Section 609 Dispute Letter Template for Credit Repair

When it comes to maintaining a healthy credit score, ensuring that your credit report contains accurate information is essential. Credit errors can negatively impact your ability to obtain loans, mortgages, or even secure employment in some cases. Fortunately, there are ways to challenge incorrect entries on your credit report and request their removal, helping to restore your creditworthiness.

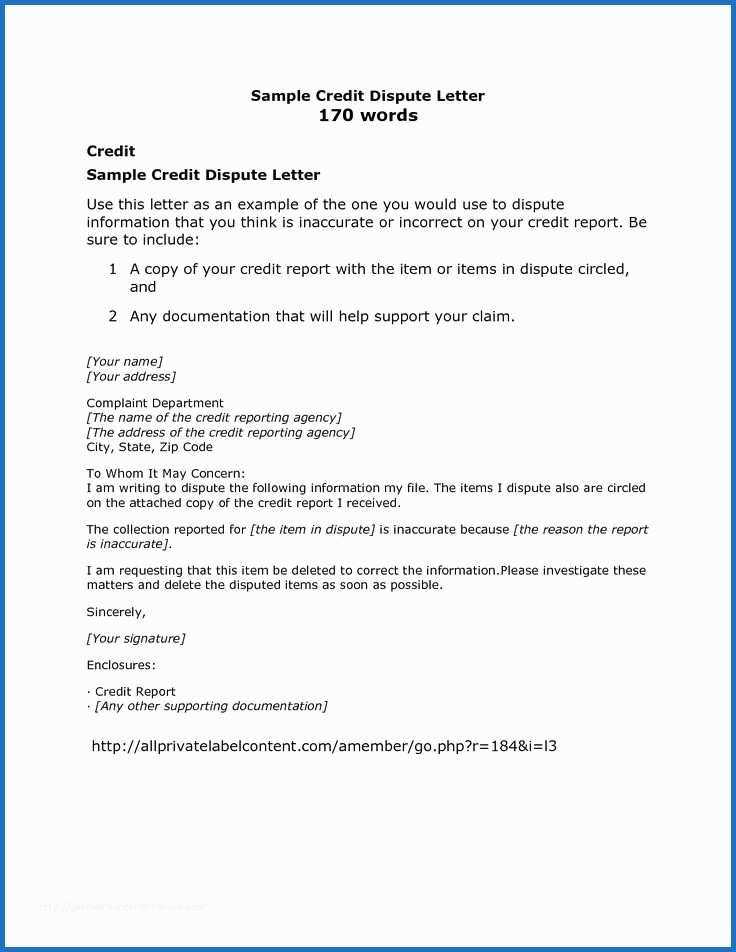

One effective method for addressing inaccuracies involves formally notifying credit bureaus about the errors you’ve identified. By submitting a carefully written request, you can prompt an investigation into the disputed entries. This process allows you to potentially remove or correct any misleading information that may be dragging down your score.

Taking the right approach is crucial when it comes to drafting your formal request. A well-crafted communication can ensure that your concerns are taken seriously and acted upon promptly. It’s important to know what to include and how to structure your message to maximize the chances of success. In this guide, we’ll walk you through the necessary steps to effectively challenge inaccurate credit information and improve your financial standing.

Understanding Section 609 of the FCRA

The Fair Credit Reporting Act (FCRA) offers individuals the right to challenge inaccuracies found in their credit reports. This legal framework ensures that consumers can maintain accurate records and protect their financial reputation. One specific provision of the FCRA allows people to request the removal of incorrect or unverifiable information from their credit history.

This part of the law is particularly important for those seeking to improve their credit scores. By using the appropriate procedures outlined in the FCRA, individuals can take action against data that is inaccurate, outdated, or not supported by reliable sources. It provides a legal avenue to ensure the integrity of the information that affects major financial decisions.

The following table outlines the key aspects of the legal provision that empowers individuals to request changes to their credit reports:

| Key Aspect | Description |

|---|---|

| Right to Challenge | Consumers have the right to challenge any information that they believe is incorrect or cannot be verified. |

| Credit Bureau Responsibility | Credit bureaus must investigate the challenged information and provide a response within a set time frame. |

| Impact on Credit Report | If the information is found to be inaccurate, it must be removed or corrected, which can positively affect the credit score. |

| Time Limit | The credit bureau must respond to a challenge within 30 days, ensuring a timely resolution. |

How Section 609 Helps with Credit Disputes

The Fair Credit Reporting Act provides a powerful tool for consumers to challenge inaccurate or misleading information on their credit reports. This specific provision empowers individuals to ask for the removal of unverifiable or erroneous data, ensuring that only accurate and reliable information affects their credit scores. By utilizing this legal framework, consumers have the ability to protect their financial identity and maintain a fair representation of their credit history.

When credit reporting agencies are unable to verify certain information, they are required to investigate the claim and, if necessary, remove or amend the details. This process helps ensure that no faulty or outdated entries remain on a person’s record, which could otherwise harm their ability to secure loans or credit. It also promotes transparency and accountability in the financial industry.

This provision is particularly valuable because it helps rectify errors that may have been introduced by creditors, reporting agencies, or third parties. Whether it’s a mistaken account entry or outdated debt, individuals can seek correction, which can have a significant impact on their creditworthiness. As a result, it provides a means for consumers to regain control over their financial reputation and work toward improving their credit scores.

Steps to Write a Dispute Letter

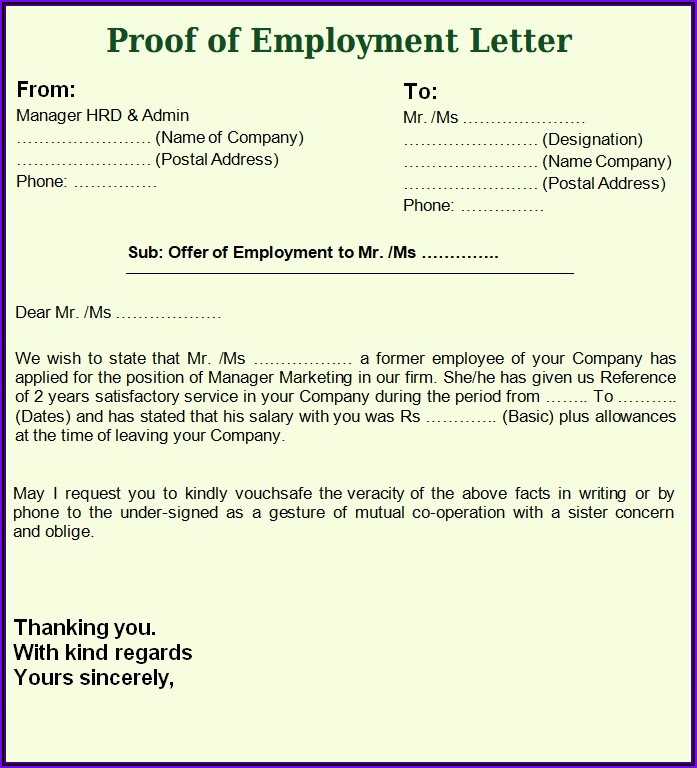

When challenging inaccurate information on your credit report, it’s essential to submit a well-structured and clear request to the relevant credit bureau. A formal inquiry ensures that your concerns are addressed promptly and accurately. By following a few straightforward steps, you can draft a compelling message that supports your case and increases the likelihood of a successful resolution.

Gather Necessary Information

Before you begin writing, gather all relevant documentation related to the item you are questioning. This may include account statements, proof of payment, or any correspondence with the creditor. Having this information at hand will help you present a strong case and support your claim.

Crafting Your Message

Your communication should clearly outline the issue and provide a detailed explanation of why you believe the information is incorrect. Be concise and include all necessary facts to avoid confusion. Ensure that your request is polite yet firm, emphasizing the need for a thorough investigation of the inaccurate entry.

Common Mistakes to Avoid in Dispute Letters

When submitting a request to challenge inaccurate information on your credit report, it’s crucial to avoid certain missteps that could hinder the process. A well-constructed message can make all the difference in ensuring that the credit bureaus take your concerns seriously and act quickly. Here are some common errors to be aware of when crafting your communication.

One common mistake is providing insufficient details about the issue you’re addressing. Without a clear explanation or supporting evidence, your inquiry may be dismissed or delayed. It’s essential to include all relevant information, such as account numbers, dates, and a concise description of the error, to ensure the investigation proceeds smoothly.

Another error is using vague or unprofessional language. While it’s important to be firm in your request, using aggressive or overly emotional language can undermine your credibility. Keeping the tone polite and respectful increases the chances of a positive outcome. Additionally, avoid making broad or unfounded accusations, as this may weaken your case.

Effective Strategies for Disputing Inaccuracies

When challenging incorrect information on your credit report, applying the right approach can significantly improve your chances of a favorable outcome. By following a systematic process and utilizing proven techniques, you can increase the likelihood of having misleading data removed or corrected. Below are a few effective strategies to consider when addressing inaccuracies.

Gather and Organize Documentation

One of the first steps is to gather all relevant documentation that supports your claim. Having evidence to back up your assertions will strengthen your case and provide the credit bureaus with the necessary information to investigate your claim thoroughly.

- Account statements that show payments or account status.

- Receipts, emails, or other correspondence with the creditor.

- Proof of identity, such as a government-issued ID, to confirm your details.

Be Clear and Concise

When explaining the error, avoid ambiguity. Provide a direct and clear statement outlining the issue, why it is incorrect, and why it needs to be corrected. A well-organized message is more likely to be taken seriously.

- State the specific item on your credit report that is in question.

- Explain why the information is inaccurate or unverifiable.

- Provide a request for removal or correction, backed by supporting documents.

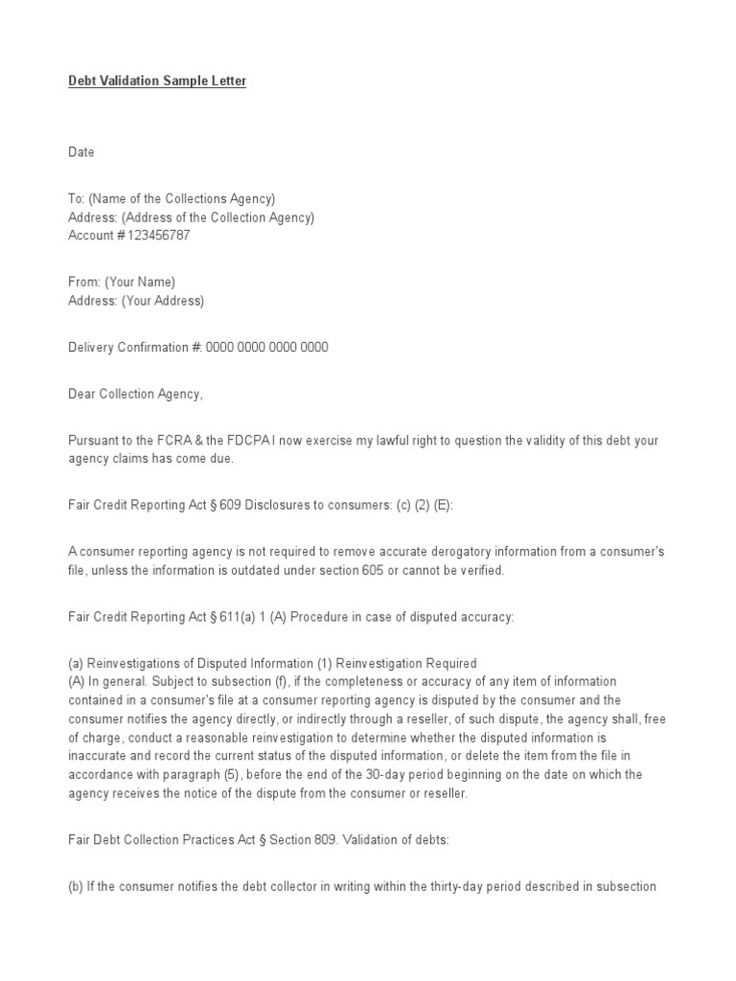

When to Use a Section 609 Letter

There are specific situations when it’s necessary to challenge inaccurate or unverifiable information on your credit report. If you come across entries that seem incorrect, outdated, or unsubstantiated by proper documentation, it may be time to take action. Using a formal request can help you address these issues directly with the credit reporting agencies, prompting them to investigate and potentially correct the record.

One of the key moments to use this approach is when you identify information that cannot be verified or when a creditor fails to provide proper proof of the debt. If the details in your report are outdated or incorrect, and there is no way to validate them, initiating a formal process is a powerful tool. This request puts the burden on the credit bureau to verify the information and correct any inaccuracies that may be harming your credit score.