PPI Letter Template from Martin Lewis

Many consumers have unknowingly purchased financial products that weren’t suitable for their needs. This has led to a significant number of claims being made to recover funds for these mis-sold items. Understanding the process can be crucial in ensuring a successful claim and getting back what is rightfully yours.

When taking action to request compensation, having a clear and effective approach is essential. Utilizing proven strategies can simplify the process and increase your chances of a positive outcome. By following a straightforward format, you can ensure all necessary details are included and present your case in the best possible light.

Efficiently drafting your claim and knowing how to address the right parties can be daunting. However, with a clear structure and the right guidance, even those new to the process can navigate the steps with confidence and clarity. It’s important to stay informed and follow a methodical approach to maximize your chances of success.

Overview of Compensation Process

When individuals are misled into purchasing financial products that were not suitable for their needs, they have the right to seek compensation. The process of claiming back the money paid for such products involves several clear steps to ensure that the complaint is handled correctly and effectively. The journey begins with identifying the issue and determining the best way to approach the provider.

To successfully pursue compensation, individuals must gather relevant information, including the nature of the product and details about how it was mis-sold. Once the claim is submitted, the financial institution is obligated to review the case and respond. A structured and detailed submission increases the chances of a swift and favorable outcome.

The entire procedure can be completed independently, but utilizing guidance from experts or utilizing pre-drafted documents designed to address the most important elements can help streamline the process. Proper follow-up and tracking of the claim are also essential to ensure it progresses smoothly.

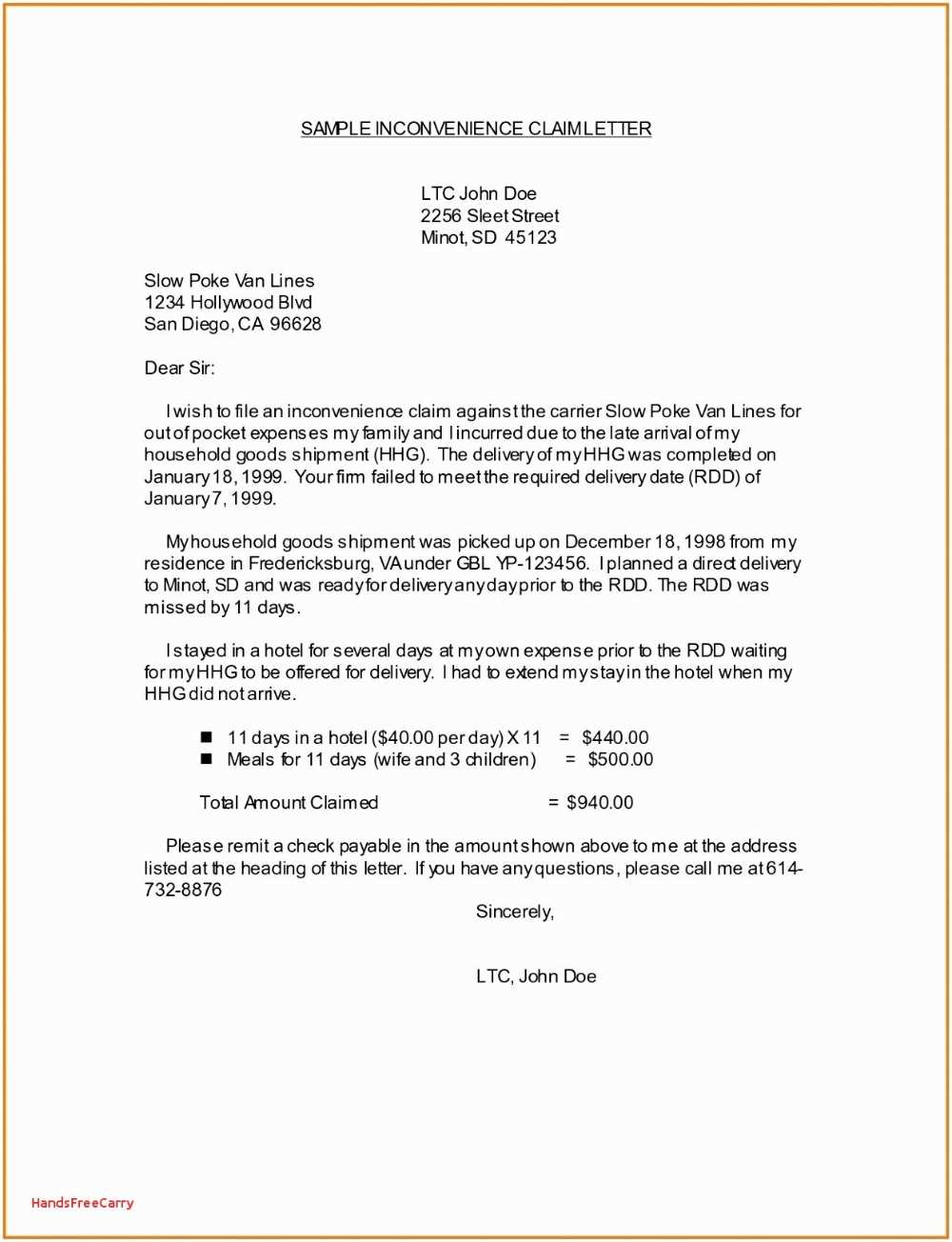

How to Use Martin Lewis’ Template

To successfully pursue compensation for mis-sold financial products, utilizing a well-structured document can significantly simplify the process. A proven format is available that guides users through the essential details needed for a formal complaint. By following this outline, individuals can ensure that they cover all necessary points, increasing the likelihood of a successful claim.

Here’s how to make the most of this tool:

- Personal Information: Begin by clearly stating your full name, address, and contact details. Make sure to include any reference numbers linked to your financial product.

- Explain the Issue: Provide a detailed description of how the product was mis-sold. Include dates, communication, and any promises made by the provider.

- State Your Claim: Clearly express your request for a refund or compensation, specifying the amount you are seeking and why you believe it is owed to you.

- Supporting Documents: Attach any relevant paperwork that can strengthen your case, such as contracts, emails, or other communication records.

- Request for Resolution: Conclude by outlining the next steps you expect from the company, including a reasonable timeframe for a response.

By adhering to this structure, you present a strong case that is clear, concise, and easy for the recipient to review. Following the recommended approach helps ensure that no critical details are overlooked, boosting your chances of a favorable outcome.

Writing an Effective Claim Document

Crafting a clear and compelling complaint is essential when seeking compensation for mis-sold financial products. A well-written submission not only communicates your concerns but also ensures that all relevant information is easily accessible to the recipient. The goal is to present your case in a way that is both concise and persuasive, making it easier for the company to understand your position and respond appropriately.

Start with Clear Personal Information: Make sure to include your full name, address, and contact details at the beginning. Providing any account or reference numbers associated with the product helps the recipient quickly identify your case.

Detail the Issue: Describe the situation in a structured way, emphasizing how the product did not meet your needs. Outline specific instances where you believe the product was mis-sold, such as misleading information, pressure tactics, or failure to explain key terms.

Be Direct in Your Request: Clearly state what you are asking for, whether it’s a full refund, compensation, or a combination of both. Be specific about the amount you believe you are entitled to, and explain why this is a fair resolution based on your experience.

Provide Supporting Evidence: Attach any documents that can support your claim, such as emails, contracts, or terms and conditions. Evidence helps strengthen your case and shows that you are prepared.

Set Expectations for Response: Indicate a reasonable timeframe within which you expect to hear back. This helps keep the process moving and shows that you are serious about receiving a resolution.

Common Pitfalls When Filing Claims

While pursuing compensation for mis-sold financial products, many individuals fall into common traps that can delay or even jeopardize their chances of success. Understanding these potential missteps can help you avoid costly mistakes and streamline the process. It’s crucial to approach the claim methodically and avoid oversights that may undermine your case.

Incomplete Information: One of the most frequent errors is failing to provide all necessary details. This can include personal information, product specifics, or key dates. Without a complete record, your case may be dismissed or delayed.

Vague Descriptions: Being unclear or general about how the product was mis-sold can weaken your claim. It’s important to be specific, providing concrete examples and evidence to support your argument.

Ignoring Deadlines: Many individuals overlook the importance of submitting claims within the required timeframe. Missing deadlines can lead to automatic rejection, so always verify the time limits associated with your claim.

Neglecting Supporting Documents: Failing to include relevant evidence such as contracts, emails, or correspondence can significantly impact your chances of success. Having the right documentation to back up your claim is essential.

Not Following Up: Once a claim is submitted, it’s important to regularly follow up and track progress. A lack of follow-up can lead to delays, leaving your case unresolved for longer periods than necessary.

Essential Details to Include in Your Letter

When filing a formal complaint for mis-sold financial products, it’s crucial to ensure that all the necessary details are clearly included. A well-organized and thorough document will allow the recipient to fully understand your case and take the appropriate action. Providing key information in an easy-to-read format can significantly enhance the chances of your claim being processed efficiently.

Key Personal and Product Information

Make sure to include personal details that can help identify you and your case. In addition, include specific information about the financial product involved, such as the account number, dates, and the nature of the product itself.

| Detail | Example |

|---|---|

| Full Name | John Doe |

| Address | 123 Elm Street, Townsville, ABC123 |

| Reference Number | ABCD123456 |

| Product Type | Personal Loan |

| Relevant Dates | August 1, 2015 – January 30, 2017 |

Clear Explanation of the Issue

Be sure to explain the circumstances surrounding the mis-selling clearly. Describe the misleading information, lack of proper guidance, or any other issue you encountered with the product. The more precise you are, the easier it will be for the company to assess your claim.

Best Practices for a Successful Claim

To ensure a smooth and successful claim process, it’s essential to follow certain best practices. Properly organizing and presenting your case can significantly increase the chances of your request being approved. By being thorough and attentive to detail, you demonstrate your commitment to the process and improve the likelihood of a favorable outcome.

Prepare All Required Information

Gathering the necessary documentation is the first step toward a successful claim. This includes all relevant records such as contracts, transaction details, and communication exchanges. Ensure that you have everything on hand to support your case effectively.

- Account numbers and policy details

- Correspondence with the provider

- Relevant dates and transaction history

- Any additional supporting documents

Follow Clear and Concise Communication

When making your case, clarity and precision are key. Avoid using vague language or leaving out essential details. Being direct and specific helps the recipient understand your position and the reasons behind your request.

- State your case clearly and without unnecessary detail

- Be specific about how the product was mis-sold or mishandled

- Provide evidence that supports your claims

- Keep your tone professional and respectful

Monitoring the Progress of Your Claim

Once you’ve submitted your request for a refund or compensation, it’s important to stay actively involved in the process. Tracking the progress ensures that any delays or issues are identified early and can be addressed promptly. Regular follow-ups and keeping detailed records of all communications are essential to moving things forward efficiently.

Stay in Contact with the Provider

Maintain regular communication with the company handling your case. Contact them periodically to inquire about the status of your claim. If any further information or action is required, it’s important to respond quickly to avoid unnecessary delays.

- Set reminders to follow up every few weeks

- Document all interactions, including dates and names

- Ask for updates in writing for clarity

Know Your Rights and Deadlines

Familiarize yourself with the timeline for processing claims and the specific regulations in place for your situation. By understanding the deadlines and your rights, you can better manage your expectations and ensure that the process stays on track.

- Be aware of statutory time limits for claims

- Understand the typical processing time for cases

- Ensure that the company adheres to legal requirements