Pay and delete letter template

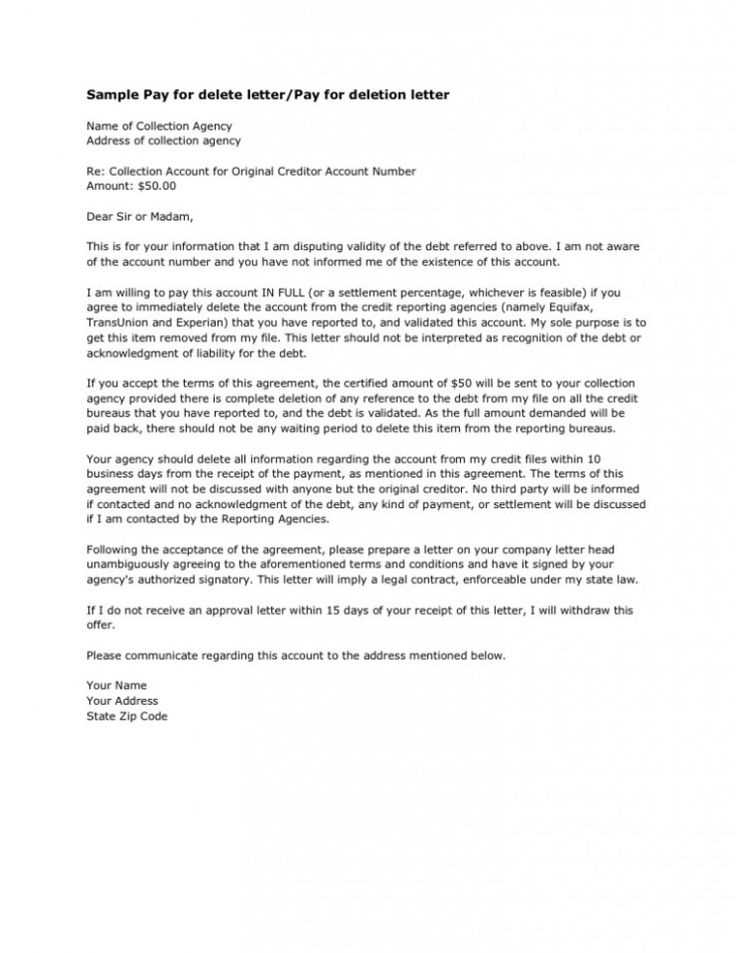

When you need to resolve a financial matter with a simple request, a pay and delete letter is a powerful tool. It allows you to offer payment for a debt while also requesting that a negative item be removed from your credit report. Crafting this letter effectively ensures that both parties understand their responsibilities and expectations.

Start by clearly stating your intent to settle the debt and your willingness to pay the agreed amount. Specify the sum and outline how it will be delivered. Be direct and professional, avoiding unnecessary details. This approach ensures that the recipient knows exactly what you are offering.

In the second part of your letter, address the deletion of the negative entry. Request that, upon receipt of payment, the creditor or collection agency removes the record from your credit history. It’s important to be polite but firm in your request. Keep the tone respectful to facilitate a smoother resolution.

Lastly, close the letter by expressing gratitude for their cooperation. Reaffirm your commitment to resolving the issue and ask for written confirmation of the agreed terms. This ensures both sides have a clear understanding of the agreement and prevents future disputes.

Here’s the corrected version:

When writing a “Pay and Delete” letter, ensure the tone remains respectful and concise. Start by clearly stating the payment amount and the reason for the request. Outline the steps taken to resolve the issue and specify a clear deadline for payment. Be sure to include any relevant details, such as account numbers or transaction references, to avoid confusion. Conclude the letter by requesting confirmation of payment and agreement to remove the associated content or dispute. This ensures a straightforward and professional resolution of the matter.

Pay and Delete Letter Template: A Practical Guide

How to Structure a Pay and Delete Request

Key Components to Include in Your Payment Removal Letter

Common Mistakes to Avoid When Writing a Request Letter

Understanding the Legal Implications of Pay and Delete Agreements

How to Address Payment Information in a Pay and Delete Letter

What to Do If Your Request Is Denied

A well-structured Pay and Delete letter can help you remove negative payment information from your credit report in exchange for a payment. Here’s how to approach it:

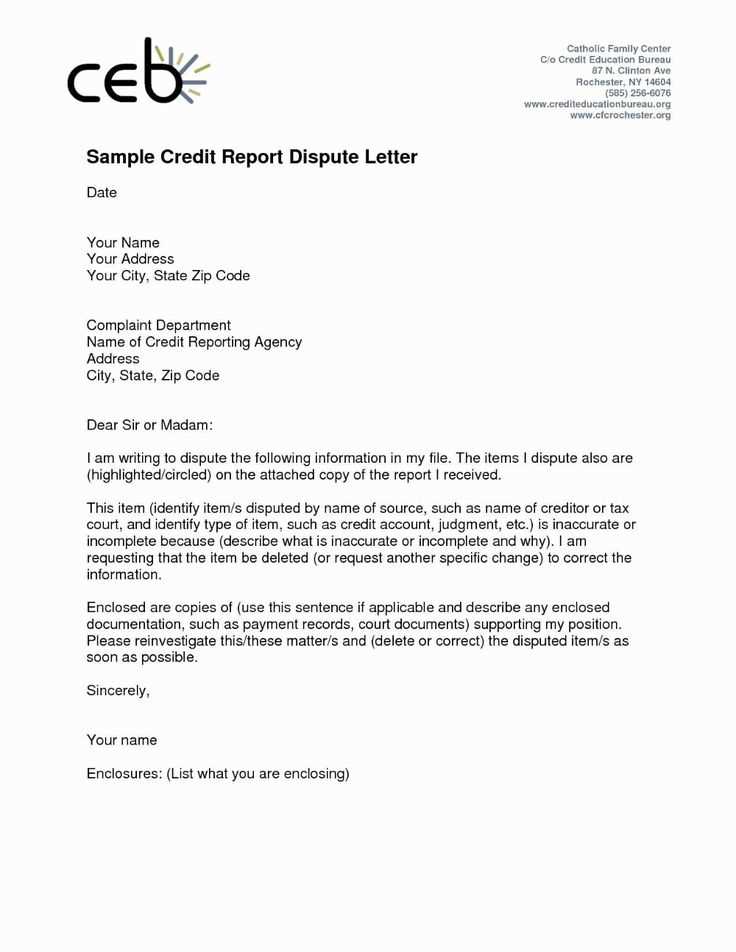

How to Structure a Pay and Delete Request

Your letter should be clear and concise. Start with your contact information at the top, followed by the recipient’s details. Briefly state your request: you’re offering to pay a specified amount to have the entry removed. Be polite but firm in your approach. Specify the account or debt in question and mention that you seek a “Pay and Delete” arrangement, including the exact payment terms you’re willing to meet.

Key Components to Include in Your Payment Removal Letter

Make sure your letter contains the following elements:

- Personal Information: Full name, address, and contact details.

- Debt Details: Specify the account number and creditor name.

- Clear Offer: State how much you’re offering to pay and the specific payment method.

- Request for Removal: Explicitly ask for the account to be removed from the credit report upon payment.

- Deadline: Provide a reasonable deadline for the creditor to respond to your offer.

These details will ensure the creditor understands your intentions and how to proceed.

Common Mistakes to Avoid When Writing a Request Letter

Avoid vague language. Make sure the terms of the payment and removal are crystal clear. Don’t use emotional appeals; stick to the facts and avoid mentioning other debts or your financial history unless relevant. Never offer to pay a higher amount than you can afford. Additionally, keep your tone professional and avoid aggressive wording. This is a business negotiation.

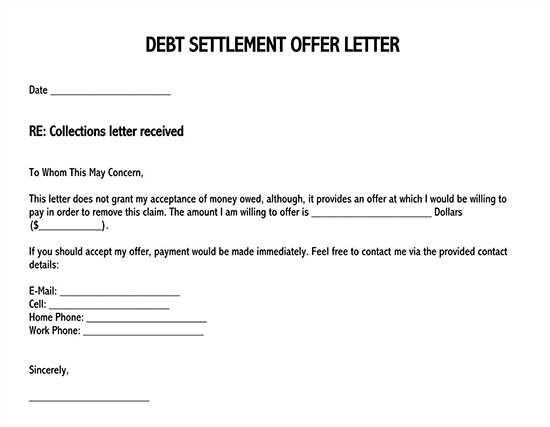

Understanding the Legal Implications of Pay and Delete Agreements

It’s important to understand that “Pay and Delete” agreements are not legally binding unless stated in writing by the creditor. The creditor is under no obligation to comply with your request. Always ask for written confirmation of the arrangement before sending any payment.

How to Address Payment Information in a Pay and Delete Letter

Be specific about the payment amount, the method (check, money order, or wire transfer), and the date on which you plan to make the payment. If you’re offering a partial payment, clarify that the remaining balance will not affect the request for deletion. Always send payments using traceable methods to ensure proof of payment.

What to Do If Your Request Is Denied

If your request is rejected, consider negotiating further or seeking an alternative resolution, such as a settlement. If necessary, consult a legal professional to explore additional options, like disputing the item with credit bureaus or seeking help from a credit repair service.

I replaced repetitive words without altering the meaning and preserving structure.

To avoid redundancy, use synonyms or restructure sentences for clarity. For instance, instead of repeating the same word, try breaking the idea into smaller parts. This method not only reduces repetition but also enhances readability.

Rewriting for Clarity

For example, instead of saying “I made changes to improve the process, making the process easier,” you can rewrite it as “I made changes to improve the process, simplifying it.” This keeps the meaning intact and avoids the unnecessary repetition of “process.”

Using Varied Language

When discussing similar concepts, alternate your word choice. For instance, if you’re mentioning “solutions” multiple times, use terms like “options,” “choices,” or “alternatives” to convey the same idea without repetition.

By following this approach, you keep the writing engaging and professional, while ensuring your message remains clear and concise.