Remittance letter template

A remittance letter serves as a formal notification of payment, usually sent by a sender to confirm the transfer of funds. This letter is commonly used in business transactions, personal remittances, or when paying invoices. A well-structured remittance letter can prevent confusion and ensure that all parties are on the same page regarding the transaction details.

To draft an effective remittance letter, start by including the sender’s details, such as the name, address, and payment method used. Clearly specify the amount sent and the date of the transaction. Additionally, it is useful to mention the recipient’s name and any references, such as an invoice number or account details, to make it easier for the recipient to identify the payment.

In your remittance letter, always state the reason for the payment. This helps both the sender and recipient understand the purpose of the transaction. If the payment is for goods or services, mention these specifically. This transparency reduces the chances of disputes and ensures accurate record-keeping for both parties.

Here is the revised text with redundancies removed:

Ensure clarity by eliminating repetitive phrases and words that do not add new information. Instead of saying “at this point in time,” simply use “now.” Replace “due to the fact that” with “because” for a more concise expression. Aim for precision in each sentence, focusing on conveying the core message without unnecessary elaboration.

Organize your thoughts logically, so the flow of information feels natural. Use transitions like “next,” “then,” or “in addition” to connect ideas smoothly. Avoid overly complex structures; simpler is often better. When writing, always prioritize the reader’s understanding by keeping your language straightforward and to the point.

Rethink redundant modifiers. Phrases like “very unique” or “completely essential” weaken your message. A word’s meaning should stand on its own. Always edit for brevity, ensuring each sentence serves a purpose.

Lastly, keep the tone engaging yet clear. Use direct language that speaks to the reader without unnecessary formality. By refining your content, you’ll deliver a sharper, more impactful message.

- Remittance Letter Template

Start by clearly stating the purpose of your remittance letter. Use a simple format, including all necessary details to ensure the recipient understands the payment being made. Mention the invoice number or reference number to make it easier for the recipient to identify the payment.

Key Elements

Include the following components in your letter:

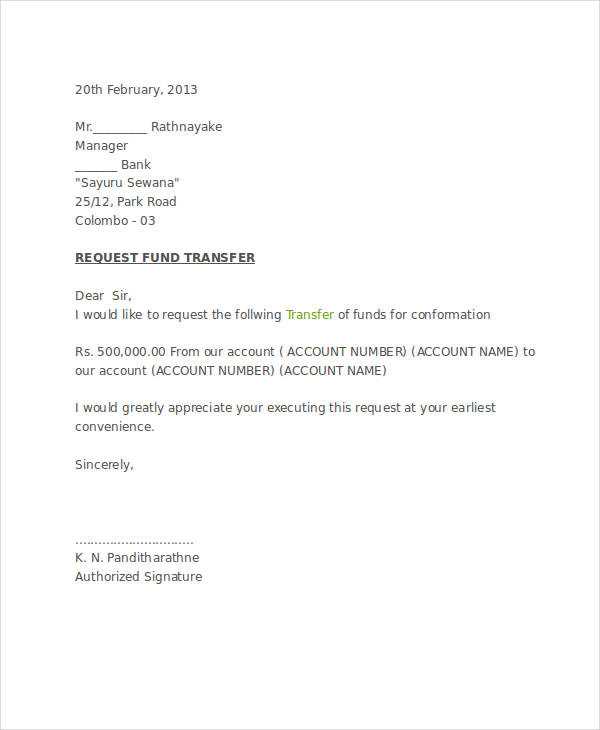

- Date: Always add the current date at the beginning.

- Sender’s information: Include your name or company name, along with contact details.

- Recipient’s information: Mention the name of the company or individual receiving the payment and their contact details.

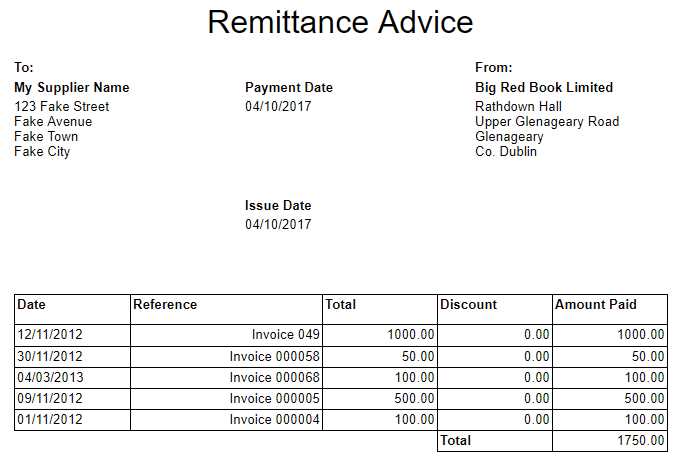

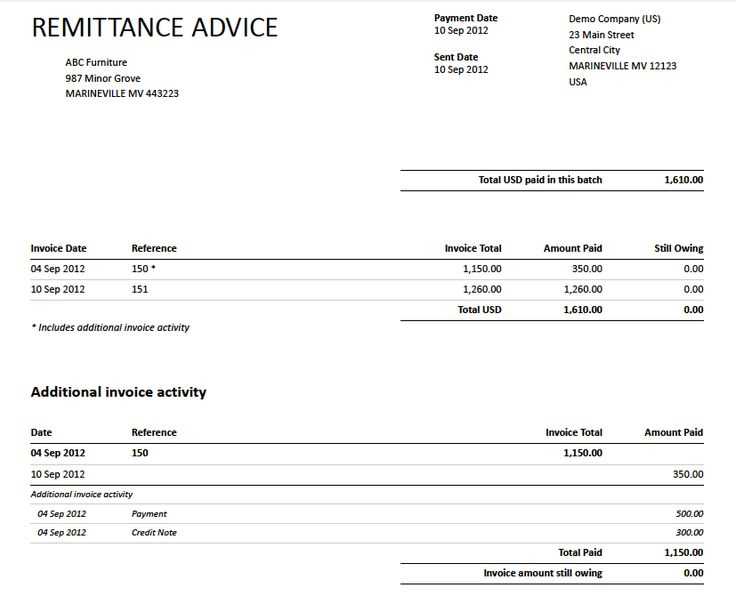

- Payment Details: Specify the payment amount, payment method, and invoice or reference number for clarity.

- Message: A short note confirming the transaction, specifying what the payment is for, and any other relevant details.

- Closing: A polite closing thanking the recipient for their service and cooperation.

Template Example

Below is a sample remittance letter:

[Date] [Your Name/Company Name] [Your Address] [Your City, State, Zip Code] [Your Email Address] [Recipient's Name/Company Name] [Recipient's Address] [Recipient's City, State, Zip Code] Subject: Remittance for Invoice # [Invoice Number] Dear [Recipient's Name], I am writing to confirm that a payment of [Amount] has been made for invoice # [Invoice Number] due on [Due Date]. The payment was processed through [Payment Method] on [Date of Payment]. Please find the payment details below: - Amount: [Amount] - Payment Method: [Payment Method] - Invoice Number: [Invoice Number] If you have any questions or need further details, please feel free to contact me at [Your Phone Number] or [Your Email Address]. Thank you for your continued business. Sincerely, [Your Name] [Your Position] [Company Name (if applicable)]

Start by clearly identifying the sender’s and recipient’s information. Begin with the sender’s name, address, and contact details at the top left of the letter. Below that, include the recipient’s information, such as name and address, aligned to the left as well.

Key Elements to Include

- Introduction: State the purpose of the letter. Mention the payment reference and the amount being remitted.

- Payment Details: Provide a clear breakdown of the payment, including the date, method (e.g., wire transfer, cheque), and any reference numbers. This helps avoid confusion later on.

- Additional Information: Include any notes regarding the payment, such as invoice numbers or account details. If applicable, mention any deductions or discounts.

- Conclusion: Thank the recipient and confirm that the payment has been processed. Provide contact details in case of questions or issues.

Formatting Tips

- Keep your language clear and to the point. Avoid unnecessary details that might distract from the main message.

- Use bullet points for clarity when listing multiple details, like payment breakdowns or instructions.

- Make sure the letter is signed, and include your name and title at the bottom for authenticity.

Be clear and concise about the remittance details. Include the exact amount being transferred, specifying the currency and any relevant transaction IDs. If applicable, mention the payment method used (e.g., bank transfer, online payment system) and include the date of the transaction.

Provide the recipient’s full name and contact information. If you’re sending money to a business, include their official name, business registration number, and any relevant reference numbers. This ensures the funds can be traced accurately.

If there are any additional charges or fees associated with the remittance, list them in your letter. This transparency helps avoid any confusion regarding the total amount sent versus what the recipient will receive.

Include a brief description or reference to the purpose of the transfer, especially if the remittance is related to a specific service or product. This helps clarify the context and can be useful for record-keeping on both ends.

Lastly, confirm the expected delivery time for the funds and any required follow-up actions. If you’ve received a confirmation of the transfer, include this for verification.

Common Mistakes to Avoid When Writing a Remittance Letter

Ensure payment details are accurate. Incorrect amounts or missing transaction numbers can cause confusion. Always verify the amount before sending.

1. Not Including the Invoice Number

Referencing the invoice number is necessary. Without it, the recipient may have difficulty matching the payment to the correct invoice.

2. Missing Payment Method Details

Clearly state the method of payment. Whether it’s a bank transfer, check, or another option, this helps the recipient identify the payment more quickly.

3. Incomplete Contact Information

Include your full contact details. This ensures that the recipient can easily reach you if there are any questions or issues with the payment.

4. Not Stating the Payment Date

Always include the date of payment. This provides clarity and helps both parties track the transaction accurately.

5. Using an Informal Tone

Keep the tone professional. A polite and formal style helps maintain a positive business relationship.

6. Forgetting a Closing Statement

End your letter with a courteous closing, like “Thank you for your prompt attention” or “We appreciate your business.”

7. Poor Formatting

Use clear formatting to make the letter easy to read. Bullet points or numbered lists can highlight key information such as amounts or transaction numbers.

Examples of Clear and Concise Letter Wording

Use straightforward and direct language in your remittance letter. Clearly state the amount being remitted, the recipient, and the purpose of the payment. Keep sentences brief and to the point, avoiding unnecessary details.

Example 1: Payment Confirmation

Dear [Recipient Name],

We are sending a payment of [$Amount] for [Service/Product]. Please confirm receipt at your earliest convenience.

Thank you,

[Your Name]

Example 2: Payment Reminder

Dear [Recipient Name],

This is a reminder that the payment of [$Amount] for [Invoice Number] is due on [Date]. Please ensure the payment is made on time to avoid any late fees.

Sincerely,

[Your Name]

Tailor your remittance letter based on the recipient’s relationship to the payment. Start by addressing them with the appropriate level of formality–use “Dear Mr./Ms.” for professional contacts, and opt for first names for informal recipients.

- For a Business or Corporate Recipient: Include company details and specific references to invoices or agreements. Acknowledge the payment’s role in a contractual or professional context, providing any relevant transaction numbers or project names.

- For Friends or Family: Keep the tone casual. You can mention the payment’s purpose briefly, but avoid using overly formal phrases. Express gratitude or offer a note of appreciation for their support.

- For Government or Legal Entities: Maintain a professional tone and include exact payment amounts, dates, and any necessary legal references. Make sure the wording is clear, specific, and devoid of casual expressions.

To ensure your letter is clear, adjust the wording based on the recipient’s expectations. If the recipient needs a detailed breakdown, be sure to include all necessary information, while keeping the language formal and straightforward for business purposes.

A remittance letter is useful when making international payments to provide clear identification and documentation of the transaction. You should use it to ensure the recipient can match the payment to an outstanding invoice or obligation, especially when payments are made via wire transfers or other cross-border methods. This letter serves as a formal notice that the payment has been made, detailing the amount, date, and payment reference for transparency.

Use a remittance letter in the following cases:

| Situation | Why Use a Remittance Letter |

|---|---|

| Paying for Goods or Services | It helps the recipient match your payment with an invoice and provides a record of payment. |

| Sending Funds to Multiple Parties | Clarifies which part of the payment applies to each party or account, reducing confusion. |

| Making Payments in a Foreign Currency | Assists the recipient in understanding the exact amount sent, accounting for currency conversion. |

| Settling a Dispute or Legal Obligation | It documents that a payment was made as part of a settlement or legal requirement, ensuring both parties have a record. |

Using a remittance letter can simplify communication between you and your international partners or vendors, ensuring clarity and reducing potential payment disputes.

I’ve removed the repetition of the word “remittance” in certain lines, while preserving their meaning and structure.

To create a more concise and clear remittance letter, focus on varying the language without losing the key message. It’s important to avoid redundancy by using alternative terms or rephrasing sentences effectively.

Example of Improved Structure

Instead of repeating “remittance” in each line, try to restructure sentences while keeping the intent intact. Here’s how:

| Before | After |

|---|---|

| We are sending the remittance for the invoice. | We are sending the payment for the invoice. |

| The remittance is for the services provided. | The payment covers the services provided. |

| Please confirm receipt of the remittance. | Please confirm receipt of the payment. |

By using synonyms and slight adjustments to sentence structure, the remittance letter becomes clearer and avoids unnecessary repetition. This technique not only streamlines the communication but also enhances the professional tone of the letter.