Payment Schedule Letter Template for Effective Planning

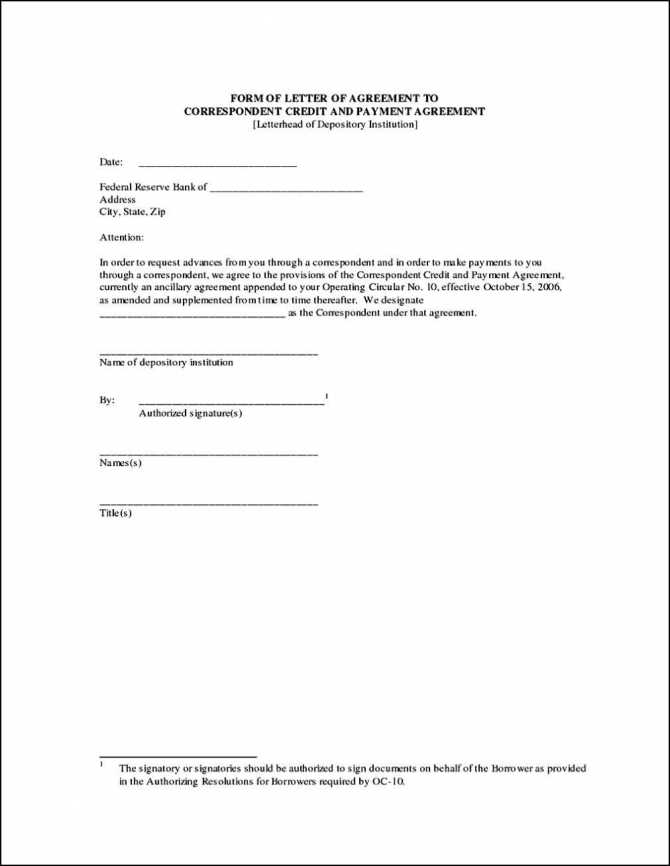

Establishing clear terms for financial obligations is essential to maintaining smooth transactions between individuals or businesses. This document outlines how to organize and formalize payment arrangements to ensure clarity and avoid misunderstandings. A well-organized arrangement can benefit both parties by setting clear expectations and reducing the likelihood of disputes.

Importance of Clear Payment Terms

Having specific and transparent guidelines for repayment can significantly impact the success of any financial agreement. Both sides benefit when the amount, deadlines, and conditions are well-documented. This allows the paying party to understand their responsibilities while providing the receiver with an assurance that payments will be made in a timely manner.

Key Components to Include

- Amount Due: Clearly specify the exact sum that needs to be paid.

- Due Dates: Set specific deadlines for when payments are expected to be made.

- Interest or Fees: If applicable, outline any additional costs, such as interest or late fees.

- Methods of Payment: Specify acceptable ways for transferring funds (e.g., bank transfer, check, online payment).

- Consequences of Late Payments: State the actions that will be taken if deadlines are not met.

Best Practices for Drafting Agreements

Ensure that the terms are straightforward and free of unnecessary complexity. Both parties should agree on the wording to avoid ambiguity. A professional tone should be maintained throughout, and all points must be clear and concise. Additionally, both parties should sign the document to make the arrangement legally binding.

Final Thoughts on Organizing Financial Agreements

Crafting an agreement that includes all relevant details and is easy to understand can help avoid issues down the line. By setting expectations upfront, both parties can move forward with confidence, knowing they are on the same page regarding financial responsibilities.

Overview of Financial Agreements and Structured Plans

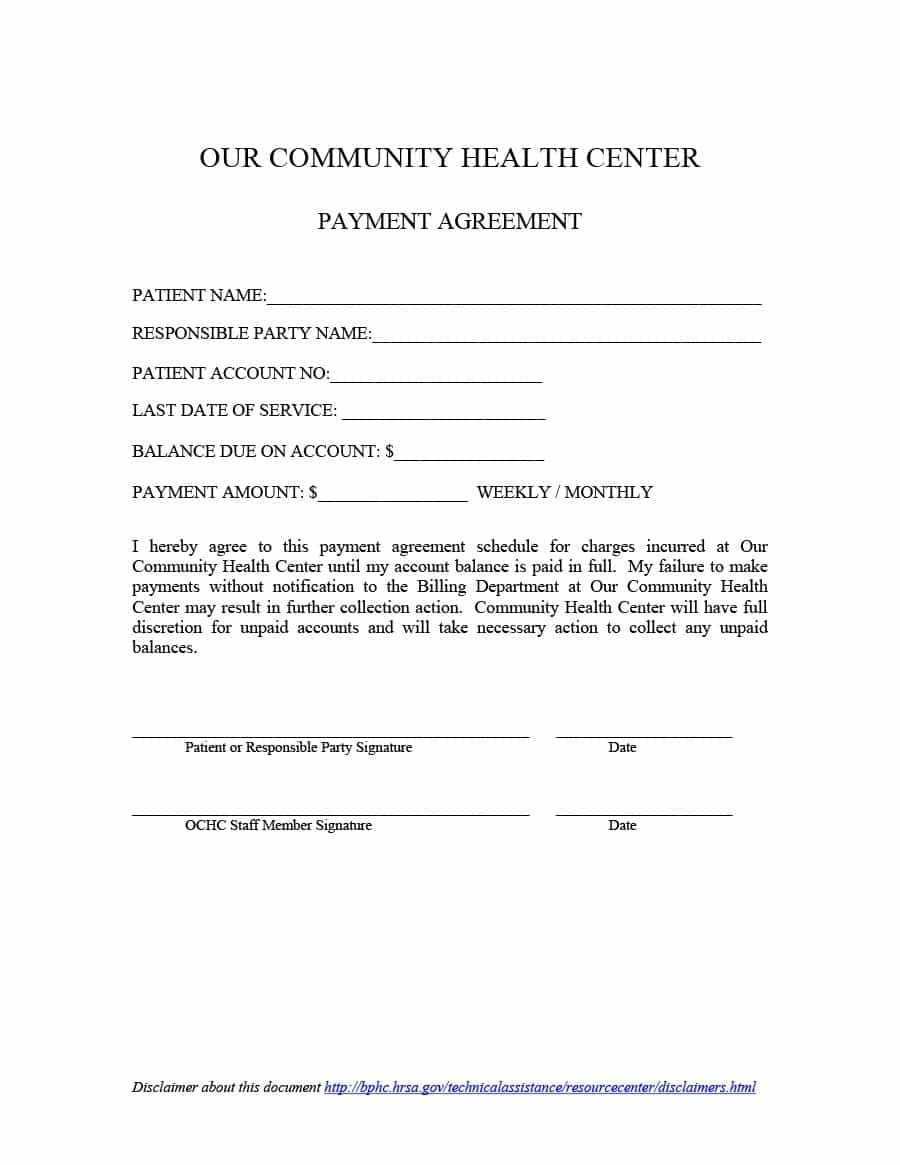

When managing financial obligations, having a well-organized document outlining the terms of payment ensures clarity and fosters trust between all parties involved. It serves as an essential tool for both the creditor and debtor, providing a clear structure for the arrangement. This document helps to avoid confusion, ensuring that both parties are aware of their duties and the timeline for fulfilling the financial commitment.

Importance of Creating Clear Payment Plans

Establishing clear terms for repayments can prevent future misunderstandings. A structured agreement is essential for both sides to have a clear understanding of amounts owed, deadlines, and conditions for payments. This reduces potential disputes and encourages responsible financial behavior.

Steps to Draft an Effective Agreement

- Begin by identifying the amount to be paid and the payment method.

- Clearly outline the deadlines for each installment or full settlement.

- Include any fees or interest charges that may apply if payments are delayed.

- Specify any conditions under which adjustments can be made to the terms.

- Ensure both parties sign the document to confirm agreement and legality.

Key Elements of a Solid Financial Agreement

- Total Amount Due: Clearly specify the amount to be repaid.

- Installment Details: Include the breakdown of the payment plan, if applicable.

- Due Dates: Define when payments are expected to be made.

- Additional Costs: List any charges for late payments or non-compliance.

- Methods of Payment: Specify acceptable payment methods (bank transfer, check, etc.).

How to Avoid Common Mistakes

To ensure the agreement is clear and effective, avoid ambiguous wording or excessive complexity. Make sure to include all essential details and double-check that all terms are accurately represented. Avoid using jargon or unclear language, as this may lead to confusion.

Personalizing the Agreement

While a template can be useful, personalizing the document with specific terms suited to both parties’ needs can make it more effective. Adjusting the tone and details of the arrangement can create a stronger sense of understanding and cooperation.

Effective Communication

Always communicate professionally and respectfully when sending or discussing the agreement. Ensure both parties fully understand the terms and feel comfortable with the arrangement. Keeping open lines of communication will prevent misunderstandings and ensure the agreement is carried out successfully.