Ppi Claim Letter Template Guide

If you believe you have been mis-sold a financial product, it’s essential to take the necessary steps to recover the funds owed to you. Writing a formal document to initiate the process is a crucial part of claiming what is rightfully yours. In this guide, we will explore how to craft an effective and compelling request to ensure the best chance of a positive outcome.

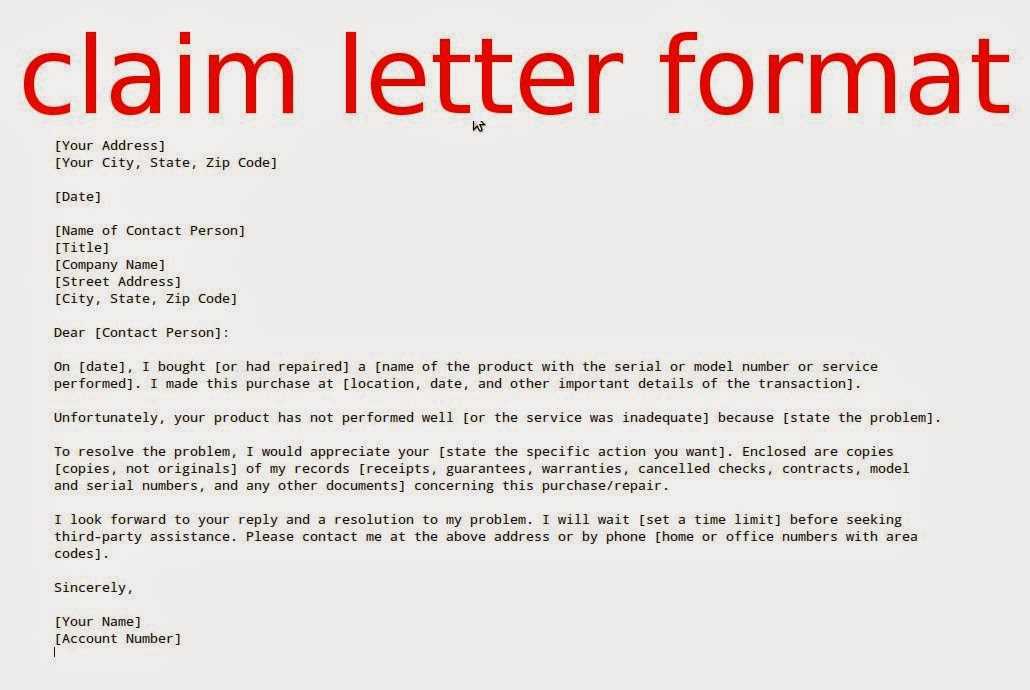

Key Elements to Include in Your Request

Your formal request should clearly communicate your situation and why you believe you are entitled to compensation. Including the following elements is essential for ensuring your message is understood and taken seriously:

- Your personal information: Provide full details such as your name, address, and contact information.

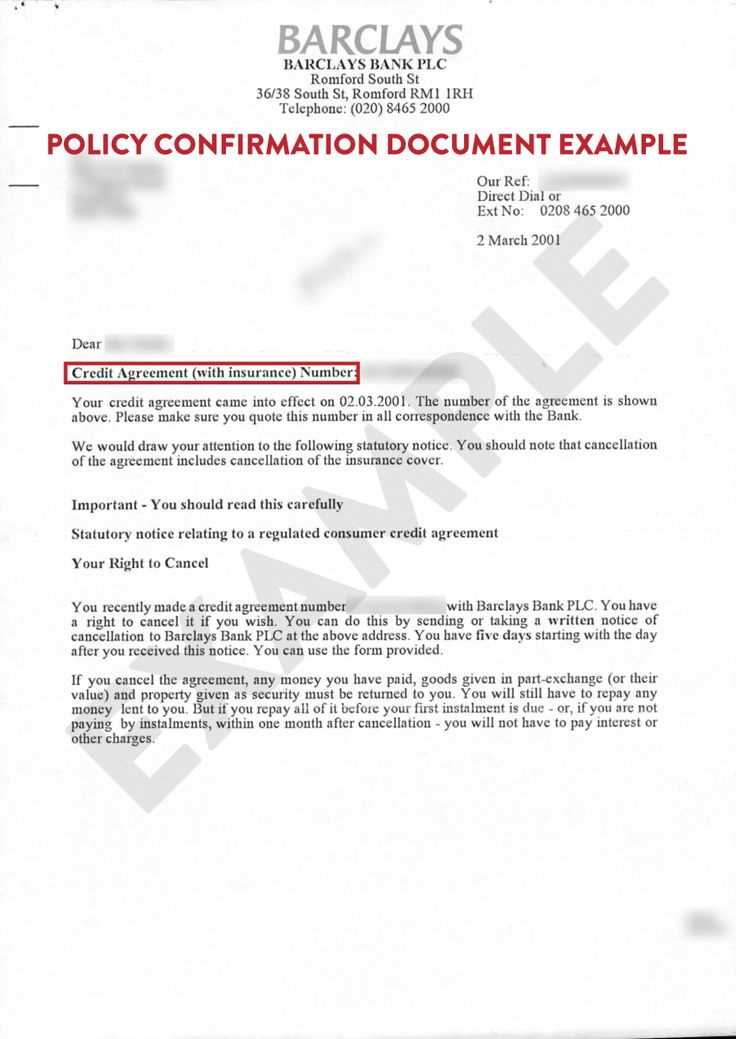

- Details of the product or service: Describe the financial product you believe was mis-sold, including when it was purchased and the provider’s name.

- Clear explanation: Explain how you were misled or why the product was unsuitable for your needs.

- Desired outcome: State the compensation amount you are requesting or the action you wish the company to take.

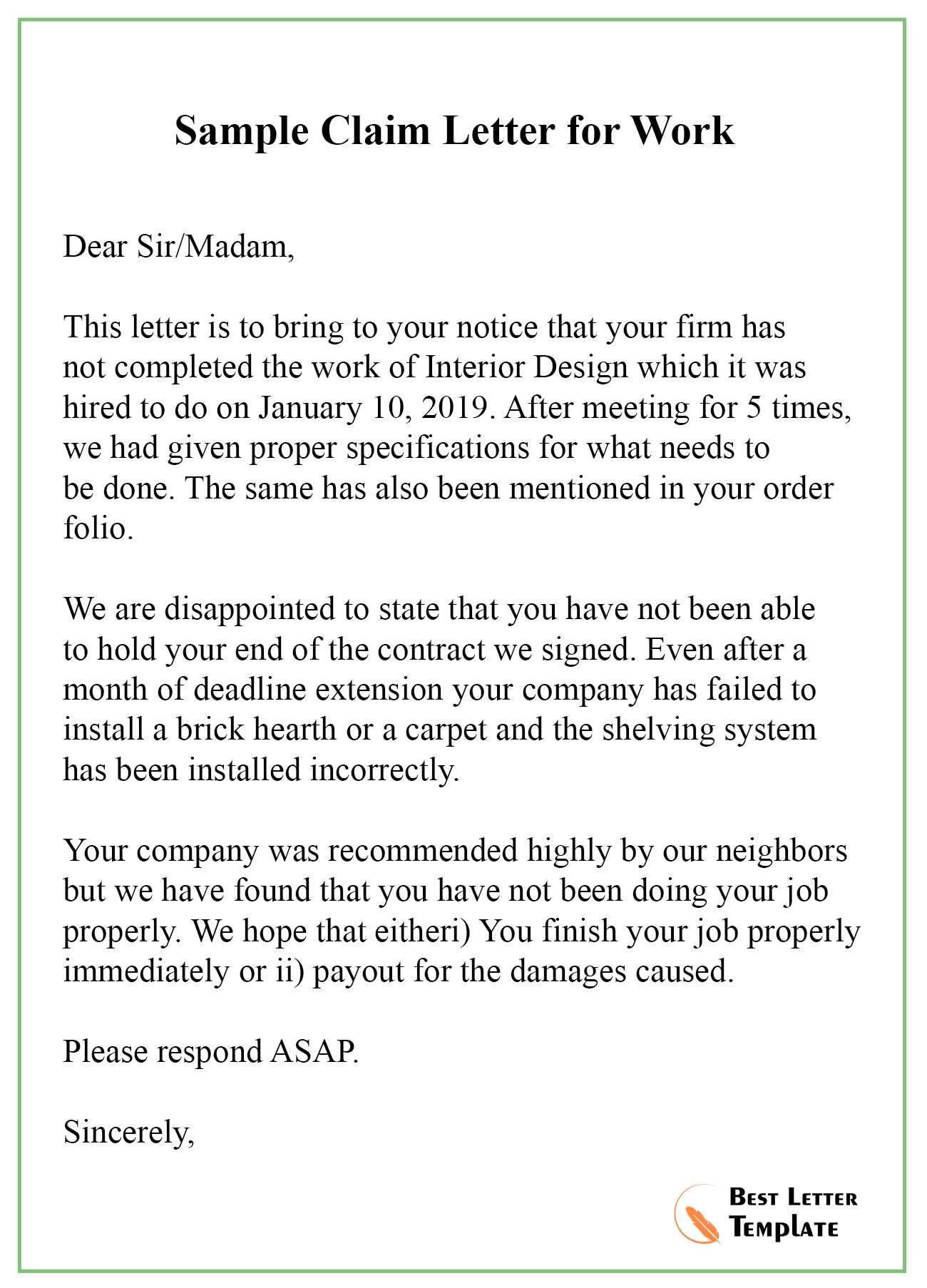

Common Errors to Avoid

- Vague information: Ensure all details are precise and backed by evidence. Lack of clarity can weaken your case.

- Emotional language: Stick to the facts and avoid using overly emotional language that could detract from your credibility.

- Missing supporting documents: Always include relevant paperwork such as receipts, contracts, or statements that support your claims.

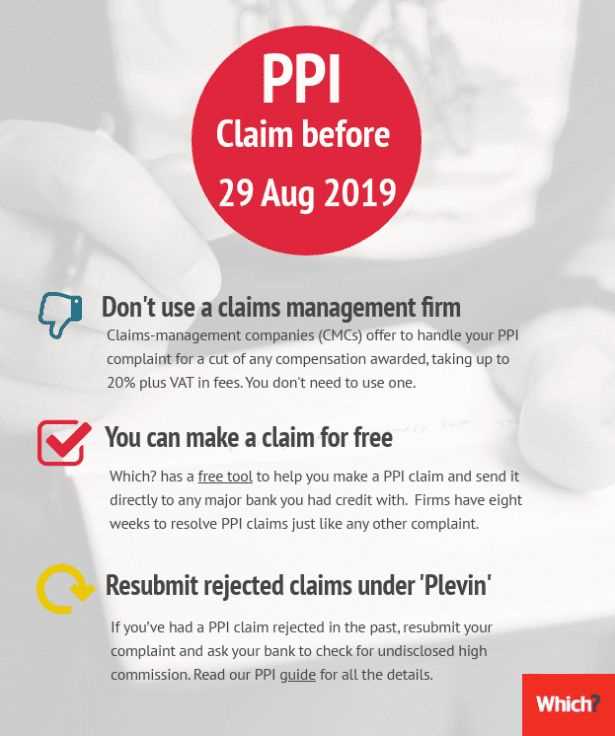

Steps to Take After Writing Your Document

Improving Your Chances of Success

Understanding Financial Compensation Requests and Their Importance

When you feel that you were wronged or misled in a financial transaction, taking action to address the situation is essential. Understanding the process and structure of a formal communication designed to seek compensation can significantly impact your ability to recover what you are owed. In this section, we will explore how to approach writing such a document, what common mistakes to avoid, and how to improve your chances of success.

How to Structure Your Request

The structure of your formal communication is key to presenting your case clearly. Start by introducing yourself and providing your personal details, including contact information. Follow with a brief overview of the situation, detailing the financial product and the issue at hand. A strong document will state the desired outcome and any compensation expected. Keep it concise, clear, and professional.

Common Errors to Avoid in Financial Compensation Requests

Several mistakes can undermine the strength of your request. First, avoid vague language. Specificity in details, such as dates and product descriptions, makes your argument stronger. Second, stay professional and avoid emotional or confrontational tones, as this can detract from the effectiveness of your appeal. Lastly, remember to include all necessary supporting documents such as contracts or payment records, as these provide the proof needed to back your claims.

Essential Information to Include in Your Request

Your formal document must include all relevant information to support your case. Be sure to mention the exact financial product, the circumstances around the purchase, and the issues encountered. Include details such as the date of purchase and the company involved. A clear outline of the problem will make it easier for the recipient to understand and process your request promptly.

How to Improve Your Success Rate

Improving your chances of a favorable outcome requires attention to detail and persistence. Be sure to follow up if you do not receive a response within the expected time frame. Remain calm, polite, and firm throughout the process. Showing that you are organized and serious about your claim can increase the likelihood of a successful resolution.

Tips for Submitting Your Request

Once you have written your communication, ensure it is submitted in the appropriate manner. Many organizations have a specific process for receiving such requests. Follow their guidelines carefully to avoid delays. Keep copies of your document and any correspondence for future reference, and track submission dates to ensure timely follow-up.