Repayment Agreement Letter Template for Clear Loan Terms

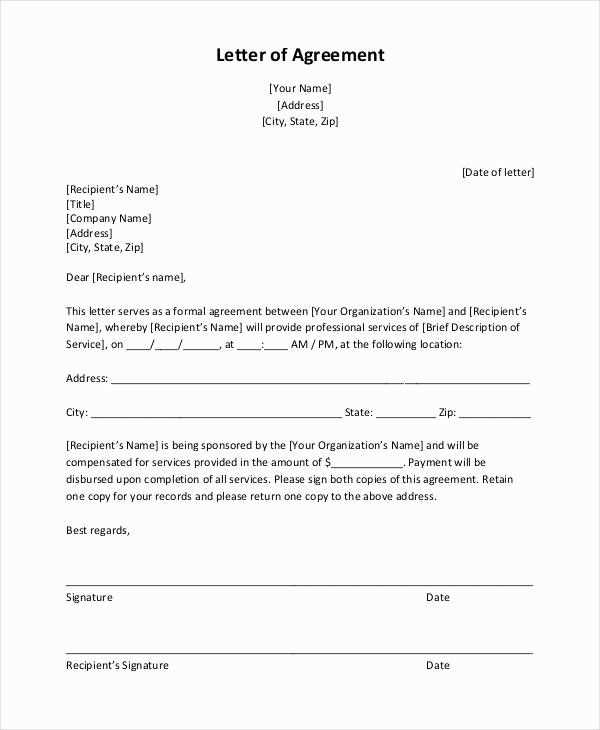

In any financial transaction, ensuring clear and mutually understood terms is essential to avoid confusion or disputes. A well-crafted written agreement helps both parties outline expectations, responsibilities, and timelines. This can be especially important when managing payments or loans, as it sets a formal record of the arrangement.

Having a clear structure in place allows all involved to refer to specific details in case of misunderstanding. This type of document provides a safeguard, offering legal protection while maintaining transparency. Whether it involves personal loans or business deals, such clarity fosters trust and accountability.

By utilizing a structured approach, you can create a document that effectively addresses the most important aspects of the financial arrangement. This includes payment amounts, deadlines, and any terms regarding potential adjustments. Taking the time to ensure all elements are carefully considered can lead to smoother financial interactions in the future.

What is a Repayment Agreement Letter

Understanding Its Purpose and Function

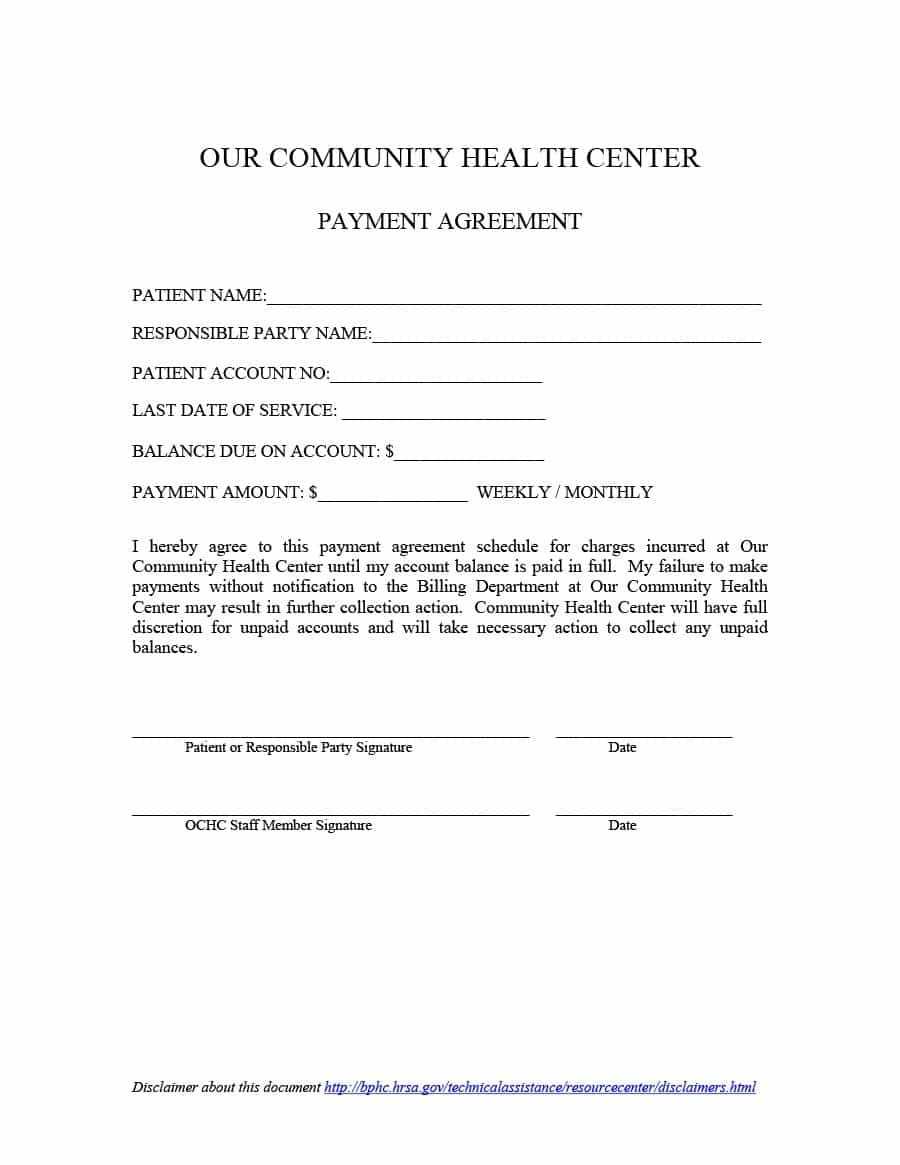

When engaging in a financial arrangement where one party owes another, it’s essential to have a clear, written understanding of the terms. A document of this nature serves as a formal outline of how the owed amount will be settled, specifying the timeline, amounts, and conditions for repayment. By detailing all aspects of the repayment process, it minimizes potential disputes and misunderstandings.

Why Such a Document is Important

This type of document acts as a safeguard for both parties involved. It not only protects the lender’s interests but also ensures that the borrower understands their obligations. By laying out clear terms, the document provides a reference point in case of missed payments or conflicts, helping to avoid unnecessary legal issues down the line.

Key Functions of This Document

The primary function is to set clear expectations and responsibilities for the repayment process. It should outline the amount owed, payment frequency, and any penalties or consequences for failing to meet agreed-upon terms. Additionally, it helps establish a formal record, offering both parties a legal basis should any disputes arise in the future.

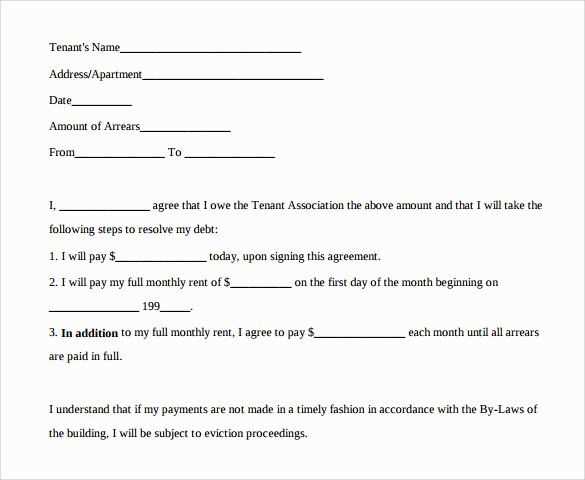

How to Draft a Repayment Agreement

Steps for Creating a Clear Document

Creating a detailed and effective document for a financial arrangement requires careful attention to ensure both parties are on the same page. The purpose of this document is to outline the specifics of the payment process, setting clear terms to avoid confusion. Following a step-by-step approach ensures that all necessary components are included, reducing the risk of miscommunication.

First, it is essential to include the full names of both parties involved. Clearly state the amount owed, the repayment schedule, and any interest or fees that may apply. It is also important to outline the specific dates when payments are due, as well as the method of payment, whether it’s through bank transfer, check, or other means.

Additionally, the document should address what happens if the borrower is unable to meet a payment deadline, including any penalties or additional terms. It’s important to remain specific and avoid vague language to ensure that the terms are enforceable. Lastly, both parties should sign the document, ideally in the presence of a witness, to make it legally binding.

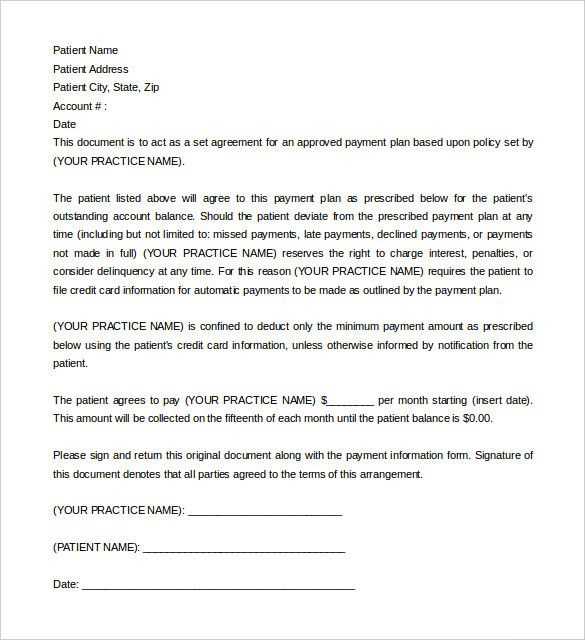

Key Clauses in Loan Repayment Contracts

Crucial Elements for Legal Safeguards

When drafting a document outlining the terms of a loan repayment, it’s essential to include specific clauses that protect both parties involved. These elements are designed to ensure clarity, fairness, and legal enforceability in case of any issues. Each section of the document should address potential risks and provide solutions for common scenarios, giving both parties a clear understanding of their rights and responsibilities.

Payment Amount and Schedule: One of the most important clauses is the clear specification of the amount to be repaid and the schedule of payments. This ensures that both parties understand how much is owed and when payments are due. Without this information, confusion and disputes are more likely to arise.

Consequences of Default: Another crucial clause is outlining what happens if the borrower misses a payment or fails to repay the loan. This may include penalties, interest charges, or other consequences. Clear terms regarding late fees or additional charges can help protect the lender’s interests and encourage timely payments.

Dispute Resolution: It is also important to include a clause on how disputes will be resolved if they arise. This may involve mediation, arbitration, or specifying the jurisdiction where any legal action will take place. Including this provision ensures that both parties know how to address disagreements without escalating to more serious legal proceedings.

Common Errors in Repayment Documents

Avoiding Pitfalls in Agreement Terms

While drafting a document outlining payment terms, it’s easy to overlook key details that could cause issues down the road. Failing to be precise or clear in certain areas may lead to misunderstandings, disputes, or legal complications. Here are some common mistakes to watch out for when creating a payment plan document:

- Unclear Payment Schedule: Not specifying the exact dates and amounts for payments can lead to confusion. Ensure that each payment is outlined with clear deadlines and amounts to avoid ambiguity.

- Lack of Penalty Terms: Failing to mention penalties or interest for missed payments can leave both parties unprotected. Always include consequences for late payments or non-payment, such as additional fees or interest charges.

- Vague Language: Using unclear or ambiguous language can cause disagreements later. Always be as specific as possible about the terms, including payment methods, deadlines, and conditions for changes to the arrangement.

By addressing these common issues, you can create a document that not only meets the needs of both parties but also minimizes the risk of future complications. Always ensure that the terms are as clear and precise as possible to avoid unnecessary legal or financial challenges.