Proof of loss of coverage letter template

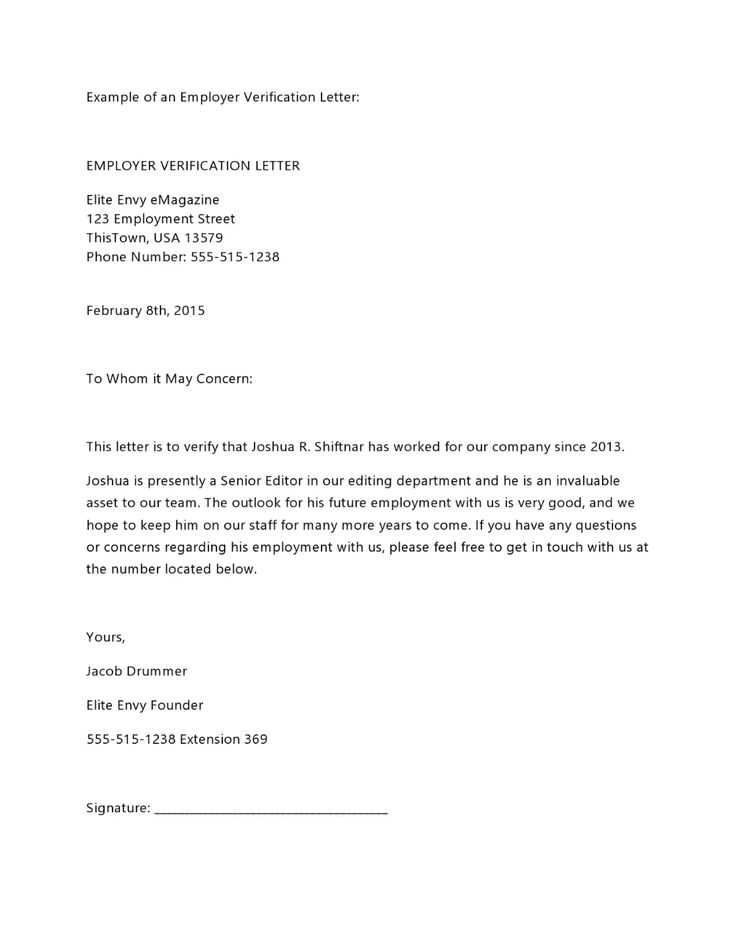

If you need to prove the loss of coverage, a well-structured letter can make the process smoother. Start by clearly stating the policy number, the coverage period, and the reason for the loss. This ensures the recipient understands the specifics of your claim right away.

Include all necessary personal information, such as your full name, contact details, and any relevant account numbers. Be precise in outlining the events that led to the coverage loss. Whether it’s due to non-payment, cancellation, or other reasons, make sure the details are clear and accurate.

It’s helpful to mention any steps you’ve already taken to resolve the issue or seek assistance, like contacting customer service or submitting previous claims. This shows your proactive approach and willingness to address the situation. Conclude by stating your expectations, whether it’s a resolution, further clarification, or assistance with reinstatement.

Here is the corrected version:

Ensure your letter is concise and to the point. Begin with a clear subject line that highlights the reason for the loss of coverage. State the policy number, effective date, and a brief explanation of why coverage was lost. Mention any communication received from the insurer regarding the cancellation or reduction of coverage, if applicable.

Include any necessary supporting documents, such as letters from the insurance company, policy statements, or payment records, to validate your claim. Address the recipient by name or title, and maintain a professional tone throughout.

Conclude by requesting confirmation of the claim and expressing your desire to resolve the matter promptly. Provide your contact information for follow-up and express appreciation for their attention to the matter.

- Proof of Loss of Coverage Letter Template

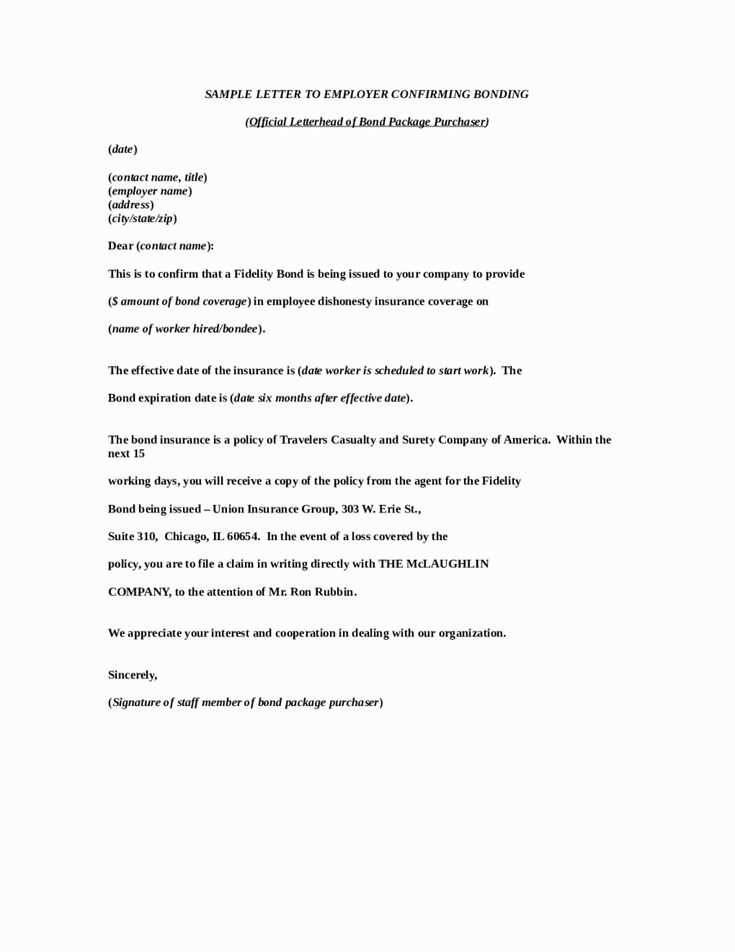

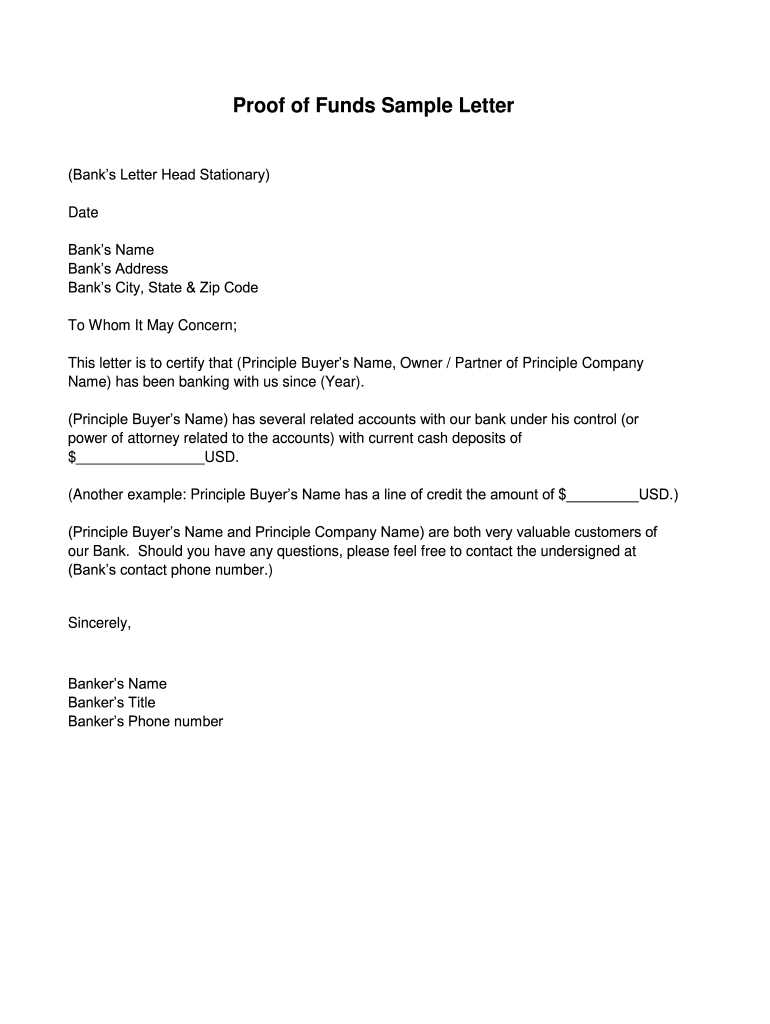

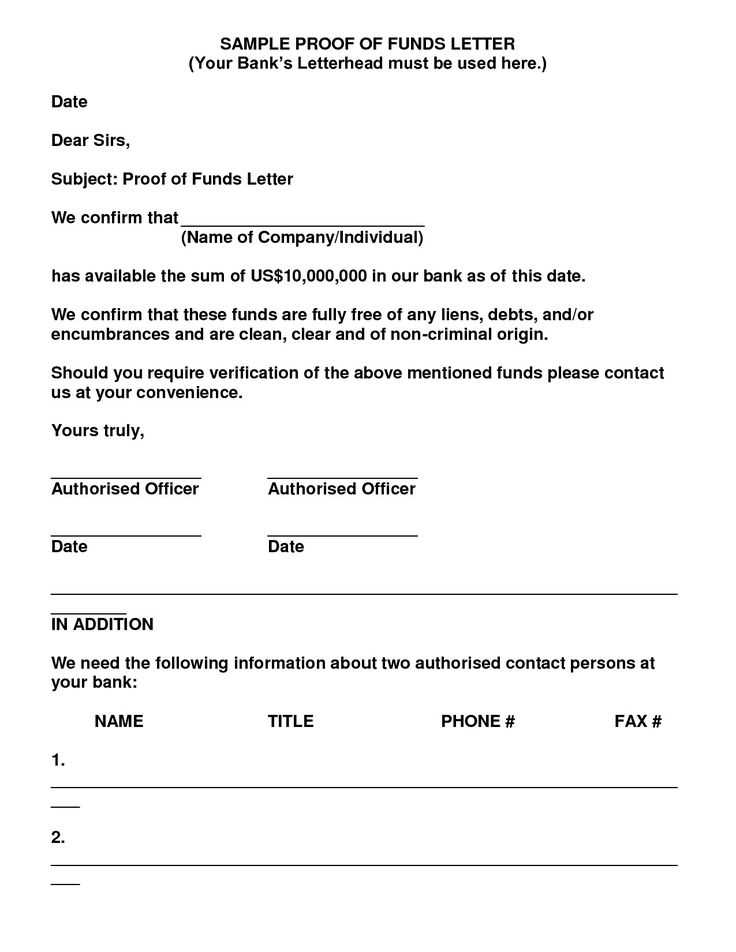

When you need to confirm the loss of insurance coverage, use a clear and concise letter to document the situation. This letter should explain the loss in detail and support your claim for potential reinstatement or compensation. Below is a template you can use to draft your letter:

Template:

Recipient’s Name

Insurance Company Name

Company Address

City, State, ZIP Code

Date

Dear [Insurance Company Representative’s Name],

Subject: Proof of Loss of Coverage

I am writing to formally notify you of the loss of coverage under my insurance policy [Policy Number], effective from [Date]. Due to [briefly explain the reason for the loss, such as policy cancellation, lapse in payment, or other cause], the coverage no longer applies to my [specify coverage type: health, auto, home, etc.].

Attached, you will find supporting documentation, including [mention any attachments such as proof of payment, cancellation notice, or statements]. I request that you review this information and confirm the loss of coverage in writing. Please advise on any next steps or procedures for reinstating my coverage, if applicable.

I look forward to your prompt response and assistance in resolving this matter.

Sincerely,

[Your Full Name]

[Your Address]

[City, State, ZIP Code]

[Your Contact Information]

Enclosures: [List of Documents]

A proof of loss letter is a critical document that helps expedite the claims process after a loss, ensuring that your insurer has the necessary details to assess and process your claim accurately. It serves as an official declaration to inform your insurance provider about the specifics of the loss, loss amount, and any damage sustained. Without this letter, insurers may have difficulty processing claims or determining the value of the damage.

Key Points to Include

- Detailed description of the incident: Clearly outline how the loss occurred, including the date, time, and cause, if possible.

- Damage assessment: Include a detailed list of damaged property, along with estimated values or repair costs. Be as specific as possible.

- Supportive documents: Attach any relevant receipts, photos, or other documentation that can support your claims of damage or loss.

- Claim number and policy details: Include your insurance claim number and policy number to make the process smoother for both parties.

Why a Proof of Loss Letter Matters

- Speed of processing: A well-prepared proof of loss letter can help speed up the claim settlement process by providing all required information upfront.

- Avoid delays: Without the letter, insurance companies may struggle to process the claim or might request additional information, causing unnecessary delays.

- Clear documentation: The letter acts as a formal record of your loss and the information provided, ensuring clarity in communication with your insurer.

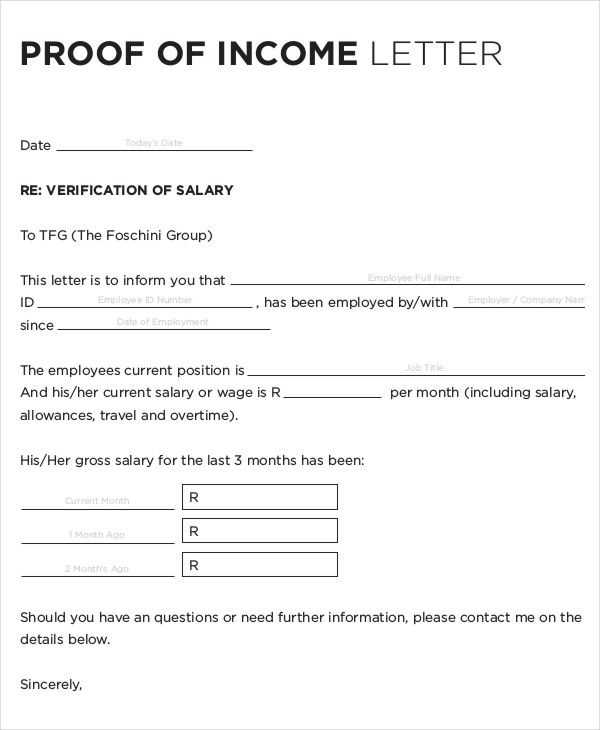

To ensure clarity and proper handling of your loss of coverage claim, include the following key elements in your letter:

| Element | Description |

|---|---|

| Policy Information | Provide your policy number, the name of the insurer, and the coverage type affected by the loss. |

| Date of Loss | Clearly state the date your coverage was lost or ceased. If applicable, specify the date you were notified of the loss. |

| Reason for Loss | Describe the reason for the loss of coverage. If it’s due to non-payment, administrative error, or another factor, include specific details. |

| Impact on Your Situation | Explain how the loss of coverage affects you, including any immediate consequences or actions you’re taking to resolve the issue. |

| Request for Action | Clearly state your request, whether it’s to reinstate the coverage, appeal the decision, or another form of resolution. |

| Contact Information | Include your full name, contact information, and any relevant details to facilitate communication. |

These elements provide a complete and structured approach to your letter, increasing the likelihood of a quick resolution.

How to Detail the Circumstances Surrounding the Loss

To clearly explain the circumstances surrounding the loss, focus on the key events that led to the incident. Provide a straightforward and concise timeline of the situation. Include specific dates, locations, and any actions that were taken before, during, and after the loss occurred.

1. Describe the Event Leading to the Loss

- Outline the exact event or series of events that caused the coverage loss.

- Mention any external factors or conditions that contributed to the situation, such as weather, accidents, or system failures.

- State whether the loss was sudden or gradual.

2. Include Supporting Details and Documentation

- Attach relevant documents, such as repair or maintenance records, photographs, or police reports.

- Provide any correspondence with the insurance company or other involved parties.

- Describe any attempts made to mitigate the loss or prevent further damage.

Ensure that your account of the situation is clear and factual, avoiding unnecessary speculation. By presenting all the relevant details, you help the insurer better understand the circumstances and expedite the claims process.

Writing a loss of coverage letter requires clarity and precision. Avoid these common mistakes to ensure your letter is effective and professional:

- Failing to include relevant details: Always provide specific information about your policy, including policy number, date of coverage loss, and the reason for the loss. Missing these details can lead to delays or misunderstandings.

- Being too vague or general: Avoid broad statements like “I lost coverage” without explaining why. Instead, include clear, detailed explanations to back up your claim, such as the date when the coverage ended and the circumstances leading to it.

- Not being concise: A letter that is too lengthy can confuse the reader. Stick to the key points: what happened, when it happened, and what you need from the insurer. Eliminate unnecessary information.

- Ignoring the tone: Even though the situation may be frustrating, keep your tone respectful and professional. Avoid sounding accusatory or overly emotional. A calm, factual tone is more likely to yield a positive response.

- Skipping a request for action: Always include a clear request for the next steps you expect from the insurer. Whether it’s requesting reinstatement of coverage or a review of the policy terms, clearly state your expectation for resolution.

- Not proofreading: Simple grammar or spelling mistakes can undermine the professionalism of your letter. Take time to proofread before sending it to ensure your message is clear and free of errors.

Additional Tips for Writing a Loss of Coverage Letter

- Double-check any documentation referenced in the letter, ensuring you provide the correct attachments if needed.

- Maintain a copy of the letter for your records and any correspondence with the insurer.

Keep your letter concise and structured. Start with a clear subject line indicating the purpose of the letter. Use short paragraphs, each focusing on one specific point. This helps the reader quickly grasp the main issues.

Be direct and specific in your wording. For instance, instead of vague phrases like “a problem occurred,” state exactly what happened–”The coverage ended on [specific date].” This avoids confusion and ensures that your point is communicated clearly.

Use bullet points to list important facts, such as dates, policy numbers, and the events leading up to the loss of coverage. This makes it easier for the recipient to understand the key details without having to read through long sentences.

Always include relevant documentation or evidence, such as policy details, communication history, or any formal notices. Attach copies rather than referencing them, to ensure clarity.

End the letter with a clear request or next step. Whether it’s asking for confirmation or further action, make sure the recipient understands what’s expected from them.

Submit the proof of loss letter as soon as you experience an incident that may require an insurance claim. Typically, insurers provide a specific timeframe for submission, which can range from a few days to several weeks, depending on your policy. It is crucial to check the terms of your insurance to avoid missing any deadlines.

If the damage is significant, you may need to gather evidence such as photos, receipts, or police reports before sending the letter. Make sure the details of the loss are clearly outlined, including the cause, extent, and date of the incident.

After submitting the letter, keep track of all communications with your insurance provider. This ensures that your claim is processed efficiently and prevents unnecessary delays. If you do not receive acknowledgment of receipt, follow up to confirm they have received the documentation.

Delaying the submission can result in the loss of coverage or denial of the claim, so it’s crucial to act promptly and ensure all the required documents are included.

Begin by clearly stating the reason for the loss of coverage, including the effective date and any relevant policy numbers. This will provide immediate context for the insurer and expedite the review process.

List all documentation you are submitting to support your claim, such as bills, communications, or medical records. Make sure each document is referenced properly and attached to the letter. This transparency helps the insurer quickly assess your case.

If applicable, describe any actions you have already taken to remedy the situation, such as contacting customer service or attempting to reinstate coverage. Show your proactive approach in resolving the matter.

Use clear and concise language throughout the letter. Avoid unnecessary details, but provide enough information to demonstrate the legitimacy of your claim. A well-structured letter will help the insurer understand your situation with minimal confusion.

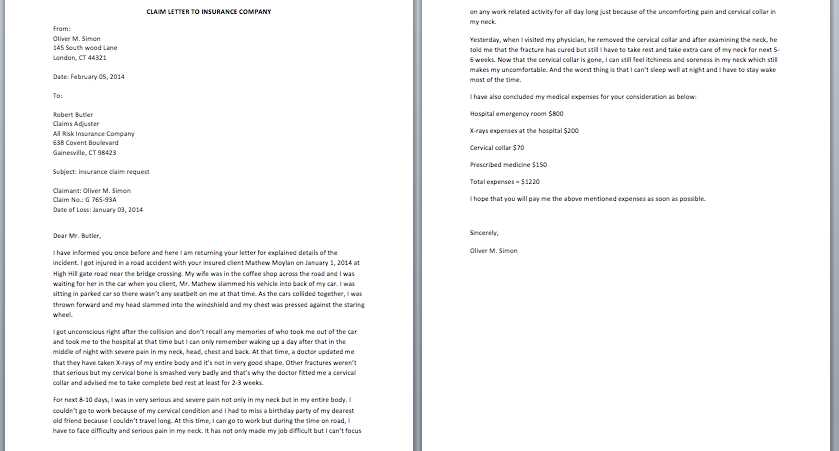

Here is an example of how to format your claim:

| Date | Description | Amount |

|---|---|---|

| January 15, 2025 | Insurance policy coverage loss notice | $500 |

| January 20, 2025 | Medical bills submitted for reimbursement | $300 |

Conclude by stating your expectations regarding the next steps. Be sure to include your contact information for any further communication.