How to Use a Reclaim Bank Charges Template Letter

htmlEdit

In certain situations, individuals may find themselves burdened with excessive and unjustified financial deductions. These charges can be a source of frustration, especially when the reasons behind them are unclear or questionable. Many seek ways to recover these amounts, and understanding the process of initiating such a claim is essential for anyone affected.

Resolving these financial issues often involves taking the necessary steps to communicate dissatisfaction and request the return of funds. This process can be straightforward when armed with the right knowledge and approach. It requires formal documentation outlining the nature of the claim and the specific amounts in question, ensuring clarity and professionalism in the communication.

By taking proactive measures, it is possible to challenge these deductions and seek a fair resolution. With a clear and effective request, individuals increase their chances of success in recovering what is rightfully theirs.

htmlEdit

Understanding Fee Refund Process

When financial deductions seem unfair or unnecessary, it’s important to know how to address the issue effectively. The procedure for challenging these unwanted expenses involves a clear, systematic approach. Knowing how to properly address these matters increases the likelihood of recovering the funds.

The first step in addressing unjust deductions is identifying the nature and details of the fees. Once the amounts and reasons are established, the next step is to prepare formal communication to present a strong case for reimbursement. This typically involves providing relevant details such as dates, amounts, and any discrepancies that support the claim.

| Step | Description |

|---|---|

| Step 1 | Gather relevant documentation, including account statements and any related communication. |

| Step 2 | Identify the specific fees that are being contested and ensure all details are clear and accurate. |

| Step 3 | Prepare formal communication outlining the reasons for requesting the return of funds, providing supporting evidence. |

| Step 4 | Send the communication to the appropriate party and track the response for follow-up if necessary. |

Once the claim is submitted, it’s important to remain patient but vigilant. A well-documented and clear request typically has a higher chance of being processed efficiently and successfully.

htmlEdit

Common Fees You Can Recover

Many individuals unknowingly incur unnecessary financial deductions that can be disputed and refunded. These deductions may vary, but understanding which ones are often eligible for recovery can make the process easier. Some of the most commonly refunded fees are associated with standard financial services, and recognizing them is key to addressing the issue effectively.

Overdraft Fees

One of the most common fees people encounter is overdraft expenses. These typically occur when an account balance falls below zero due to insufficient funds. In many cases, these fees can be contested if there are circumstances that suggest the fee was applied unfairly or without proper notification.

Late Payment Penalties

Late payment fees are another frequently disputed deduction. If payments are delayed or missed, financial institutions often apply penalties. However, if there are valid reasons for the delay, such as errors on the part of the institution or extenuating circumstances, these penalties may be eligible for reimbursement.

htmlEdit

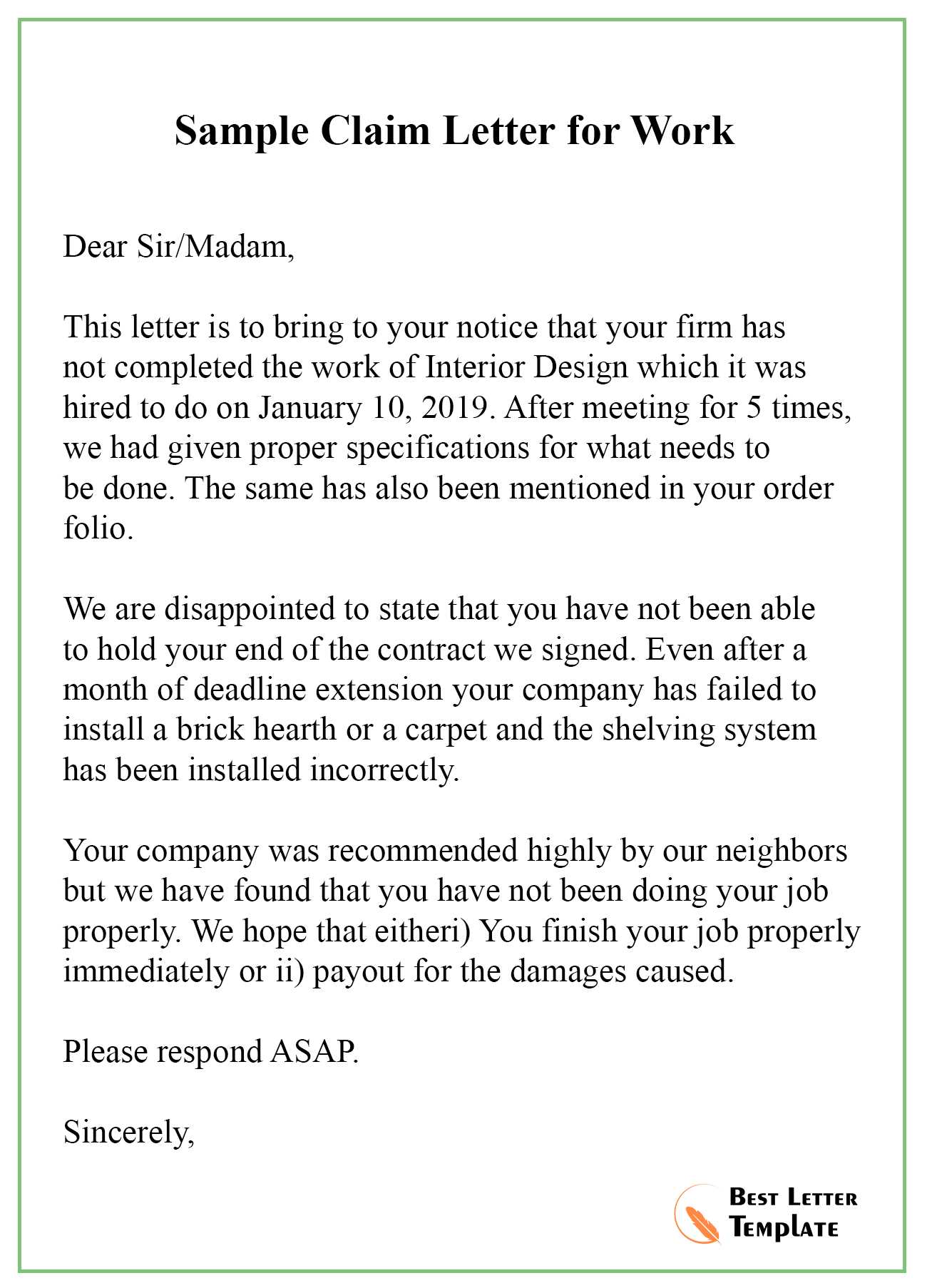

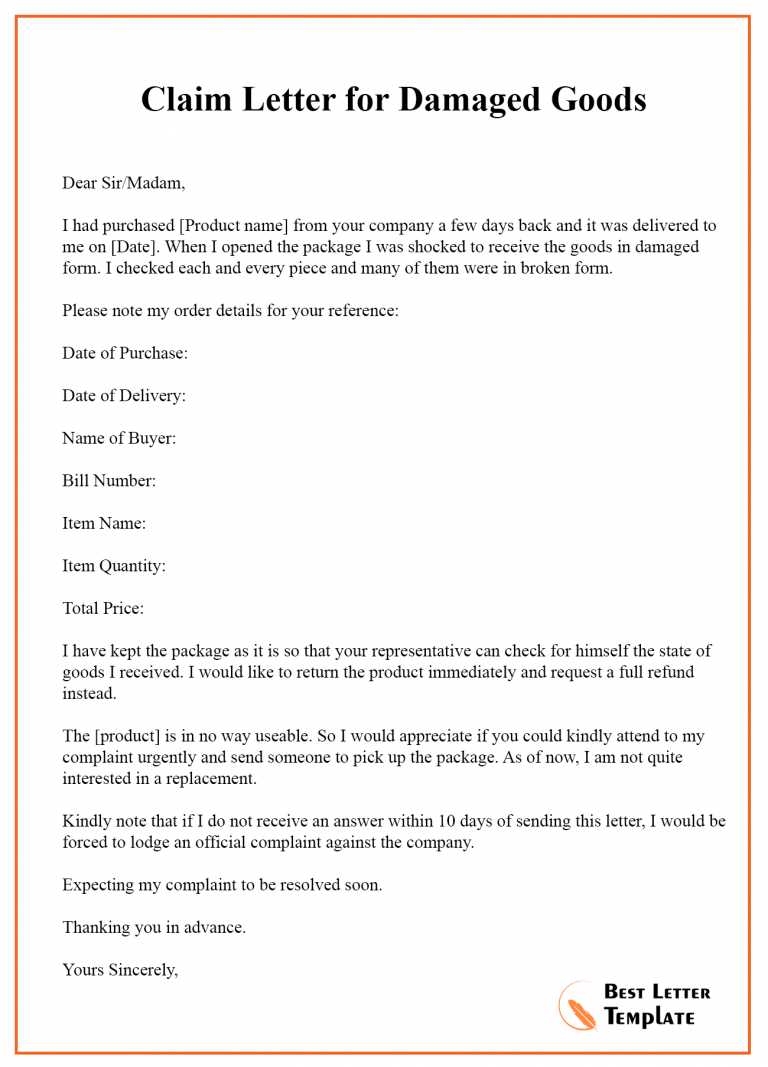

How to Write a Refund Request

When disputing an unfair financial fee, it’s essential to communicate the issue clearly and professionally. Crafting an effective request involves stating the facts, providing evidence, and formally asking for a reimbursement. A well-written request can significantly improve the chances of having the fees returned.

Step 1: Gather Your Information

Before writing the request, make sure you have all the necessary documentation to support your claim. This includes account statements, any relevant correspondence, and records of the transaction in question. Be sure to highlight the specific fees you are disputing and provide clear details of the situation.

Step 2: Structure the Request

Start by addressing the appropriate department or person, using a polite but firm tone. Clearly state the reason for the request and outline the evidence. It’s helpful to include the date of the transaction, the amount involved, and any relevant reference numbers. Additionally, express your expectations for how the situation should be resolved and include a timeline for receiving a response.

By keeping the communication clear, concise, and factual, you increase the likelihood of a favorable outcome.

htmlEdit

Legal Rights for Fee Refunds

Consumers have specific legal protections when it comes to unfair financial deductions. Understanding these rights is crucial to challenging any unjustified fees and seeking reimbursement. Knowing the legal framework surrounding these matters can help individuals navigate the process with confidence and clarity.

The legal right to dispute and request refunds often depends on whether the charges are deemed unfair or were applied without proper notification. Various consumer protection laws and regulations offer individuals the opportunity to address these issues. Below are some key rights that can support the process:

- Unfair Terms in Agreements: If fees were applied based on terms that are considered unfair or unclear, consumers may have the right to challenge them.

- Improper Notification: If you were not adequately informed about the fees or charges beforehand, you may be able to contest them.

- Errors or Mistakes: In cases where fees were applied due to errors or mistakes by the financial institution, the right to request a refund is protected.

It’s important to keep in mind that every case may vary, but understanding your rights gives you a stronger foundation for seeking a fair resolution.

htmlEdit

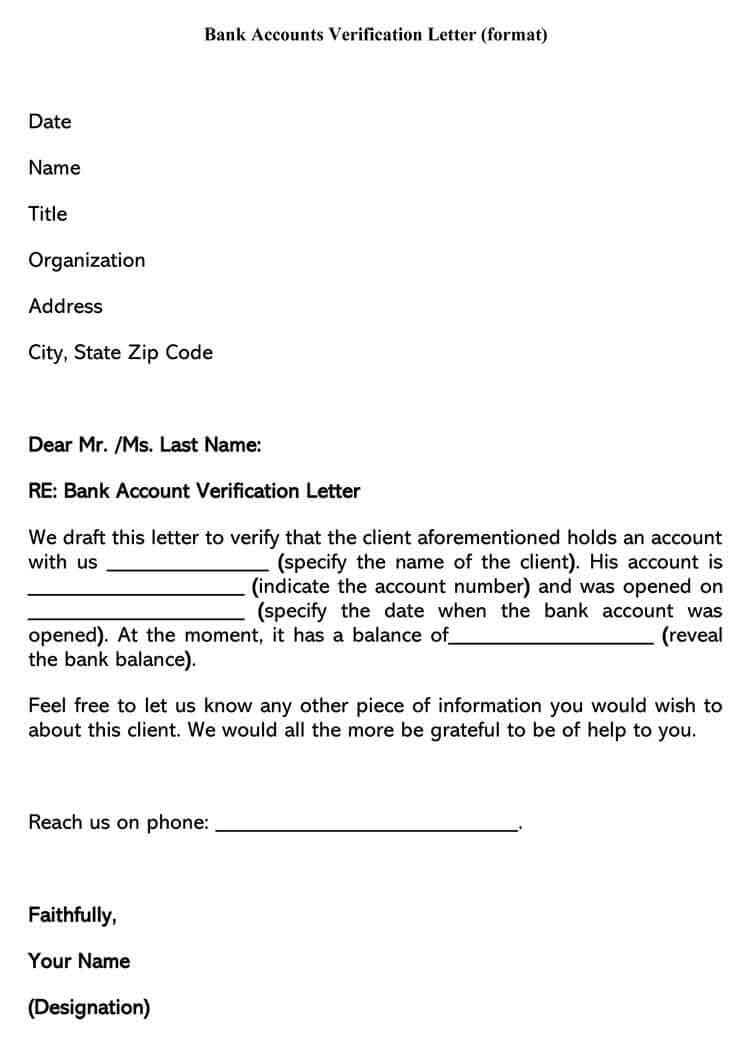

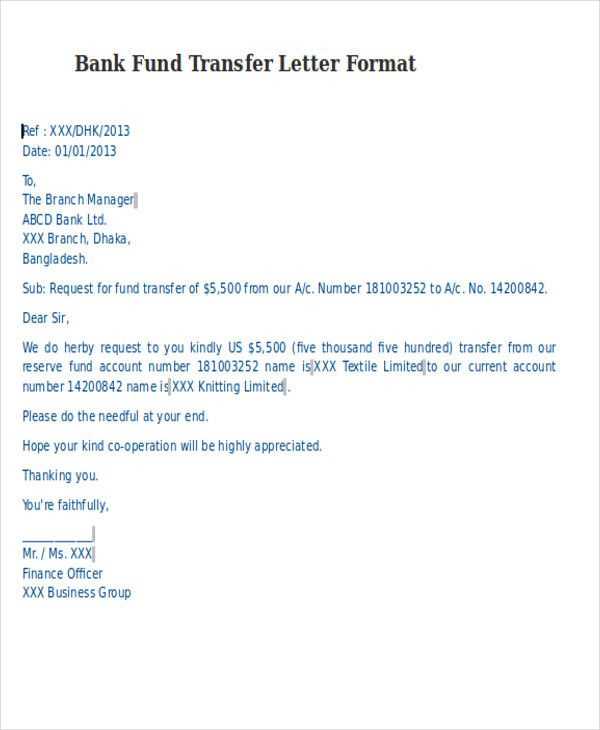

How to Submit Your Claim

Once you’ve gathered all the necessary documentation and carefully prepared your request, the next step is to submit it properly. A well-structured submission ensures that your case is considered and processed without unnecessary delays. Understanding the steps involved will help you navigate the process efficiently.

The submission process typically involves several stages. Below are the steps you should follow to ensure your claim is properly presented:

- Review Your Information: Double-check that all details are correct, including the dates, amounts, and any reference numbers. Ensure that you have attached all the supporting documents that substantiate your claim.

- Choose the Correct Channel: Determine the appropriate method of submitting your claim. Many institutions offer online portals, while others may require paper submissions. Always follow the institution’s preferred process.

- Send Your Request: If submitting online, ensure that all fields are completed accurately. If sending by post, use a trackable service to confirm receipt.

- Follow Up: After submitting, monitor the progress of your claim. If you do not receive a response within the stated timeframe, follow up politely to check on the status.

By following these steps, you maximize the chances of your claim being handled promptly and fairly.

htmlEdit

What to Do if Your Claim is Denied

In some cases, your request for a reimbursement may be rejected, despite your belief that the fees were unjustified. If this happens, it’s important not to give up immediately. There are several steps you can take to challenge the decision and continue pursuing your case.

Step 1: Review the Reason for Denial

The first step is to carefully examine the response you received. Understand the reasons for the denial and identify any potential errors or misunderstandings in the evaluation of your claim. If the explanation provided is unclear, consider reaching out for further clarification.

Step 2: Consider an Appeal

If you believe the decision was incorrect, you may have the option to formally appeal. Gather additional supporting evidence, if necessary, and present a stronger case. Be polite but firm in your appeal, and ensure that all information is well-organized and easy to understand.

By understanding the reasons for denial and utilizing the available avenues for challenging the decision, you increase your chances of a successful outcome.

htmlEdit

Tips for Maximizing Your Refund

Successfully obtaining a refund can be a challenging process, but there are certain strategies that can increase your chances of receiving the full amount. Knowing the best practices for presenting your case and staying organized can help you achieve a more favorable result.

1. Be Clear and Precise

When presenting your case, clarity is key. Ensure that you provide all relevant details, such as the exact amount, dates, and nature of the transaction. By being as specific as possible, you make it easier for the recipient to understand the issue and process your request more efficiently.

2. Stay Professional and Persistent

Approach the situation professionally and maintain a polite tone throughout all communications. If your initial request is not successful, don’t be discouraged. Persistence is crucial, and following up regularly can demonstrate your commitment to having the matter resolved.

By staying organized, clear, and persistent, you significantly improve the likelihood of a successful and timely reimbursement.