Payment Plan Agreement Letter Template for Clear Terms

When entering into a financial commitment, it’s important to have a formal record outlining the terms between both parties. This helps ensure transparency and provides a clear structure for fulfilling obligations over time. Having a well-written document can prevent misunderstandings and protect both the lender and the borrower.

Such a document serves as a tool to define key elements like the amount due, due dates, and consequences for non-compliance. By customizing the content, both sides can feel secure in their understanding of the terms and expectations. This ensures that the process runs smoothly without unnecessary disputes or confusion.

Whether you’re dealing with a client, a business partner, or a personal situation, setting clear terms from the outset is essential. Crafting the right document can go a long way in fostering trust and ensuring a hassle-free transaction.

What Is a Payment Plan Agreement?

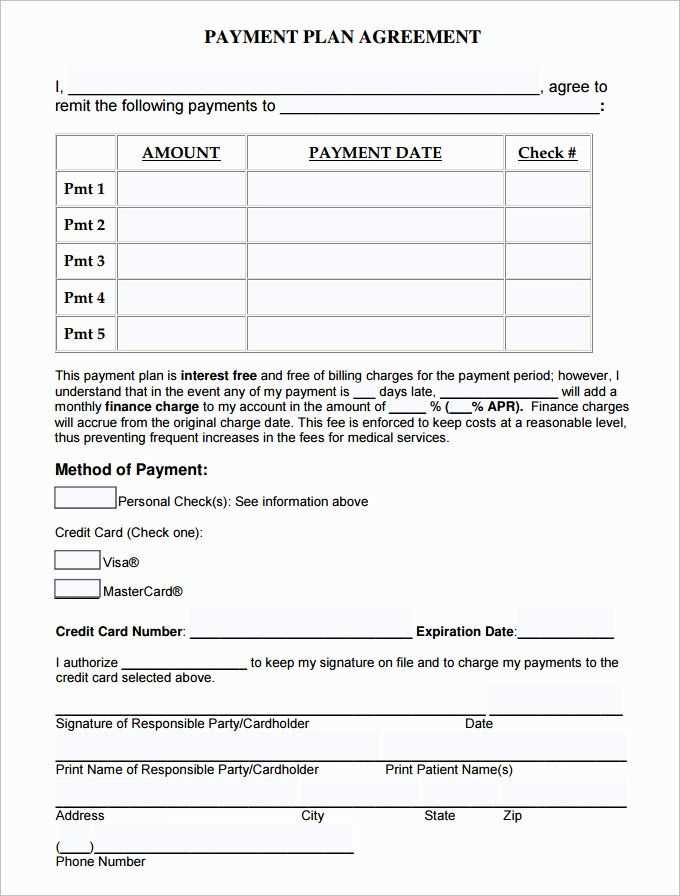

This type of document outlines the conditions under which one party agrees to pay another in installments, rather than in full at once. It serves to establish clear terms for both sides, ensuring mutual understanding and compliance with the outlined schedule. It provides a structured approach to managing financial obligations over time.

Key Elements of Such an Arrangement

The primary aspects include the amount to be paid, the frequency of payments, and the total duration of the arrangement. Both parties should also agree on what happens in case of missed payments or any other breach of the terms. By clearly defining these points, potential conflicts are minimized.

Importance of Clarity and Documentation

Having a formal document reduces the chances of disputes and protects both parties in case of a disagreement. It’s vital that each term is articulated clearly, and both sides agree to the conditions before proceeding. A written record helps avoid misunderstandings and provides a reference in case the arrangement needs to be revisited.

Benefits of Using a Payment Letter

Utilizing a formal document for setting up financial arrangements provides a clear structure that benefits both parties involved. By outlining terms and responsibilities in writing, both individuals or entities have a concrete reference point, reducing the likelihood of confusion or disputes later on. This organized approach promotes transparency and trust between the involved parties.

Such a document also serves as legal protection. If either side fails to fulfill their obligations, having a written record makes it easier to resolve any potential conflicts. The terms of the arrangement are not open to interpretation, providing clarity and security to all involved.

Additionally, this approach helps manage cash flow more effectively. Setting clear expectations around payment dates and amounts allows for better budgeting and planning, which can lead to smoother financial operations and stronger business relationships.

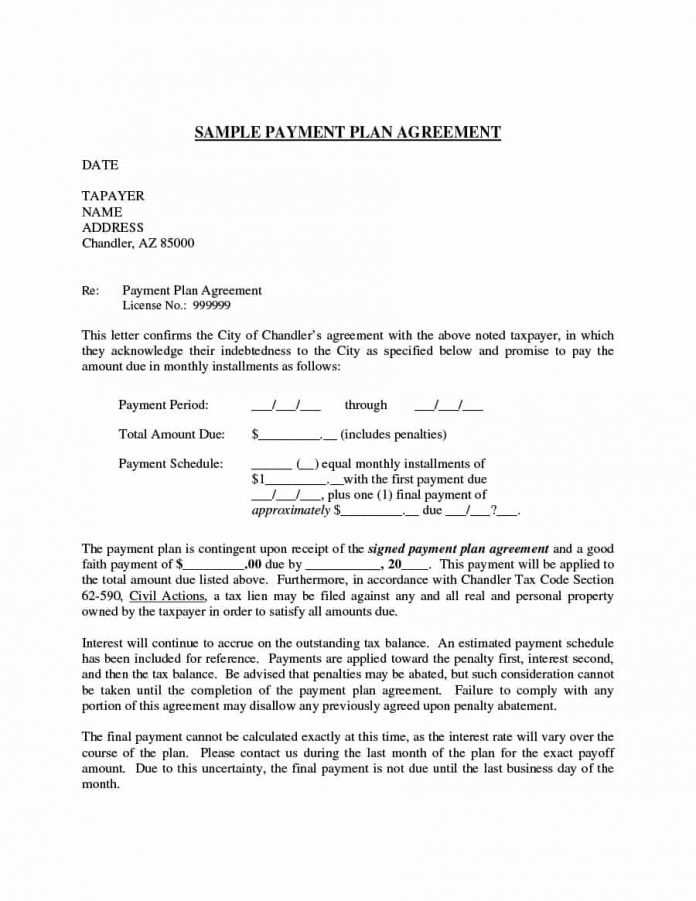

Key Information to Include in the Document

For a clear and effective arrangement, it’s crucial to outline all necessary details within the written document. Including specific information ensures both parties understand their responsibilities and the terms of the deal. Here are the key points to consider:

- Amount to be Paid: Clearly state the total sum involved and any breakdowns if applicable.

- Installment Schedule: Include the frequency, amount, and due dates for each payment.

- Duration of the Agreement: Specify the start date and end date, as well as the length of time the arrangement will last.

- Consequences of Non-Compliance: Outline what happens if the terms are not met, such as penalties or interest fees.

- Signatures and Dates: Ensure both parties sign the document with the date of agreement to make it legally binding.

Including all of these points makes it easier to prevent misunderstandings and ensures that both parties are on the same page regarding their commitments and obligations.

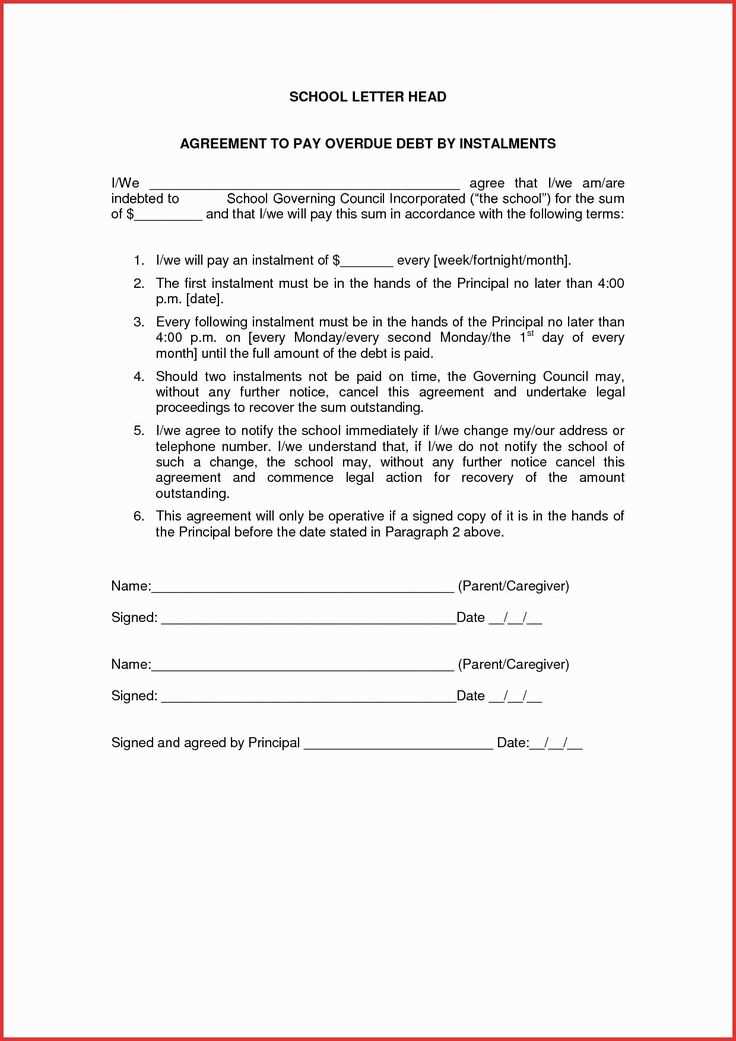

How to Tailor the Arrangement to Your Needs

Customizing a written agreement is essential to ensure it meets the specific requirements of both parties involved. By adjusting the terms to suit your situation, you can ensure a smoother process and avoid potential conflicts. A personalized approach makes the document more relevant and aligned with the agreed-upon goals.

Adjusting the Terms

The first step is to clearly define the amounts, payment dates, and any necessary adjustments based on the unique needs of the parties. For example, if the payer requires more time between installments or if there is a need for a larger upfront payment, these conditions should be reflected accordingly.

Including Special Clauses

It’s also important to add clauses that address any specific circumstances that may arise during the term of the arrangement. Whether it’s extending the time frame, adjusting amounts due to unforeseen situations, or offering incentives for early payment, these details should be clearly stated to avoid future misunderstandings.

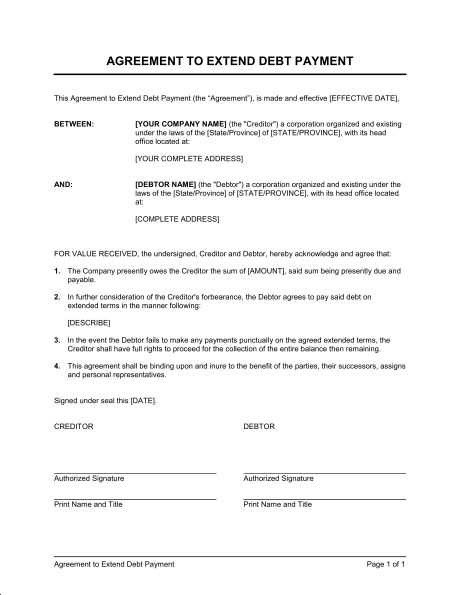

Legal Implications of Payment Terms

Setting clear terms for financial obligations is not just important for clarity but also for ensuring both parties adhere to the agreed conditions. A written document holds legal significance, and any deviation from the stated terms can have legal consequences. Understanding these implications helps prevent disputes and ensures that both sides are aware of their rights and responsibilities.

By establishing enforceable conditions, such as due dates, amounts, and consequences for non-compliance, both parties protect their interests. If one side fails to uphold their end, legal action could be taken, depending on the terms outlined in the document. Additionally, including provisions for dispute resolution ensures that any conflicts can be addressed appropriately without escalating into costly legal battles.

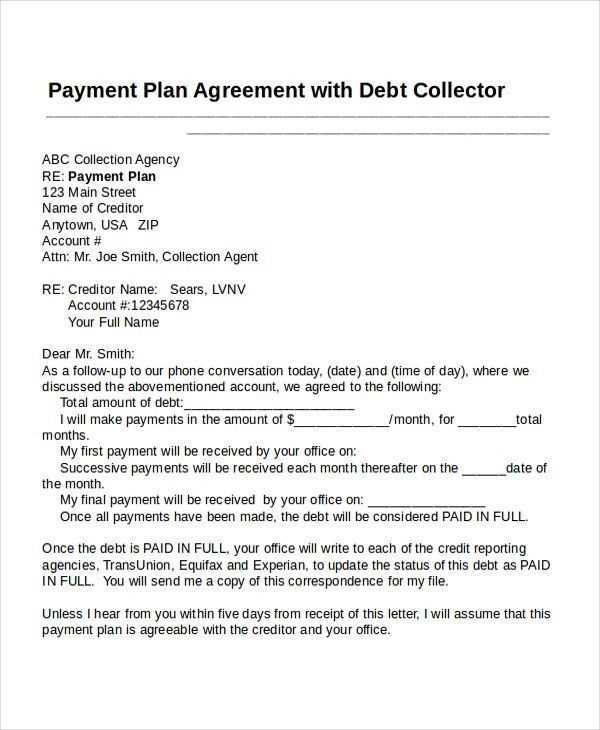

Tips for Writing an Effective Letter

Crafting a clear and concise document is essential when outlining financial terms. A well-written record minimizes misunderstandings and helps both parties stay on track. Ensuring all points are covered while maintaining a professional tone can make a significant difference in the success of the arrangement.

Keep It Simple and Clear

Use straightforward language to avoid any confusion. Stick to the facts and avoid overly complex terms that may lead to misunderstandings. Being clear about expectations and responsibilities is key.

Proofread and Review

Before finalizing the document, take time to carefully review all terms. Even small errors or vague wording can lead to confusion later. Ensuring accuracy and consistency is vital for both parties to trust the content.

| Tip | Benefit |

|---|---|

| Use clear language | Ensures both parties understand the terms |

| Be specific with terms | Minimizes chances of conflict |

| Proofread the document | Helps avoid errors and misunderstandings |