How to Write a Past Due Invoice Template Letter

When payments are delayed, it’s essential to address the situation promptly and professionally. Whether you’re managing a small business or overseeing a large corporation, clear communication can help resolve financial matters smoothly while maintaining good relationships with clients.

Crafting a polite yet firm request for outstanding amounts can make all the difference in ensuring prompt payment. It’s not just about asking for what is owed but also about setting the right tone to encourage a positive response.

In this section, we’ll guide you through the key elements of an effective payment reminder, providing you with the tools to ensure your message is both professional and clear. Whether you are following up on a minor delay or a more significant arrear, these guidelines will help you maintain professionalism and clarity in your communication.

Effective Strategies for Invoice Payment Reminders

When payments are delayed, timely reminders are crucial in keeping the cash flow steady while preserving professional relationships. A clear and respectful approach encourages prompt action and reduces the risk of conflict. The key to a successful reminder lies in balancing firmness with politeness, ensuring that the message is both professional and clear.

To help improve the efficiency of your payment reminders, consider the following strategies:

| Strategy | Description |

|---|---|

| Send Early Reminders | Notify clients before the payment becomes overdue to prevent delays and encourage timely action. |

| Maintain a Polite Tone | Use respectful language to ensure the client feels valued while still reminding them of their obligations. |

| Provide Clear Payment Details | Ensure all necessary payment information is included to avoid confusion and facilitate swift processing. |

| Follow Up Regularly | If the payment isn’t received within the agreed time, follow up with a courteous reminder at regular intervals. |

| Offer Flexible Payment Options | If possible, provide various payment methods or terms to make the process easier for your clients. |

By implementing these strategies, you can enhance your chances of receiving payments promptly, keeping your business operations smooth and your relationships with clients intact.

Understanding the Importance of Timely Payments

Ensuring that payments are received on time is vital for maintaining the financial health of any business. Delays in receiving funds can disrupt operations, affect cash flow, and strain relationships with suppliers and service providers. Timely payments contribute to a well-functioning business ecosystem and can prevent unnecessary complications.

When payments are made promptly, businesses are able to:

- Maintain a steady cash flow, enabling consistent business operations.

- Strengthen relationships with suppliers and vendors through reliable financial practices.

- Minimize the need for repeated reminders or legal actions.

- Ensure they can meet their own financial obligations without delay.

On the other hand, late payments can result in:

- Increased administrative costs due to follow-up actions and reminders.

- Damage to business reputation and trust with clients or partners.

- Potential for loss of business opportunities or collaborations.

- Strain on internal resources as businesses may need to divert attention to managing overdue amounts.

By emphasizing the importance of timely payments, companies not only secure their financial stability but also build a reputation for professionalism and reliability in the marketplace.

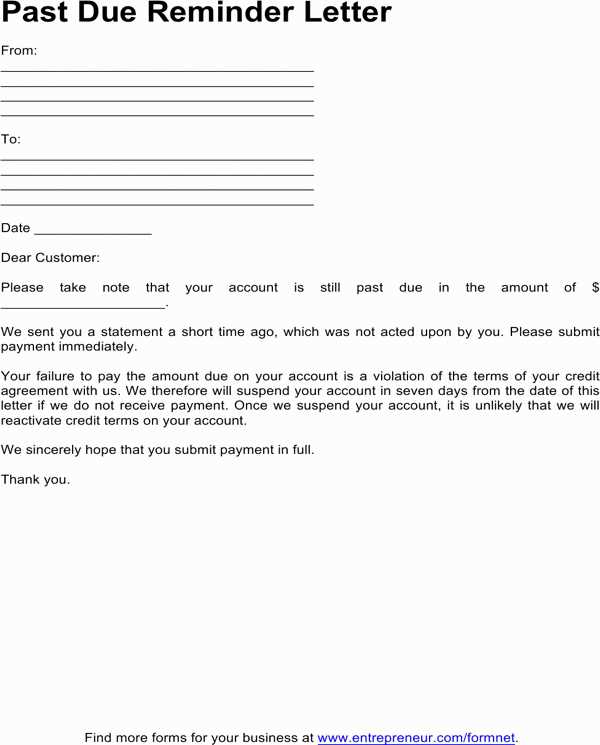

How to Craft a Professional Payment Request

Creating an effective payment request requires a balance of clarity, professionalism, and courtesy. The goal is to communicate the outstanding balance while maintaining a respectful tone, which encourages the recipient to take swift action without feeling uncomfortable or pressured. A well-crafted message can expedite the process and prevent misunderstandings.

Key Components of a Payment Request

To ensure your request is clear and effective, include the following key elements:

- Recipient Details: Clearly state the recipient’s name, company (if applicable), and contact information to ensure the message reaches the right person.

- Amount Owed: Specify the amount that is outstanding, including any taxes, fees, or other charges that may apply.

- Payment Terms: Outline the agreed-upon payment terms, including any applicable dates or timelines for settlement.

- Method of Payment: Provide clear instructions on how the recipient can make the payment, including preferred payment methods or account details.

- Polite Reminder: Use courteous language that emphasizes the importance of timely payment while maintaining a friendly tone.

Best Practices for Effective Communication

When crafting your request, consider these best practices to maintain professionalism:

- Be Clear and Concise: Avoid unnecessary jargon or complicated language. Keep the message straightforward and easy to understand.

- Maintain a Polite Tone: Always use polite language, even if the payment is overdue. A respectful tone promotes positive relationships.

- Follow Up Regularly: If payments are not received on time, send gentle reminders, but avoid being overly aggressive or demanding.

By following these guidelines, you can craft a professional payment request that helps maintain your cash flow while fostering a positive relationship with your clients.

Key Elements of a Payment Reminder Message

When requesting outstanding payments, it’s essential to include all the necessary details in your communication to ensure clarity and prompt action. A well-structured reminder should provide the recipient with the information needed to process the payment quickly while maintaining professionalism. The following elements are crucial for an effective request.

Essential Information to Include

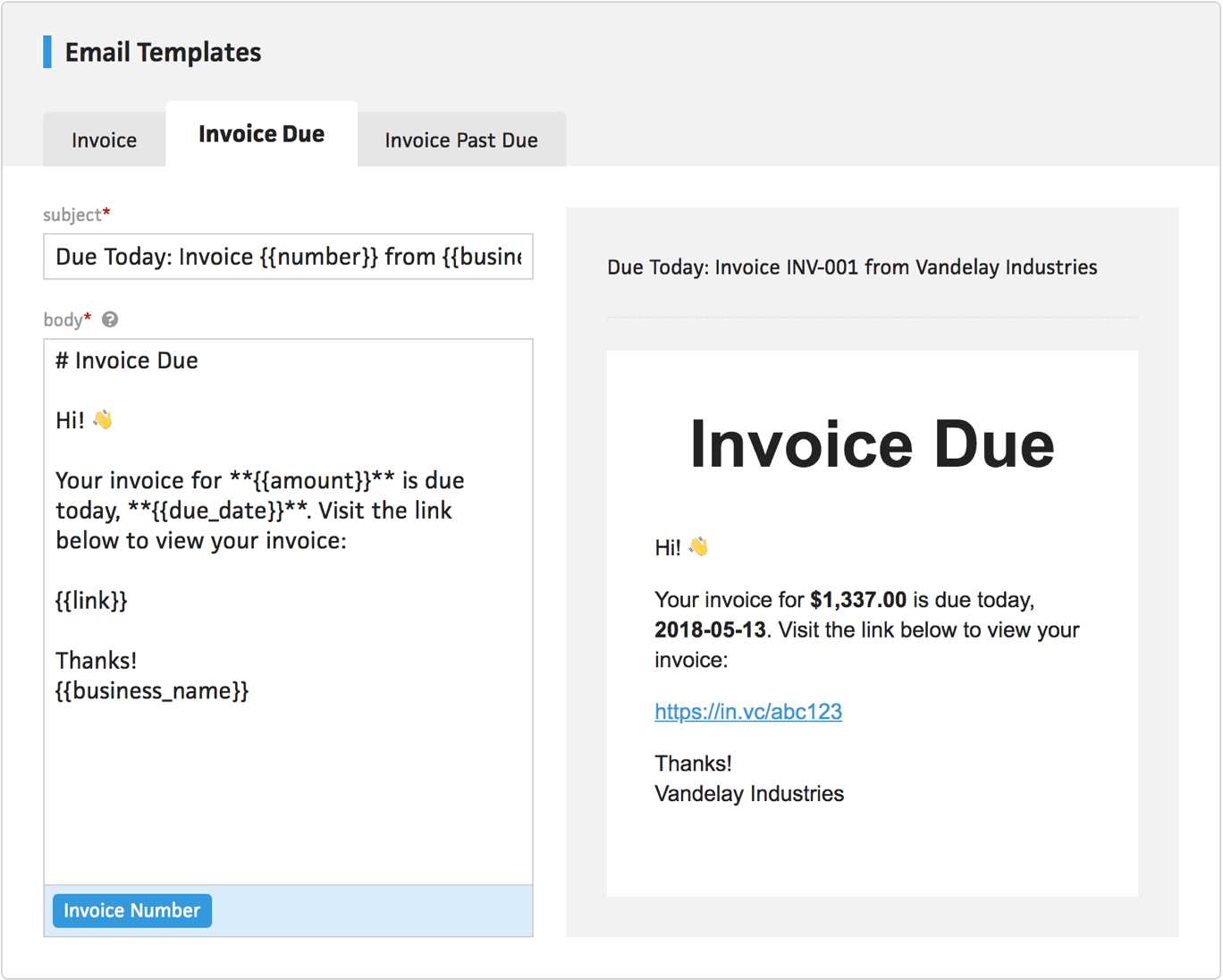

To ensure your message is both clear and actionable, be sure to include these key details:

- Recipient Information: Clearly state the name of the individual or business you are addressing, including any relevant contact details.

- Outstanding Amount: Specify the exact amount owed, making sure to list any additional charges or fees if applicable.

- Payment Instructions: Provide clear instructions on how the payment should be made, including bank details or online payment options.

- Deadline for Payment: Specify the date by which the payment should be received to avoid any further complications.

Tone and Language Considerations

The tone of the message plays a significant role in encouraging a positive response. Keep the language polite and professional, even when addressing overdue amounts. Consider the following:

- Politeness: Use courteous phrases, such as “please” and “thank you,” to maintain a respectful tone.

- Firmness with Tact: Clearly state that the payment is expected without being confrontational or rude.

- Clear Action Request: End the message by requesting a specific action, such as confirming the payment or contacting you for further details.

Including these elements ensures your payment reminder is clear, professional, and effective, helping to resolve outstanding balances without damaging business relationships.

How to Maintain a Positive Client Relationship

Maintaining a strong, positive relationship with clients is essential for long-term business success. Even when financial matters such as unpaid balances arise, it’s important to address them in a way that preserves goodwill and fosters mutual respect. A tactful approach can help ensure that clients feel valued, which encourages continued business and trust.

Communicate with Empathy and Understanding

When reaching out to clients regarding unpaid balances, approach the situation with understanding and empathy. People face various challenges, and sometimes delays are unavoidable. Acknowledging this can help you maintain a supportive tone that strengthens the client relationship. Some tips include:

- Be empathetic: Acknowledge any potential difficulties your client may be facing without being judgmental.

- Offer solutions: If possible, provide flexible payment options or extensions to accommodate their situation.

- Stay calm: Maintain a composed and patient attitude, even if the issue persists longer than expected.

Keep the Communication Professional and Respectful

While it’s important to be understanding, it’s equally crucial to maintain professionalism. Clear, respectful communication helps set the right tone for resolution and ensures that the client doesn’t feel pressured or embarrassed. Remember:

- Be clear: Clearly state the outstanding amount and any agreed-upon payment terms without ambiguity.

- Be polite: Use courteous language that conveys your request without being demanding or pushy.

- Be patient: Understand that it may take time for clients to respond, especially if they need to consult their financial team or review their budget.

By addressing payment matters with empathy, respect, and professionalism, you help build a foundation for trust that can support your ongoing business relationship, even through financial challenges.

Common Mistakes to Avoid in Payment Requests

When requesting payment, the way you communicate can significantly impact your relationship with the client and the likelihood of receiving the owed amount promptly. Mistakes in these communications can lead to confusion, delays, or even strained business relationships. It’s essential to avoid certain common errors to ensure your payment requests are clear, professional, and effective.

Ambiguity and Lack of Clarity

One of the most common mistakes is not providing enough detail or being unclear in your message. Ambiguity can lead to confusion and may delay the payment process. Here’s how to avoid this pitfall:

- Specify the exact amount: Always include the precise amount owed and any additional fees, if applicable.

- Clearly mention payment terms: Avoid vague language about when the payment is due and what methods can be used.

- Provide detailed instructions: Be explicit about how the payment should be made, such as offering bank details or other payment methods.

Inappropriate Tone or Language

The tone of your message can have a significant impact on how the client perceives the request. Using aggressive or overly harsh language can damage your relationship. To maintain a professional tone:

- Be polite and respectful: Even when following up on a payment, ensure your language remains courteous.

- Avoid confrontation: Instead of focusing on blame, use neutral phrasing that encourages action without being accusatory.

- Stay professional: Maintain a professional attitude and tone, no matter how long the payment has been outstanding.

By avoiding these common mistakes, you can ensure your payment requests are clear, polite, and professional, fostering better communication and a smoother payment process.

Best Practices for Sending Outstanding Payment Requests

When payment deadlines have passed, it’s essential to follow up with clients in a way that is both effective and respectful. A professional approach to handling overdue payments can prevent misunderstandings and maintain a positive business relationship. There are certain strategies that can enhance the chances of successful payment collection while maintaining professionalism.

Timely and Clear Communication

One of the most important aspects of collecting unpaid amounts is ensuring that communication is both timely and clear. Prompt reminders help avoid unnecessary delays, while clear messaging ensures the client understands what is expected. Consider these guidelines:

- Act quickly: Send a reminder as soon as a payment deadline has passed, but avoid being too aggressive.

- Be clear and concise: Specify the amount owed, the original payment terms, and any applicable late fees.

- Use professional language: Maintain a polite and respectful tone throughout the message.

Offering Flexible Payment Options

Sometimes clients face financial difficulties, making it challenging to pay the full amount at once. In such cases, offering payment flexibility can increase the likelihood of receiving payment. Consider the following options:

- Installment plans: Offer clients the option to pay in smaller, manageable installments over a set period.

- Alternative payment methods: Provide a variety of payment options to accommodate your client’s preferences, such as bank transfers, online payments, or checks.

- Payment extensions: If the client requires more time, consider offering an extension while ensuring the new terms are clearly agreed upon.

By following these best practices, you can improve the chances of receiving timely payments while maintaining professional and positive client relationships.