Proof of Income Letter Template for Apartment Applications

When applying to rent a new place, landlords often ask potential tenants to show they have the means to pay rent. This request typically involves providing documentation that outlines your financial situation. Such a document serves as a way to prove that you are financially responsible and able to meet the requirements of the rental agreement.

Providing clear and accurate details is essential when preparing this type of document. It should highlight your monthly earnings, job stability, and any other relevant financial information that may reassure the landlord of your ability to manage rental payments. In most cases, it is a straightforward process that requires a few key details to be included in the written form.

Understanding the format and necessary content of the document can make the process smoother and increase your chances of securing the rental. Whether you’re employed full-time or self-employed, there are various ways to demonstrate your financial reliability in a way that meets the landlord’s expectations.

What is a Financial Verification Document?

A financial verification document is a written statement that outlines an individual’s financial stability and ability to cover regular expenses, including housing costs. It acts as a confirmation of your earning capacity and provides insight into your ability to meet obligations related to renting a place. This document is often required by landlords or property managers to ensure that prospective tenants have the necessary resources to maintain timely payments.

Typically, this document includes details such as employment history, monthly earnings, and sometimes additional financial assets. It helps demonstrate that you have a stable source of revenue and the means to handle rent payments without difficulty. The purpose is to give landlords confidence in the tenant’s ability to meet their financial commitments throughout the lease term.

Providing a well-structured financial verification increases the likelihood of your rental application being approved. Whether you’re employed full-time, part-time, or self-employed, there are different ways to present your financial situation in a manner that satisfies the landlord’s requirements.

Step-by-Step Guide to Writing the Document

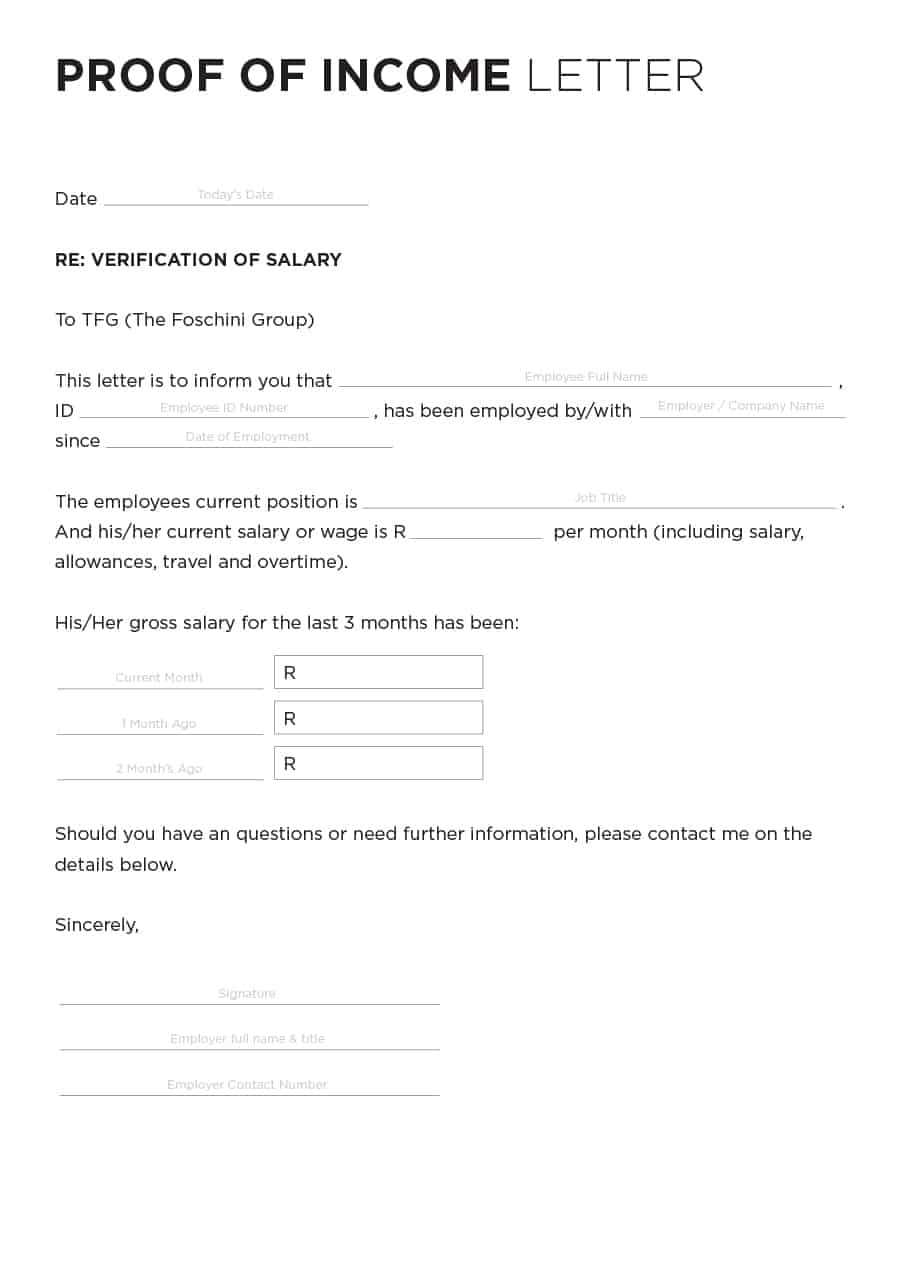

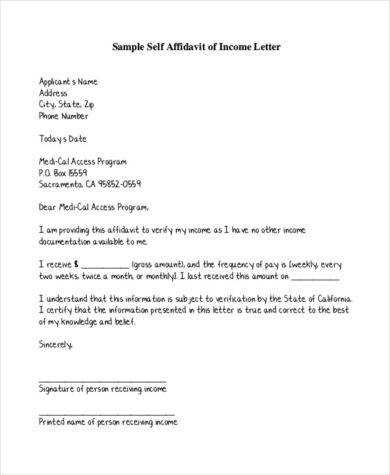

Creating a financial verification statement may seem like a daunting task, but following a clear structure can make it much easier. This document needs to clearly outline the necessary details of your financial situation in a way that is easily understandable for landlords. Below is a step-by-step guide to help you write a comprehensive and effective statement.

- Start with Your Personal Information: Begin the document by including your full name, contact details, and any other identifying information that may be required by the landlord.

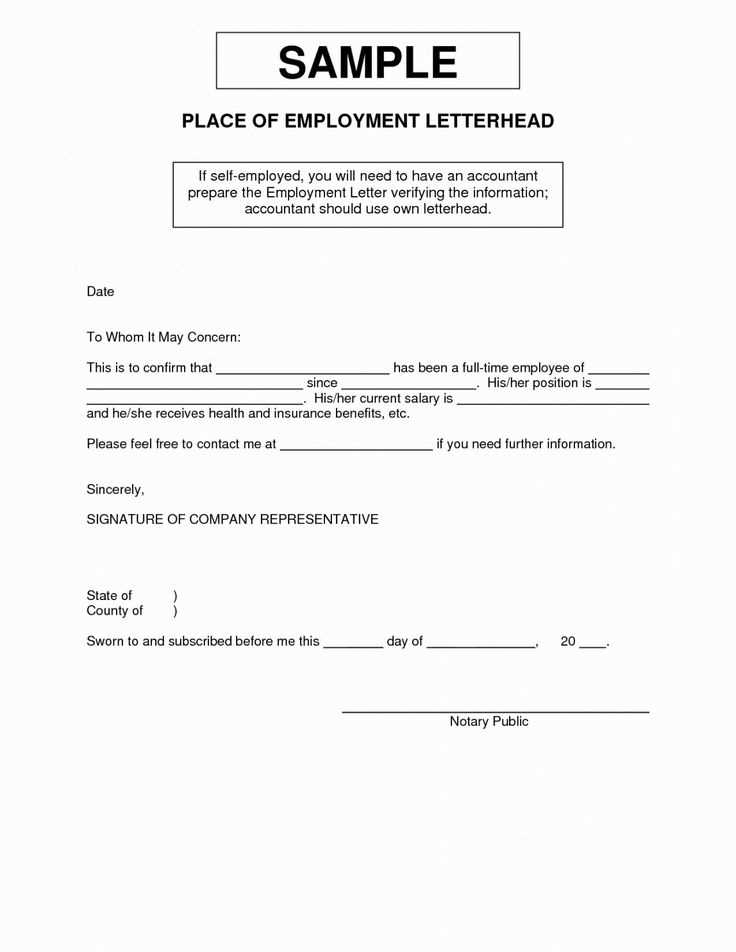

- State Your Employment Details: Include information about your employer, job title, length of employment, and your current salary. If you are self-employed, provide details about your business and income sources.

- Outline Your Monthly Earnings: Specify the total amount you earn each month before taxes. This should be an accurate reflection of your regular income.

- Provide Additional Financial Information: If applicable, include other sources of revenue such as bonuses, freelance work, or investments. This helps provide a more complete picture of your financial capacity.

- Include Supporting Documents: Attach any relevant pay stubs, tax returns, or bank statements that further validate the information in your statement.

- End with a Formal Closing: Conclude the document with a polite closing statement, including your signature and the date. This serves as confirmation that the provided details are accurate.

Following these steps ensures that the document is well-organized and contains all the necessary information to make a positive impression on the landlord.

Documents Required for Financial Verification

When a landlord requests confirmation of your ability to pay rent, they may ask for various documents to verify your financial stability. These documents provide essential information regarding your earnings and overall financial situation. Ensuring that you provide accurate and complete paperwork will help streamline the approval process.

Commonly required documents may include the following:

- Recent Pay Stubs: These show your regular earnings from your employer and help verify your current salary.

- Tax Returns: A copy of your most recent tax return can provide a comprehensive view of your annual earnings, including any additional income sources.

- Bank Statements: Statements from your bank accounts can confirm the consistency of your income and demonstrate savings or available funds.

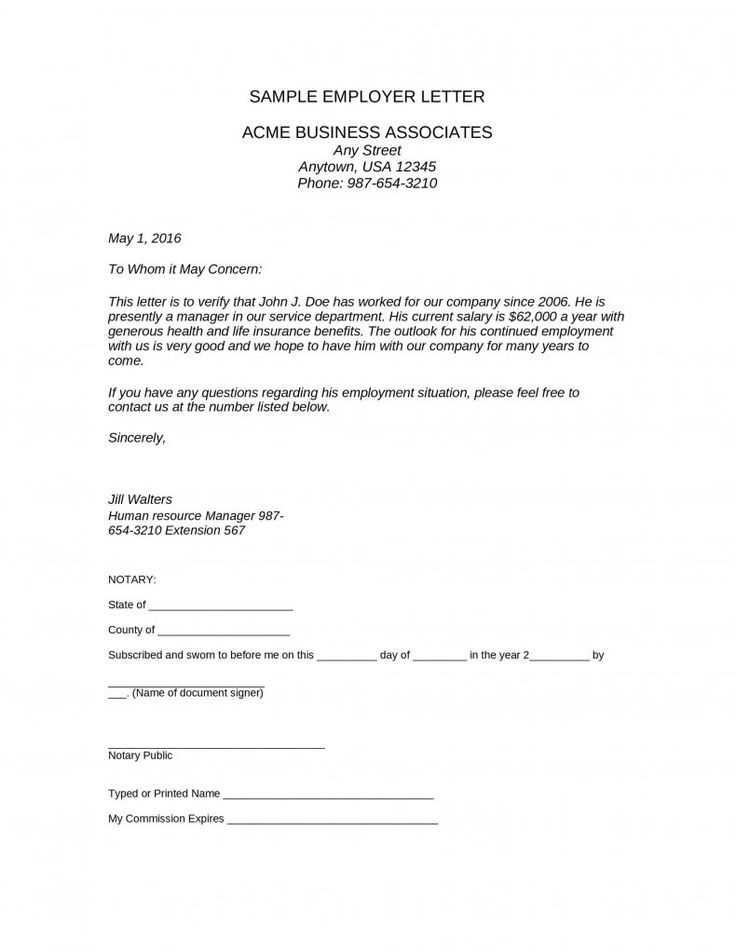

- Employment Verification: A formal letter from your employer verifying your position and salary is often requested as an additional proof of your financial situation.

- Self-Employment Documents: If you’re self-employed, providing recent invoices, contracts, or proof of business income can substitute for standard pay stubs.

Having all of these documents ready will make the process smoother and demonstrate your preparedness to meet rental obligations. Providing detailed and accurate paperwork reassures landlords and shows you’re a responsible tenant.

Essential Information to Include in the Document

When preparing a financial confirmation, it’s important to ensure that you include all the necessary details that will reassure the landlord of your ability to meet rental obligations. A well-structured document that clearly conveys key points will make the process much smoother.

Personal and Employment Details

Start by providing your personal information such as your full name, address, and contact details. Include your employer’s name, your position, and the length of your employment. This will help establish your job stability and make it easier for the landlord to verify your employment status.

Financial Information and Stability

Clearly outline your monthly earnings before taxes and any additional sources of income. It’s important to provide precise figures so the landlord can gauge your financial capability. Including supporting documents, such as pay stubs or bank statements, can further validate your claims and enhance the credibility of your statement.

Including accurate and relevant information is key to ensuring that your application is processed without delays. Be concise yet thorough in your presentation to avoid confusion or unnecessary back-and-forth.

Why Landlords Request Financial Verification

Landlords request verification of a tenant’s financial situation to ensure they have the ability to pay rent consistently and on time. This is a standard procedure that helps protect their investment and maintain a stable tenancy. By confirming the tenant’s earnings, landlords can minimize the risk of non-payment or future disputes.

Assessing financial stability is essential to determine whether a tenant can meet their obligations throughout the lease term. Landlords want to ensure that tenants have sufficient funds to cover rent and other living expenses, reducing the likelihood of late payments or eviction processes.

Validating the tenant’s financial background also provides peace of mind to landlords, knowing they have a reliable renter. This process fosters trust between the two parties, creating a more positive and lasting rental relationship.

Common Mistakes When Drafting the Document

When preparing a financial confirmation, it’s important to avoid common errors that can lead to delays or misunderstandings. A well-written document is clear, accurate, and professional, ensuring that the information presented is trustworthy and complete.

Missing or Inaccurate Financial Information

One of the most common mistakes is failing to include accurate financial details. Ensure that all income figures are current and correctly represent your earnings. Omitting or providing outdated data can raise concerns and delay the review process.

Lack of Verification Documents

Another mistake is not including supporting documents such as pay stubs, bank statements, or employment verification. These documents help validate the financial details provided and make the confirmation more credible. Without these attachments, your submission might be seen as incomplete or untrustworthy.

Attention to detail is essential when creating a financial confirmation, as any inconsistencies or missing information can hinder the approval process. Double-checking your work ensures that all necessary elements are included and presented correctly.

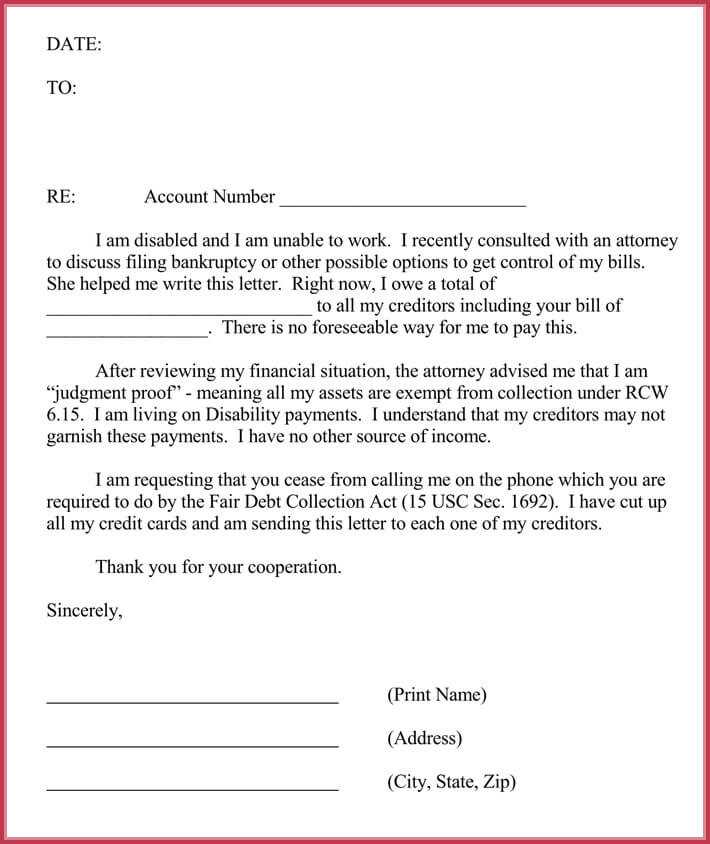

Alternative Methods to Prove Financial Stability

While standard financial verifications are commonly used, there are other methods available to demonstrate your ability to meet rental obligations. These alternatives can provide landlords with the necessary confidence in your financial situation when traditional documentation is unavailable or difficult to obtain.

| Method | Description |

|---|---|

| Bank Statements | Providing recent bank statements can show consistent deposits and savings, reflecting your financial stability and ability to manage funds. |

| Guarantor or Co-Signer | If you have a guarantor or co-signer, their involvement can reassure landlords that rent will be covered even if you face financial challenges. |

| Tax Returns | Submitting your tax returns from the past year offers a comprehensive overview of your financial situation, including earned income and overall financial health. |

| Government Assistance | For those receiving government support, providing proof of assistance can demonstrate a reliable income source that ensures the ability to pay rent. |

| Assets and Investments | If applicable, listing your assets, such as savings, property, or other investments, can show additional financial security and backup resources. |

These alternatives can be just as effective in confirming your financial capacity as traditional methods. By presenting a full picture of your financial standing, you can build trust with potential landlords.