Payment receipt letter template

When creating a payment receipt letter, clarity and professionalism are key. A well-structured template ensures that all necessary details are included, making the process of confirming transactions smooth and transparent for both parties.

Include the date of the transaction at the top of the letter to specify when the payment was made. This helps establish a clear timeline for future reference.

Next, state the amount paid, and confirm the method of payment, whether it’s cash, credit card, or another form. This gives both parties a clear record of the transaction details.

Details of the payer and recipient should be included as well, including names and addresses, ensuring there is no confusion about who is involved in the transaction.

Finally, don’t forget to mention any relevant payment terms, such as what the payment is for, any reference numbers, and any remaining balance if applicable. This information creates a complete and understandable record of the transaction.

Payment Receipt Letter Template

To create a clear and formal payment receipt, begin with the header, including the date and the title of the document. Ensure that it clearly states it’s a receipt, such as “Payment Receipt” or “Receipt of Payment”. This helps in quick identification for both parties involved.

Sender Information

Include the name, address, and contact details of the organization or individual issuing the receipt. This establishes the source and credibility of the payment record.

Recipient Details

List the name and contact information of the individual or business that made the payment. This provides clarity and ensures that the receipt is linked to the correct party.

Next, specify the payment amount. Use both numeric and written formats to avoid any confusion. For example, “Amount Received: $500 (Five Hundred Dollars)”. This ensures the amount is clear in both forms.

Include a detailed description of the payment. Mention the reason for the payment, such as “Payment for invoice #12345” or “Payment for services rendered.” This helps avoid ambiguity about the payment’s purpose.

Payment Method

Clearly state the method used for the payment, whether it’s through check, credit card, cash, or bank transfer. Indicate any transaction or reference numbers if applicable.

Signature and Acknowledgment

Conclude with a signature and an acknowledgment line, such as “Authorized Signature” or “Received By.” This signifies the transaction has been completed and verified by the sender.

How to Structure the Letter

Begin with a clear heading that identifies the purpose of the letter, such as “Payment Receipt” or “Acknowledgement of Payment.” This sets the tone and ensures the recipient understands the document’s intent immediately.

Introduction

Start with a brief opening sentence confirming receipt of the payment. Include relevant details like the date, amount, and method of payment. Keep this part direct and to the point, providing the necessary transaction information without unnecessary elaboration.

Body

In the body, provide more specific details regarding the payment. For example, include the invoice number, the products or services paid for, and any applicable reference numbers. This section should confirm that the payment has been processed and is complete. Avoid over-explaining–just provide the facts that might be needed for record-keeping.

End the body with a brief thank you or acknowledgment of the business relationship, maintaining a polite and professional tone.

Conclude with a closing line that offers assistance if further details are needed. Keep this section polite but succinct, without offering redundant details.

Sign off with a professional closing statement, such as “Sincerely” or “Best regards,” followed by your name and position. If applicable, include company details or contact information.

Essential Information to Include

Begin by providing the full name of the payer and the recipient. Include their contact details, such as phone numbers or email addresses, to avoid any confusion regarding payment confirmation.

State the payment amount clearly, specifying the currency used. If the payment involves partial amounts, make sure to list the total amount due and the current payment’s portion.

Include the payment date and any reference number related to the transaction. This helps both parties track the payment with ease.

Clearly describe the purpose or reason for the payment. Whether it’s for services rendered, a product purchase, or a debt settlement, this section avoids any ambiguity.

End the letter by confirming that the payment has been received in full, or if applicable, mention any outstanding balance. This ensures both parties are aware of the transaction’s current status.

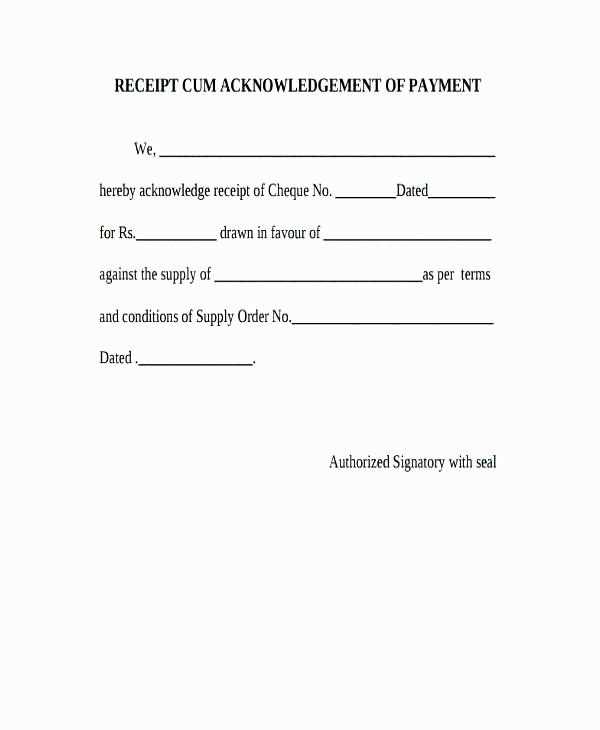

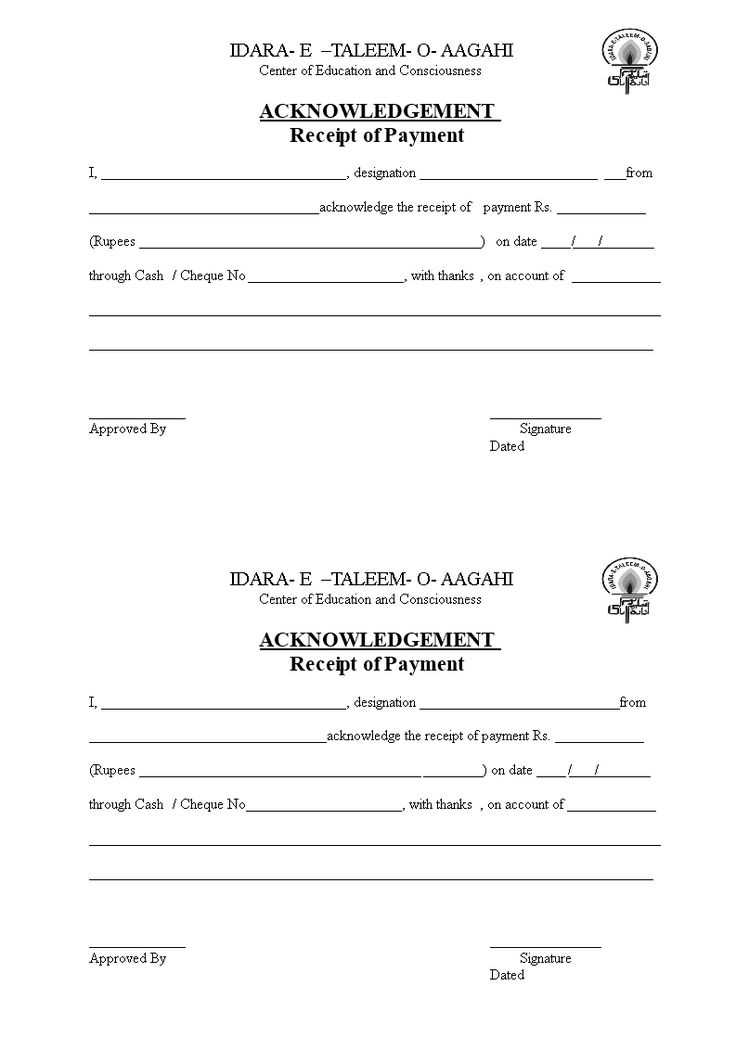

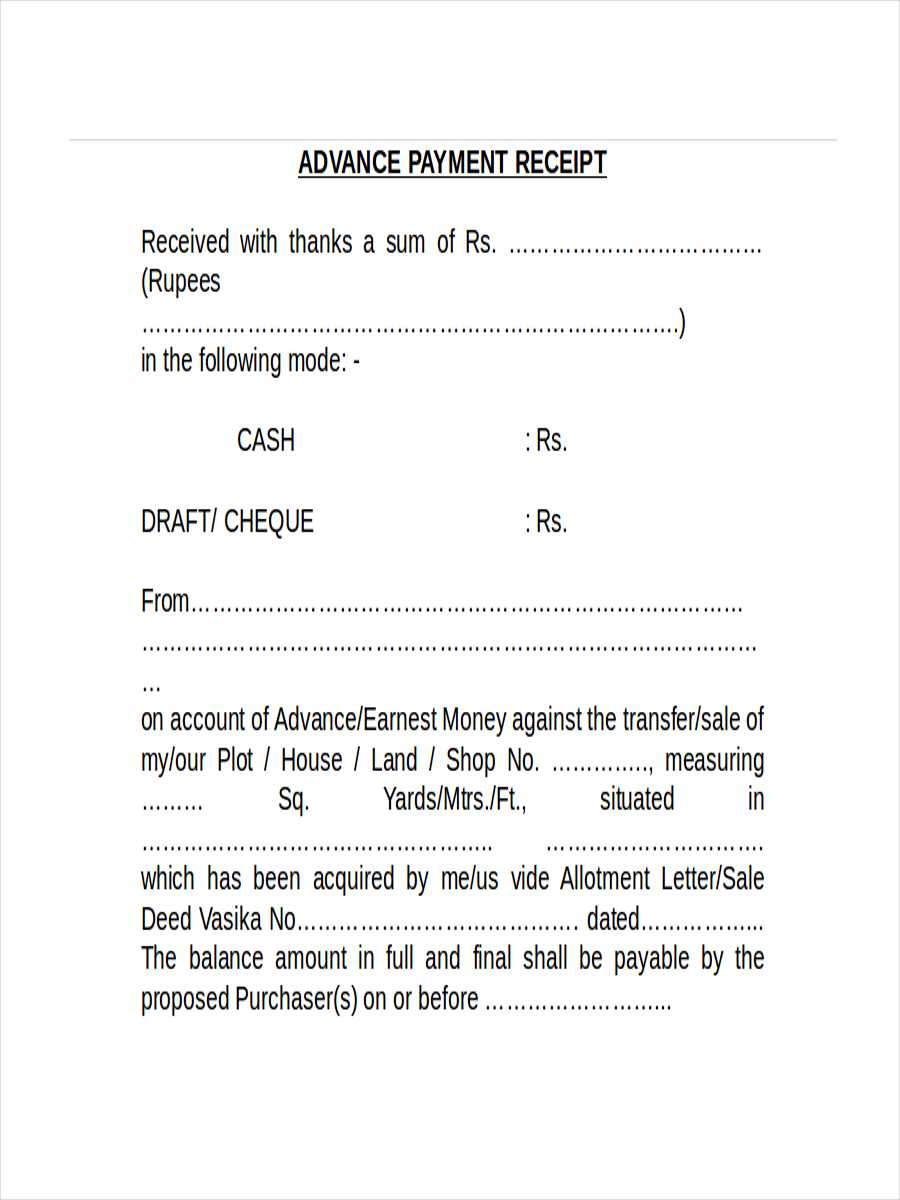

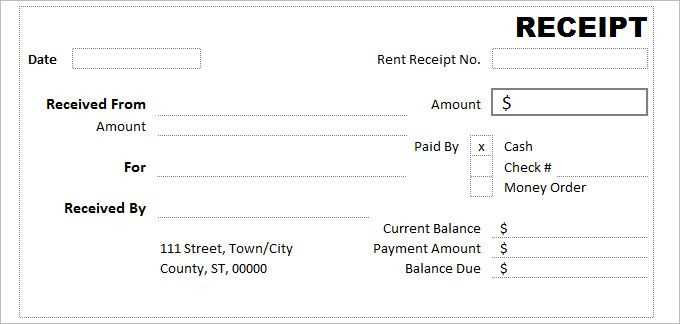

Sample Payment Receipt Templates

Use these payment receipt templates to easily create professional receipts for your transactions. Each template can be customized to fit your specific needs. Below is a simple format for a payment receipt, followed by another example for more detailed transactions.

Basic Payment Receipt

This template is perfect for straightforward transactions, ensuring you cover the key details without overcomplicating the process.

| Receipt Number | [Insert Receipt Number] |

|---|---|

| Date | [Insert Date] |

| Received From | [Name of Payer] |

| Amount | [Amount Paid] |

| Payment Method | [Cash/Bank Transfer/Credit Card] |

| For | [Description of Goods/Services] |

Detailed Payment Receipt

This template includes more comprehensive information for complex transactions, ideal for businesses requiring more extensive details.

| Receipt Number | [Insert Receipt Number] |

|---|---|

| Date | [Insert Date] |

| Received From | [Name of Payer] |

| Amount | [Amount Paid] |

| Payment Method | [Cash/Bank Transfer/Credit Card] |

| Invoice Number | [Invoice Number] |

| Service Description | [Detailed Description] |

| Tax | [Tax Amount] |

| Total | [Total Amount] |

Adapting Receipts for Various Payment Methods

Modify your receipt format based on the payment method used to ensure clarity and accuracy. Each payment method requires specific information that should be highlighted clearly to avoid confusion. For instance, when dealing with credit or debit card payments, include the last four digits of the card number along with the authorization code. This assures the customer that the payment was processed successfully.

Credit and Debit Cards

- Include the last four digits of the card used for the transaction.

- List the authorization or transaction code provided by the payment processor.

- Clearly display the transaction amount and date of purchase.

Cash Payments

- Note the amount tendered and change given.

- Include the exact time and date of the transaction to avoid discrepancies.

For online payments, make sure to specify the transaction ID and the payment gateway used. This helps in resolving any potential issues related to online transactions and ensures transparency for both parties.

Mobile Payments

- State the payment method (e.g., Apple Pay, Google Pay) for easy reference.

- Include any reference numbers provided by the mobile payment system.

By customizing your receipts for each payment method, you ensure that your customers have all necessary information, making future references or disputes simpler to resolve.

Addressing Common Issues in Receipts

Ensure all key details are clear and accurate. Double-check the total amount, including taxes and discounts. Incorrect totals can lead to confusion and disputes.

Missing Information

When creating a receipt, make sure to include the date, vendor information, and a description of the purchased items or services. Missing or incomplete details can make it difficult to process returns or warranties.

Incorrect Payment Method

Verify that the payment method is listed correctly on the receipt. If a customer paid by credit card, ensure that it is reflected accurately. Mismatches between the payment method and transaction details can create complications for both parties.

Always check the receipt for any typographical errors. A minor mistake, such as an incorrect number, could cause issues when making claims or returns.

Best Practices for Sending Letters

This version reduces redundancy while keeping the meaning intact.

Use clear subject lines to indicate the purpose of the letter. A direct subject helps the recipient identify the letter’s importance quickly.

Address the recipient properly, using their full name or a formal salutation. Avoid using generic terms like “To whom it may concern” unless absolutely necessary.

Ensure the content is concise and to the point. Avoid long-winded explanations or irrelevant details that might confuse the recipient.

Include necessary details like payment amounts, reference numbers, and relevant dates in an organized manner. This makes the letter more understandable and useful to the recipient.

Always double-check for spelling and grammatical errors. A well-written letter reflects professionalism and care, which is vital when discussing payments.

If sending the letter via email, attach it as a PDF or another universally accessible format. This ensures the recipient can easily open and read the document.

Follow up if needed, but allow a reasonable time for a response before doing so. This shows respect for the recipient’s time while ensuring the matter is addressed in a timely manner.