Payroll overpayment letter template

If you’ve mistakenly overpaid an employee, it’s essential to address the situation quickly and clearly. A well-structured payroll overpayment letter helps in recovering the excess amount while maintaining a professional relationship with the employee. Start by acknowledging the error and explaining the exact overpayment amount. Be transparent and specific to avoid confusion or misunderstandings.

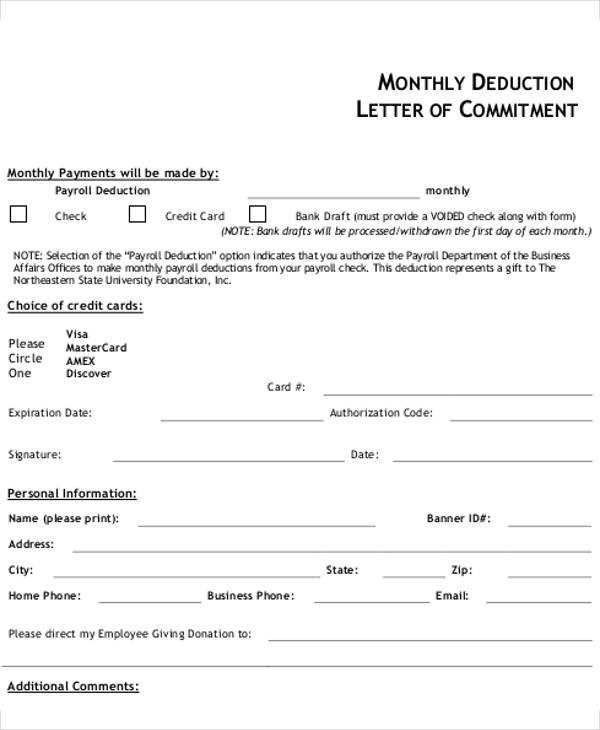

Ensure the letter clearly outlines the method of repayment, whether through a deduction from future paychecks or another arrangement. Providing a timeline for the repayment process helps both parties stay on track. Additionally, include contact information in case the employee has any questions or concerns. This shows your commitment to resolving the matter smoothly and respectfully.

In case the employee is unable to repay the overpayment immediately, offer flexibility in the repayment plan. This can go a long way in maintaining a positive working relationship. Always ensure the tone remains professional, respectful, and understanding throughout the letter.

Payroll Overpayment Letter Template

Begin the letter with a clear statement of the overpayment and its amount. Specify the date the overpayment was made and the period it covers. Be direct in informing the recipient of the overpayment and the next steps to resolve the issue.

Key Elements to Include

| Section | Details |

|---|---|

| Recipient’s Name | Start with the employee’s full name and job title for clarity. |

| Overpayment Amount | Clearly mention the total amount of the overpayment. |

| Overpayment Period | Indicate the specific pay period or dates for which the overpayment applies. |

| Payment Details | Explain how the overpayment was made (e.g., extra hours, incorrect rate). |

| Repayment Plan | Outline how the overpayment will be recovered or refunded. |

| Contact Information | Provide contact details for further inquiries or clarifications. |

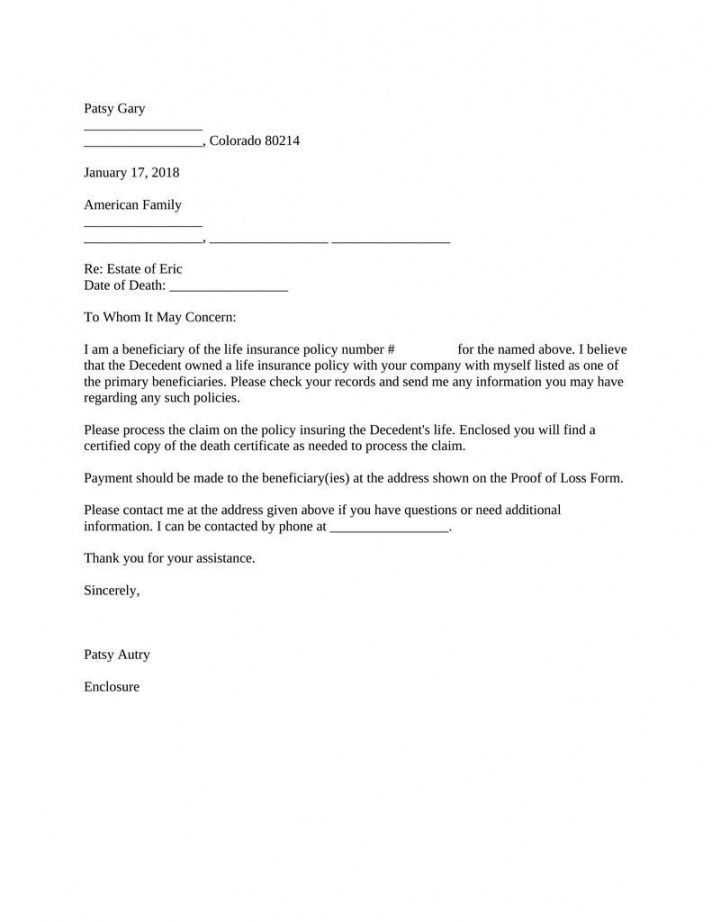

Sample Template

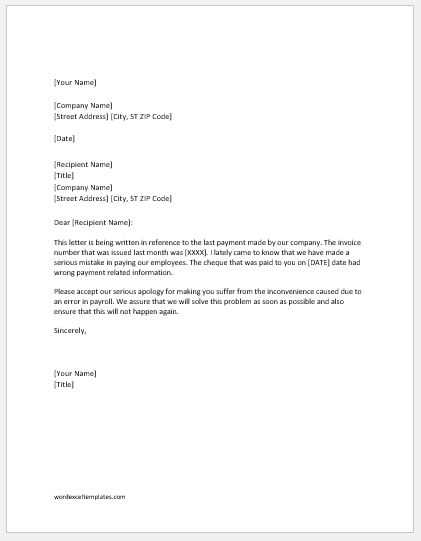

Dear [Employee Name],

We would like to inform you that an overpayment has been made to you for the [insert period]. The total amount overpaid is [insert amount]. This overpayment occurred due to [briefly explain reason, e.g., incorrect hours or rate applied].

To resolve this, we propose a repayment plan where [insert repayment method, e.g., deduction from future paychecks]. Please let us know if this plan works for you, or if you have any questions or concerns, feel free to contact us at [insert contact information].

Thank you for your attention to this matter.

Sincerely,

[Your Name]

[Your Job Title]

Identifying Payroll Overpayment Issues

First, verify the accuracy of employee records. Compare the payroll data with official work hours and contracts. Look for discrepancies such as:

- Excessive overtime pay

- Incorrect salary rates or hourly wages

- Missed deductions for benefits or taxes

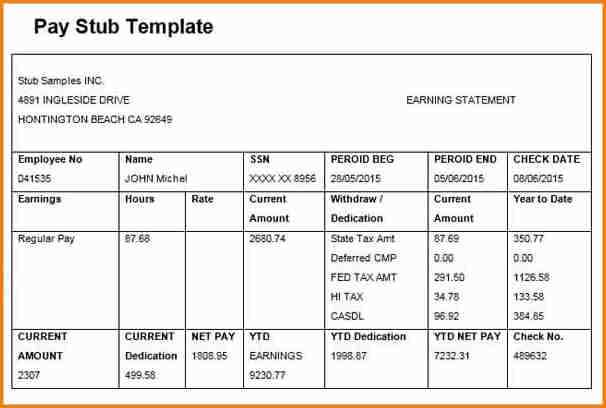

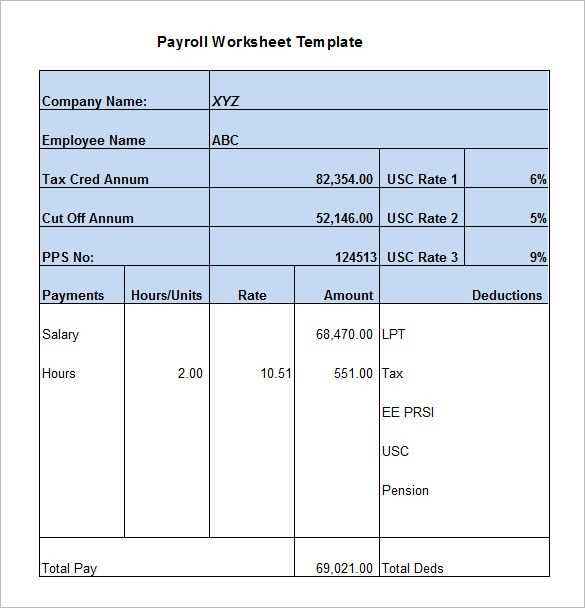

Check the pay stubs against the payroll system for any calculation errors. A common mistake is inputting incorrect hours or misclassifying employees’ pay rates. Address missing or duplicated payments promptly to prevent confusion.

Ensure that the correct deductions for taxes, benefits, and other withholdings are applied based on the current employee status. Incorrect deductions can lead to overpayments. Look for any unprocessed updates, such as tax changes or benefits adjustments, that may affect employee pay.

Reviewing payroll processing dates is another key factor. Overpayment may occur if payroll processing happens too early or late relative to the actual work performed. A simple review of work schedules and payroll dates will often uncover issues in timing.

Lastly, confirm if there are any automated processes in the payroll system that may be causing overpayments, such as incorrect bonuses or holiday pay. Regular audits of automated calculations help to identify and resolve these issues before they affect employees’ paychecks.

Key Elements to Include in the Letter

Clearly state the overpayment amount and the period it covers. Be specific about the discrepancy, referencing payroll dates and the exact figures involved. This ensures the recipient understands the issue immediately.

Provide a clear explanation of how the error occurred. Avoid unnecessary details, but be transparent about the nature of the mistake, whether it was a calculation error or data entry oversight.

Offer a proposed solution for the repayment. Specify whether you expect the employee to repay the overpaid amount in full or if installments will be an option. Include clear instructions on how the repayment can be made.

Include a deadline for repayment or a timeline for resolving the matter. This helps both parties plan accordingly and ensures a smooth resolution process.

Provide contact information for any questions or clarifications. Encourage the recipient to reach out if they need further assistance or need to discuss the matter in more detail.

Express understanding and professionalism. Acknowledge that errors can happen and that you’re committed to resolving the matter fairly. This helps maintain a positive working relationship with the employee.

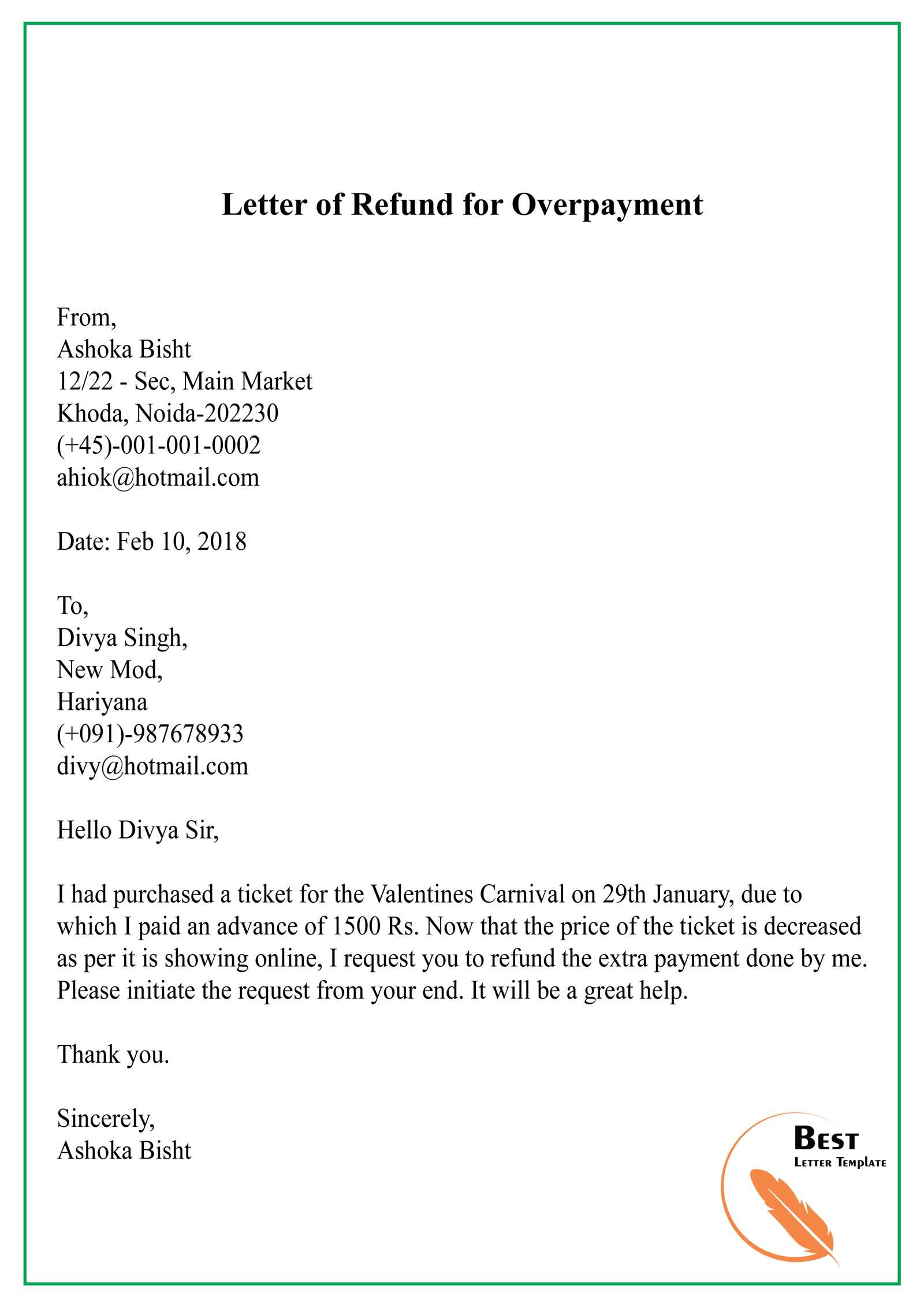

How to Politely Communicate Overpayment in a Letter

Begin by addressing the recipient politely, acknowledging the positive aspects of their work or cooperation before addressing the issue. Clearly state that an overpayment has been identified and briefly describe the situation without assigning blame.

Step 1: Acknowledge the overpayment

Start with a clear statement, such as:

- “We have noticed an overpayment of $X in your recent paycheck.”

- “It seems that an extra amount was included in your last payment.”

Step 2: Offer a solution

Present a clear course of action for addressing the issue. Make sure to provide options that make it easy for the recipient to take the next steps. For example:

- “We are happy to arrange a deduction in your next paycheck to correct this.”

- “Please let us know if you prefer a refund via check or bank transfer.”

Finally, express gratitude for their understanding and cooperation. Offer assistance in case they have any questions or need further clarification.

Setting a Clear Repayment Plan

Establish a repayment plan that is both realistic and manageable for the employee. Be clear about the total overpayment amount and outline the steps for repayment in simple terms. Set specific repayment dates and amounts to avoid confusion. If the full amount cannot be paid in one lump sum, offer a reasonable installment schedule based on the employee’s financial situation.

Provide options for the employee to suggest a repayment period that aligns with their paycheck cycles. This flexibility ensures that both parties are comfortable with the plan and prevents undue financial strain. Consider offering automatic deductions from future wages to simplify the process for both the employee and the employer.

Keep a record of the agreed-upon plan and ensure that the employee acknowledges it in writing. This helps prevent misunderstandings and provides clarity for future reference. If any adjustments to the plan are needed, communicate them promptly and in writing, maintaining transparency throughout the process.

Legal Considerations When Handling Payroll Overpayments

Correcting payroll overpayments requires adherence to legal guidelines. It is vital to act promptly and transparently to avoid disputes. Employers should notify employees as soon as possible after identifying an overpayment, explaining the reason for the discrepancy and the steps to resolve it.

Understanding Repayment Terms

Employers should clearly communicate the repayment terms, including the amount to be repaid and the timeline for repayment. Avoid abrupt deductions from future paychecks. Instead, offer an installment plan if the repayment amount is significant. Be mindful of state-specific regulations that may limit how much can be deducted from an employee’s wages.

Employee Rights and Protections

Ensure that employees are aware of their rights during the repayment process. Employees cannot be forced to repay amounts that were not knowingly or voluntarily accepted. In some jurisdictions, laws may protect employees from having excessive repayment amounts deducted from their wages. Always check applicable local labor laws for specific protections that apply to overpayment recovery.

Document all communications with employees regarding payroll overpayments. This will provide clarity and protection in case of any future disputes or misunderstandings.

Best Practices for Follow-Up and Resolution

Act quickly after identifying an overpayment. Delaying resolution can complicate the situation and damage trust. Start by verifying the overpayment amount and ensuring it is accurate. Contact the employee directly with clear and polite communication.

Maintain transparency throughout the process. Provide a detailed breakdown of the overpayment and offer a clear plan for repayment. This helps the employee understand the situation and reduces confusion.

Offer repayment options that are reasonable and flexible. Allow the employee to choose between a lump-sum payment or installment options, depending on what works best for their situation. This demonstrates empathy and supports a smoother resolution.

Be open to discussions and create space for employees to express concerns or ask questions. This can help identify any misunderstandings early and lead to a quicker, more agreeable resolution.

Follow up regularly to ensure the employee is on track with the repayment plan. Send reminders as necessary, but keep the tone respectful and supportive to avoid unnecessary stress.

Document everything related to the overpayment and its resolution. Record all communication, agreements, and adjustments made, ensuring that both parties are aligned. This documentation can protect both the employer and employee in case of future discrepancies.