Template for Past Due Invoice Letter

In any business, managing finances efficiently is crucial, especially when payments are delayed. One of the most effective ways to address this issue is by sending a formal communication requesting the overdue balance. This type of message serves as both a reminder and a professional approach to collecting payments without damaging client relationships.

Crafting a clear and concise request ensures that your message is understood and motivates the recipient to take action. It is important to maintain a respectful tone while being direct, as this can lead to quicker resolutions and help maintain a positive rapport with your clients.

Customizing your communication for each situation can improve its effectiveness. Whether you are dealing with a long-standing client or a new customer, adapting the message to fit the context is key to achieving the desired outcome.

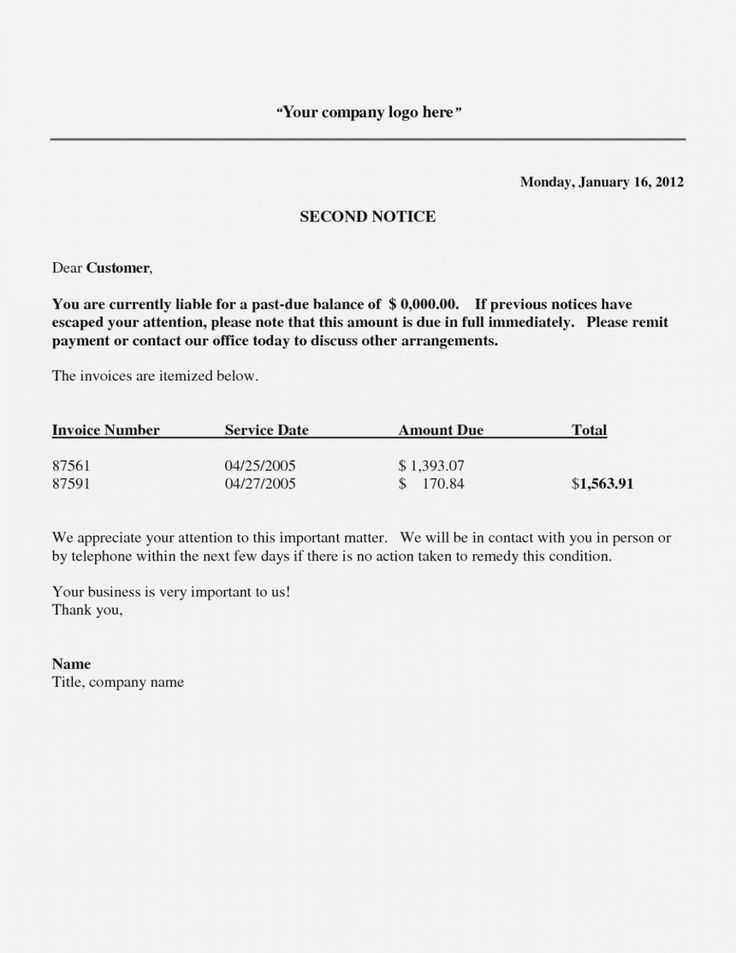

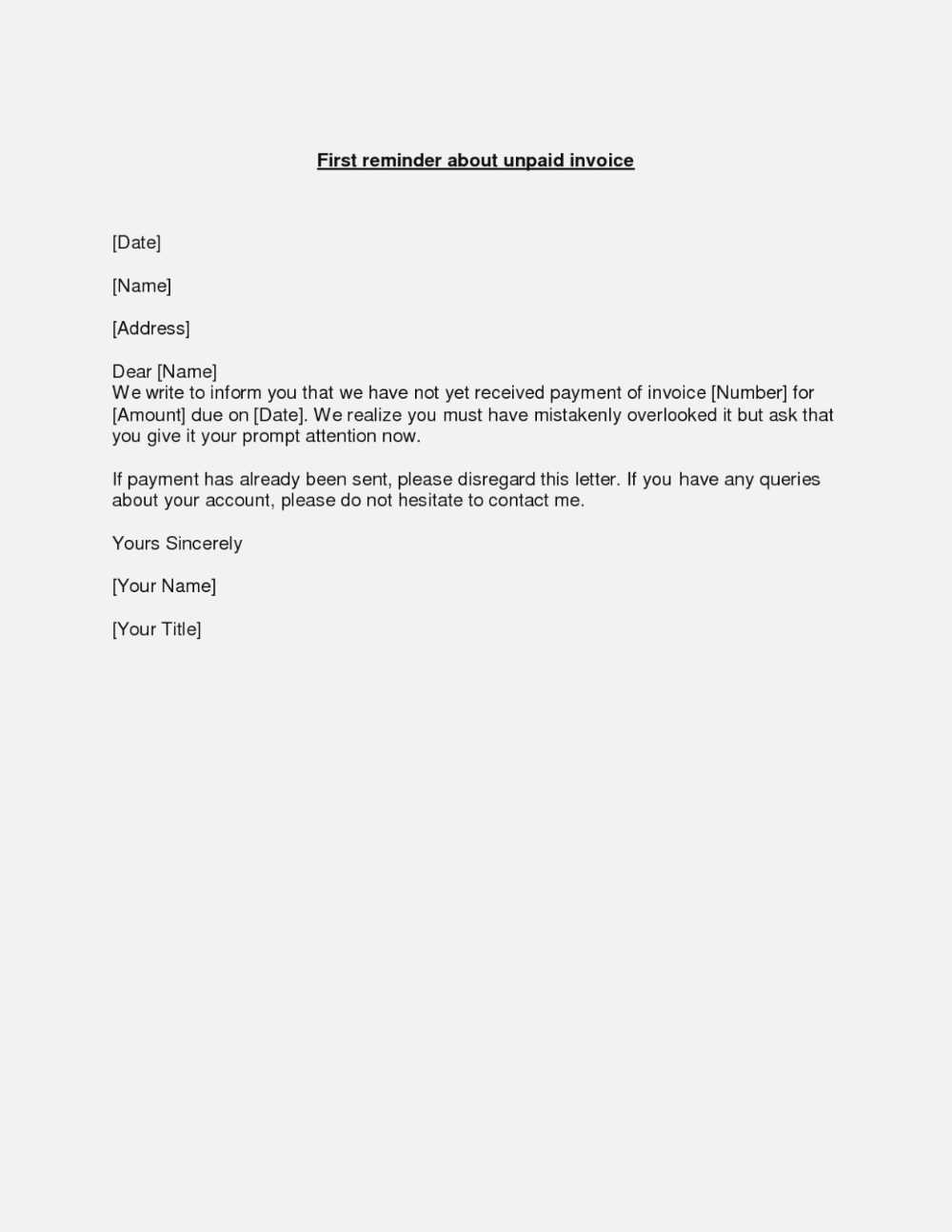

Past Due Invoice Letter Template

When payments are not received by the agreed-upon date, it is essential to send a formal communication to request the outstanding amount. This professional message helps remind the client of their responsibility and encourages timely payment while maintaining a positive business relationship. A well-crafted message is clear, polite, and to the point, ensuring the recipient understands the urgency without feeling pressured.

The structure of your communication plays a significant role in conveying the message effectively. Below is an example of how you can format the key points in your request:

| Section | Description |

|---|---|

| Greeting | Start with a polite salutation, addressing the recipient by name. |

| Payment Details | Clearly state the amount owed, the original payment date, and any relevant account or order numbers. |

| Polite Request | Make a courteous but firm request for payment, indicating the need for prompt action. |

| Next Steps | Inform the recipient of potential consequences if payment is not received within a certain period, such as late fees or further actions. |

| Closing | End the message with a polite closing, offering assistance if needed. |

By structuring your communication this way, you ensure clarity and professionalism, which helps in resolving outstanding payments efficiently while preserving client relations.

Why You Need a Payment Reminder

In business transactions, it is common for payments to be delayed, whether due to oversight or financial difficulties. Regardless of the reason, it is crucial to send a reminder to your clients, ensuring they are aware of the outstanding balance. This step not only helps improve cash flow but also reinforces the importance of timely payments in maintaining smooth business operations.

Maintaining Professionalism and Respect

A well-crafted reminder upholds a professional image while avoiding confrontation. It shows that you value the relationship with your clients, even as you remind them of their financial obligations. By approaching the situation with respect, you create an environment where your clients are more likely to take action without feeling alienated.

Encouraging Timely Payment

Sending a reminder increases the chances of receiving payment promptly. Clients may forget or delay payments unintentionally, and a reminder serves as a gentle nudge to resolve the outstanding amount. It also demonstrates that you are serious about maintaining financial agreements, which encourages future payments to be made on time.

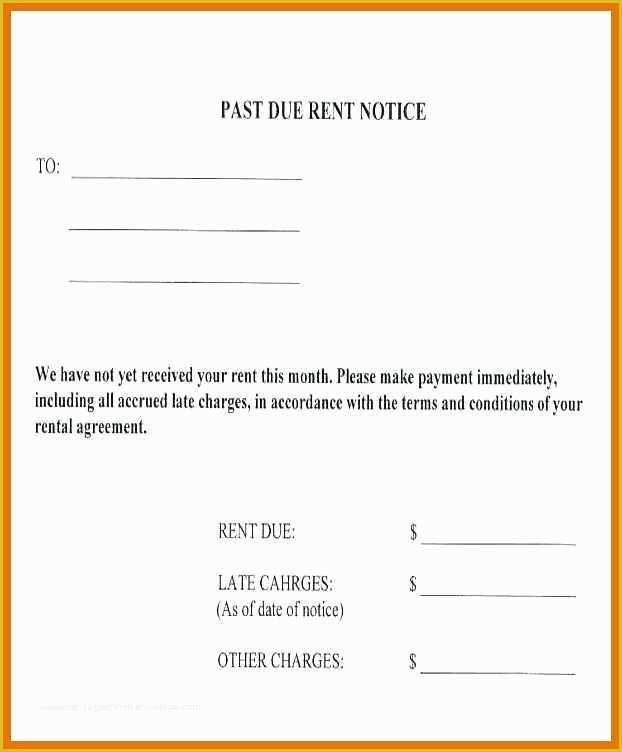

Key Elements of an Effective Letter

When requesting payment for an overdue balance, it is essential to ensure that the communication is clear, concise, and professional. An effective message includes specific elements that help convey the necessary information while maintaining a polite tone. These components not only facilitate quick resolution but also preserve positive business relationships.

The key aspects to focus on include addressing the recipient respectfully, providing clear details about the outstanding amount, and politely requesting payment. Additionally, offering a timeframe for action and outlining any potential consequences for non-payment can motivate clients to act promptly without causing tension. A well-structured approach ensures that the message is taken seriously while keeping the communication professional and courteous.

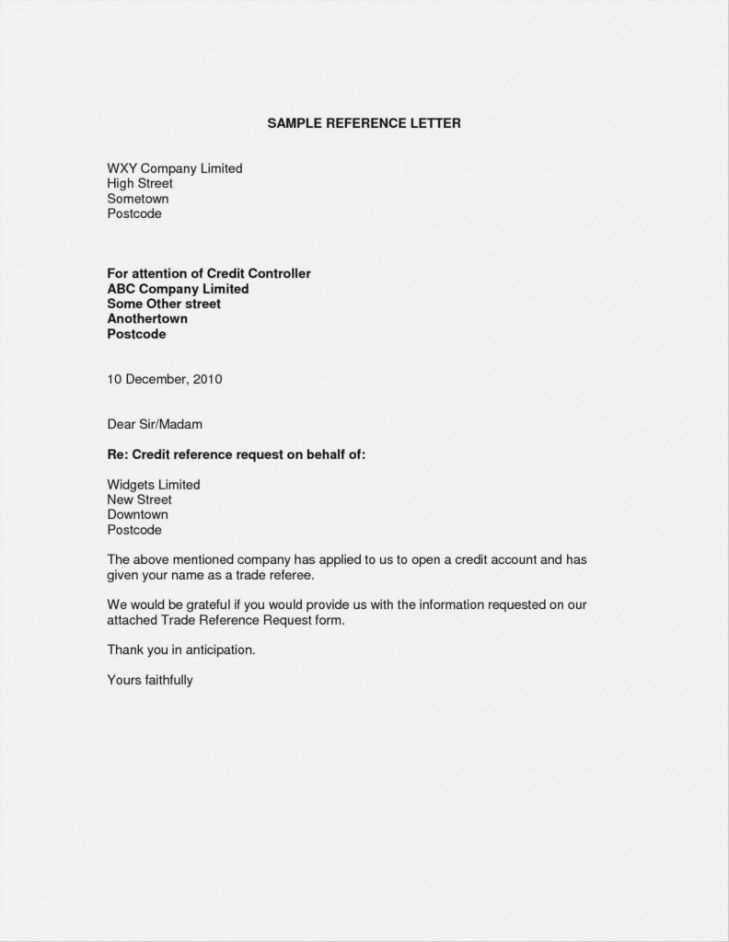

How to Personalize Your Template

Customizing your communication helps make the message more relatable and relevant to each specific situation. By adding personal touches, you ensure that the recipient feels valued while being reminded of the financial obligation. Personalization increases the likelihood of a prompt response and strengthens the relationship with the client.

Essential Personalization Elements

Consider including the following elements to tailor your message:

- Recipient’s Name: Always address the individual directly to make the message more personal.

- Specific Transaction Details: Mention the particular product, service, or agreement related to the outstanding amount to provide clarity.

- Polite Tone: Use respectful language to maintain professionalism, regardless of the situation.

- Flexible Payment Options: If possible, offer different payment methods or terms that suit the client’s needs.

Why Personalization Matters

By customizing your approach, you show that you are attentive to the client’s needs and circumstances. A well-personalized request increases the chance of timely payment, as clients are more likely to respond positively when they feel recognized and respected.

Common Mistakes to Avoid

When requesting payment for an outstanding balance, there are several pitfalls to avoid in order to maintain professionalism and encourage prompt action. Mistakes in the communication can lead to misunderstandings, delayed payments, or even strained business relationships. By being aware of common errors, you can ensure your message is effective and well-received.

Key Mistakes to Watch Out For

- Being Too Aggressive: While it’s important to be firm, being overly harsh or demanding can alienate your client and damage the relationship.

- Lack of Specificity: Failing to include clear details about the outstanding amount, payment terms, or the due date can cause confusion and delay resolution.

- Ignoring the Client’s Situation: Not acknowledging possible reasons for the delay or offering flexibility may make your message seem impersonal and less understanding.

- Not Following Up: Sending only a single message without a follow-up reminder can reduce the chances of receiving payment on time.

How to Avoid These Mistakes

To prevent these issues, maintain a balanced approach by being clear, polite, and understanding in your communication. Ensure all necessary details are included, and follow up if needed. By addressing these mistakes early, you improve the chances of getting paid promptly while keeping the client relationship intact.

Tips for Professional Communication

Effective communication is key when discussing financial matters, as it sets the tone for future interactions and helps ensure a smooth resolution. When requesting payment or addressing a delayed balance, maintaining professionalism and clarity is essential. A well-crafted message fosters trust and encourages prompt action from the recipient.

Essential Guidelines for Professional Tone

- Be Clear and Concise: Avoid overly complicated language. Clearly state the purpose of your message and the required actions, ensuring the recipient understands the urgency without feeling pressured.

- Maintain a Polite and Respectful Tone: Use courteous language to keep the communication amicable. Being respectful helps preserve the business relationship while still addressing the issue at hand.

- Use Proper Formatting: Organize your message for easy reading. Break it into paragraphs or bullet points to highlight key information, such as the amount owed and the next steps.

- Stay Neutral and Objective: Focus on the facts and avoid making assumptions or expressing frustration. A calm and neutral approach will foster a more cooperative response.

Why Professional Communication Matters

Clear and professional communication ensures that both parties understand each other and helps avoid any potential conflicts. By adhering to these principles, you not only increase the chances of receiving payment but also demonstrate respect for the business relationship, setting the stage for positive future interactions.

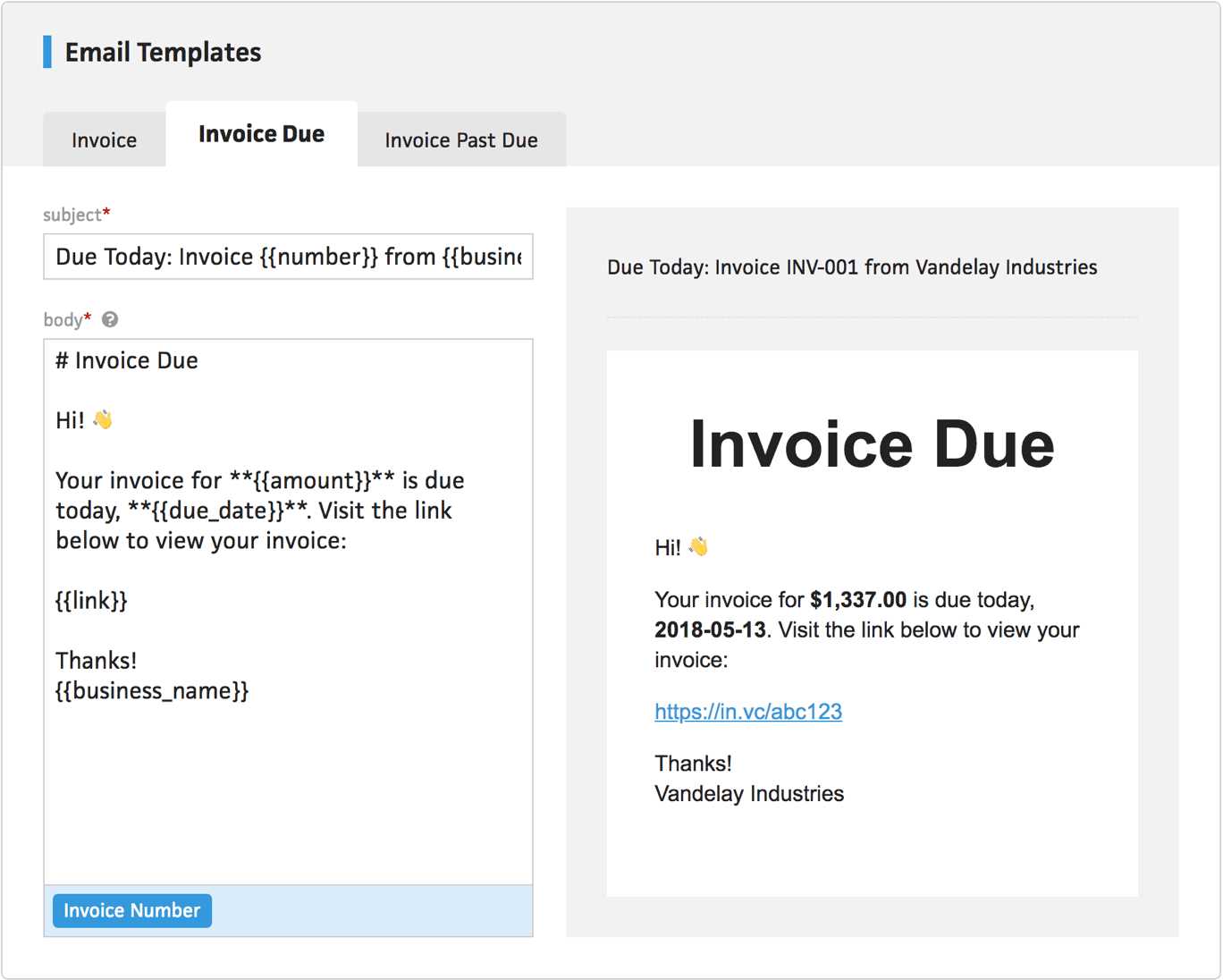

When to Send a Follow-Up Reminder

Following up on an outstanding payment is a delicate task that requires timing and tact. Sending reminders too soon can come across as aggressive, while waiting too long may result in delayed payments. Knowing when to send a reminder is crucial for maintaining professionalism and increasing the likelihood of a timely response.

Optimal Timing for Follow-Up

- Initial Reminder: After the agreed payment date passes, it’s best to send the first reminder within a week. This gives the client a reasonable grace period while still addressing the issue promptly.

- Second Reminder: If no action is taken after the first reminder, wait another 7 to 10 days before sending a second message. This shows persistence while still being considerate.

- Final Reminder: If the payment has not been made within a month, it’s appropriate to send a more urgent reminder. At this stage, include details about potential consequences, like late fees or suspension of services.

Consider Client Relationship

The frequency and tone of reminders should also depend on your relationship with the client. For long-standing clients, you might want to be more flexible and patient, while newer or less reliable clients may require stricter follow-up protocols. Always aim for a balance between firmness and professionalism to preserve the business relationship.