Self Employed Proof of Income Letter Template

When running your own business or working independently, demonstrating your financial stability may be necessary for various purposes. Whether applying for a loan, renting an apartment, or proving your ability to manage expenses, a well-crafted financial statement can help you showcase your earnings and establish trust. It’s crucial to present a clear and accurate account of your financial situation to ensure potential clients, landlords, or lenders have a reliable reference.

Creating a document that outlines your earnings involves including specific details to make your statement credible and professional. Knowing what information to include, how to format it, and ensuring that it meets the requirements of the requesting party are essential steps. By following the right approach, you can avoid common pitfalls and present a polished representation of your financial standing.

Mastering this process can make a significant difference in achieving your financial goals. The following section will guide you through the steps to create a comprehensive and trustworthy document that accurately reflects your financial position.

Understanding Financial Documentation for Independent Workers

For individuals working independently or running their own business, demonstrating financial stability can be a key factor in various situations. Whether applying for loans, renting property, or securing contracts, it is often necessary to present a clear account of how much money is earned and how consistently it comes in. This documentation serves as a way to reassure others that financial obligations can be met without difficulty.

The essential component of such records is the ability to showcase earnings over a period of time. The goal is to create a document that proves reliability and establishes credibility with external parties. The challenge lies in ensuring that the information provided is transparent, accurate, and understandable, as each financial situation may vary depending on the type of work or business model involved.

Clarity and precision are key in making this kind of financial evidence effective. Understanding what details to include, how to present them, and the level of detail required can make a big difference in how the information is perceived by others.

What to Include in Your Document

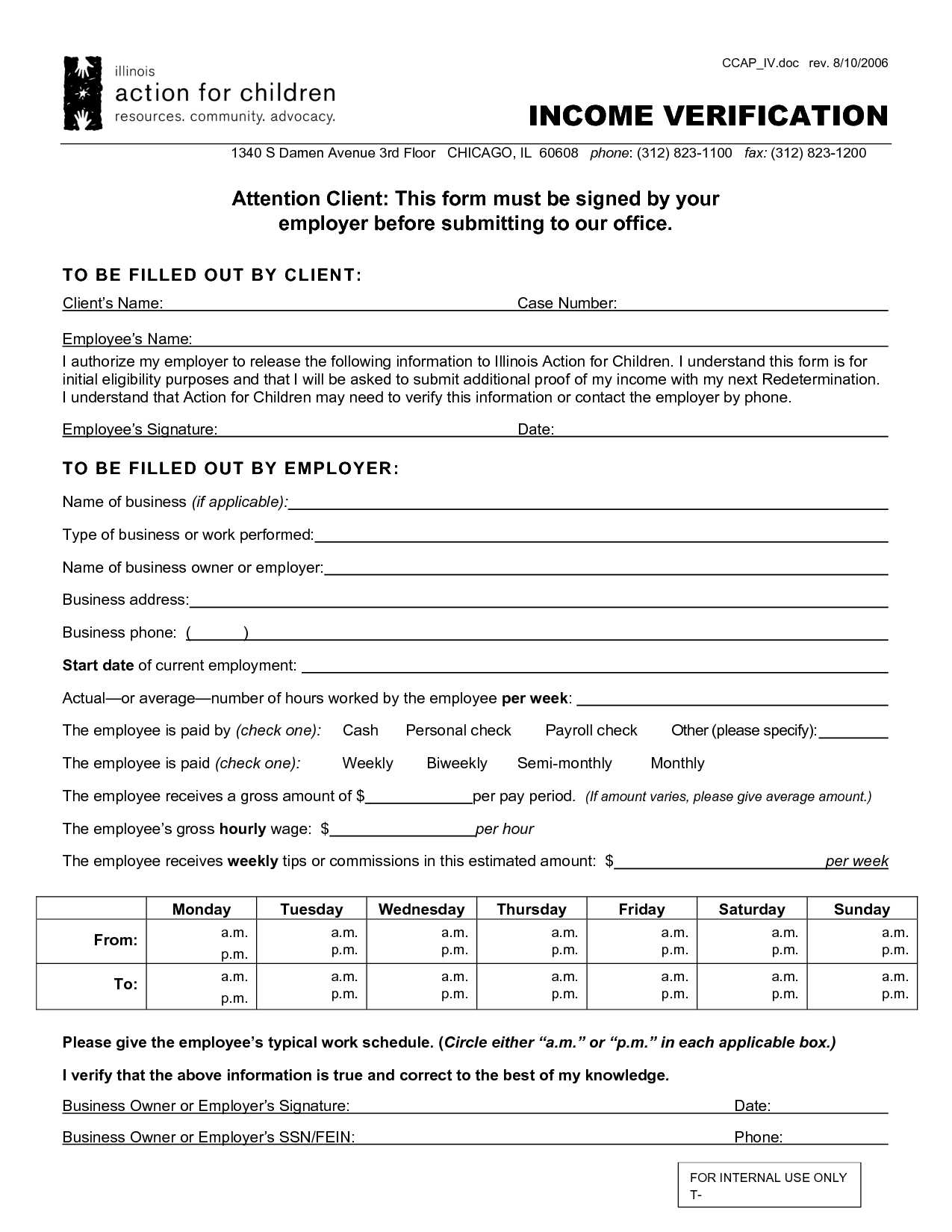

When creating a document to demonstrate financial standing, certain key details must be included to make it credible and useful. A well-structured account should cover all the necessary aspects of your earnings, ensuring that it provides a comprehensive picture of your financial situation. Including the right information will make it easier for others to assess your ability to meet obligations.

Start by clearly stating the time period that the document covers, as this helps to establish the scope of your earnings. Next, include the total amount earned, broken down by sources or types of work, if applicable. It’s important to highlight regular payments and note any significant fluctuations. Additionally, providing contact information, your business name, and other identifying details adds legitimacy to the document, allowing the recipient to reach out for verification if necessary.

Why Independent Workers Need This Document

Individuals who work independently or run their own businesses may face situations where they need to prove their financial reliability. Unlike traditional workers who receive regular paychecks, independent professionals often have income that varies month to month. This can make it challenging for others, such as lenders or landlords, to assess their financial stability. A properly prepared document helps clarify this situation and builds trust with external parties.

There are several situations where such a document becomes necessary:

- When applying for loans or mortgages

- While renting or leasing property

- For tax reporting or legal purposes

- When securing contracts or funding from investors

Having a reliable way to present earnings can significantly improve opportunities and streamline various processes that require financial transparency. This document serves as an essential tool in providing the necessary details that others need to assess your ability to meet obligations.

Common Situations Requiring Proof of Earnings

There are several instances where demonstrating your financial capacity becomes essential. These situations often arise when others need to evaluate your ability to fulfill financial commitments. Whether for securing housing, applying for loans, or proving financial responsibility in other ways, providing clear documentation of your earnings helps others make informed decisions.

Some of the most common scenarios include:

- Applying for a mortgage or personal loan

- Renting or leasing a property

- Seeking financial assistance or grants

- Submitting tax returns or responding to tax inquiries

- Negotiating contracts or business agreements

In each case, being able to present a well-documented and verifiable summary of your financial earnings ensures that the process runs smoothly and that you can demonstrate your ability to meet financial obligations.

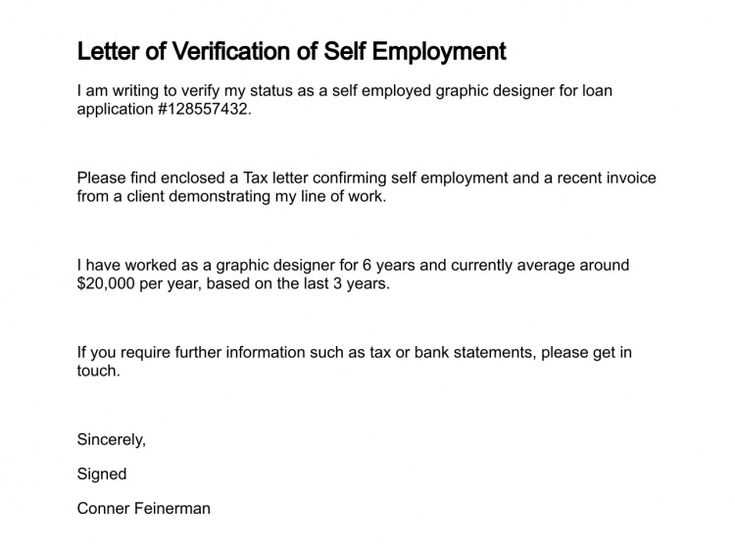

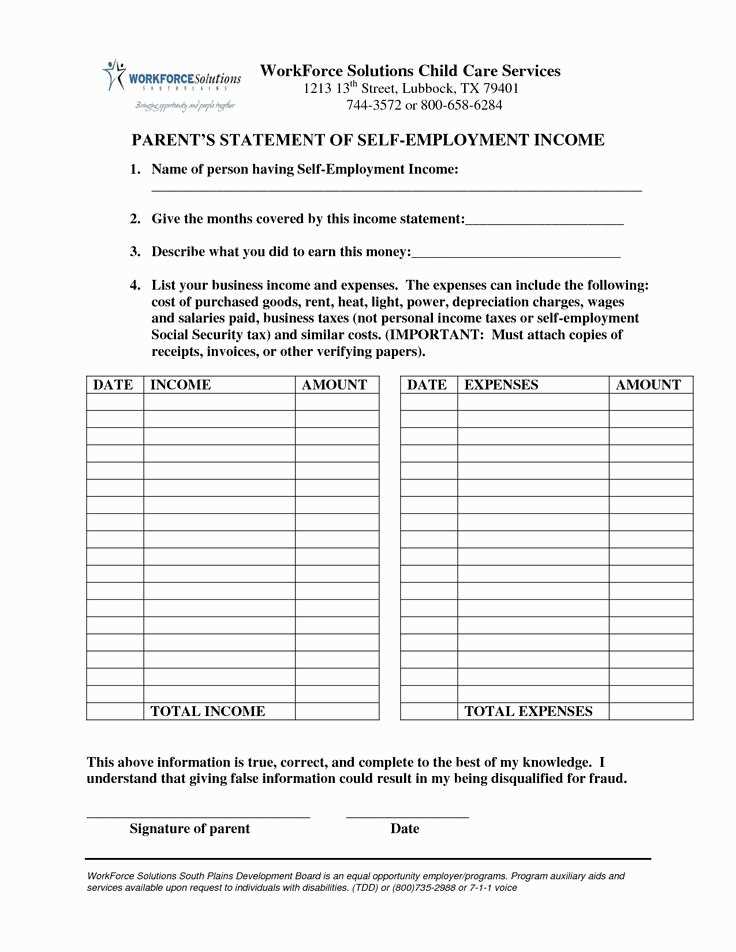

How to Write a Financial Statement for Independent Workers

Creating a comprehensive financial summary involves more than just listing numbers; it requires a clear presentation of your earnings and expenses in a format that is easy to understand. This document serves as a formal record of your financial situation, and its accuracy is crucial when presenting it to others. Below are the steps to follow when preparing a financial statement that accurately reflects your earnings.

Steps to Follow

- Start with personal details, including your name, business name, and contact information.

- Specify the time period that the statement covers, such as monthly, quarterly, or yearly.

- List your sources of income, breaking them down by type or client if needed.

- Include any irregular earnings or one-time payments, highlighting them separately.

- Deduct business-related expenses to provide a clear view of your net earnings.

- Ensure clarity by using easy-to-understand language and a clean layout.

Additional Tips

- Include supporting documentation like invoices or bank statements to verify amounts.

- Double-check for accuracy and consistency to avoid any discrepancies.

- If necessary, provide a summary of your monthly or yearly earnings to give a broader picture.

By following these steps, you can create a statement that clearly communicates your financial situation in a professional manner, ensuring that others can easily assess your ability to meet financial obligations.

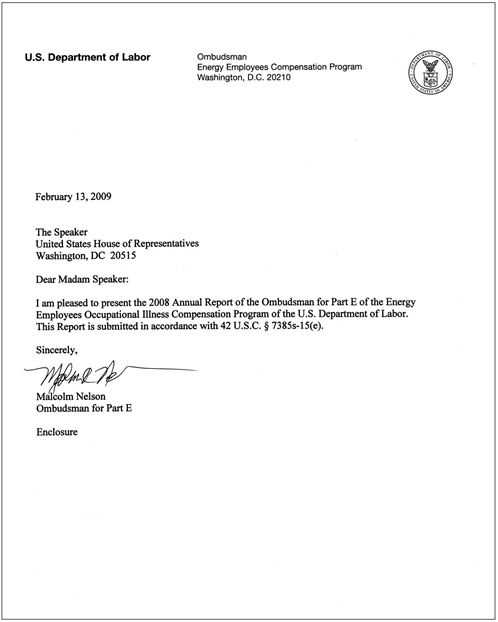

Best Practices for Clear Documentation

When creating a document to showcase your financial standing, clarity is essential. A well-organized and easy-to-read statement ensures that the information is accessible and comprehensible for anyone reviewing it. Following best practices not only improves the document’s effectiveness but also increases its trustworthiness and professionalism.

Consistency and accuracy are key elements when presenting your financial data. Be sure to use uniform formatting throughout the document, including consistent date ranges and clear labels for each section. Avoid unnecessary jargon and focus on presenting the facts in a simple yet professional manner.

Another important practice is to provide supporting evidence when possible. Attach relevant invoices, receipts, or bank statements to strengthen the credibility of the information. Always ensure that the data is up-to-date and free from errors, as even small mistakes can raise doubts about the validity of the document.

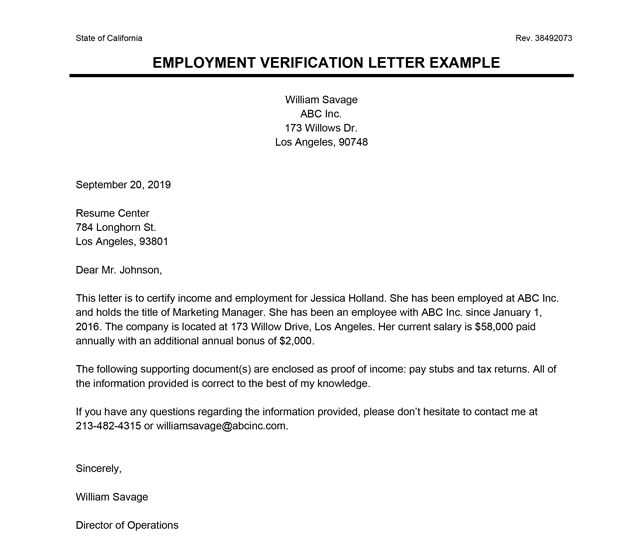

Tips for Ensuring Your Document’s Credibility

To ensure that your financial statement is taken seriously, it is crucial to maintain a high level of trustworthiness in the information presented. A credible document can help avoid skepticism from lenders, landlords, or any other parties requiring verification of your financial standing. There are several key practices to follow in order to establish the document’s reliability.

One of the most important factors is providing clear, verifiable information. Using well-organized details and supporting documents, such as invoices or transaction records, adds weight to your claims. Below is a simple example of how to structure the key components to maintain clarity and transparency:

| Section | Details |

|---|---|

| Personal Information | Include full name, business name, and contact details. |

| Income Sources | Break down earnings by client or type of work. |

| Dates | Clearly state the time period the document covers. |

| Supporting Documents | Attach relevant invoices, contracts, or bank statements. |

By adhering to these practices and ensuring all details are accurate and supported by evidence, your document will be much more likely to gain the trust of the recipient and serve its intended purpose effectively.

Avoiding Common Mistakes in Your Document

When creating a financial summary, it’s important to avoid certain errors that could undermine the credibility of your submission. Even minor mistakes can lead to confusion or doubts about the accuracy of the information, potentially causing delays or issues in achieving your goals. Being aware of these common pitfalls and taking steps to avoid them can ensure that your document is both clear and professional.

Some typical mistakes to avoid include:

- Not including the necessary time frame for the earnings

- Failing to provide sufficient details about income sources

- Leaving out key supporting documents, such as invoices or transaction records

- Using vague or imprecise language that could lead to misunderstandings

- Failing to proofread for errors in spelling, math, or formatting

By ensuring that all necessary components are present, accurate, and well-organized, you can help avoid these mistakes and create a document that effectively communicates your financial situation with confidence and clarity.