Proof of funds template letter

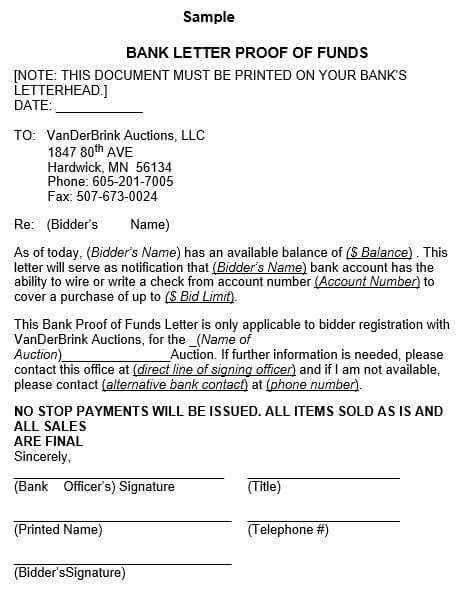

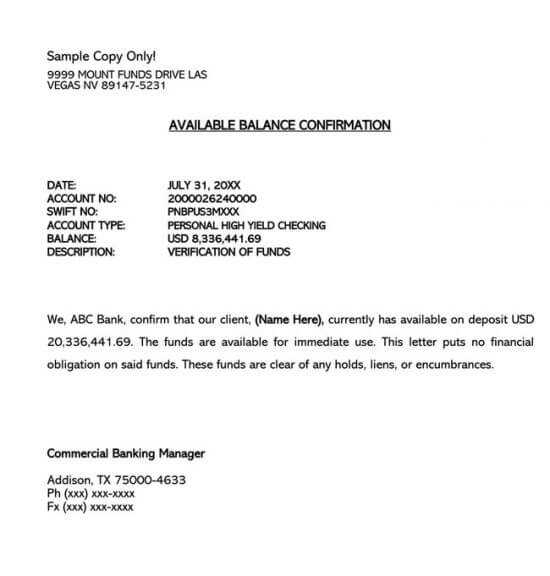

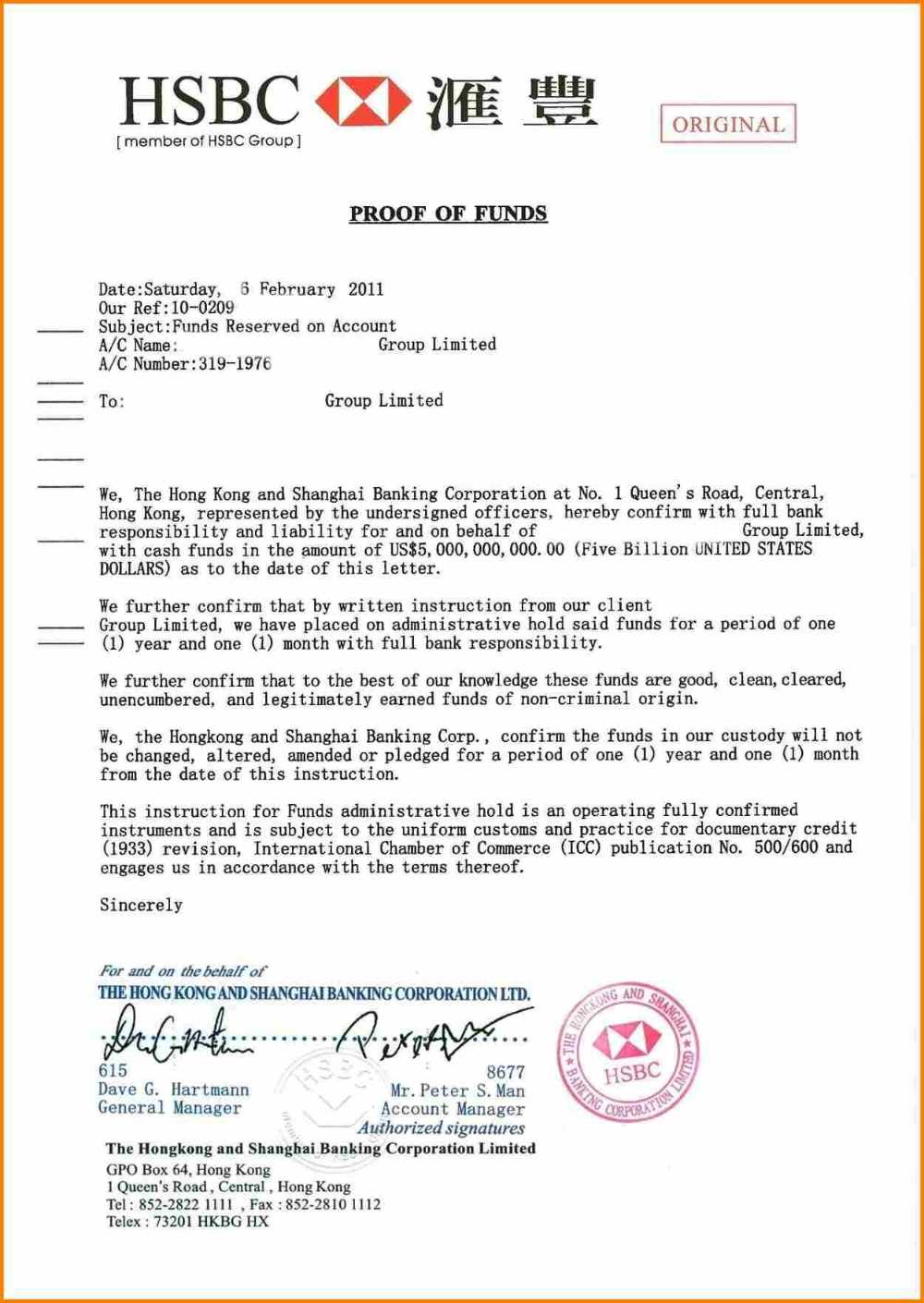

To draft a proof of funds letter, ensure it clearly states the necessary financial details to demonstrate your ability to meet a financial requirement. Include the name of the account holder, account type, and current balance. The letter should come directly from your bank or financial institution for authenticity.

Start by addressing the recipient of the letter with their title and name. Specify the purpose of the letter right after, explaining that the letter serves as proof of funds for a particular transaction or investment. Clearly mention the total balance available in the account and provide any supporting details such as the type of account and date of the statement.

Make sure to include any required bank letterhead and ensure it is signed by an authorized representative from the bank. This adds credibility to the document and assures the recipient that the information is valid. Be direct and professional while providing the information without unnecessary elaboration.

Lastly, remember to double-check the details for accuracy before submitting the letter. A concise, clear, and well-documented proof of funds letter will help meet the requirements efficiently.

Here’s an edited version with reduced repetition:

Use clear and concise language when drafting your proof of funds letter. Begin by stating the account holder’s full name and the specific amount of funds available. Ensure the bank’s name, address, and contact details are included, along with a confirmation of the available balance. The letter should confirm that the funds are liquid and accessible, making no assumptions about future availability.

Include the date the funds were verified and the method of verification, such as through account balance or investment statement. Ensure the document is signed by an authorized bank representative, with their title and contact information listed for any follow-up. This information guarantees the validity of the statement while maintaining clarity and professionalism throughout.

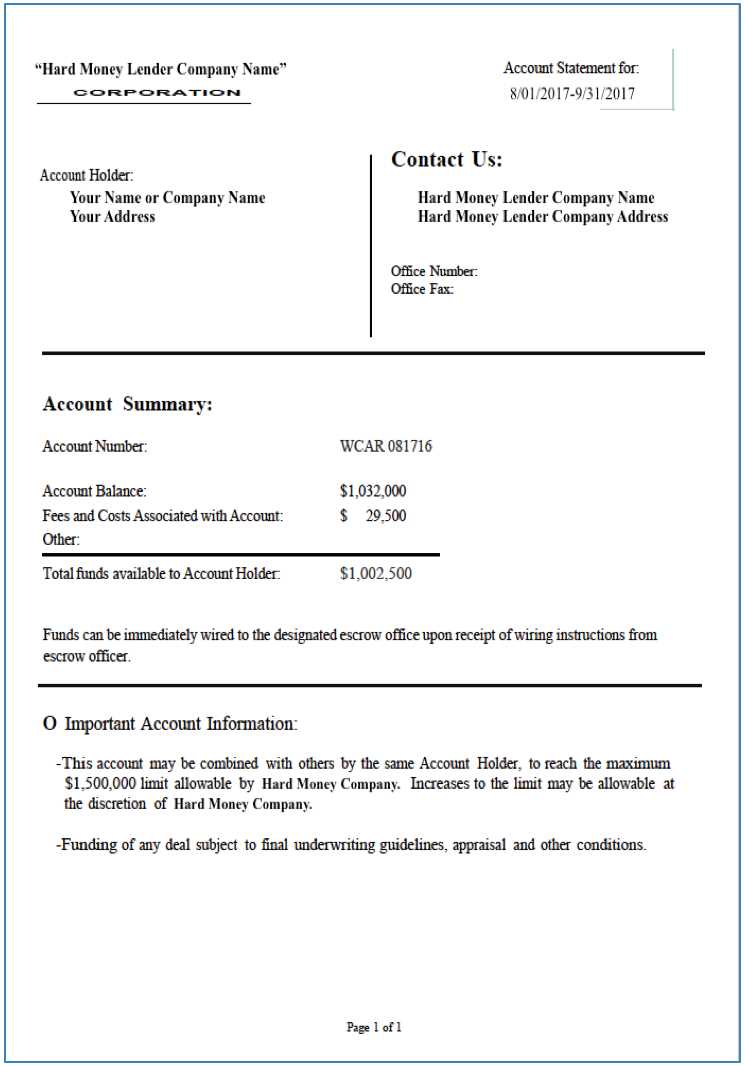

- Proof of Funds Letter Template

A proof of funds letter should be clear and concise, outlining the financial resources available to the applicant. Ensure that the letter includes key details such as the amount of money available, the type of assets (e.g., bank balance, investments), and the institution where these assets are held. Avoid unnecessary jargon or vague statements that can cause confusion.

The letter must begin with the name and contact information of the applicant, followed by the name and address of the financial institution. Specify the current balance of the account(s) or asset(s) being used as proof. Include account numbers only if necessary and ensure that any sensitive data is protected according to privacy regulations.

In the body of the letter, state that the financial institution can verify the availability of the funds if required. It’s helpful to include a statement like: “The undersigned affirms that the above-mentioned funds are currently available and may be used for [purpose of funds].”

Conclude the letter with a formal closing, such as “Sincerely,” followed by the name, position, and signature of the authorized representative from the financial institution, if applicable. Make sure to add the date and any necessary contact information for verification purposes.

A Proof of Funds document confirms that an individual or organization has the financial resources necessary for a transaction. It is typically requested when purchasing real estate, applying for a loan, or completing other financial commitments. The document helps reassure the seller or lender that the buyer or borrower has sufficient funds to complete the transaction.

How It Works

The document usually includes bank statements or financial statements, showing the available balance in a savings or checking account. It may also include investment accounts, proving liquidity. It is important to ensure the document is current and accurately reflects the available funds at the time of the request.

When It Is Needed

Proof of Funds is often required in high-value transactions, such as property purchases, business investments, or large loans. This requirement protects the seller or lender, ensuring that the buyer can meet the financial obligations outlined in the agreement.

Begin with the recipient’s details, including their full name, job title, and company name. Then, state the purpose of the letter and specify the type of verification required. Clearly mention the amount of funds being verified, along with the currency. Provide proof of the source of funds, such as bank statements, investment accounts, or income sources. Ensure the letter includes the name of the financial institution, its address, and relevant contact information. Finally, include a declaration of authenticity and the signatory’s position in the institution, ensuring it is signed and dated.

| Element | Description |

|---|---|

| Recipient’s Details | Full name, job title, and company name |

| Verification Purpose | Clear statement of verification type required |

| Fund Amount | Exact amount and currency |

| Source of Funds | Details of the funds’ origin, such as bank accounts |

| Institution Information | Name, address, and contact details of the financial institution |

| Signature | Signed by an authorized person with position and date |

Ensure all financial data in the proof of funds letter comes from a verified source. Use official statements from recognized institutions, such as bank or investment account statements, rather than informal documents. Cross-check the amounts, account numbers, and dates with the source documents to confirm accuracy.

Verify the Account Holder’s Information

Double-check the account holder’s name, account number, and address details. Confirm that these match exactly with the information shown on the bank statements or other supporting documents. Any discrepancies could raise questions about the authenticity of the letter.

Authenticate the Source of Funds

Provide supplementary documentation that proves the legitimacy of the funds. This may include proof of income, tax returns, or sales contracts for assets that contributed to the account balance. Support the stated amounts with original documents from reputable financial institutions to avoid any doubts about the funds’ origins.

Be precise with the amount you’re listing. It’s vital to provide an accurate and up-to-date figure. Avoid rounding off or estimating the balance. This can lead to confusion and possible rejection of your statement.

1. Failing to Include All Necessary Details

Ensure the statement contains clear information about the source of funds, account holder details, and the bank’s confirmation. Leaving out any essential components can create doubts about the legitimacy of the funds.

2. Using Vague Language

Be direct and specific about the amount and type of assets. Avoid vague terms such as “around” or “approximately.” The more precise the information, the stronger your statement will be.

| Common Issue | Correct Approach |

|---|---|

| Inaccurate Funds | List the exact balance with supporting evidence. |

| Lack of Source of Funds | Specify where the funds originate (e.g., savings, investments). |

| Missing Documentation | Include bank statements or official documents confirming the funds. |

By addressing these common mistakes, your proof of funds statement will appear more reliable and meet the required standards for submission.

Submitting a funds verification letter may be required in situations such as applying for a visa, securing a loan, or confirming financial support for a major purchase. Here’s when and why you should consider providing this letter:

- Visa Applications: When applying for a visa, especially for study or work purposes, authorities often require proof that you have sufficient funds to support yourself during your stay. A verification letter from your bank can serve as proof of financial stability.

- Loan Applications: Lenders may ask for a funds verification letter to confirm your ability to repay the loan. This can help establish your financial reliability and improve your chances of approval.

- Real Estate Purchases: If you are purchasing property, especially in a foreign country, sellers or real estate agencies might request proof of available funds to ensure you are capable of completing the transaction.

- Business Investments: When starting or investing in a business, partners or investors may request a funds verification letter to assess the financial strength behind the venture.

In these cases, providing clear and accurate proof of your financial standing through a funds verification letter can speed up processes and build trust with institutions and individuals involved.

Adjust the proof of funds letter based on the specific requirements of each situation. Here’s how you can tailor it:

- For a Visa Application: Include specific details about the type of visa you’re applying for. Mention the financial requirements outlined by the embassy and ensure the funds meet or exceed these thresholds. Highlight your ability to support yourself during your stay.

- For a Loan Application: Modify the letter to emphasize your financial stability. Include account balances, recent transactions, and any assets that can support your loan request. Be clear about how the funds will be used to demonstrate responsible borrowing.

- For Business Ventures: Outline how the funds support your business goals. Specify the amount allocated for business operations, expansion, or other business activities. This gives a clear picture of how your finances are being utilized for growth.

- For Real Estate Purchases: Mention the exact property and its cost, ensuring your proof of funds aligns with the down payment and other associated costs. The letter should reflect your readiness to cover the required amount for the property transaction.

- For Personal Transactions: If the funds are for personal purposes, state the intended use and how the funds are available for that purpose. Provide supporting financial documentation, such as bank statements or investment portfolios, to back up your claim.

Tailoring your proof of funds template to the specific scenario ensures it provides the right level of detail and relevance to your situation.

To create a solid proof of funds letter, make sure the letter includes specific details about the financial source. These are the critical components to include:

- Bank Name and Address: The letter should state the name and address of the bank holding the funds.

- Account Holder Details: Clearly mention the name of the account holder and account type (checking, savings, etc.).

- Current Balance: Specify the exact current balance available in the account. This should be an accurate and recent figure.

- Verification Statement: The bank should confirm that the funds are available for use. This can be a simple statement from the bank representative.

- Letter Issuance Date: Ensure the letter is dated and includes any reference numbers or details for validation.

Formatting the Letter

Structure the letter in a formal tone. Begin with a heading, address it to the appropriate recipient, and make sure all required details are clear. Here is an example format:

- Bank’s Letterhead: Use the official bank’s letterhead to ensure legitimacy.

- Greeting and Introduction: Start with the greeting, followed by a clear introduction explaining the purpose of the letter.

- Details of Funds: Clearly list the details mentioned above regarding account information and the available balance.

- Closing: End with a polite closing, signed by an authorized bank official.

Final Tips

- Accuracy: Double-check all figures and account details for accuracy before submission.

- Authorized Signatures: Ensure the letter is signed by an authorized bank representative, preferably with a stamp.