Returned Check Letter Template for Customers

In any business, managing financial transactions smoothly is essential. However, when a payment fails due to insufficient funds, clear communication with the payer becomes crucial. Ensuring that your communication is professional and effective can help resolve the situation without escalating tensions.

Notifying someone of a failed payment requires careful wording. It’s important to remain polite yet firm, providing the necessary information for them to rectify the situation. A well-constructed notice not only clarifies the issue but also helps maintain a positive relationship moving forward.

Effective communication should focus on offering solutions and providing clear instructions for the next steps. This approach ensures that both parties understand the issue and work towards a resolution. Crafting such messages requires attention to detail and empathy, while still being direct and straightforward.

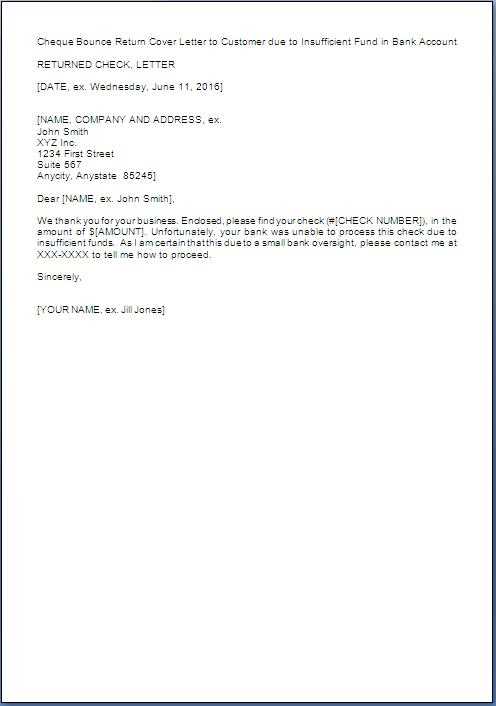

Returned Check Letter to Customer Template

When a payment is unsuccessful due to insufficient funds, it’s important to communicate the situation clearly and professionally. A formal notification should be drafted to inform the payer about the issue and provide them with the next steps. This helps ensure the matter is addressed promptly and maintains a professional tone throughout the interaction.

To avoid misunderstandings and ensure clarity, the notification should include relevant details such as the amount involved, the reason for the failure, and the requested actions to resolve the issue. A well-crafted message encourages the recipient to take immediate action without feeling frustrated or alienated.

By following a straightforward format and addressing all necessary points, the notification serves as a clear guide for the payer. This structured approach makes it easier for both parties to understand the situation and work towards a resolution without confusion or delay.

Understanding the Returned Check Situation

When a payment fails to go through due to insufficient funds, it’s crucial to address the issue with care and clarity. This situation requires both parties to fully understand the circumstances and agree on the necessary steps to resolve it. Effective communication is key to ensuring a quick resolution and avoiding any misunderstandings.

Why Payments Fail

Payments may not be processed due to several reasons, such as an overdrawn bank account or errors in account information. Understanding the root cause of the issue helps in crafting the right response and guiding the recipient on how to fix the problem efficiently.

Impact on Business Relationships

While a failed transaction can cause inconvenience, it’s important to handle the situation professionally to maintain a positive business relationship. Addressing the issue promptly and respectfully encourages trust and keeps the lines of communication open for future dealings.

Key Elements of a Returned Check Letter

When addressing an unsuccessful payment, the communication must include specific details to ensure clarity and avoid confusion. Key elements in this type of message help provide the recipient with all the necessary information to understand the issue and take appropriate action. A well-structured message not only conveys the necessary details but also maintains a professional tone throughout.

Essential Information to Include

The main details that should be present include the amount of the failed transaction, the reason for the issue, and any fees or charges incurred due to the problem. Additionally, the message should outline clear instructions on how to resolve the issue, such as providing an alternative payment method or correcting account details.

Maintaining a Professional Tone

Even though the situation may be frustrating, it’s important to stay professional and courteous. Using polite language and offering helpful solutions can help preserve the relationship with the payer while ensuring the situation is resolved quickly and efficiently. The message should focus on providing assistance and not laying blame.

How to Address Insufficient Funds Professionally

When a payment fails due to a lack of funds, it’s essential to approach the situation with professionalism and understanding. Addressing the issue in a respectful manner helps maintain a positive relationship with the payer while ensuring the problem is resolved promptly. Clear and concise communication is crucial for both parties to understand the situation and the next steps.

Start by providing the necessary details of the failed transaction, including the amount and reason for the failure. It’s also important to remain polite and offer clear instructions on how to proceed. Whether it’s requesting an alternative payment method or providing more time to resolve the issue, always frame your message in a way that shows willingness to work with the recipient to resolve the matter.

Being empathetic yet firm ensures that the payer feels heard, but also understands the seriousness of the situation. A professional tone will help avoid escalation and foster a cooperative approach towards resolving the issue quickly.

Common Mistakes to Avoid in Letters

When communicating about a failed payment or insufficient funds, certain errors can undermine the effectiveness of the message. Avoiding these mistakes is essential for maintaining professionalism and ensuring that the recipient clearly understands the issue and the required actions. Below are some common mistakes that can hinder the communication process.

| Mistake | Effect | Solution |

|---|---|---|

| Using harsh or accusatory language | Can damage relationships and create tension | Maintain a neutral and respectful tone |

| Being vague or unclear | Leads to confusion and delays in resolving the issue | Provide clear details and instructions |

| Failing to offer solutions | Can leave the recipient unsure about how to proceed | Provide actionable steps and options for resolution |

| Not including necessary payment details | Causes confusion and delays | Clearly outline the amount, reason, and next steps |

Avoiding these common mistakes ensures that your communication remains effective and professional, ultimately helping to resolve the situation smoothly and quickly.

Steps to Take After Sending the Letter

After sending the communication regarding the failed payment, it’s important to follow up and ensure that the recipient is taking the necessary actions to resolve the issue. Waiting for a response is not enough; proactive steps can help speed up the process and prevent further complications.

Begin by tracking the response from the recipient. If no action is taken within the expected timeframe, it’s appropriate to send a polite reminder or follow-up message. This helps keep the matter on the recipient’s radar and increases the chances of a quick resolution.

If the issue persists despite reminders, consider offering additional options for resolving the payment, such as discussing payment plans or exploring alternative methods. Clear communication at this stage can encourage the recipient to act swiftly, maintaining a professional and cooperative approach.

Best Practices for Handling Customer Disputes

When dealing with disagreements regarding failed transactions, it’s crucial to approach the situation with patience and professionalism. Effectively managing disputes can prevent escalation, protect relationships, and lead to timely resolutions. By following best practices, you can address concerns in a way that maintains mutual respect and fosters positive outcomes.

- Stay Calm and Professional: Always remain composed when addressing disputes, no matter how frustrating the situation may be.

- Listen Carefully: Allow the other party to explain their side of the story, showing empathy and understanding.

- Clarify the Issue: Ensure both parties understand the cause of the problem by asking relevant questions and restating key points.

- Offer Solutions: Propose practical solutions, such as alternative payment methods or payment arrangements, that are mutually beneficial.

- Document Communication: Keep a record of all exchanges to avoid misunderstandings and ensure transparency throughout the process.

By adhering to these guidelines, you can resolve disputes effectively while maintaining a positive relationship with the other party. It’s important to communicate clearly, offer viable solutions, and avoid being confrontational to encourage a collaborative approach to problem-solving.