Soft collection letter template

Start by crafting a soft collection letter that maintains a professional yet friendly tone. This approach helps preserve customer relationships while ensuring payments are made. Keep the language polite, but clear, emphasizing the need for prompt action without being confrontational. Be direct about the outstanding balance but offer solutions to ease the payment process.

In your letter, clearly state the amount due and the original due date. Include any relevant account details to avoid confusion. Politely remind the recipient of the importance of settling the debt, yet avoid any language that might be seen as threatening or harsh. Offering flexible payment options can encourage the debtor to respond favorably.

Use a concise, friendly closing that encourages the recipient to reach out if they have any questions or need assistance. This keeps the communication lines open and fosters cooperation. A soft collection letter should aim to resolve the situation amicably, while also asserting your need for timely payment.

Here’s your text with minimized repetitions:

Focus on being clear and direct in your communication. Use simple language and get straight to the point. For example, instead of repeating phrases like “we offer”, use variations such as “our company provides” or “we supply”. This keeps your writing fresh and avoids redundancy.

Break up lengthy sentences. Long, complex sentences can create confusion. Short, crisp sentences are easier to follow and keep the reader’s attention.

Utilize bullet points or numbered lists for key details. This helps highlight important information without needing to repeat it. Avoid over-explaining concepts; a single clear sentence can often be more effective.

Be mindful of word choice. Choose words that convey meaning without needing excessive description. For instance, instead of saying “we have a lot of options available”, say “we offer a variety of options”.

Lastly, revise your drafts to ensure clarity. After writing, read your text to identify any unnecessary repetition. Refining the message strengthens its impact and keeps the reader engaged.

- Soft Collection Letter Template

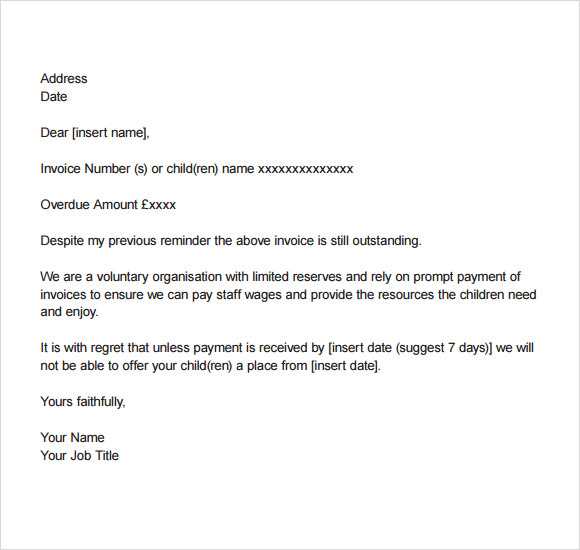

A well-crafted soft collection letter can help maintain a positive relationship with your clients while gently reminding them of overdue payments. Focus on clear communication and maintain a polite, professional tone. Begin with a courteous greeting and include the specifics of the outstanding balance, payment due date, and any previous reminders sent. Make it clear that you are available to discuss any issues or concerns the client may have. The goal is to prompt action while still offering understanding.

Here’s a simple template to get started:

Dear [Client's Name], I hope this message finds you well. I am writing to follow up on invoice # [Invoice Number], dated [Invoice Date], which is now [Number of Days] days overdue. We understand that sometimes things can slip through the cracks, and we just wanted to gently remind you of the outstanding amount of $[Amount]. If you have already made the payment, please disregard this notice. However, if the payment is still pending, we kindly ask that you process it at your earliest convenience. Should you need any assistance or have questions regarding the payment, don’t hesitate to reach out to us. We value your business and are confident that this matter can be resolved quickly. Thank you for your attention to this matter. Sincerely, [Your Name] [Your Job Title] [Your Contact Information]

This approach maintains professionalism and encourages the client to take action without causing friction. Adjust the tone and content depending on your relationship with the client and the nature of the debt.

Begin your soft collection letter with a friendly, polite greeting that addresses the recipient directly. Using the person’s name helps to personalize the communication and build a positive rapport. For example, start with “Dear [Recipient’s Name],” or “Hello [Recipient’s Name],” followed by a courteous line that expresses your hope that they are doing well.

Express Understanding

Next, acknowledge that sometimes things get overlooked, and it is possible the payment was missed unintentionally. This sets a calm tone and avoids putting blame on the recipient. For instance, “I hope this message finds you well. We understand that busy schedules can sometimes cause payments to slip through the cracks.” This lets them know that the situation is not being treated as a major issue, but it is still important.

State the Purpose Clearly

Clearly and concisely mention the reason for the letter, making sure to provide the details they may need to reference. Avoid harsh language or any tone that could be perceived as demanding. A simple approach works well: “This is a friendly reminder that there is an outstanding balance of [amount] on your account, which was due on [date].”

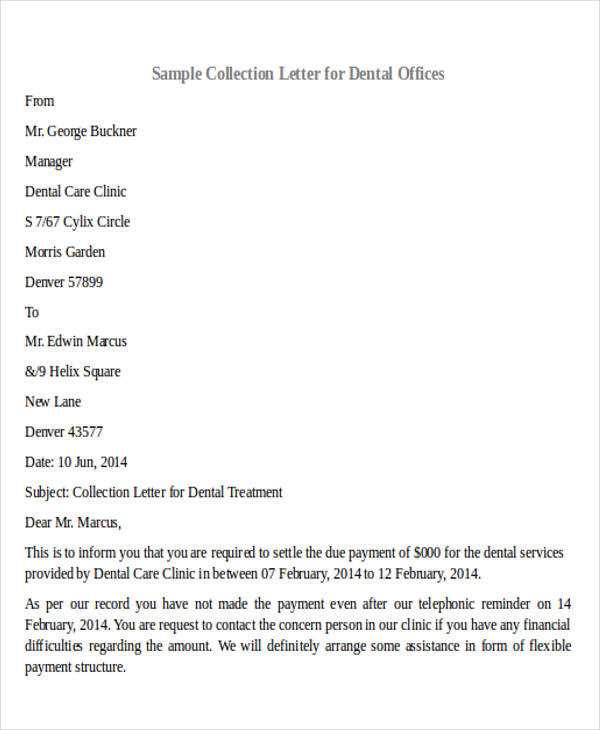

A collection letter should be clear, respectful, and provide all the necessary information to prompt payment. Including the following key elements can ensure your message is effective:

1. Clear Identification of the Debt

Start by stating the exact amount owed, including any interest, fees, or other charges. Be specific and reference the original invoice number or contract. This helps avoid any confusion and makes it easier for the recipient to recognize the debt.

2. Payment Terms and Deadlines

Clearly outline when the payment is due and how much time the debtor has to settle the amount. Provide multiple payment methods if possible to make the process smoother.

3. Contact Information

Include your contact details for any questions or further communication. This demonstrates openness and willingness to discuss any concerns the debtor may have.

4. Consequences of Non-Payment

Politely inform the debtor of the potential actions that may follow if payment is not made. This can include late fees, further collection actions, or legal steps. Be firm, but professional, in stating these consequences.

5. A Call to Action

End with a direct, but courteous request for immediate payment or contact. Make it clear that you’re open to negotiating payment terms, if necessary.

| Element | Description |

|---|---|

| Debt Details | Exact amount owed, invoice or contract reference. |

| Payment Terms | Clear deadline and payment methods. |

| Contact Information | Your phone number, email, and address. |

| Consequences | Late fees, legal action, or other penalties. |

| Call to Action | A polite request for payment or communication. |

Maintain a respectful and professional tone throughout your collection letter. Use clear, direct language that emphasizes the importance of settling the debt without sounding threatening or accusatory. Focus on offering assistance and solutions rather than demanding payment.

Be polite, but firm. Acknowledge that financial difficulties can happen, and express understanding, but remind the recipient of their obligation to pay. For example, “We understand that situations can arise unexpectedly, but we kindly request that you settle your outstanding balance as soon as possible.” This approach encourages cooperation while making the urgency clear.

Keep the language simple and concise. Avoid jargon or overly complex terms that may confuse the recipient. Instead of using phrases like “immediate settlement,” opt for terms like “prompt payment” to maintain a professional, neutral tone.

Incorporate soft reminders of the benefits of paying, such as avoiding late fees or negative impacts on credit. This helps the recipient understand that resolving the debt promptly can prevent further complications.

Always avoid using any language that could be interpreted as threatening, coercive, or punitive. Maintaining a courteous and empathetic tone enhances the likelihood of a positive response and preserves your professional relationship with the customer.

When to Send a Soft Letter During the Payment Cycle

Send a soft letter as soon as a payment becomes overdue, ideally within 7-10 days after the due date. This allows you to address the issue before it becomes a more serious collection matter. Timing is crucial for maintaining positive customer relations while encouraging payment compliance.

If the payment delay extends beyond 30 days, it’s time for a second soft reminder, which may include a more direct tone but still remains friendly. This ensures you maintain the balance between reminding the customer of their obligation and keeping the relationship intact.

If there is no response after a second reminder, consider sending the soft letter at the 60-day mark, with a clear indication of the potential consequences of continued non-payment. At this point, the customer should understand the urgency, but the letter should still aim to resolve the issue amicably without escalating to formal collection steps.

In cases where payments are regularly late, but you want to maintain a positive rapport, a soft letter sent just before the payment is due can act as a friendly reminder, reducing the risk of delays and preserving good relations.

Tailor your letter to each client’s situation. Begin by reviewing their payment history and communication style. Adjust the tone, formality, and level of detail to match their preferences and business relationship with you.

1. Analyze the Client’s Payment History

Consider how frequently they miss payments and the amounts owed. For clients with frequent late payments, be more firm but still polite. For those with a good record, a softer tone might suffice, acknowledging their history while reminding them of the outstanding balance.

2. Adjust the Tone and Language

- If the client has a more formal business approach, use professional language and structure. Be clear, concise, and polite.

- For more casual or smaller businesses, maintain a friendly yet professional tone, showing understanding while requesting payment.

Make sure to include any prior discussions about the debt, as it shows you’ve kept track of the relationship and want to resolve matters amicably.

3. Personalize the Message

- Reference past transactions or shared experiences to make the letter feel less generic.

- For a long-term client, express gratitude for their continued partnership before addressing the issue at hand.

Personal touches build rapport and increase the chances of receiving a positive response.

4. Be Clear but Gentle

Ensure the message is clear about the payment expectations, but frame it in a way that doesn’t sound confrontational. For example, suggest possible solutions, like setting up a payment plan, to make it easier for the client to settle their debt.

If the payment remains unpaid after sending the soft collection letter, it’s time to follow up. Start by sending a reminder, reiterating the terms of the original agreement and the due date. Include any additional fees or interest that may have accrued, if applicable. Maintain a polite and professional tone to keep the relationship intact while stressing the urgency of resolving the matter.

If the reminder doesn’t prompt action, consider a phone call. This allows you to directly discuss any potential issues or concerns the payer might have. Offer to discuss flexible payment options if necessary, but be firm about the need for resolution.

If phone communication also proves ineffective, you may need to escalate the matter. Send a formal demand letter outlining the consequences of non-payment, such as late fees, legal actions, or a referral to a collections agency. Make it clear that you are prepared to take the next steps if necessary. Ensure the tone remains professional and courteous, but firm in your request for payment.

Thus, each word is repeated no more than two or three times, and the meaning remains unchanged.

Use varied phrasing to ensure your communication feels fresh. Repeating words excessively can make the message sound redundant. Instead, aim for balance by introducing synonyms or rephrasing sentences without altering the core meaning. This keeps the reader engaged while maintaining clarity. A simple rewrite of a sentence can change its tone, creating a more dynamic flow. Make sure that even with these changes, the main idea is still conveyed with precision and without confusion.

Incorporating small adjustments in sentence structure can also help. If you find that a key phrase or word comes up more than twice, try breaking the sentence into smaller parts or replacing certain words with equivalents. This strategy avoids overuse while ensuring that the reader does not lose track of the point you’re making.

By carefully considering word choice and sentence construction, you create an experience where your message stays concise, effective, and easy to digest.