Roof Certification Letter Template for Quick and Easy Use

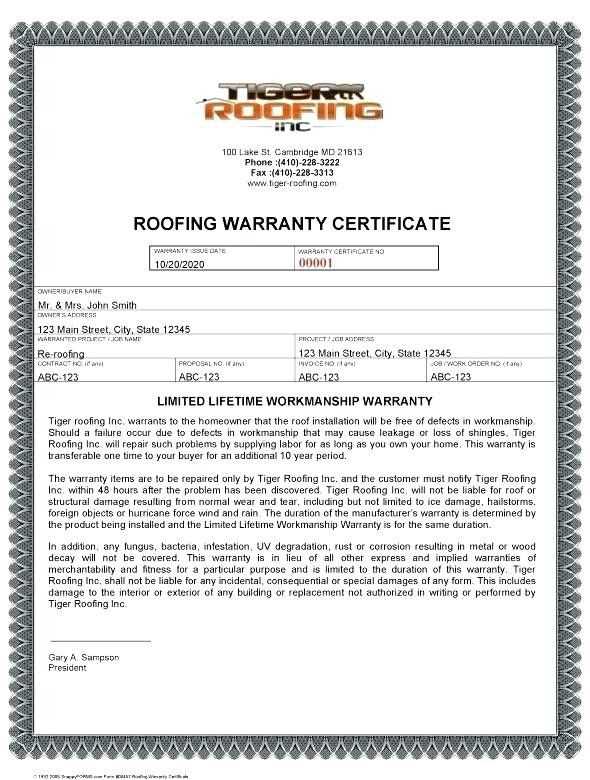

When you’re looking to verify the condition of a building’s upper structure, a formal document is often required. This document serves as a proof of the inspection’s completion and confirms that the structure meets necessary safety standards. Whether you’re buying a home or seeking insurance, knowing how to draft such a report is crucial.

Why You Might Need an Inspection Report

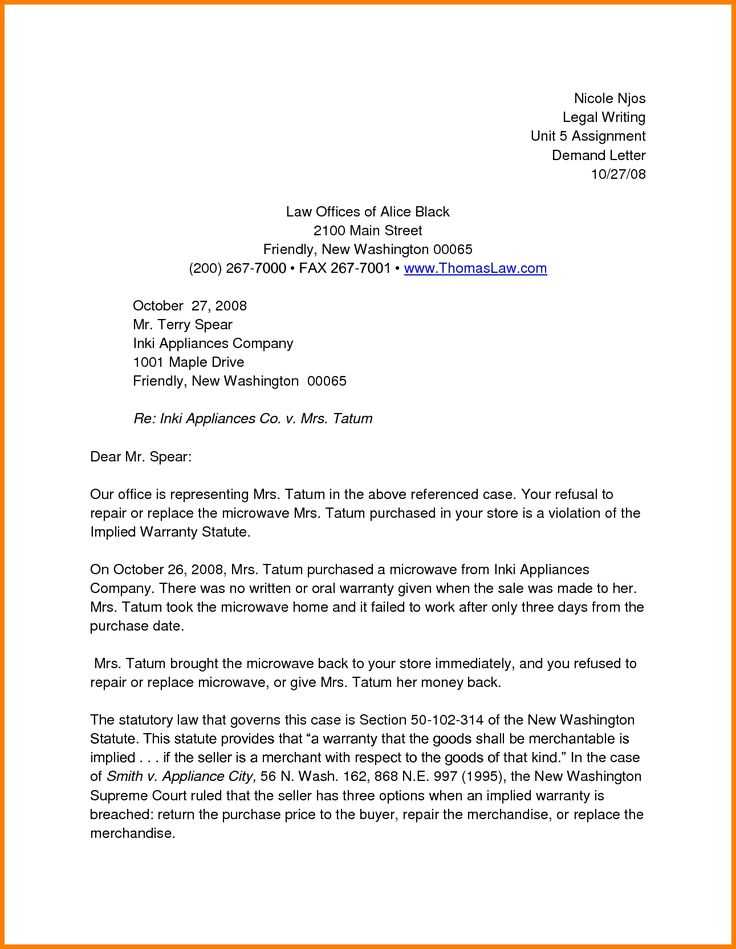

There are several situations where this report becomes essential. Typically, it’s needed when a property transaction is in progress or if an insurer requires verification before providing coverage. In some cases, it’s used to demonstrate the integrity of the building to potential buyers or lenders.

Key Points to Include

- Inspector Information: Include the name, qualifications, and contact details of the individual performing the assessment.

- Condition Assessment: Describe the findings, focusing on any issues found, including wear and tear or structural concerns.

- Conclusion: A clear statement about the overall condition of the inspected area and whether it meets safety regulations.

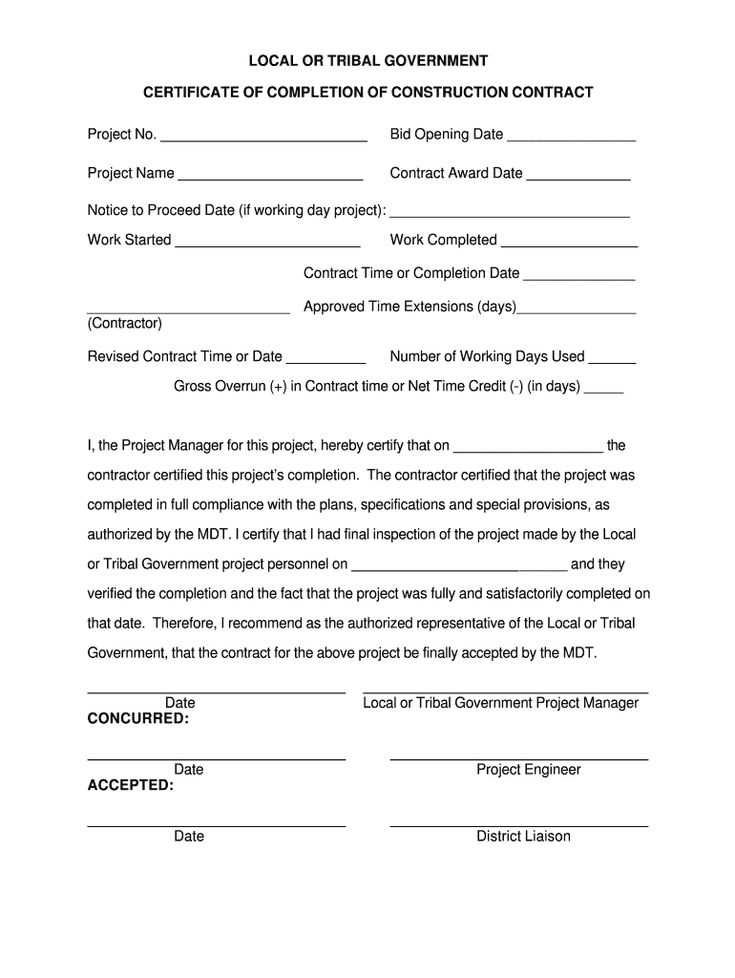

Steps to Draft the Document

- Start with basic property details: address, owner, and the date of inspection.

- Include a summary of the assessment process, such as methods used and areas examined.

- Provide the detailed findings, including descriptions and any recommendations for repairs if necessary.

- End with the inspector’s signature and contact details for any follow-up queries.

Common Mistakes to Avoid

Creating a clear and professional document is essential, but there are common mistakes to be aware of. Ambiguities or incomplete assessments can lead to confusion or delays in transactions. It’s important to avoid technical jargon unless it’s necessary and to ensure all details are accurate and easy to understand.

Understanding Property Inspection Reports and Their Importance

When assessing the condition of a building’s upper structure, a professional evaluation is often required. This document serves as proof that the property has been thoroughly checked and meets required standards for safety and functionality. It plays a crucial role in various processes, including property transactions, insurance applications, and general maintenance records.

One of the key reasons to request this type of inspection is to ensure that a building is safe and structurally sound. Many potential buyers or insurance providers require this verification before proceeding with a sale or issuing a policy. A comprehensive assessment offers clarity and confidence, ensuring that the property meets all necessary regulations.

Important Elements in Inspection Documentation

- Inspector’s Credentials: Clearly state the qualifications and contact details of the individual performing the check.

- Detailed Findings: Describe any identified issues or repairs needed. This section should be thorough, noting any risks or damage.

- Final Assessment: A clear conclusion that indicates whether the structure is in good condition or requires maintenance.

How to Create a Comprehensive Evaluation Document

To produce a well-organized report, start by including basic details, such as the property address, the date of inspection, and the name of the professional carrying out the assessment. Follow this with a breakdown of the areas that were examined, including the methods used and findings. Be clear about any issues and provide an expert recommendation on whether further work is required. End the document with the inspector’s signature for validation.

How These Documents Affect Insurance Coverage

Insurance companies often rely on this documentation to determine the level of risk associated with a property. A report that confirms the building is in good condition may result in lower premiums, while findings of damage or risk may increase costs or even prevent coverage from being issued. This makes an accurate report crucial when dealing with insurers.

Common Mistakes to Avoid in Inspection Reports

Failure to clearly articulate findings or include all relevant details can lead to confusion or delays. Incomplete assessments may cause issues when trying to sell or insure a property. It’s important to avoid vague language, ensure all areas are thoroughly checked, and maintain accuracy in the final report.