sure to clearly state the amount owed and provide any relevant reference numbers or details that link the payment to the outstanding balance. A polite reminder allows the recipient to recall the obligation without feeling pressured.

Next, outline the payment methods available and offer assistance if needed. Let the recipient know that you are open to discussing any issues they might have, whether it’s related to payment difficulties or misunderstandings. Always ensure that your tone remains courteous throughout the communication.

Finally, conclude with a gentle reminder of the consequences of non-payment. You can mention possible actions that may be taken if the balance remains unpaid, but do so in a way that emphasizes your desire to resolve the matter amicably. Always end with a polite call to action, encouraging the recipient to resolve the matter as soon as possible.

Common Mistakes to Avoid in Debt Letters

When crafting a request for unpaid funds, it’s essential to approach the matter with professionalism and care. However, there are common errors that can undermine the effectiveness of your communication, potentially leading to misunderstandings or even legal complications. Recognizing and avoiding these mistakes can improve the likelihood of a successful resolution while maintaining a positive relationship with the recipient.

One common mistake is being overly aggressive or threatening in tone. While it’s important to be firm, overly harsh language can alienate the recipient and escalate the situation unnecessarily. Instead, aim for a polite yet assertive approach that clearly outlines the outstanding amount and expectations without sounding confrontational.

Another mistake is failing to include essential details. Omitting important information, such as invoice numbers, due dates, and the total amount owed, can lead to confusion and delay in payment. Always make sure the recipient has all the necessary information to process the payment swiftly.

Additionally, neglecting to provide clear instructions on how to make the payment can cause unnecessary complications. Ensure that you include detailed payment methods and instructions to help the recipient fulfill their obligation easily.

Lastly, being unclear about the consequences of non-payment can weaken your position. While you don’t want to sound threatening, it’s important to mention potential legal or financial actions that may be taken if the matter is not resolved. However, this should always be communicated in a respectful and professional manner.

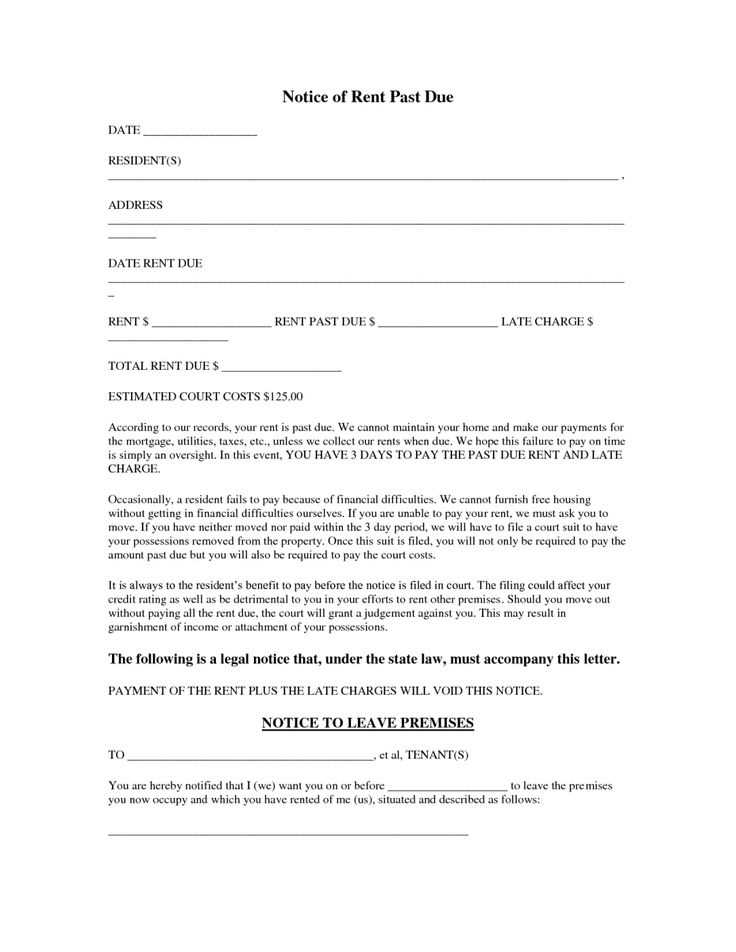

Legal Considerations for Debt Collection

When pursuing unpaid balances, it’s crucial to understand the legal aspects surrounding the process. Failing to comply with the applicable laws can lead to significant consequences, including fines and damage to your reputation. Ensuring that your actions are legally sound not only protects you but also helps maintain a professional relationship with the other party.

One of the most important legal considerations is adhering to consumer protection laws. These laws are designed to prevent harassment and ensure that individuals are treated fairly. It’s essential to follow regulations such as the Fair Debt Collection Practices Act (FDCPA) or similar laws in your jurisdiction, which limit how and when you can contact individuals about unpaid amounts.

Additionally, it’s important to be aware of the statute of limitations, which dictates how long you have to take legal action to recover funds. Once this time period has expired, you may lose the right to file a lawsuit or take other legal measures to recover the debt. Understanding the applicable statute of limitations in your jurisdiction is critical to avoid unnecessary legal risks.

Another key factor is ensuring that all communication is truthful and transparent. Misrepresenting facts or attempting to deceive the recipient can lead to legal repercussions. Be sure to provide clear and accurate details about the amount owed and the next steps, and always avoid any language that could be seen as coercive or misleading.

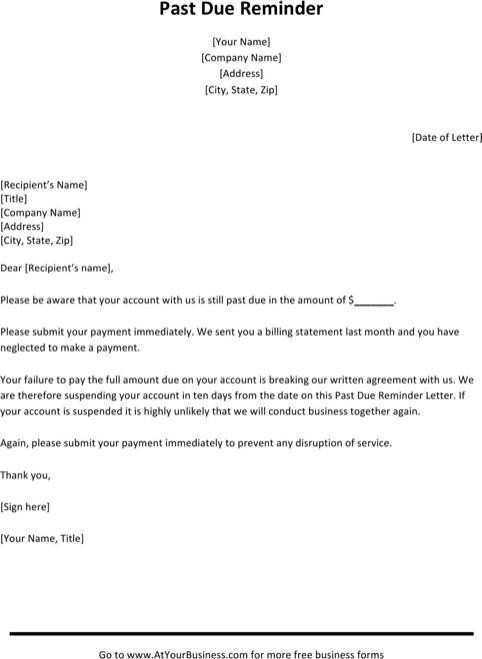

Best Practices for Sending Payment Requests

Requesting payment for an outstanding balance requires a strategic approach to ensure that the process remains smooth and professional. By following a set of best practices, you can increase the chances of receiving payment promptly while maintaining a positive relationship with the recipient.

Here are some essential guidelines to keep in mind when sending payment requests:

- Be Clear and Specific: Always include all relevant details such as the amount owed, payment terms, and any reference numbers. A well-organized request leaves little room for confusion and helps the recipient understand exactly what is being asked of them.

- Choose the Right Communication Method: Depending on the recipient, you may choose between email, postal mail, or phone calls. Consider the most effective and professional method for reaching out to ensure that your request is seen and addressed.

- Be Polite Yet Firm: While it’s important to remain courteous, don’t hesitate to be firm in your request. Maintain a balance between being friendly and conveying the urgency of the matter.

- Offer Multiple Payment Options: Make it as easy as possible for the recipient to settle their balance by providing a range of payment methods, such as online payments, checks, or bank transfers.

- Provide a Clear Deadline: Set a specific deadline for payment to create a sense of urgency and clarity. This helps avoid any ambiguity regarding the timeline for fulfilling the payment.

By incorporating these best practices, you can ensure that your payment requests are professional, effective, and prompt, helping you recover owed amounts while maintaining positive business relations.