Proof of income from employer letter template

To verify income for various financial purposes, a letter from your employer serves as a reliable document. This letter typically outlines your salary details and employment status. It is often requested for loan applications, renting property, or applying for financial assistance. Crafting this letter correctly is crucial to ensure it meets all the necessary requirements.

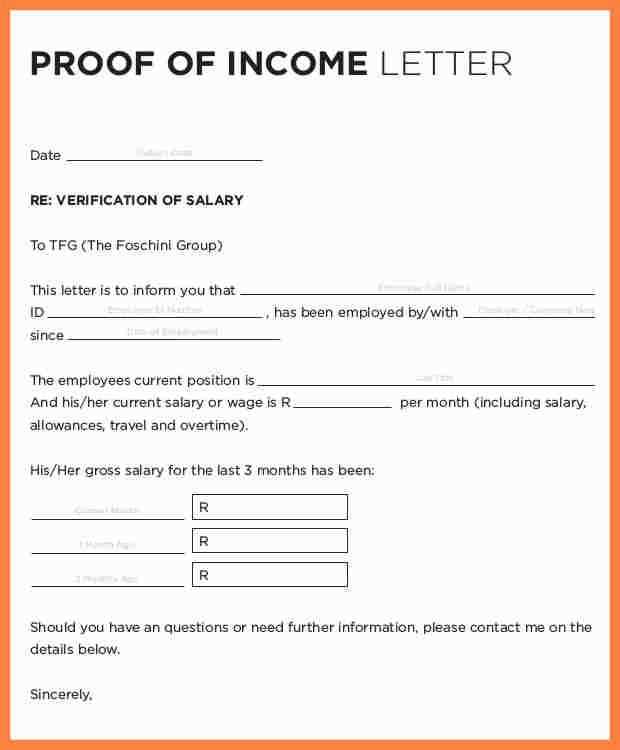

A well-structured proof of income letter should include specific details, such as the employee’s full name, job title, start date, salary information, and any additional benefits. The employer should also provide their contact details and sign the letter to confirm its authenticity. This template offers a straightforward approach to creating an effective proof of income letter.

Make sure to follow the basic structure when drafting the letter, ensuring clarity and accuracy. This will help you avoid any misunderstandings or delays in processing your request. Always check with the organization requesting the letter to confirm any additional requirements they may have.

Here are the corrected lines:

Ensure that your employer’s letter includes a clear statement about your current employment status, including job title and start date. Specify your monthly or annual salary, mentioning if it’s fixed or variable. Include the payment method and frequency, such as weekly or monthly, and ensure that the letter is signed by an authorized company representative.

Salary and Employment Terms

Clearly state your employment terms. Mention whether your job is full-time, part-time, or temporary. Include any bonuses or commissions, if applicable, and specify how frequently they are paid. Be transparent about any other forms of compensation like stock options or health benefits.

Additional Details

Provide any relevant details about job stability, length of service, or performance reviews. This helps to build credibility. Make sure the company’s contact information is listed, including the business address and phone number.

- Proof of Income from Employer Letter Sample

For a clear and concise proof of income letter, follow this structure:

- Employer’s Letterhead: Include the company’s name, address, phone number, and email address at the top of the letter.

- Employee’s Details: Mention the full name, position, and the start date of employment for the individual requesting the proof.

- Income Information: Clearly state the employee’s salary or hourly wage, including the frequency of payment (e.g., weekly, bi-weekly, monthly).

- Additional Benefits: If applicable, mention any additional income or benefits the employee receives, such as bonuses or allowances.

- Verification Statement: Include a statement confirming the accuracy of the provided information and the duration of employment.

- Contact Information: Add a line stating that the company is available for further inquiries. Include contact details for verification purposes.

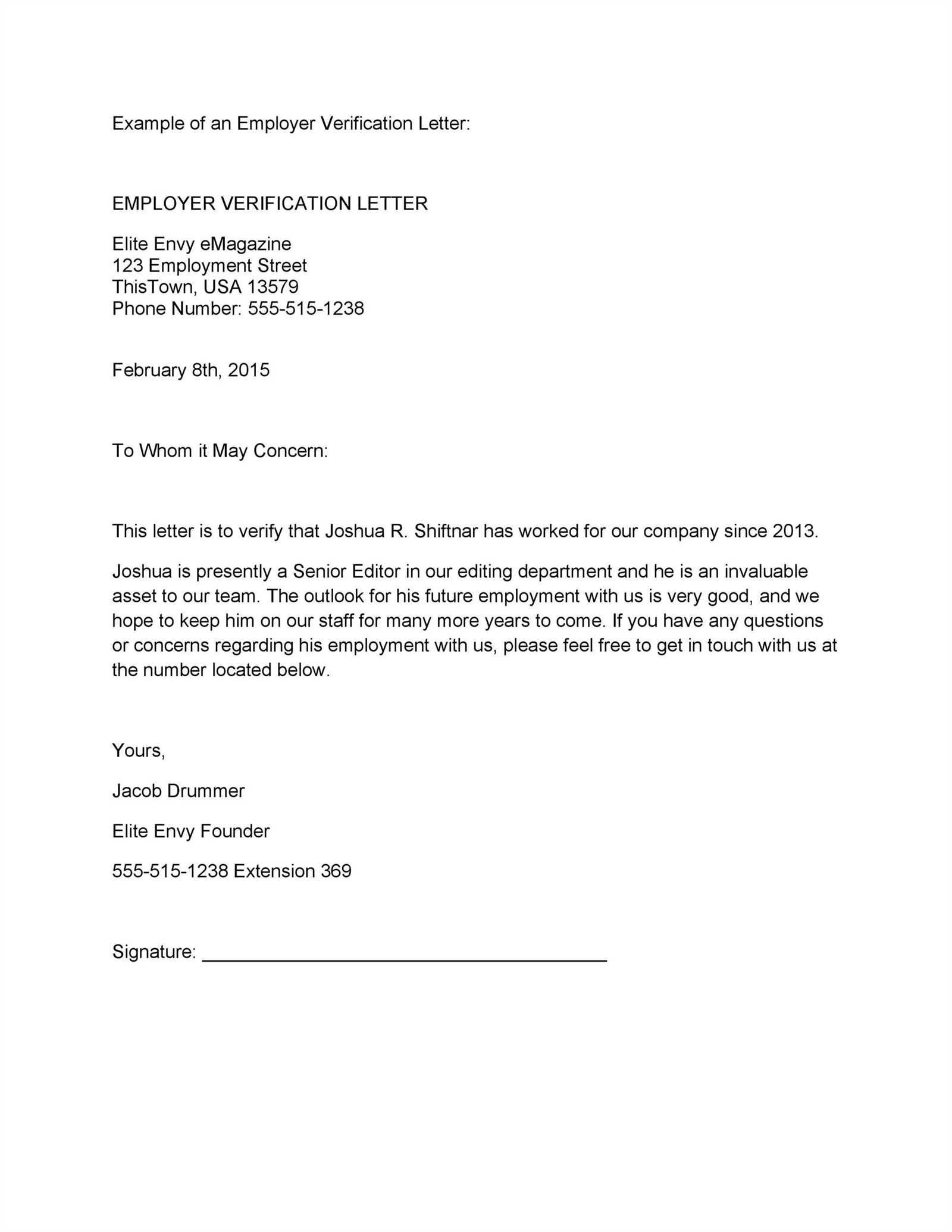

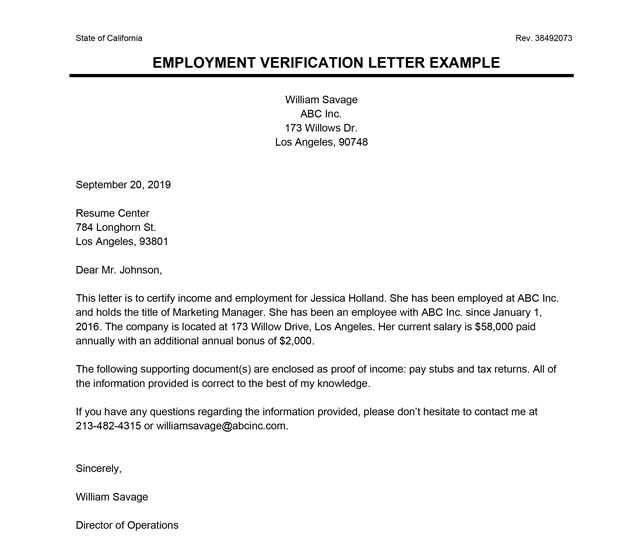

Here’s a quick example of a proof of income letter:

[Employer’s Letterhead] [Date] To Whom It May Concern, This letter is to verify that [Employee’s Name] has been employed with [Company Name] since [Start Date]. [He/She] holds the position of [Job Title], and earns a salary of [Salary Amount] per [Month/Year]. If you require further information, please feel free to contact me at [Phone Number] or [Email Address]. Sincerely, [Employer’s Name] [Employer’s Position] [Company Name]

Begin with the employer’s company name and full address at the top. Follow this with the date the letter is being written. Ensure that the letter is addressed to the correct party, using their name or title (e.g., “To Whom It May Concern”).

Clearly state the purpose of the letter, such as confirming the employee’s income and employment status. Provide the employee’s full name, job title, and the dates they have been employed at the company.

List the employee’s income details. This should include their base salary, any bonuses, commissions, or overtime pay they receive regularly. Specify whether the income is hourly, weekly, bi-weekly, or monthly.

If applicable, mention the payment method and frequency (e.g., direct deposit, check) to add clarity. Include any other relevant financial details that may be requested, such as tax deductions or employee benefits that could affect the total income calculation.

End with a statement offering to provide further information if necessary. Close with the employer’s signature, their name, job title, and contact information (phone number or email). Ensure that the letter is dated and signed appropriately.

Finally, review the letter for accuracy, ensuring all the information is correct and clearly formatted. Keep the tone professional and concise throughout the document.

Include the employee’s full name, job title, and employment status (full-time, part-time, etc.). Specify the start date of employment and any relevant details about the position. Clearly state the current salary, whether it’s an hourly wage, annual salary, or commission-based pay, and include the frequency of payment (weekly, bi-weekly, monthly). If applicable, mention any bonuses, overtime, or other sources of income the employee receives regularly. Make sure to include the employer’s name, contact information, and the date the letter is issued. A signature from an authorized company representative is necessary to verify the authenticity of the information.

Details to Be Clear and Specific

Clarify whether the letter confirms permanent or temporary employment. Include any probationary periods or contract end dates if relevant. Avoid ambiguity regarding salary figures; specify whether the amount is before or after tax. If the letter serves a specific purpose, such as applying for a loan, ensure the details support that request, such as demonstrating sufficient income to meet the requirement.

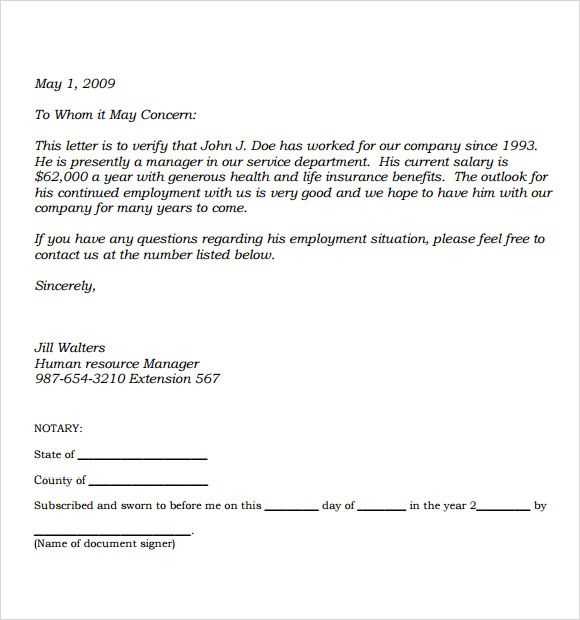

Ensure accuracy in the details of the employment letter. Double-check the employment dates and job title. A common mistake is listing the wrong start or end date, which could cause confusion or delay in processing.

1. Inaccurate Salary Information

Providing incorrect salary figures can lead to significant complications. Confirm the exact salary amount, including bonuses or benefits, if applicable. Avoid estimates or approximations.

2. Omitting Relevant Employer Details

Failing to include the employer’s full business name, address, and contact information may result in the letter being rejected. Include all relevant company information to avoid delays in verification.

| Error Type | Impact | Recommendation |

|---|---|---|

| Inaccurate Salary | Delays in approval | Double-check salary and include bonuses |

| Missing Employer Information | Letter may be rejected | Include complete company details |

| Unclear Job Title | Confusion over role | Clearly state job title and responsibilities |

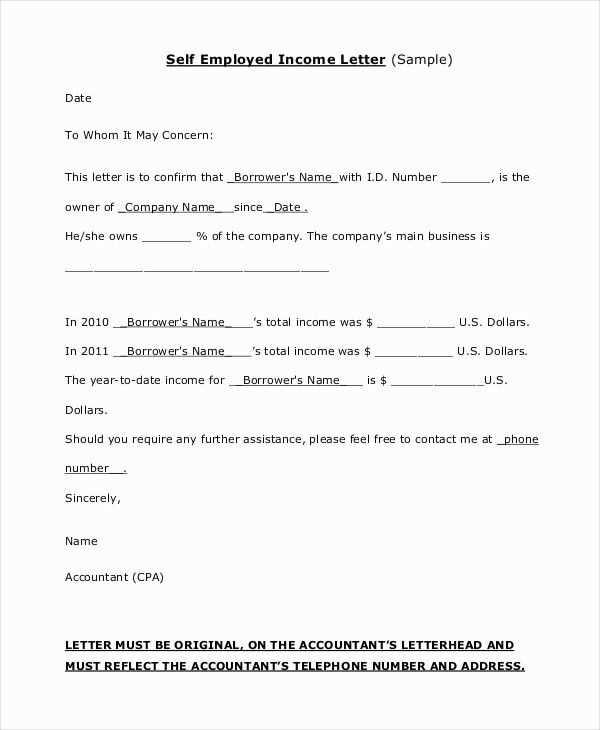

Employers must adhere to legal guidelines when providing proof of income letters. These documents should accurately reflect an employee’s earnings and employment status, and include specific details such as salary, position, and the duration of employment. Failure to include these key points could lead to legal complications for both the employer and the employee.

Legal frameworks vary by country and jurisdiction, but employers generally have a responsibility to comply with local labor laws regarding wages and employment verification. It’s crucial to provide truthful and precise information to avoid misrepresentation or fraud.

When drafting a proof of income letter, avoid including extraneous information that might violate privacy or disclose sensitive data without consent. For example, personal identification numbers or banking details are not necessary unless specifically required for a particular process.

Employees should also be aware of their rights regarding income verification letters. They can request one at any time, and employers are obliged to provide it, ensuring that the request is reasonable and in accordance with the organization’s internal policies.

Check the document’s source carefully. Ensure that the letter is printed on the employer’s official letterhead with a recognizable company logo and contact details, such as an address, phone number, and email. Look for the signature of an authorized representative, like a human resources manager or supervisor, and verify their position within the company.

Confirm the details provided in the letter by reaching out to the employer directly. Contact the company’s main office to verify the legitimacy of the letter and the employment information mentioned. Make sure to use contact details from the company’s official website or other trusted sources to avoid potential fraudulent schemes.

Pay attention to the formatting and language used in the document. Official company letters should follow a professional tone and be free from spelling or grammatical errors. If the letter appears poorly formatted or contains inconsistencies, it could be a sign that the document is not genuine.

Another method of verification is to cross-check the information with other documents. If available, compare the letter with pay stubs, tax documents, or employment contracts to confirm the details match up. Inconsistencies between the documents should raise concerns.

Finally, ask the employer for any additional verification steps or documents they can provide. For example, some companies may offer to send a confirmation email or make a phone call to verify the details provided in the proof of income letter.

If you need to prove your financial stability for a specific purpose, request an income verification letter when applying for a loan, renting a property, or during a visa application process. This letter is often required by banks, landlords, and government agencies to assess your ability to meet financial commitments.

Loan and Mortgage Applications

When applying for a loan or mortgage, an income verification letter provides the lender with proof of your ability to repay the borrowed funds. They may ask for this document as part of the application process to ensure your financial capacity aligns with the loan amount requested.

Rental Agreements

Landlords typically ask for an income verification letter to ensure that you can consistently pay rent. This step is part of the screening process to avoid potential issues with payment reliability.

Requesting this letter ahead of time ensures that you have all the necessary documentation in place for a smooth transaction. It’s important to reach out to your employer early so they can prepare the letter promptly.

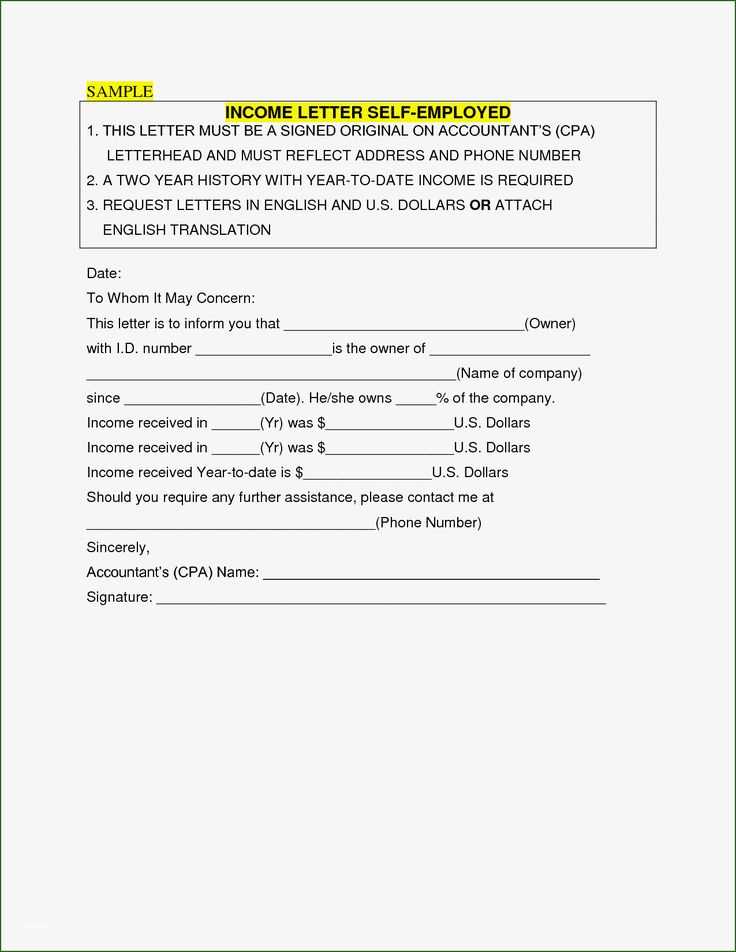

When requesting proof of income from an employer, be clear and direct in your communication. Make sure the letter includes the following key elements:

Employer’s Information

Start by providing the employer’s name, job title, company name, and contact details. This establishes the authenticity of the document and makes it easier for the recipient to reach out for verification if necessary.

Employee’s Employment Details

Clearly state the employee’s position, employment start date, and full-time or part-time status. This provides the context of their role within the company. Also, include salary information, such as annual salary or hourly rate, and any additional compensation, like bonuses or commissions. Be sure to mention if the income is regular or irregular.

Finally, ensure the letter is signed by an authorized person from the company, such as the HR manager or supervisor, and includes the company’s official letterhead for further legitimacy.