Proof of Insurance Letter Template for Your Needs

When you need to confirm that you have valid coverage, there are specific documents that can help establish this. These official papers serve as evidence, showcasing the necessary details to assure others that your protection is active and compliant with legal or contractual requirements. Whether for personal or business use, understanding how to properly create and manage such records is crucial.

Creating these documents requires careful attention to the right information, formatting, and clarity. The contents need to meet the expectations of those requesting the proof while remaining accurate and straightforward. By using the right structure, you ensure that your verification stands up to scrutiny in any context.

It is essential to learn how to craft a clear and effective verification record to avoid delays or misunderstandings. Knowing which pieces of information to include, how to format them, and what details to prioritize can make the process smoother and more efficient.

Understanding Coverage Verification Documents

In many situations, individuals and businesses are required to provide confirmation that they have active coverage for various purposes, such as legal compliance or contract fulfillment. These documents act as official statements, detailing the necessary information to prove that protection is in place and meets specified standards. Properly preparing and presenting this kind of documentation is essential for ensuring its acceptance by concerned parties.

These records generally contain several key components, which need to be accurate and comprehensive. A well-crafted document helps prevent confusion and ensures that the verification is legally valid, while also making the process faster and more efficient. Below is a breakdown of the typical elements found in these records:

| Component | Description |

|---|---|

| Policy Holder Information | Details about the person or entity covered, including names and contact info. |

| Coverage Details | Specifics about the type of coverage, including the scope and limits. |

| Effective Dates | The start and end dates of the coverage period. |

| Provider Information | Name and contact information of the company offering the protection. |

| Policy Number | The unique number associated with the coverage for identification. |

By including these details, the document provides all the essential information that others need to verify that the required coverage is in place. Whether for legal or personal matters, a well-organized and clear document can save time and ensure a smooth verification process.

Why You Might Need a Coverage Verification Document

There are various situations in which having an official document to confirm that you have appropriate protection becomes necessary. Whether for a personal transaction, business requirements, or legal matters, such records help to establish trust and ensure compliance with specific rules or agreements. Providing such a document often becomes essential to meet the expectations of others or to fulfill a specific condition.

In many cases, businesses and individuals are asked to prove that they are covered before entering into contracts, signing leases, or obtaining loans. It can also be required for certain licenses, permits, or even for travel purposes. Without such confirmation, delays or complications may arise, making it crucial to understand when and how to present the right documentation.

Furthermore, these documents can be used in situations such as vehicle registration, mortgage approvals, or property rental, where a third party needs to verify that you have the proper protection in place. The absence of a valid record in these cases could prevent you from moving forward with your plans or agreements.

How to Write a Coverage Verification Document

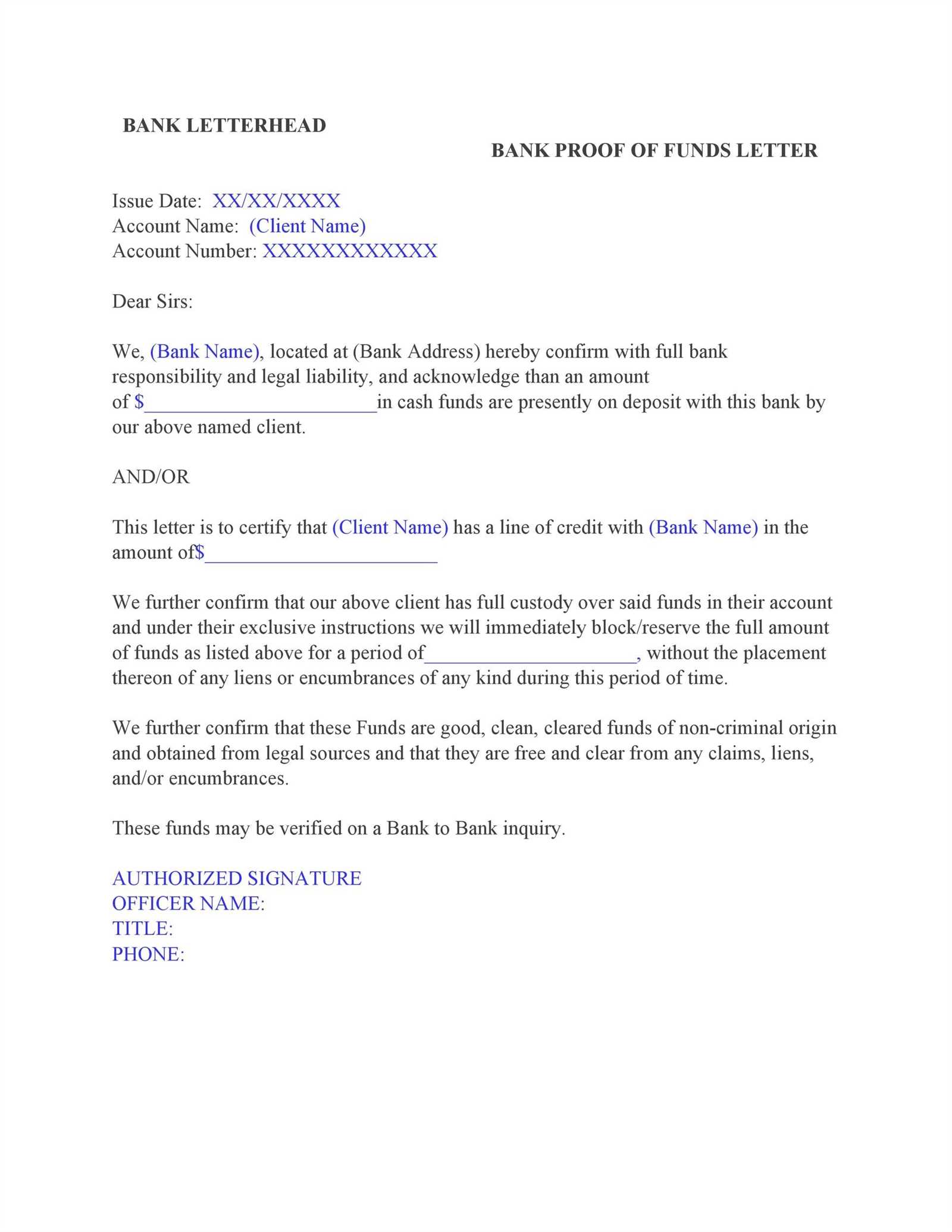

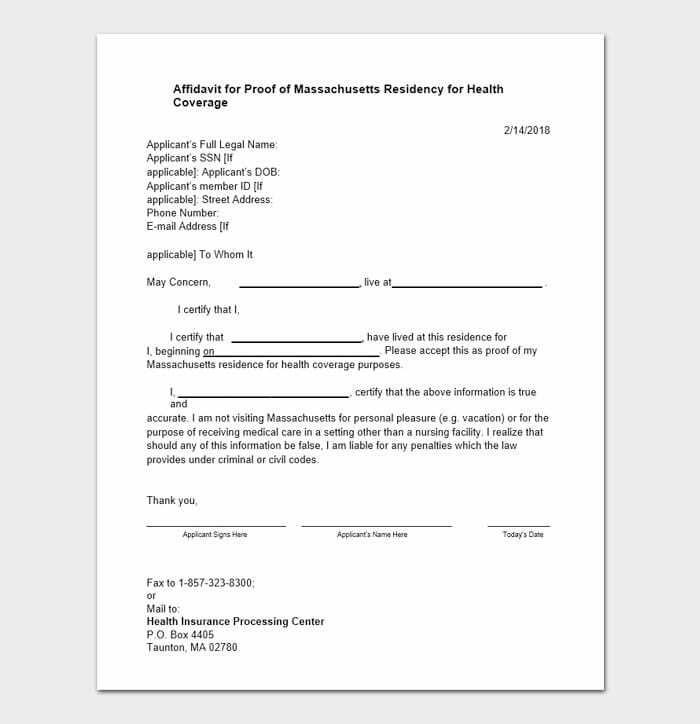

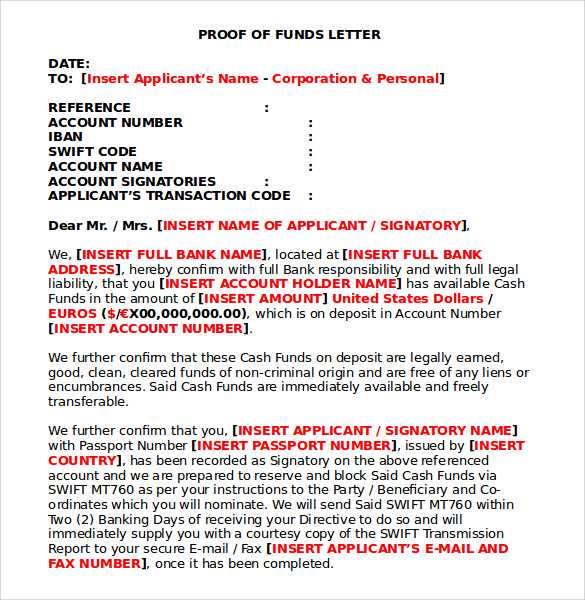

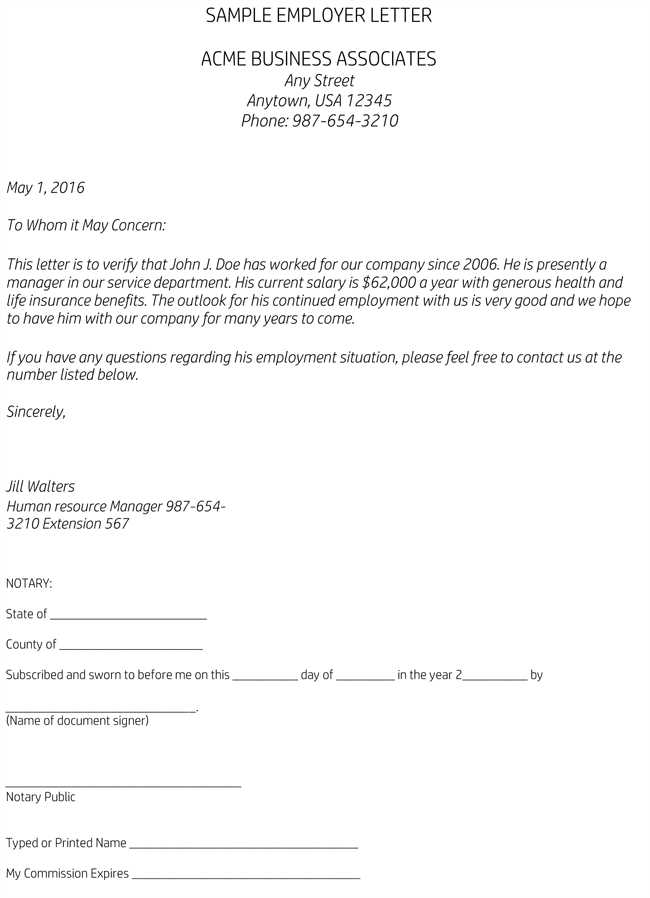

Creating an official document to confirm your protection requires clarity and precision. It is essential to include specific details that accurately reflect the coverage, while keeping the information well-organized and easy to understand. Following a structured approach ensures that the document serves its purpose effectively and meets the expectations of the recipient.

The first step in crafting such a document is to begin with the necessary information about the individual or entity that holds the coverage. This includes full names, contact details, and relevant identification numbers. Next, clearly state the type of protection, specifying its scope, limits, and any exclusions that may apply. The document should also include the effective dates of the coverage to indicate when it began and when it ends.

It is important to include the name of the provider, along with their contact information, to verify the authenticity of the document. Additionally, referencing the policy number can help to quickly identify the coverage in question. Ensure that all information is accurate, as any discrepancies can lead to complications or delays.

Essential Details to Include in the Document

When preparing a document to verify coverage, it is crucial to ensure that all the necessary details are included for it to be both accurate and effective. Missing or incorrect information can lead to confusion or delays in the verification process. Below are the key elements that must be present in such a document:

Key Information to Include

- Policyholder Details: Full name, address, and contact information of the person or entity covered.

- Coverage Type: Clearly specify the kind of protection, whether it’s for property, liability, or another type.

- Coverage Limits: Define the extent or maximum amount of coverage provided under the policy.

- Effective Dates: The start and end dates of the coverage to ensure it is current.

- Provider Information: Name, address, and contact details of the company offering the protection.

- Policy Number: The unique identification number assigned to the coverage.

Additional Considerations

- Exclusions: Mention any conditions or situations that are not covered by the policy.

- Signatures: If necessary, the signature of an authorized representative from the coverage provider.

- Additional Notes: Any other relevant details that might be important for the recipient to know, such as the method for verifying the coverage.

Including these key elements will help ensure the document serves its intended purpose and meets all requirements for verification. Properly structured and complete documentation minimizes the chances of any issues arising during the verification process.

Common Mistakes to Avoid in Verification Documents

When creating a document to confirm that protection is in place, several common mistakes can undermine its effectiveness or lead to rejection. These errors often stem from incomplete, unclear, or inaccurate information. Avoiding these pitfalls ensures that the document will be accepted by those requesting it and facilitates a smooth verification process.

Inaccurate or Missing Information

One of the most critical mistakes is failing to include or correctly input key details. This could involve incorrect dates, missing coverage details, or inaccurate personal information. Omitting even a small detail like the policy number or the coverage start date can make the document invalid and require you to redo the entire process.

Double-check all data before finalizing the document to ensure that everything is correct and up-to-date.

Poor Formatting and Clarity

Another common mistake is presenting the information in a disorganized or unclear manner. A poorly formatted document can confuse the recipient and slow down the verification process. Make sure that all the required details are easy to find and clearly labeled. Avoid cluttering the document with unnecessary information that does not directly relate to the coverage.

Use simple, straightforward language and a logical structure to make the document easy to read and understand.

Tips for Ensuring Accuracy and Clarity

Creating a document to confirm coverage requires attention to detail to ensure that all the information is both accurate and easy to understand. Small errors or unclear formatting can cause confusion and result in delays. Here are some practical tips to help you maintain both precision and clarity when drafting such a document.

Double-Check All Information

Before finalizing your document, thoroughly review all the details for accuracy. This includes personal or business information, coverage specifics, policy numbers, and the effective dates. Even minor errors, such as misspelled names or incorrect dates, can render the document invalid. Make sure each piece of information is correct before submitting it.

Use Clear and Simple Language

Avoid using complex jargon or unnecessary terms that could confuse the reader. Stick to clear and straightforward language that communicates the essential details without ambiguity. This ensures that anyone reviewing the document will easily understand the content without needing further clarification.

Proper structure and well-defined sections also help in making the document more readable and user-friendly. Organize the content logically and use bullet points or numbered lists where appropriate to enhance clarity.