Soc 2 Bridge Letter Template for Effective Compliance

When preparing for audits or assessments, organizations need to maintain clear and effective communication with their stakeholders. One key aspect of this process involves creating a document that bridges gaps in reporting, ensuring continuity and accuracy during the review period. This document serves to clarify any changes or updates in an organization’s operations that could impact the audit timeline or scope.

Creating this essential document requires careful attention to detail, as it must meet the requirements of various regulatory bodies and provide a comprehensive snapshot of the organization’s status. Whether it’s a temporary disruption or an ongoing process, the document must clearly convey all necessary information without causing confusion or ambiguity.

Accurate documentation plays a critical role in demonstrating the organization’s commitment to maintaining high standards of compliance and transparency. By following proper guidelines and leveraging effective structure, businesses can ensure their documentation remains relevant and useful for audit purposes.

Overview of SOC 2 Bridge Letters

In the context of compliance assessments, it’s essential for organizations to provide a detailed document that explains any changes or updates affecting the audit scope. This communication ensures auditors and stakeholders have a clear understanding of the organization’s current practices and any factors influencing the results of the evaluation. It helps fill the gap between audit periods and clarifies aspects that could impact the final assessment.

Such a document is commonly requested when there is a lapse in reporting or when there is a need to account for adjustments during the evaluation process. It serves as a bridge between audit stages, providing the necessary context for maintaining transparency and clarity in the review process.

Key Information to Include

When preparing this document, several pieces of information are crucial to ensure it serves its purpose effectively. The content should be precise and include the following:

| Element | Description |

|---|---|

| Period Covered | Indicate the period for which updates are provided, ensuring clarity on the time frame. |

| Changes and Updates | Provide a clear summary of any modifications to processes, systems, or controls during the covered period. |

| Impact on Compliance | Describe how these changes may affect the organization’s compliance status or any previously reported findings. |

Why This Document is Essential

This form of communication is crucial for maintaining audit integrity and ensuring that there are no discrepancies between what is reported during assessments. It also serves to keep both the organization and auditors aligned on what has changed since the previous review, ensuring that the auditing process can proceed smoothly without any misunderstandings.

Essential Components for Effective Letters

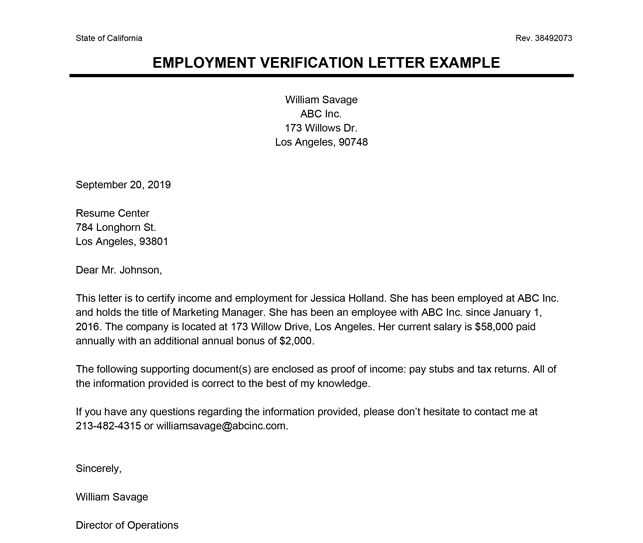

To ensure a document serves its purpose in compliance audits, it must contain specific elements that make it clear, informative, and aligned with audit expectations. These components help ensure that the recipient fully understands the context, changes, and any actions taken by the organization. Proper structuring of this document is crucial for demonstrating transparency and maintaining trust with stakeholders.

The document should start with a clear introduction, outlining the purpose and scope. It should follow with a section describing any relevant changes, updates, or activities that impact the compliance status. Additionally, a detailed explanation of the potential impact on assessments or audits is necessary to provide a full understanding of the situation.

Another vital part of an effective document is a closing section that summarizes the steps the organization has taken to address any concerns. This should include any additional actions, plans, or mitigations in place to maintain compliance and ensure that the audit process moves forward without issues.

Guidelines for Achieving SOC 2 Compliance

To meet the requirements of a successful audit, organizations must establish and maintain a set of practices and controls that align with industry standards. This involves creating processes that ensure data security, availability, confidentiality, and privacy are upheld throughout the organization. Consistent evaluation and adherence to these practices are crucial for achieving and maintaining a positive compliance status.

One of the first steps towards compliance is the identification of applicable control objectives and relevant criteria. By understanding the specific goals of each compliance requirement, businesses can tailor their internal processes to meet these expectations effectively. Additionally, maintaining accurate and thorough documentation is critical for providing transparency during the review process.

Continuous Monitoring and Improvement

Achieving compliance is not a one-time effort; organizations must establish systems for continuous monitoring. Regular assessments of controls, policies, and procedures ensure that the organization remains compliant over time. Any deviations or vulnerabilities identified should be promptly addressed to prevent issues during future audits.

Collaboration and Communication

Effective collaboration between departments, such as IT, legal, and operations, is essential for maintaining compliance. Clear communication channels should be established to ensure that all team members are aligned with the organization’s goals and aware of their responsibilities. This collaboration enhances accountability and ensures that compliance efforts are cohesive and well-coordinated.

Common Pitfalls in Bridge Letter Creation

When drafting a document that serves to clarify changes or updates during an audit process, several common mistakes can undermine its effectiveness. These errors can lead to confusion, miscommunication, or even delays in the audit process. It is essential to be aware of these pitfalls to ensure that the document fulfills its intended purpose and provides clear, actionable information for all parties involved.

One of the most frequent mistakes is insufficient detail. A vague or overly general description of the changes or updates can leave auditors and stakeholders with more questions than answers. To avoid this, the document must provide precise information on what has changed, why it matters, and how it could affect compliance.

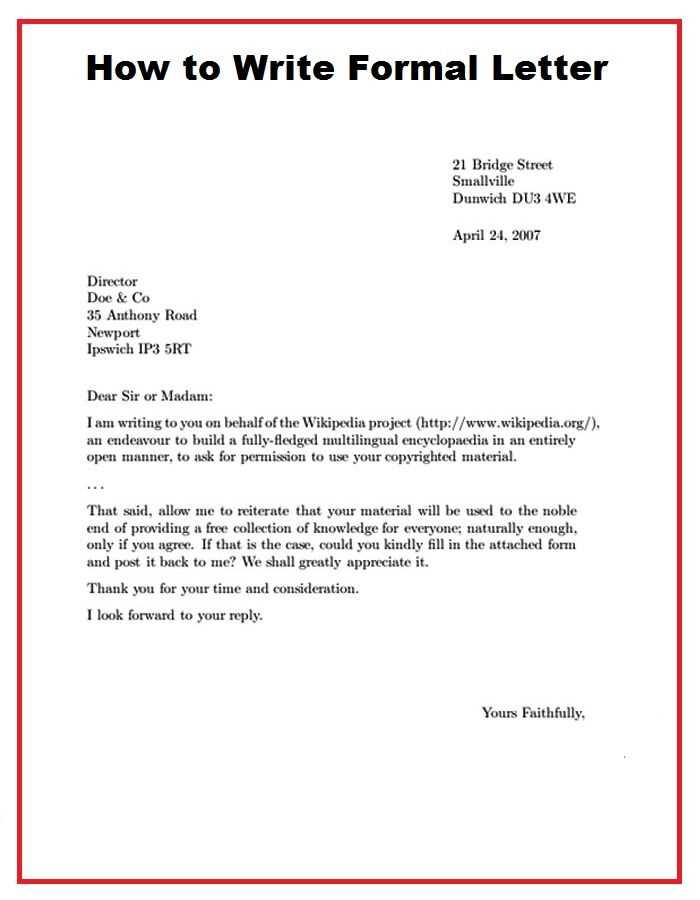

Lack of Clear Structure

Another common issue is poor organization. Without a clear structure, the document can become difficult to follow, making it harder for readers to understand the key points. A well-structured document should have a logical flow, starting with the purpose, followed by detailed descriptions of changes, and concluding with any actions taken to maintain or restore compliance.

Failure to Address Potential Impacts

Omitting or downplaying the potential impact of the changes can also lead to misunderstandings. The document should explicitly state how the updates may affect the overall compliance status and any audit-related outcomes. A failure to acknowledge these potential impacts can result in an incomplete or misleading picture, which may delay the review process.

How to Tailor Your Template

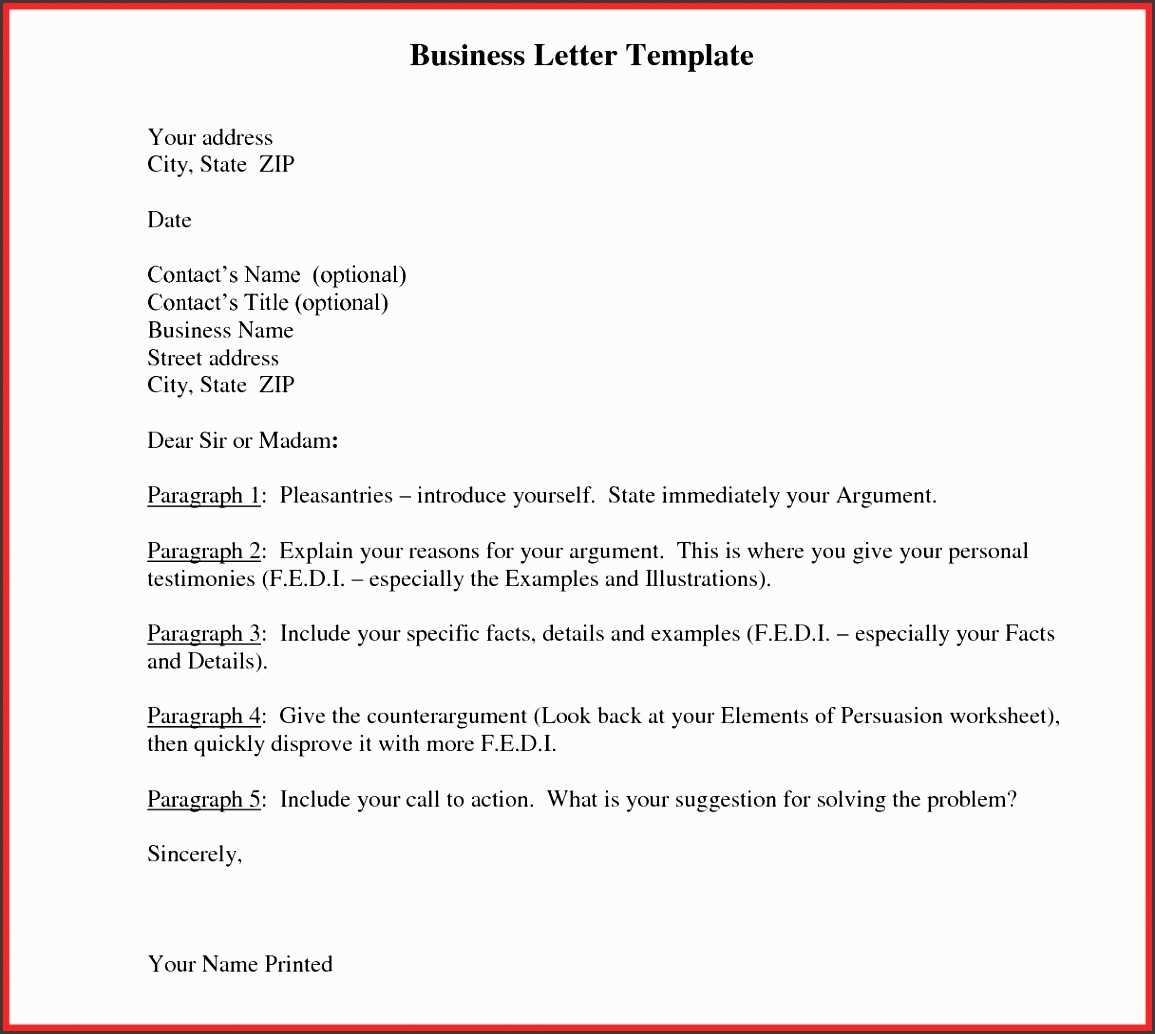

Adapting a document to your specific needs requires a careful approach to ensure that it effectively communicates the necessary details. Customization allows the document to address the unique circumstances of the organization while maintaining clarity and compliance with standards. To tailor it successfully, consider the following key steps to ensure the content is relevant and impactful.

- Understand the Audience: Identify who will be reading the document and what information is most relevant to them. Whether it’s auditors, stakeholders, or compliance teams, tailor the content to meet their needs and expectations.

- Provide Context: Clearly explain the purpose of the document and any specific events or updates that it addresses. Ensure that all relevant background information is included for a complete understanding.

- Align with Specific Requirements: Adjust the language and content to meet any industry-specific standards or regulatory guidelines. This helps ensure the document meets compliance criteria.

By making these adjustments, you can create a document that is both comprehensive and suitable for the unique needs of your organization, while also maintaining the necessary structure and detail required for audits and assessments.

Importance of Accurate Documentation for Audits

In any audit process, thorough and precise records are essential for ensuring transparency and demonstrating compliance with industry regulations. The quality of the documentation reflects the organization’s commitment to maintaining its standards and facilitates a smooth review by external parties. Without clear and accurate documentation, it becomes challenging to validate the effectiveness of controls and practices in place.

Accurate documentation serves as evidence of the processes and actions taken to meet established standards. It helps auditors to assess whether the organization is meeting its commitments and adhering to regulatory requirements. Furthermore, well-documented records can prevent misunderstandings and expedite the audit process by providing a clear, concise overview of the organization’s compliance efforts.

Supporting Audit Efficiency

Detailed and organized documentation streamlines the audit process by minimizing the time auditors need to spend searching for necessary information. When documents are well-structured, auditors can quickly verify the accuracy of the data, leading to faster assessments and fewer follow-up requests for additional information.

Mitigating Risks and Ensuring Accountability

Maintaining precise records not only aids in passing audits but also reduces the risk of compliance issues. By ensuring that all necessary details are properly documented, organizations can demonstrate accountability and minimize the likelihood of errors that could negatively impact their audit results.