Pre approval letter template

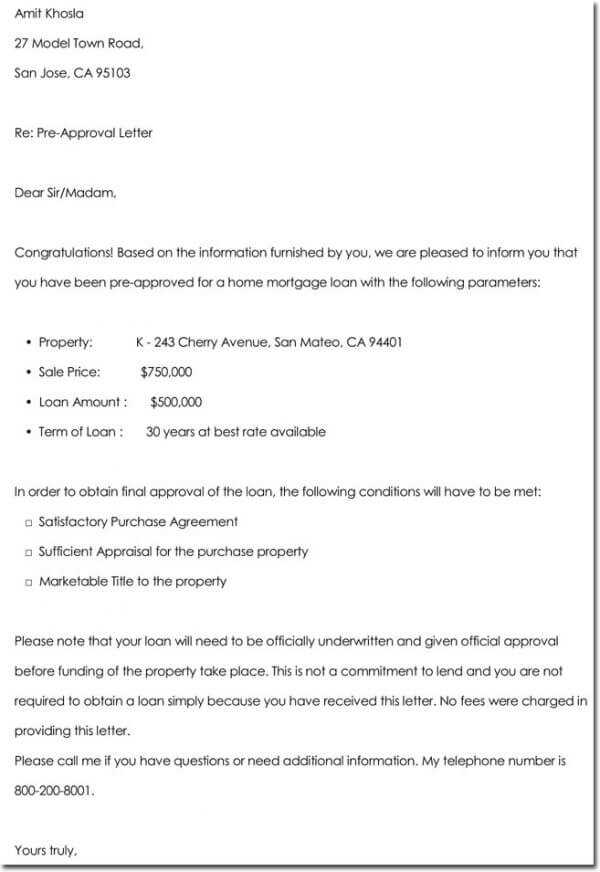

A pre-approval letter is a crucial document in the home-buying process, offering both clarity and confidence for buyers and sellers. This letter proves that a lender has evaluated a borrower’s financial situation and determined that they qualify for a loan up to a specific amount. Having a pre-approval letter in hand can significantly speed up the home buying process and position buyers as serious candidates in competitive markets.

To create a pre-approval letter, start by clearly outlining the loan amount, the type of loan, and the terms that the lender is willing to offer. Ensure that the letter includes the buyer’s name, the lender’s contact details, and the conditions under which the pre-approval is granted. A well-crafted letter will also state that the approval is contingent on the buyer meeting any final conditions, such as completing a home appraisal or providing additional financial documentation.

Make the tone professional yet approachable, providing all necessary details without overwhelming the reader. This will allow potential homeowners to move forward with confidence, knowing that they have financial backing from a lender and can proceed with serious offers when they find the right property.

Here’s the revised version with minimal repetition of words:

Ensure your pre-approval letter is clear and direct. Include the applicant’s name, loan amount, and property type. Specify the conditions for approval, such as income verification or credit score. Keep the tone formal yet approachable.

Include the lender’s contact details for further communication. Indicate the time frame within which the pre-approval is valid. If applicable, outline any necessary documentation the borrower needs to submit for final approval.

Sign off with a polite closing, emphasizing the lender’s willingness to assist with the next steps in the process. Avoid over-explaining, and instead, focus on providing straightforward information that is easy to follow.

Pre-Approval Letter Template: A Practical Guide

How to Write a Mortgage Pre-Approval Letter

Key Information to Include in a Pre-Approval Letter

Common Mistakes to Avoid When Creating a Pre-Approval Letter

Understanding the Importance of Pre-Approval for Home Buyers

How a Pre-Approval Letter Can Strengthen Your Offer in a Competitive Market

What to Do After Receiving Your Pre-Approval Letter

A mortgage pre-approval letter is a key tool in the home-buying process. It demonstrates to sellers that you’re a serious buyer with the financial means to complete a purchase. Here’s a guide to writing a clear, professional pre-approval letter.

How to Write a Mortgage Pre-Approval Letter

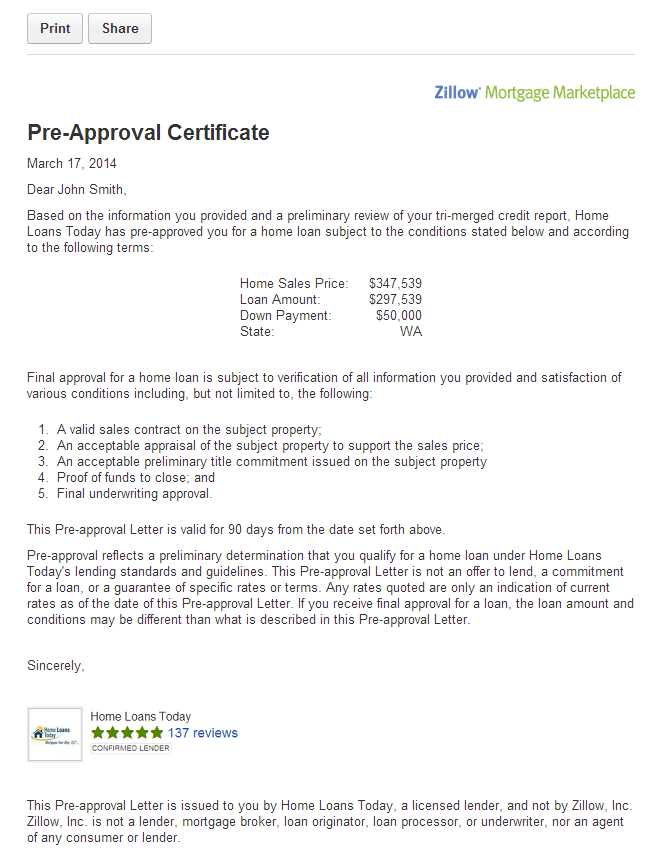

Start with your lender’s contact information, including their name, title, and company. Then, include the buyer’s details, such as name and the pre-approval amount. Ensure that the letter is clear about the loan type, interest rate, and any contingencies involved. End with a signature from the lender confirming the pre-approval status.

Key Information to Include in a Pre-Approval Letter

- Loan amount: Clearly state the loan amount the buyer is pre-approved for.

- Interest rate: Mention the interest rate offered and whether it’s fixed or adjustable.

- Loan term: Include the loan term (e.g., 30 years, 15 years).

- Pre-approval conditions: Specify any conditions that apply, such as income verification or appraisals.

- Expiration date: Indicate the date when the pre-approval expires.

Common Mistakes to Avoid When Creating a Pre-Approval Letter

- Not verifying all buyer information–ensure all details, like income and debt levels, are accurate.

- Overlooking pre-approval conditions–be clear about any terms that may affect the approval process.

- Vagueness in the letter–ensure all financial details are specific and understandable to the seller.

- Failure to update the letter–make sure the letter reflects the current financial situation of the buyer.

Understanding the Importance of Pre-Approval for Home Buyers

A pre-approval letter gives you a clear picture of how much you can afford and sets realistic expectations. Sellers often prefer buyers with pre-approval since it indicates that the buyer has already undergone a thorough review of their financial health and can secure financing quickly.

How a Pre-Approval Letter Can Strengthen Your Offer in a Competitive Market

In a competitive housing market, a pre-approval letter can differentiate you from other buyers. Sellers are more likely to consider offers from buyers who are pre-approved since it reduces the risk of delays or financing issues.

What to Do After Receiving Your Pre-Approval Letter

Once you have your pre-approval letter, keep it updated and share it with your real estate agent when making offers. Be mindful of any changes in your financial situation, as they can affect your loan status. Finally, proceed with finding a home that matches the pre-approval amount and fits your needs.

This version retains the meaning and structure while minimizing word repetition.

To create a pre-approval letter with clarity and precision, focus on direct language and streamlined content. Avoid unnecessary phrases, and ensure that each sentence conveys the purpose without redundancy. Instead of repeating terms, utilize varied sentence structures to maintain a smooth flow of information. Begin by clearly stating the approval status, followed by the terms of the agreement. Present any additional requirements concisely, and close with a clear call to action or next steps. This approach keeps the message clear and professional while avoiding repetition.

Avoid excessive adjectives or filler words that do not add value to the core message. Each section of the letter should be informative but concise, focusing on the details that matter most to the recipient. A straightforward tone builds trust and ensures the purpose of the letter is clear, leaving no room for confusion.