Quicken loans gift letter template

If you’re applying for a mortgage with Quicken Loans and receiving a gift to help with the down payment, you’ll need to provide a gift letter. This letter confirms that the funds are a gift and not a loan, which is crucial for your loan approval process. A well-written gift letter ensures that Quicken Loans has all the necessary information to proceed with your application smoothly.

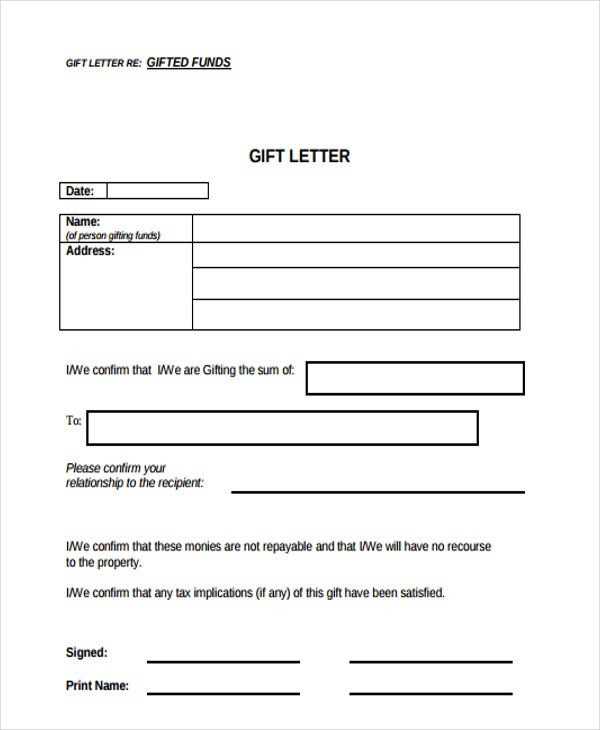

The gift letter should include several key details. First, it must state the donor’s relationship to you. This helps establish that the money is truly a gift and not a loan. You’ll also need to mention the exact amount of money being gifted, the date the gift was given, and the donor’s contact information. It’s also important to clarify that the donor does not expect repayment.

Quicken Loans typically provides a gift letter template to simplify the process. By using the provided template, you can ensure that you include all the required information in the correct format. Be sure to fill in all the necessary fields and have the donor sign the letter before submission. This small but important step can make a significant difference in the speed of your loan approval.

Here’s the corrected version:

For a valid Quicken Loans gift letter, include the donor’s full name, address, and relationship to the borrower. Specify the gift amount and confirm that no repayment is expected. State that the funds are a gift, not a loan, and include the date the gift was made. Both the donor and borrower should sign the letter for authenticity.

Ensure that the donor provides a bank statement or proof of funds, showing that they have the financial capacity to make the gift. Include a statement from the donor confirming they are not expecting repayment or any other form of consideration in return.

The letter should be clear, concise, and free of unnecessary details. Avoid using vague language and be direct about the nature of the gift to prevent any confusion during the loan approval process.

Quicken Loans Gift Letter Template: A Comprehensive Guide

A gift letter for Quicken Loans is a document that verifies funds gifted to a borrower for their down payment. This letter serves as proof that the funds were not obtained through a loan, which would affect the borrower’s debt-to-income ratio. The purpose of the gift letter is to ensure transparency and compliance with mortgage lending standards.

Key Information to Include in a Gift Letter for Quicken Loans: Your gift letter should contain the following details:

- Donor’s Information: Full name, address, and phone number.

- Recipient’s Information: Full name and the relationship to the donor.

- Gift Amount: The exact amount being gifted.

- Statement of No Repayment: A clear declaration that the gift is not a loan and does not require repayment.

- Source of Funds: The donor should specify where the funds are coming from (e.g., savings, sale of property).

How to Verify the Source of Funds in Your Gift Letter: It is important that the donor provides documentation showing where the gift funds originated. This can include bank statements, proof of savings, or a liquidation of assets. Quicken Loans will require this verification to ensure that the funds are legitimate and not a hidden loan.

Common Mistakes to Avoid When Drafting a Gift Letter for Quicken Loans:

- Do not state that the gift is a loan. A gift letter must be clear that repayment is not expected.

- Avoid vague descriptions of the source of funds. Be specific and provide documentation if necessary.

- Ensure the letter is signed and dated by the donor. An unsigned or undated letter may delay processing.

How to Address Gift Letter Requirements for Non-Relative Givers: If the gift comes from someone who is not a family member, additional documentation may be required. Quicken Loans may request more thorough proof of the relationship between the borrower and the donor, as well as further evidence of the legitimacy of the gift.

Steps to Submit Your Gift Letter to Quicken Loans During the Mortgage Process:

- Complete the gift letter accurately with all necessary details.

- Include any additional documentation verifying the source of the gift funds.

- Submit the letter to Quicken Loans as part of your mortgage application, either through their online portal or via email as directed.