Repayment Plan Letter Template for Debt Management

When dealing with outstanding financial obligations, it’s important to communicate clearly with creditors to arrange manageable terms for repayment. Establishing a formal document that outlines agreed-upon conditions helps both parties stay on track and ensures mutual understanding. This approach promotes a sense of responsibility and accountability while minimizing conflicts.

Why This Agreement Matters

Having a written agreement detailing how debts will be settled provides both the borrower and creditor with a clear reference point. It helps avoid confusion and ensures that expectations are understood. This approach offers both parties security, as they can rely on a documented commitment to follow through with agreed payments over time.

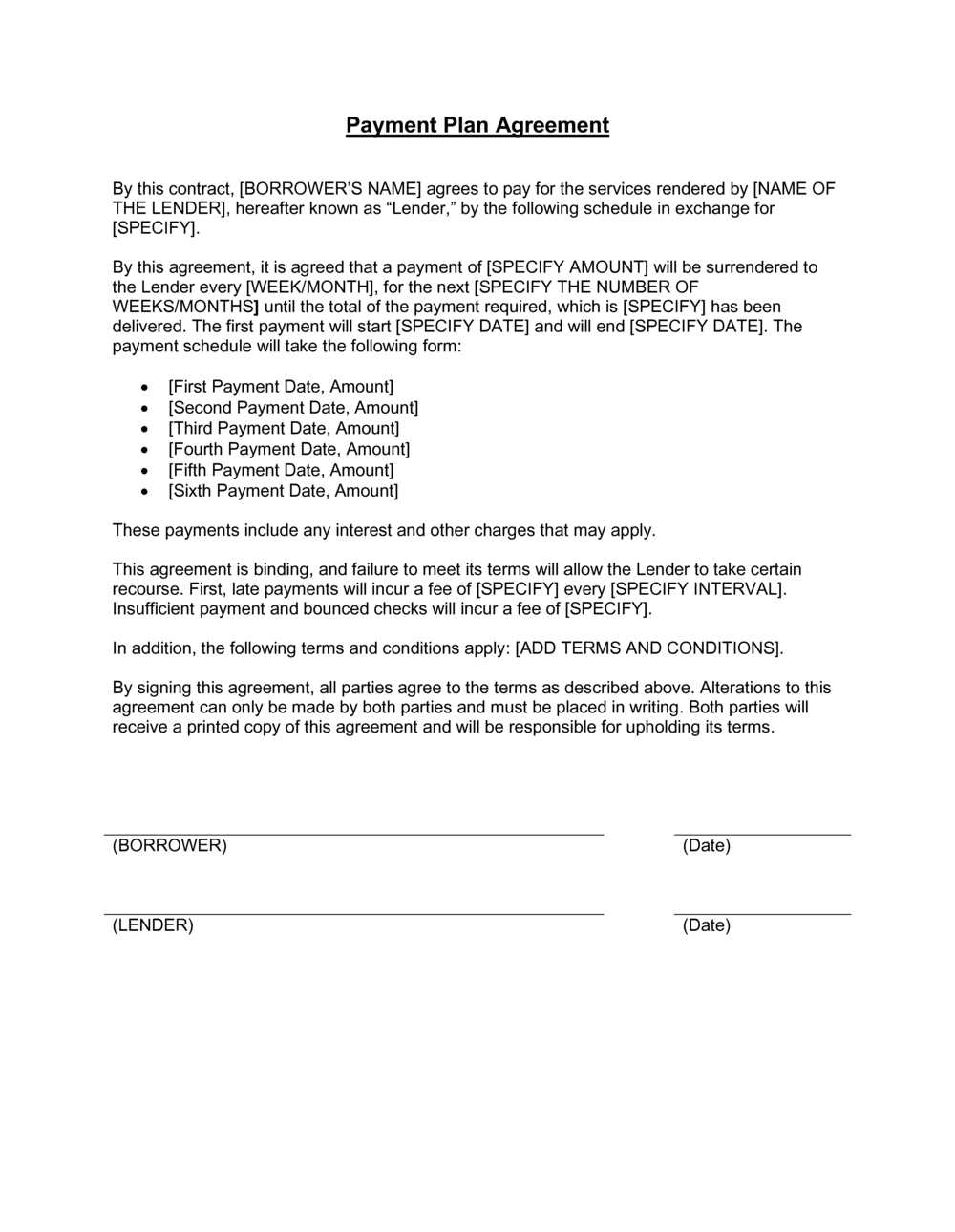

Essential Components to Include

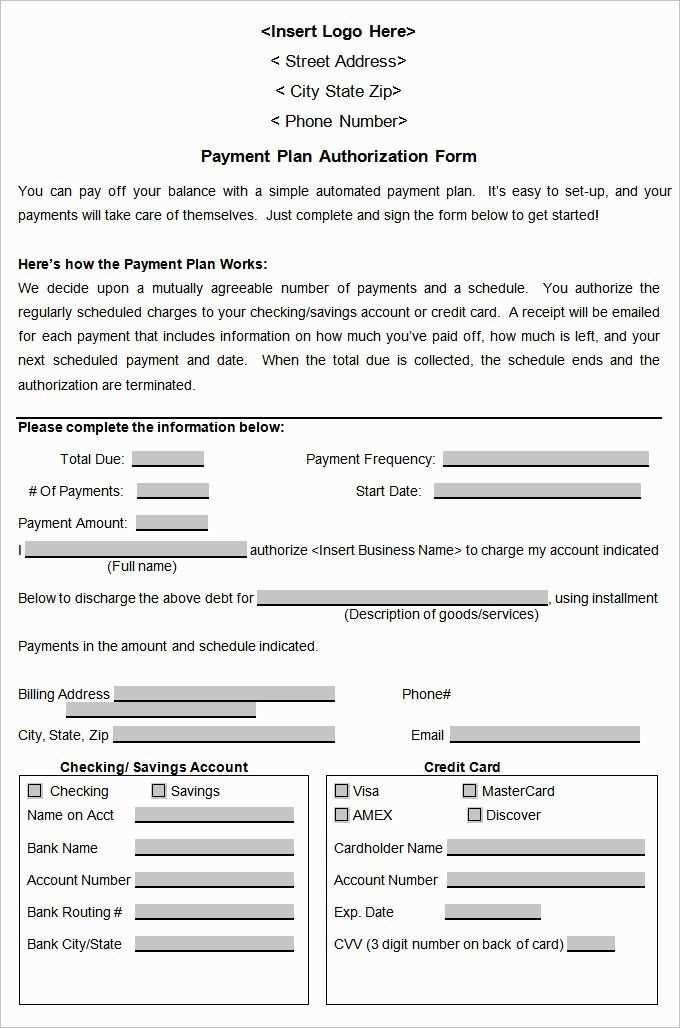

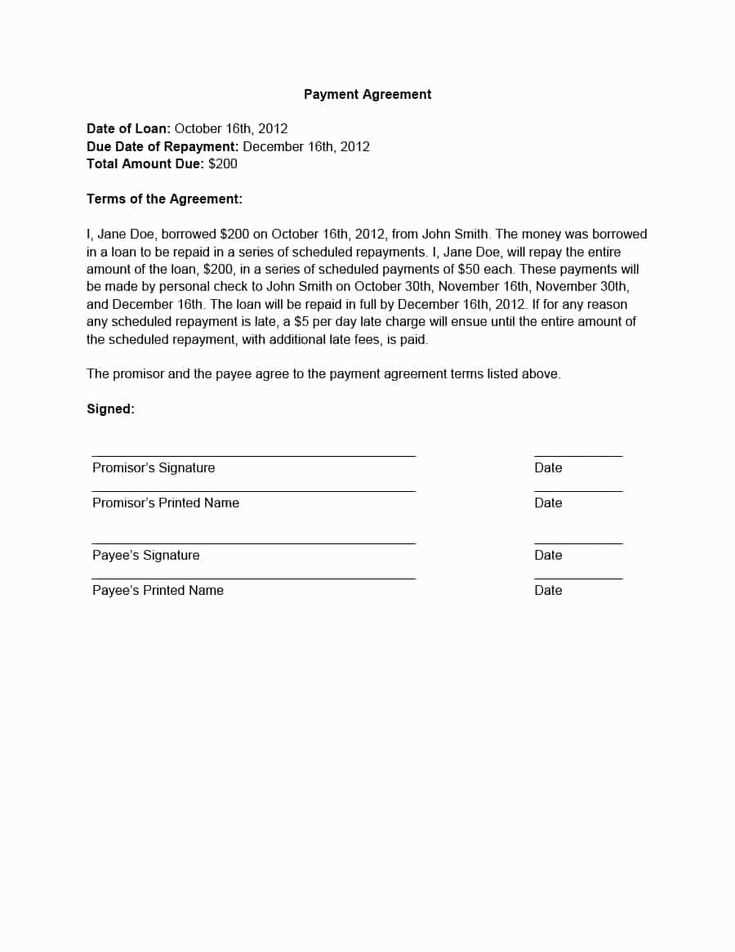

- Contact Details: Include personal information of both parties involved in the agreement.

- Amount Owed: Clearly state the total debt amount and any related interest or fees.

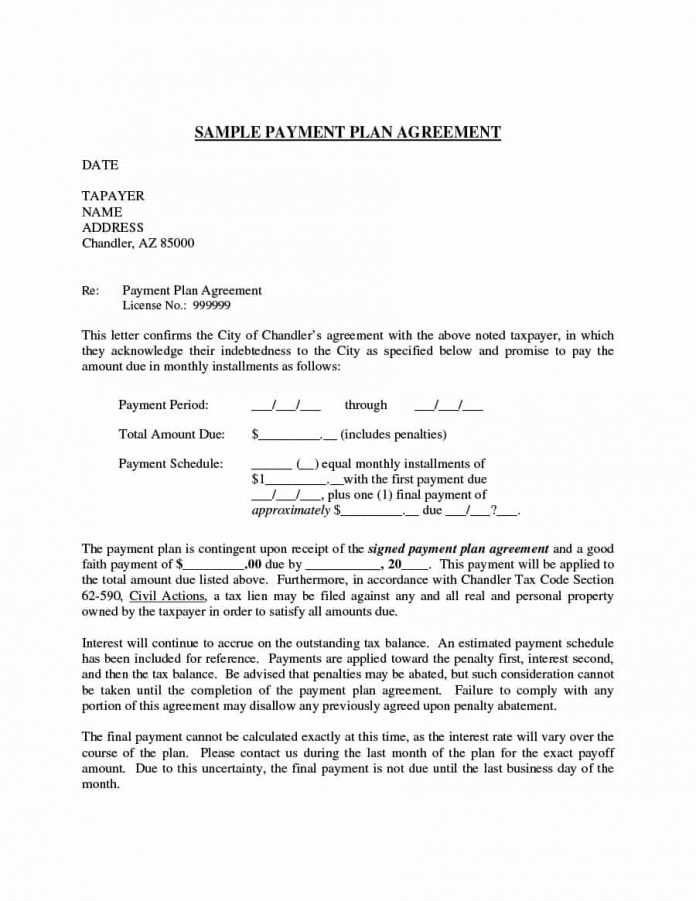

- Payment Schedule: Specify the frequency, amount, and due dates of each installment.

- Consequences of Non-Payment: Outline any penalties or actions that will be taken if payments are missed.

- Signatures: Both parties should sign to acknowledge and confirm the terms.

Customizing the Document for Your Needs

Every financial situation is different, and tailoring the document to fit specific circumstances can be crucial. Consider adjusting the terms based on your capacity to pay, as well as the creditor’s flexibility. It’s important that both sides are comfortable with the arrangements to ensure compliance.

Avoiding Common Errors

It’s easy to overlook critical details when drafting such an agreement. Failing to include clear payment deadlines or the repercussions of missed payments could lead to confusion later. Another mistake is neglecting to specify the full amount due, including fees or interest. Always ensure that the language used is straightforward and leaves little room for interpretation.

Next Steps After Agreement Submission

Once the agreement is finalized, the next step is to monitor compliance. Regularly review the terms to ensure timely payments are made. If circumstances change, don’t hesitate to contact the creditor to renegotiate the terms, ensuring the arrangement remains feasible for both sides.

Structured Agreement Document Overview

Why Use a Financial Agreement

Key Components to Include in the Document

How to Customize Your Agreement

Common Pitfalls to Avoid

Professional Tips for Writing Your Agreement

Next Steps After Finalizing the Document

When dealing with outstanding debts, it’s essential to create a clear, written outline that defines how payments will be handled. This formal agreement helps avoid misunderstandings, ensuring both parties are on the same page regarding repayment expectations and timelines.

Why Use a Financial Agreement

Such an agreement provides both the debtor and creditor with a structured way to manage payments, offering clarity and peace of mind. It serves as an official record that can be referred back to, helping prevent disputes and ensuring both sides are committed to fulfilling the terms.

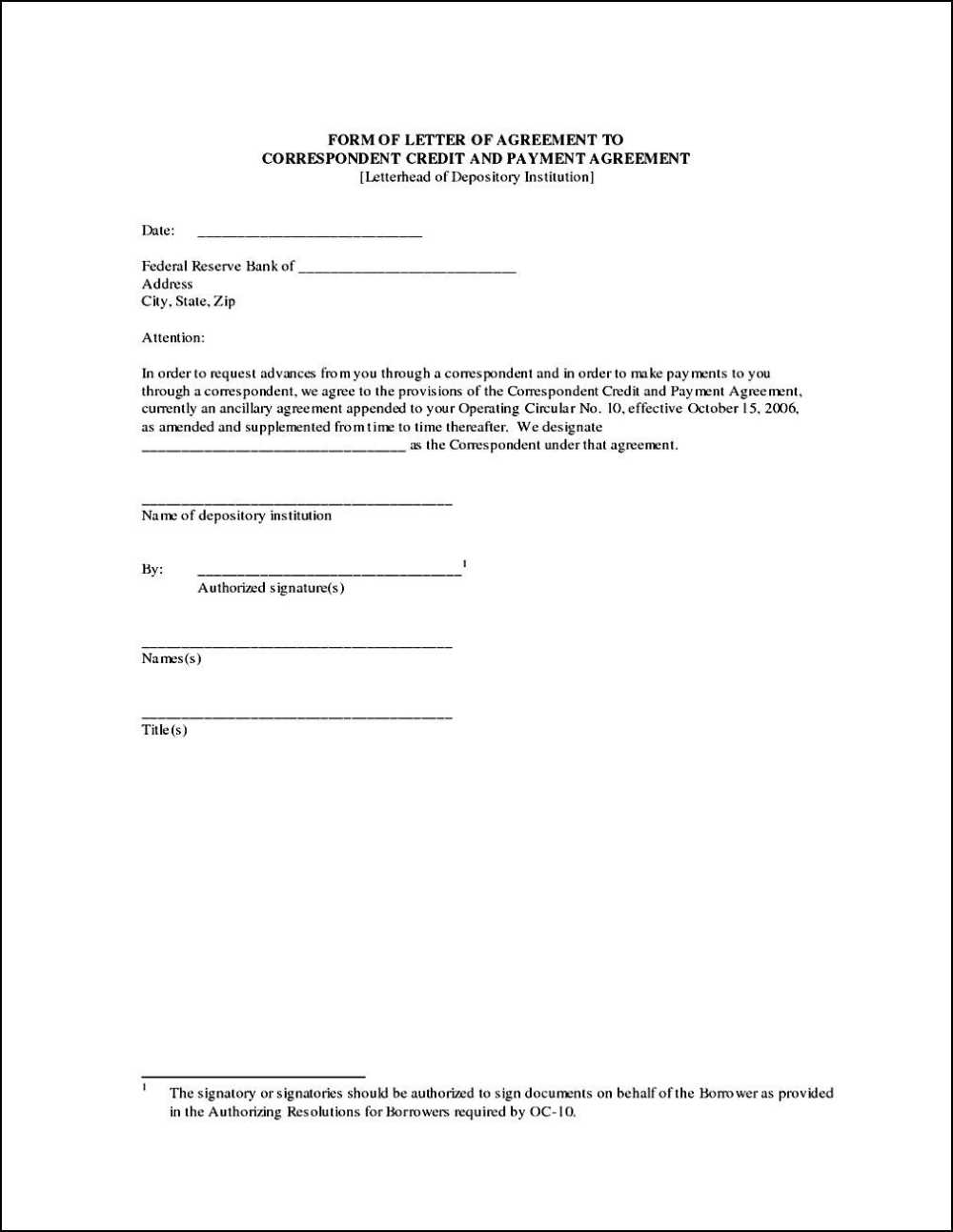

Key Components to Include in the Document

- Personal Details: Both parties should be clearly identified, including contact information.

- Outstanding Amount: Specify the full debt amount, including any accrued interest or fees.

- Payment Schedule: Clearly define how often payments will be made and the amount for each installment.

- Missed Payment Consequences: Outline any penalties for failing to adhere to the payment schedule.

- Signatures: Ensure both parties sign to validate the agreement.

How to Customize Your Agreement

Tailoring the agreement to fit your specific situation is crucial. Adjust the payment amounts and deadlines according to your ability to meet them, while considering the flexibility of the other party. Customization ensures the terms are manageable for both sides.

Common Pitfalls to Avoid

Omitting important details such as payment dates, the total owed, or consequences for missed payments can lead to confusion. Make sure to clarify all terms and avoid vague language that could lead to disagreements later on.

Professional Tips for Writing Your Agreement

Keep the language simple, direct, and formal. Avoid unnecessary jargon and ensure that all terms are easily understandable. Proofreading the document before submitting is essential to ensure accuracy and clarity.

Next Steps After Finalizing the Document

After the agreement is finalized, both parties should keep a copy for their records. Regularly check that payments are being made as per the schedule, and if circumstances change, reach out to renegotiate the terms to ensure the arrangement remains viable.