Private Mortgage Payoff Letter Template Guide

When you complete the payment of a loan, you may need to request formal confirmation from your lender to mark the official end of the agreement. This document serves as proof that all outstanding amounts have been cleared and that you have fulfilled your financial commitment. It’s a key step in ensuring all records are updated and legally finalized.

Key Information to Include

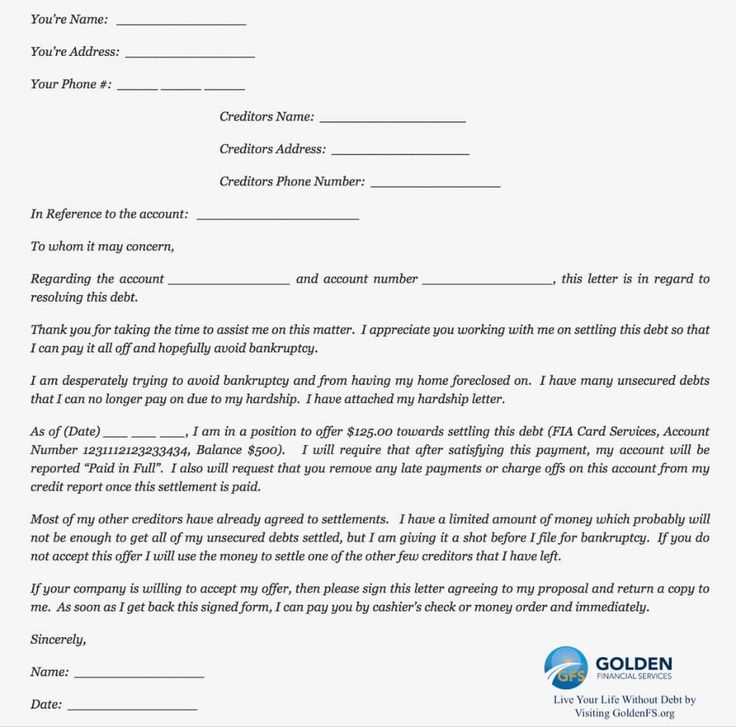

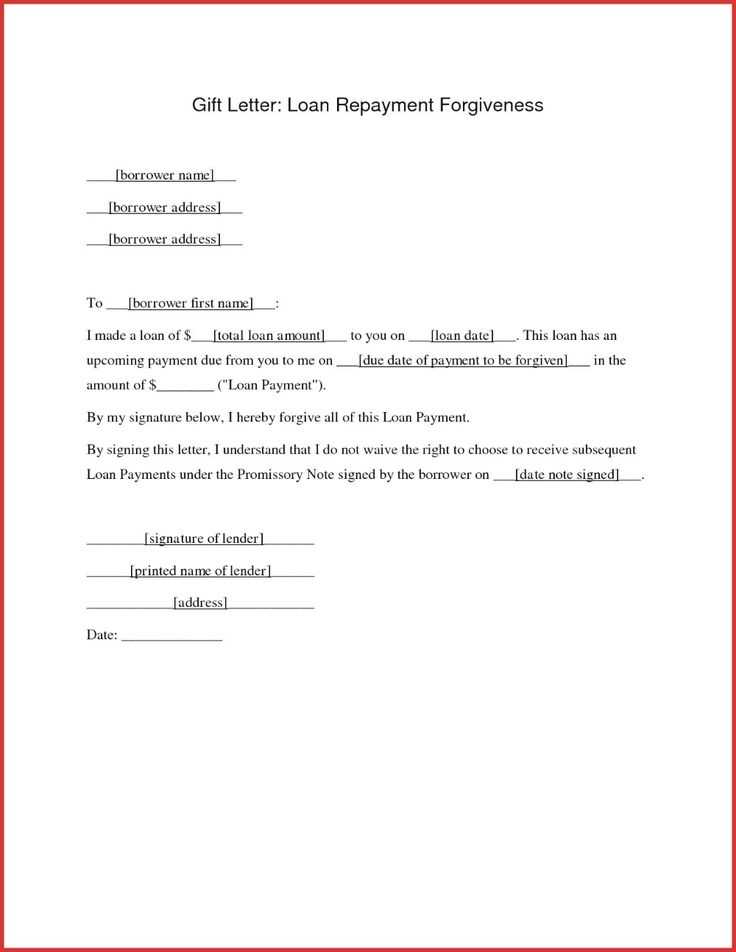

The document should contain specific details to confirm the settlement has been achieved. The following points should be addressed:

- Personal and loan details: Include your full name, account number, and loan reference.

- Final payment amount: Clearly state the exact sum paid, including any interest or fees.

- Confirmation of full payment: The statement should confirm that the balance is now zero.

- Official signatures: Both the lender and borrower should sign to validate the completion.

Steps to Draft the Document

Creating this document is a simple task if you follow a clear format. Start with the date, followed by your personal information and loan specifics. Specify the full payment amount and include a formal acknowledgment from the lender. Ensure the document is concise and clear, with no ambiguity about the payment status.

Avoid Common Mistakes

There are a few common errors to watch out for when requesting this official confirmation:

- Missing or incorrect account details.

- Failure to specify the exact amount paid.

- Not obtaining the required signatures.

What Happens After the Settlement

Once the document is issued, ensure that all relevant parties are notified, including credit bureaus if necessary. This will prevent any future misunderstandings or issues related to the loan account. It’s important to keep a copy of the document for your records and to ensure your financial history reflects the completed transaction.

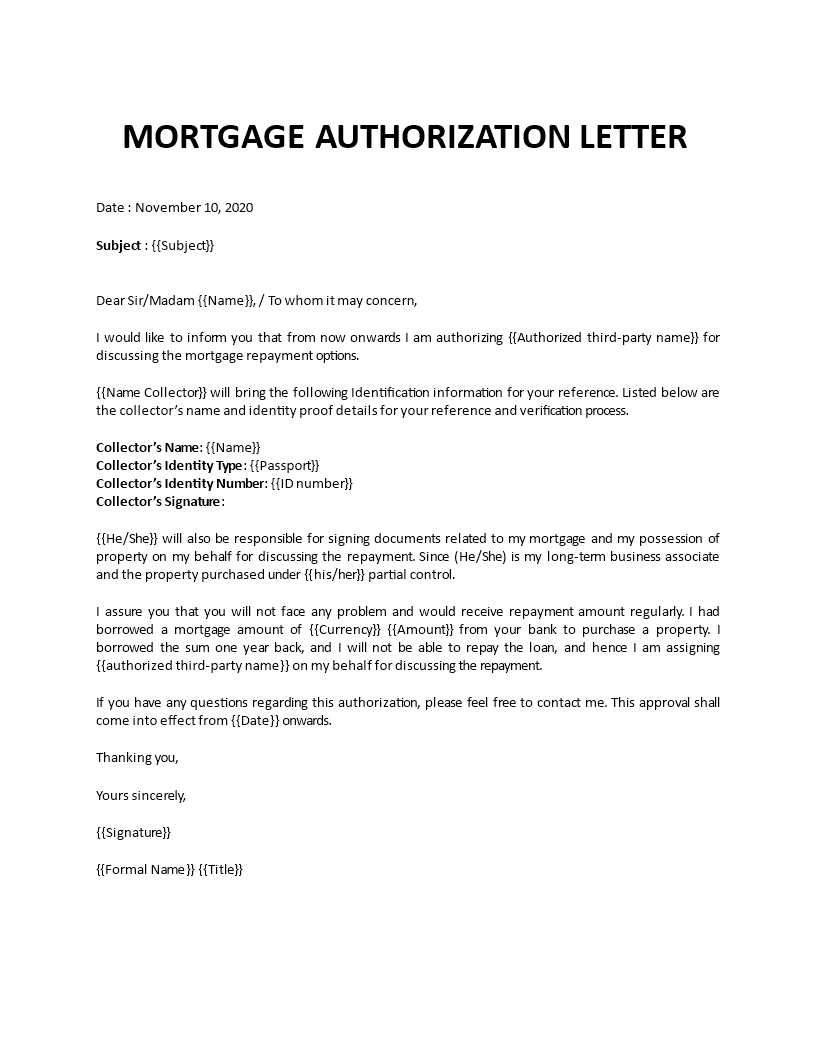

Understanding Loan Settlement Documents

When you settle a loan, obtaining an official document from your lender confirming the full payment is crucial. This document serves as evidence that the debt has been cleared, ensuring that both parties are in agreement regarding the loan’s closure. It’s an essential step in securing your financial record and preventing any future disputes over the remaining balance.

Why a Settlement Statement is Important

A settlement statement is vital for several reasons. It acts as a record of the transaction and protects both you and the lender from any future confusion or misunderstandings. This document guarantees that the loan has been fully paid and that there is no remaining balance. It’s also necessary when updating credit records to reflect that the debt has been cleared.

Key Information to Include in the Document

To ensure the document is complete and valid, it must include specific details:

- Identification details: Full name, account number, and loan reference are essential.

- Exact payment amount: The total sum paid, including interest or fees, should be clearly stated.

- Confirmation of balance clearance: The statement should indicate that the balance is fully settled.

- Signatures: Both the lender and borrower should sign the document to authenticate it.

Ensuring that these elements are present helps avoid any future confusion or potential legal issues.